Bajaj Finserv Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 16

- Average annual returns 3.69%

About Bajaj Finserv Mutual Fund

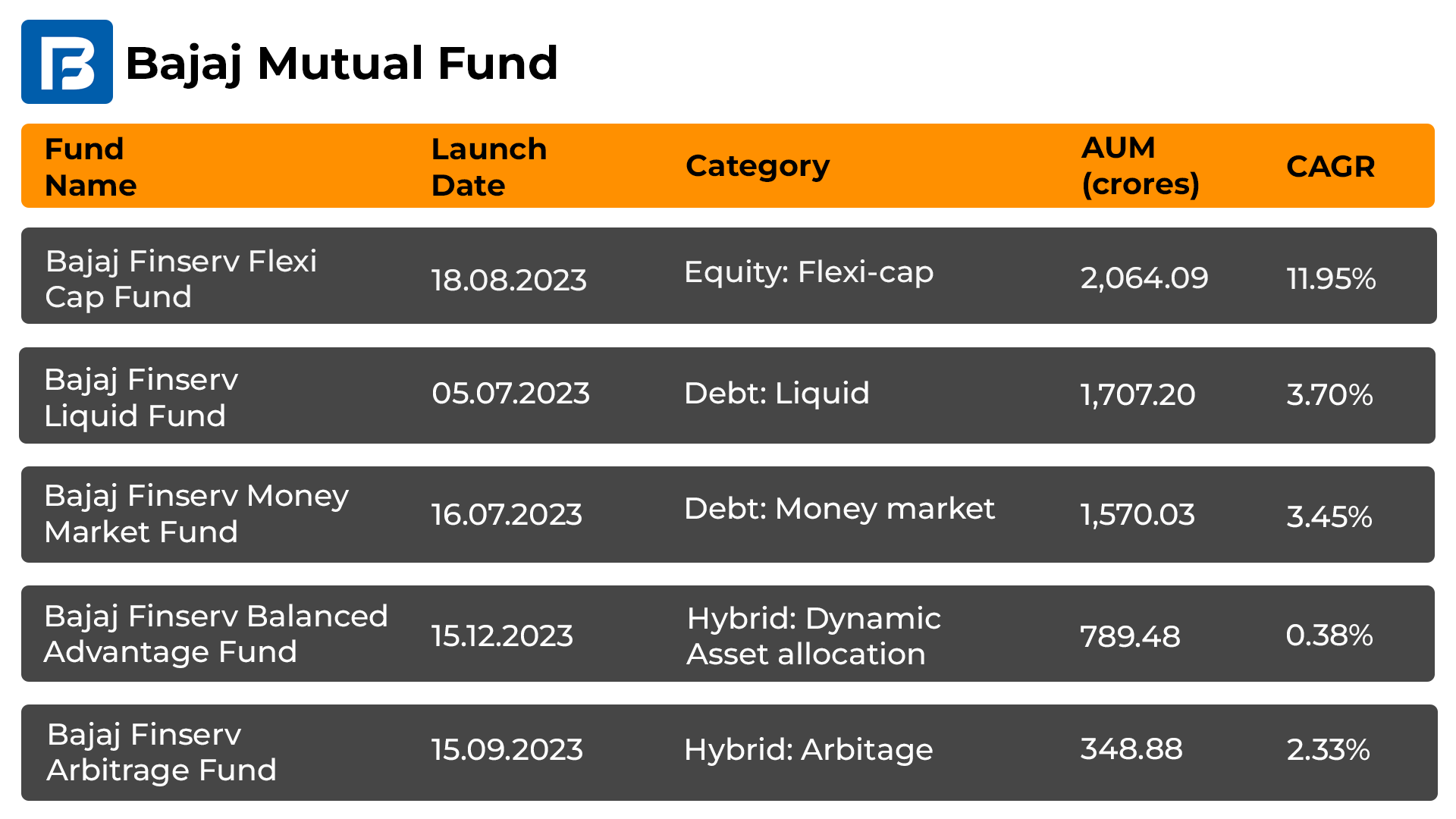

Bajaj Finserv Mutual Fund, supported by one of India's well-known and oldest brands, is ranked 29th among its competitors. This AMC offers a total of 9 funds, including 3 equity funds, 4 debt funds, and 2 hybrid funds. By making wise investment choices, the plan seeks to preserve money, reduce risk, and guarantee adequate liquidity all while maintaining a consistent income. This mutual fund house has various schemes registered with the Securities and Exchange Board of India (SEBI), including liquid funds, overnight funds, money market funds, flexi cap, arbitrage funds, balanced advantage funds, and large and midcap funds. Since its launch, the flagship plan, Bajaj Finserv Flexi Cap Fund, has demonstrated a remarkable average annualized return of 15.69%.

