360 ONE Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 9

- Average annual returns 3.69%

About 360 ONE Mutual Fund

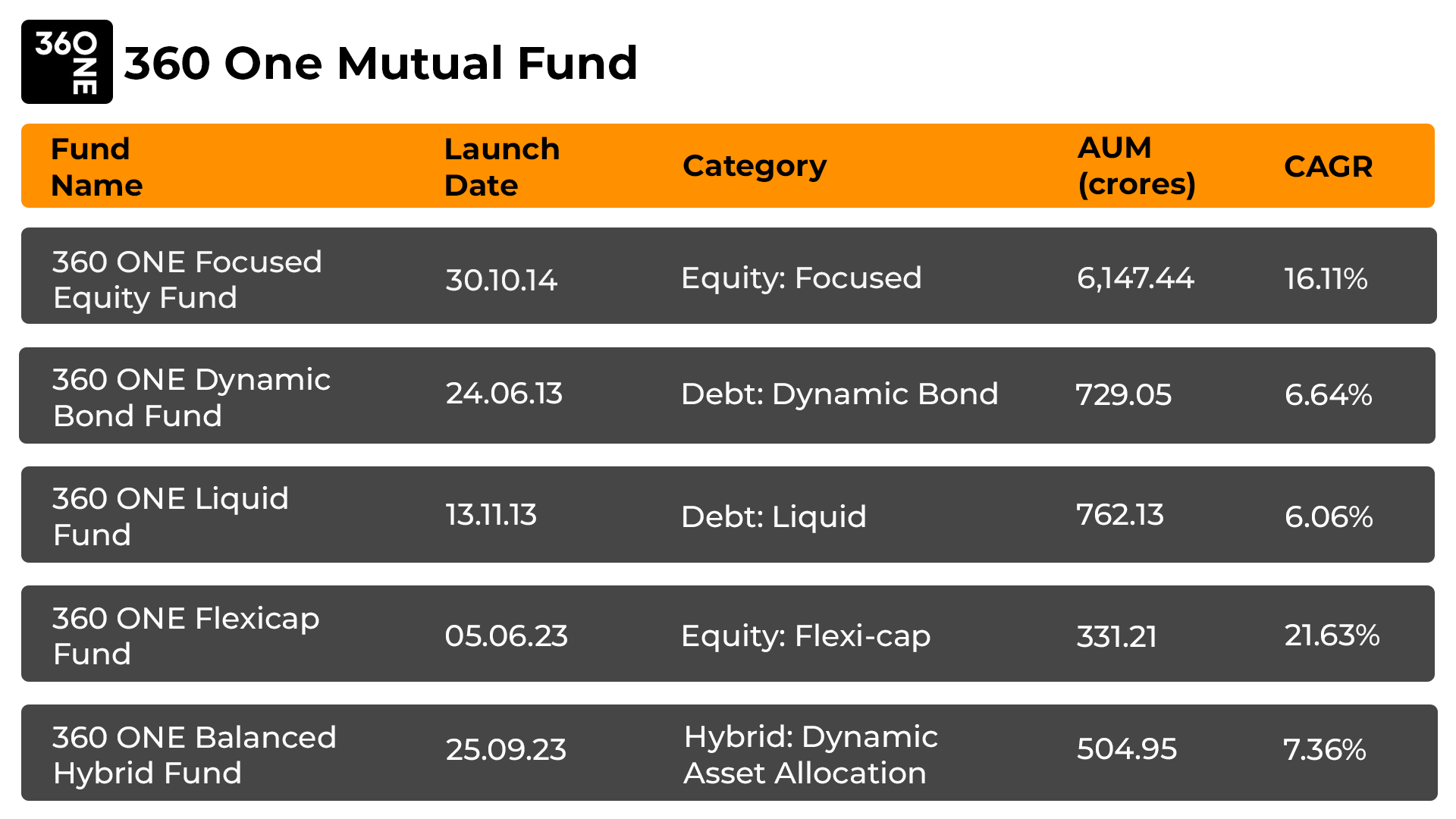

360 ONE Mutual Fund, previously known as IIFL Wealth, commenced its mutual fund operations on March 23, 2011. This AMC is a well-known name in the finance industry, serving wealthy individuals and companies. This fund house offers 4 Equity funds, 2 Debt funds, and 1 Hybrid fund and is ranked 27 among its peer AMC. Mr. Mayur Patel leads the Equity section, and Mr. Milan Mody leads the Debt section, bringing their expertise to the AMC. This fund house makes people's money grow over time by investing in a variety of stocks and similar assets. The flagship scheme of 360 One Focused Equity fund has exhibited an excellent average annualized return of 16.15% since its inception.

