Start Freedom SIP

Freedom SIP

How Our Freedom SIP Works?

A smart way to track your Freedom SIP journey, starting with building wealth to getting a regular monthly income.

Looking for expert guidance available 24*7 at your service?

Book a Live Call NowAbout Our Team Of Experts

We offer quick, simple and transparent investment solutions and have helped over one million investors achieve financial freedom, long-term wealth and super-performance investment returns.

Every investment strategy has its time; the key is knowing when to trust & act decisively.

- 10+ years of industry experience and strong skillset.

- Managing 100+ crore family office portfolios efficiently.

- Leading a team of 10 expert mutual funds analysts.

- Financial consultancy for goal-based and child’s future planning.

- Expertise in Equity, Mutual Funds, PMS, AIF & Startup Investing.

- Qualified CAs, NISM Certified Research Analyst & Investment Advisor.

Feedback From Our Satisfied Investors

Get ready to be inspired by our satisfied investors who turned their financial goals into reality.

I have been using Freedom SIP with MySIPonline for a long time, and it’s been amazing. The process was simple and now I am getting regular income and good returns. It’s exactly what I needed for my future.

Pune

My experience with Freedom SIP on MySIPonline has been great! I started with small amounts and now I’m getting both good growth and monthly withdrawals. It’s been a simple way to secure my future.

Jaipur

Thanks to Freedom SIP on MySIPonline, my investments have grown steadily. It is easy to manage and now I get a regular income every month. I’m really happy with the results.

Vadodara

Frequently asked questions

Everything you need to know to kick-start your financial freedom with confidence.

What is a Freedom SIP?

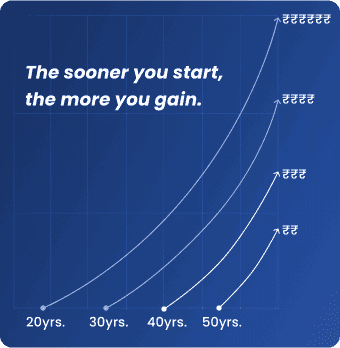

Freedom SIP is a plan that helps you grow your money through regular investments (SIP) and then start taking out a fixed amount each month (SWP) when your investment grows, giving you regular income.

How does Freedom SIP work?

First, you invest regularly through SIP to build up your savings. Once you have reached a large amount, you start withdrawing a fixed monthly income through SWP, giving you a steady cash flow while keeping your money invested for further growth.

What are the key advantages of using Freedom SIP?

Freedom SIP lets you build wealth with regular investments and then provides a steady income once your investment grows. It is great for long-term financial goals and helps ensure you have regular income when you need it most.

Can I stop Freedom SIP?

Yes, you can stop your Freedom SIP whenever you want. If you decide to stop the SIP or SWP, you can easily do it through your account but stopping early may affect the returns you would’ve earned.

Who should invest in Freedom SIP?

Freedom SIP is perfect for people who want to build wealth over time and then turn it into regular income, like for retirement. It is good for those with long-term goals and a medium to high-risk appetite.

How is Freedom SIP different from normal SIP?

A normal SIP is just about investing regularly to grow your money. Freedom SIP is different because it also lets you withdraw regular income once your investment has grown, making it easier to both save and get income.

How to start an SIP today for future financial freedom?

To start an SIP, choose a mutual fund, set up a free account with MySIPonline and invest a fixed amount regularly. This will help you build wealth for your future and achieve financial freedom.

What is the time limit for SIP withdrawal?

There is no set time limit for SIP withdrawals. You can start withdrawing once your investment has grown enough or once the required duration is complete. For Freedom SIP, you can begin withdrawals after your SIP phase is done.

Accumulation

Accumulation

Distribution

Distribution

Quality Companies

Quality Companies Quality Companies

Quality Companies