More-

Launched in

01-Jan-1970

-

AMC Age

0 Years

-

Website

https://www.bajajamc.com -

Email Address

compliance@bajajamc.com

Top Performing Bajaj Finserv Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 149.22 | 1 years | 0.27% | 0.05% | 0.52% | 4.43% | 5.63% | 7.85% | - | - | - | - | Invest | |

| 4554.89 | 2 years | 0.1% | 0.46% | 1.39% | 3.22% | 4.55% | 6.79% | 7.03% | - | - | - | Invest | |

| 701.11 | 2 years | 0.1% | 0.45% | 1.33% | 2.84% | 4.07% | 6.13% | 6.43% | - | - | - | Invest | |

| 906.18 | 1 years | -0.01% | 0.36% | 1.32% | 2.9% | 4.13% | 6.03% | - | - | - | - | Invest | |

| 1190.92 | 1 years | 1.05% | 2.53% | 1% | 10.82% | 7.68% | 2.87% | - | - | - | - | Invest | |

| 5244.12 | 2 years | 1.48% | 2.8% | 1.08% | 18.46% | 4.71% | 2.85% | 20.72% | - | - | - | Invest | |

| 341.35 | 8 months | 0.91% | 3.89% | 2.74% | 13.75% | -1.76% | - | - | - | - | - | Invest | |

| 601.79 | 9 months | 0.97% | 6.36% | 3.7% | 16.58% | -0.79% | - | - | - | - | - | Invest | |

| 840.37 | 6 months | 1.2% | 2.37% | -1.33% | 11.53% | - | - | - | - | - | - | Invest | |

| 9.91 | 3 months | 1.2% | 2.58% | -1.1% | - | - | - | - | - | - | - | Invest | |

| 7.91 | 3 months | 1.07% | 1.77% | -0.24% | - | - | - | - | - | - | - | Invest | |

| 1201.14 | 1 months | 2.19% | 3.22% | - | - | - | - | - | - | - | - | Invest | |

| - | 23 days | 0.01% | - | - | - | - | - | - | - | - | - | Invest | |

| 1298.54 | 1 years | 0.95% | 1.98% | -0.77% | 9.3% | 4.1% | -0.51% | - | - | - | - | Invest | |

| 1501.12 | 1 years | 1.05% | 2.54% | -0.31% | 11.97% | 3.58% | -1.6% | - | - | - | - | Invest | |

| 2098.13 | 1 years | 1.02% | 2.18% | -0.99% | 12.82% | 1.38% | -1.77% | - | - | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 149.22 | Moderate |