More-

Launched in

23-Mar-2011

-

AMC Age

14 Years

-

Website

https://www.iiflmf.com -

Email Address

regcompliance@iiflw.com

Top Performing 360 ONE Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 669.28 | 12 years | 0.26% | 0.16% | 0.58% | 4.65% | 6.11% | 8.32% | 8.88% | 7.82% | 6.96% | 7.02% | Invest | |

| 976.01 | 11 years | 0.1% | 0.46% | 1.37% | 3.15% | 4.48% | 6.69% | 6.93% | 6.83% | 5.42% | 5.8% | Invest | |

| 864.65 | 1 years | 0.85% | 1.16% | 0.15% | 7.55% | 2.69% | 2.73% | - | - | - | - | Invest | |

| 86.86 | 2 years | 1.08% | 1.8% | -0.12% | 11.68% | 6.02% | 1.11% | 12.52% | - | - | - | Invest | |

| - | 22 days | 0.98% | - | - | - | - | - | - | - | - | - | Invest | |

| 77.06 | 1 months | 0.1% | 0.45% | - | - | - | - | - | - | - | - | Invest | |

| 1967.72 | 2 years | 1.73% | 2.52% | 0.04% | 12.39% | -0.18% | -2.41% | 18.83% | - | - | - | Invest | |

| 767.38 | 3 years | 1.55% | 3.5% | -1.08% | 17.2% | 5.51% | -3.08% | 22.18% | 22.63% | - | - | Invest | |

| 7487.31 | 10 years | 1.87% | 2.45% | -0.42% | 10.71% | 3.16% | -3.86% | 13.18% | 15.66% | 20.91% | 16.41% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 669.28 | Moderately High |

0.81%

|

7.28%

|

8.66%

|

8.53%

|

7.54%

|

7.04%

|

7.14%

|

Invest | |

| 976.01 | Low to Moderate |

1.41%

|

6.32%

|

6.71%

|

6.83%

|

6.3%

|

5.67%

|

5.78%

|

Invest | |

| 864.65 | High |

1.74%

|

4.76%

|

-

|

-

|

-

|

-

|

8.3%

|

Invest | |

| 86.86 | Very High |

2.39%

|

6.64%

|

8.29%

|

-

|

-

|

-

|

11.22%

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Invest | ||

| 77.06 | Average |

-

|

-

|

-

|

-

|

-

|

-

|

5.13%

|

Invest | |

| 1967.72 | Very High |

3.25%

|

3.11%

|

9.8%

|

-

|

-

|

-

|

12.13%

|

Invest | |

| 767.38 | Very High |

2.54%

|

7.05%

|

10.93%

|

20.04%

|

-

|

-

|

20.97%

|

Invest | |

| 7487.31 | Average |

2.13%

|

2.78%

|

6.22%

|

12.33%

|

14.46%

|

16.76%

|

16.35%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Moderately High |

1.95%

|

0.30%

|

0.92%

|

0.50%

|

Invest | |

| Low to Moderate |

0.17%

|

-

|

1.14%

|

0.96%

|

Invest | |

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

16.11%

|

-

|

-

|

0.91%

|

Invest | |

| Average |

12.28%

|

1.45%

|

0.87%

|

0.68%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹1000

|

₹10000

|

0.52%

|

Milan Mody

|

24-Jun 2013

|

Invest | |

|

₹1000

|

₹5000

|

0.25%

|

Milan Mody

|

13-Nov 2013

|

Invest | |

|

₹1000

|

₹1000

|

1.94%

|

Mayur Patel

|

25-Sep 2023

|

Invest | |

|

₹500

|

₹500

|

0.52%

|

Parijat Garg

|

28-Dec 2022

|

Invest | |

|

₹1000

|

₹1000

|

-

|

|

22-Aug 2025

|

Invest | |

|

₹5000

|

₹5000

|

-

|

|

14-Jul 2025

|

Invest | |

|

₹1000

|

₹1000

|

2.06%

|

Mayur Patel

|

26-Jun 2023

|

Invest | |

|

₹1000

|

₹1000

|

1.83%

|

Parijat Garg

|

29-Nov 2021

|

Invest | |

|

₹1000

|

₹1000

|

1.78%

|

Mayur Patel

|

24-Oct 2014

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

22.8252

(12-09-2025)

|

22.8165

(11-09-2025)

|

0.04%

|

22.9126

|

21.1206

|

Invest | |

|

2032.5888

(12-09-2025)

|

2032.3296

(11-09-2025)

|

0.01%

|

2032.59

|

1906.36

|

Invest | |

|

12.7450

(12-09-2025)

|

12.7200

(11-09-2025)