0.75%

|

6.76%

|

-

|

-

|

-

|

-

|

7.59%

|

Invest | |

| 4554.89 | Low to Moderate |

1.43%

|

6.42%

|

6.82%

|

-

|

-

|

-

|

6.86%

|

Invest | |

| 701.11 | Low |

1.35%

|

5.81%

|

6.18%

|

-

|

-

|

-

|

6.24%

|

Invest | |

| 906.18 | Low |

1.3%

|

5.86%

|

-

|

-

|

-

|

-

|

6.23%

|

Invest | |

| 1190.92 | Very High |

2.7%

|

8.37%

|

-

|

-

|

-

|

-

|

6.55%

|

Invest | |

| 5244.12 | Moderate |

5.39%

|

11.03%

|

13.78%

|

-

|

-

|

-

|

14.35%

|

Invest | |

| 341.35 | Very High |

5.08%

|

-

|

-

|

-

|

-

|

-

|

12.36%

|

Invest | |

| 601.79 | Very High |

6.8%

|

-

|

-

|

-

|

-

|

-

|

13.34%

|

Invest | |

| 840.37 | Very High |

2.02%

|

-

|

-

|

-

|

-

|

-

|

11.53%

|

Invest | |

| 9.91 | Average |

-

|

-

|

-

|

-

|

-

|

-

|

-3.93%

|

Invest | |

| 7.91 | Average |

-

|

-

|

-

|

-

|

-

|

-

|

-5.03%

|

Invest | |

| 1201.14 | Average |

-

|

-

|

-

|

-

|

-

|

-

|

-6.37%

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Invest | ||

| 1298.54 | High |

1.53%

|

4.23%

|

-

|

-

|

-

|

-

|

3.84%

|

Invest | |

| 1501.12 | Very High |

2.54%

|

5.06%

|

-

|

-

|

-

|

-

|

3.99%

|

Invest | |

| 2098.13 | Very High |

2.84%

|

5.5%

|

-

|

-

|

-

|

-

|

6.35%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low |

-

|

-

|

-

|

-

|

Invest | |

| Low |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest | |

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹1000

|

₹1000

|

0.89%

|

Nimesh Chandan

|

13-Nov 2023

|

Invest | |

|

₹1000

|

₹100

|

0.27%

|

Nimesh Chandan

|

05-Jul 2023

|

Invest | |

|

₹1000

|

₹100

|

0.13%

|

Nimesh Chandan

|

05-Jul 2023

|

Invest | |

|

₹500

|

₹500

|

0.95%

|

Siddharth Chaudhary

|

15-Sep 2023

|

Invest | |

|

₹500

|

₹500

|

2.08%

|

Nimesh Chandan

|

06-Jun 2024

|

Invest | |

|

₹500

|

₹500

|

1.85%

|

Nimesh Chandan

|

14-Aug 2023

|

Invest | |

|

₹500

|

₹500

|

-

|

Nimesh Chandan

|

27-Dec 2024

|

Invest | |

|

₹500

|

₹500

|

2.37%

|

Nimesh Chandan

|

03-Dec 2024

|

Invest | |

|

₹500

|

₹500

|

-

|

Nimesh Chandan

|

03-Mar 2025

|

Invest | |

|

₹500

|

₹500

|

-

|

|

14-May 2025

|

Invest | |

|

₹500

|

₹500

|

-

|

|

19-May 2025

|

Invest | |

|

₹500

|

₹500

|

-

|

|

22-Jul 2025

|

Invest | |

|

₹500

|

₹500

|

-

|

|

21-Aug 2025

|

Invest | |

|

₹500

|

₹500

|

2.09%

|

Nimesh Chandan

|

08-Dec 2023

|

Invest | |

|

₹500

|

₹500

|

2.1%

|

Nimesh Chandan

|

23-Aug 2024

|

Invest | |

|

₹500

|

₹500

|

2.06%

|

Nimesh Chandan

|

27-Feb 2024

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

11.5286

(12-09-2025)

|

11.5172

(11-09-2025)

|

0.1%

|

11.5409

|

10.6997

|

Invest | |

|

1159.9064

(12-09-2025)

|

1159.7396

(11-09-2025)

|

0.01%

|

1159.91

|

1086.61

|

Invest | |

|

1146.7518

(12-09-2025)

|

1146.5866

(11-09-2025)

|

0.01%

|

1146.75

|

1080.89

|

Invest | |

|

11.340

(12-09-2025)

|

11.337

(11-09-2025)

|

0.03%

|

11.34

|

10.692

|

Invest | |

|

11.1677

(12-09-2025)

|

11.1278

(11-09-2025)

|

0.36%

|

11.2071

|

9.8778

|

Invest | |

|

14.816

(12-09-2025)

|

14.774

(11-09-2025)

|

0.28%

|

14.965

|

12.269

|

Invest | |

|

9.933

(12-09-2025)

|

9.920

(11-09-2025)

|

0.13%

|

10.131

|

8.519

|

Invest | |

|

9.964

(12-09-2025)

|

9.990

(11-09-2025)

|

-0.26%

|

10.218

|

8.469

|

Invest | |

|

11.178

(12-09-2025)

|

11.172

(11-09-2025)

|

0.05%

|

11.572

|

9.897

|

Invest | |

|

10.8551

(12-09-2025)

|

10.8205

(11-09-2025)

|

0.32%

|

10.9669

|

10.425

|

Invest | |

|

10.1849

(12-09-2025)

|

10.1412

(11-09-2025)

|

0.43%

|

10.3805

|

9.8759

|

Invest | |

|

9.723

(12-09-2025)

|

9.718

(11-09-2025)

|

0.05%

|

9.998

|

9.327

|

Invest | |

|

10.032

(12-09-2025)

|

10.029

(11-09-2025)

|

0.03%

|

10.032

|

10.015

|

Invest | |

|

11.339

(12-09-2025)

|

11.314

(11-09-2025)

|

0.22%

|

11.725

|

10.191

|

Invest | |

|

9.966

(12-09-2025)

|

9.937

(11-09-2025)

|

0.29%

|

10.533

|

8.693

|

Invest | |

|

12.155

(12-09-2025)

|

12.155

(11-09-2025)

|

0%

|

12.721

|

10.596

|

Invest |

Bajaj Finserv Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Bajaj Finserv Mutual Fund