|

0.2%

|

12.8211

|

11.7631

|

Invest | |

|

14.0622

(12-09-2025)

|

14.0020

(11-09-2025)

|

0.43%

|

14.5621

|

12.3079

|

Invest | |

|

10.3712

(12-09-2025)

|

10.3060

(11-09-2025)

|

0.63%

|

10.3733

|

9.9917

|

Invest | |

|

1009.5058

(12-09-2025)

|

1009.3736

(11-09-2025)

|

0.01%

|

1009.51

|

1000.62

|

Invest | |

|

15.1827

(12-09-2025)

|

15.1135

(11-09-2025)

|

0.46%

|

16.1028

|

13.0748

|

Invest | |

|

19.4692

(12-09-2025)

|

19.3900

(11-09-2025)

|

0.41%

|

20.7067

|

15.9793

|

Invest | |

|

47.0946

(12-09-2025)

|

46.8775

(11-09-2025)

|

0.46%

|

50.2287

|

41.5103

|

Invest |

360 ONE Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top 360 ONE Mutual Fund

360 ONE Liquid Fund Regular-Growth

3Y Returns 6.83%

VS

360 ONE Liquid Fund Regular-Growth

3Y Returns 6.83%

VS

Axis Liquid Fund - Regular Plan - Growth Option

3Y Returns 7.02%

Axis Liquid Fund - Regular Plan - Growth Option

3Y Returns 7.02%

360 ONE Balanced Hybrid Fund Regular - Growth

3Y Returns 0%

VS

360 ONE Balanced Hybrid Fund Regular - Growth

3Y Returns 0%

VS

HDFC Balanced Advantage Fund Regular Growth

3Y Returns 18.09%

HDFC Balanced Advantage Fund Regular Growth

3Y Returns 18.09%

360 ONE ELSS Nifty 50 Tax Saver Index Fund Regular - Growth

3Y Returns 0%

VS

360 ONE ELSS Nifty 50 Tax Saver Index Fund Regular - Growth

3Y Returns 0%

VS

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 13.48%

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 13.48%

360 ONE Focused Fund Regular-Growth

3Y Returns 15.66%

VS

360 ONE Focused Fund Regular-Growth

3Y Returns 15.66%

VS

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.73%

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.73%

Investment Strategy

This investment business focuses on innovative product development to capitalize on long-term growth potential and keep ahead of market trends. Its innovation-focused strategy strives to generate long-term value for investors while skill-fully managing market swings. It aims to achieve favourable results and promote long-term wealth creation through smart investments.