Bajaj Finserv Multi Asset Allocation Fund-Reg (G)

3Y Returns 0%

VS

Bajaj Finserv Multi Asset Allocation Fund-Reg (G)

3Y Returns 0%

VS

AXIS Nifty Bank Index Fund - Regular (G)

3Y Returns 0%

AXIS Nifty Bank Index Fund - Regular (G)

3Y Returns 0%

Bajaj Finserv Money Market Fund Regular - Growth

3Y Returns 0%

VS

Bajaj Finserv Money Market Fund Regular - Growth

3Y Returns 0%

VS

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.5%

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.5%

Bajaj Finserv Large and Mid Cap Fund - Reg (G)

3Y Returns 0%

VS

Bajaj Finserv Large and Mid Cap Fund - Reg (G)

3Y Returns 0%

VS

Quant Large and Mid Cap Fund-Growth

3Y Returns 15.4%

Quant Large and Mid Cap Fund-Growth

3Y Returns 15.4%

Bajaj Finserv Overnight Fund Regular - Growth

3Y Returns 0%

VS

Bajaj Finserv Overnight Fund Regular - Growth

3Y Returns 0%

VS

UTI - Overnight Fund - Regular Plan - Growth Option

3Y Returns 6.41%

UTI - Overnight Fund - Regular Plan - Growth Option

3Y Returns 6.41%

Investment Strategy

This investment business of BAJAJ AMC takes a unique approach to investing, using innovative approaches to assist individuals in meeting their financial goals. Their strategy focuses on creating positive returns on equity investments, with the ultimate goal of delivering value and effectively achieving investors' financial objectives. They desire to give investors chances for development and success in an ever-changing financial world by employing creative approaches and a commitment to quality.