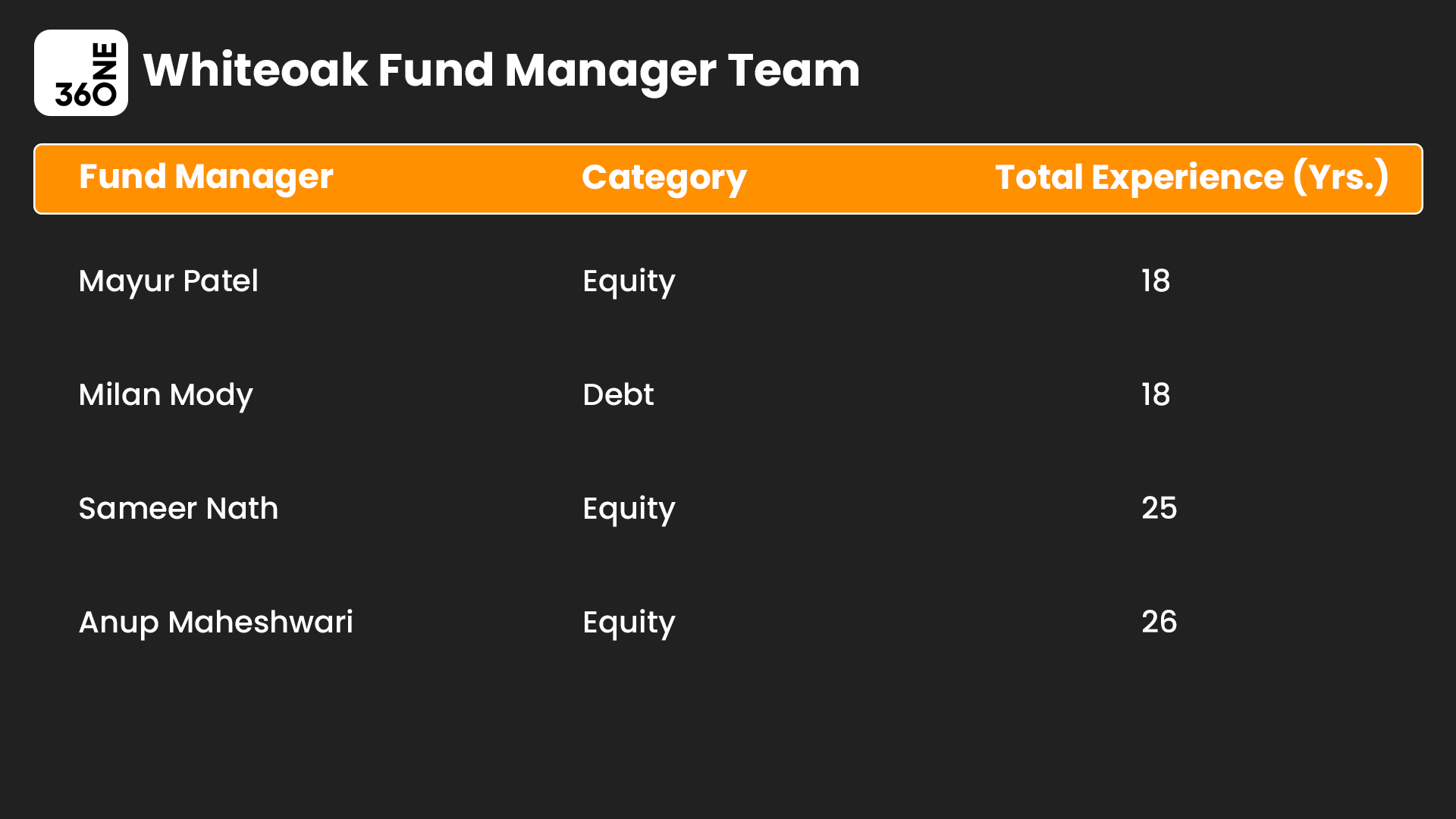

Head of Equity & Debt Team

Mr. Anup Maheshwari (CIO)

Anup Maheshwari, 360 one MF, Co-Founder and CIO, holds a PGDM from the Indian Institute of Management in Lucknow. Mr. Maheshwari has over 24 years of experience in the financial services sector and has held important positions at DSP Investment Managers Private Limited for the past 11 years, including Executive Vice President and Chief Investment Officer. He also made contributions to HSBC Asset Management (India) Private Limited and Merrill Lynch India Equity Fund (Mauritius) Limited.

Mr. Maheshwari brings a wealth of experience to his work at IIFL Asset Management Limited, having earned a Bachelor of Commerce from Bombay University and a Post Graduate Diploma in Management from IIM Lucknow.

List of Fund Manager

Top 5 360 ONE Mutual Fund

History of 360 ONE Mutual Fund

360 ONE Mutual Fund, founded on March 23, 2011, India Infoline Asset Management Company Ltd. (AMC) was established under the Companies Act, 1956 on March 22, 2010, with its Registered Office located at IIFL Centre. The AMC has been designated as the Investment Manager for IIFL Mutual Fund by the Trustee through an Investment Management Agreement (IMA) dated April 29, 2010. This agreement was executed between India Infoline Trustee Company Ltd. and India Infoline Asset Management Company Ltd.

How to select TO Best 360 ONE Mutual Fund?

To select the best 360 ONE Mutual Fund, remember these steps:

- Ensure investing goals are possible, identify and plan accordingly.

- Assess your risk tolerance and establish and adjust limits as needed.

- Diversify assets across sectors, mitigate risk, and enhance returns.

- Regularly monitor investments and make necessary adjustments.

- Research funds performance strategies, before investing in funds

- Seek experts' advice for market-linked assets such as mutual funds.

To sum up, investing in mutual funds an SIP calculator to know about the returns you will receive in the future.

How to invest in 360 One Mutual Fund via Mysiponline?

Access 360 ONE mutual fund investing opportunities through a variety of outlets:

- Opt for mysiponline.com for its user-friendly investment approach.

- Choose from top-performing 360 mutual funds that match your goals.

- Register for a free account and provide necessary profile information.

- Complete paperless KYC with PAN, Aadhar, signature, and bank proof.

- Explore and add preferred mutual funds to your cart based your goals.

- Proceed to finalize payment for your chosen mutual funds schemes.

- Await confirmation of your investment; you're done with the process.

- Use your mysiponline.com account to easily monitor your fund details.

In summary, to invest in an Online SIP, you simply need to click and fill out the required documents.

What is the Taxation on 360 Mutual Fund?

The taxation of 360 ONE mutual funds depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in 360 ONE Mutual Fund?

What are the different 360 One mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in 360 One Funds online tax-free?

How to analyse the performance of 360 ONE Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Videos and Blogs of 360 ONE Mutual Fund

Videos

Blogs

You can select three funds for compare.

You can select three funds for compare.