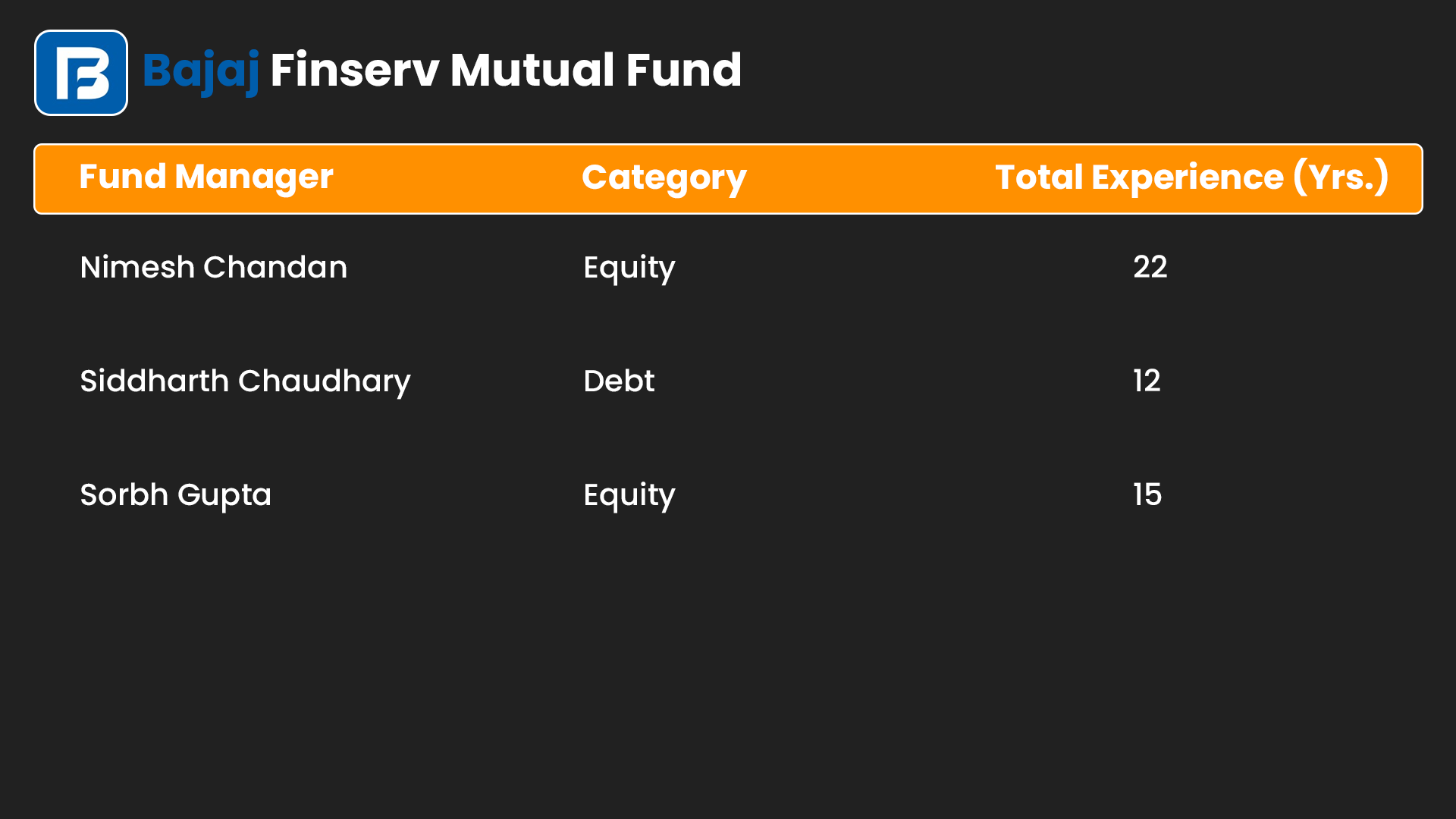

Head of Equity & Debt Team

Nimesh Chandan (CIO)

Nimesh Chandan is presently the Chief Investment Officer for Bajaj Finserv's future mutual fund. He has over 13 years of expertise and formerly worked at Canara Robeco Mutual Fund. Chandan, known for his behavioral finance insights, is now overseeing the investing team while Bajaj Finserv MF awaits SEBI's final license to launch its mutual fund operation.

List of all Fund managers

Top 5 Bajaj Finserv Funds

History of Bajaj Mutual Fund

April 2007 saw the creation of Bajaj Mutual Fund after its separation from Bajaj Auto Limited. The fund's primary focus is on providing financial services. By February 2008, the demerger process was completed, and Bajaj Finserv was officially established as a dedicated entity for a wide range of financial services throughout India.

The same year witnessed the launch of Bajaj Allianz General Insurance Company. By 2010, Bajaj Finserv had established a substantial presence in the Indian financial market, emphasizing customer satisfaction and expanding its market share.

In 2017, Bajaj Asset Management Limited launched Bajaj Finserv Health, which aims to change healthcare access in India by providing digital-first, seamless solutions.

In 2020, Bajaj Finserv reached a market capitalization of ââ¹2.44 trillion, demonstrating its steady development and major contributions to the Indian financial system.

HOW TO SELECT Best Bajaj Finserv Mutual Fund?

To select the best BAJAJ Finserv mutual fund follow these points:

- Set realistic investment goals aligned with your finances.

- Assess risk tolerance before making investment decisions.

- Diversify your investments across the sectors for stability.

- Educate yourself on the fund performance and approach.

- Regularly monitor investments for necessary adjustments.

- Consult experts for market fluctuations and asset safety.

To sum up, these guidelines offer a knowledgeable and proactive strategy for investing in mutual funds including a SIP Calculator that will you figure out your annualized return.

How to Invest in Bajaj Finserv Mutual Fund via Mysiponline?

Investing in Bajaj Finserv mutual funds is made easy through mysiponline's user-friendly platform:

- Step 1: Start your investment process by logging in to mysiponline and proceed.

- step 2: Check your KYC status, and if it's not registered, proceed with Video KYC.

- Step 3: Complete profile (PAN card, Aadhar number, bank details, nominee, signature)

- Step 4: Explore top funds from Respective AMC Name and consult to expert

- Step 5: Select your preferred fund from the provided options available.

- Step 6: Add funds to cart and choose your investment option between sip or lump sum

- Step 7: Make payment conveniently and securely from UPI or net banking options.

- Step 8: Track your investment daily on a dashboard, use our analysis to manage it.

In conclusion, using Online SIP to invest in mutual funds offers a user-friendly platform for simple investment administration and tracking.

What is the Taxation on Bajaj Finserv Mutual Fund?

The taxation of Bajaj Finserv schemes depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs.1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Bajaj Finserv Mutual Fund?

What are the different Bajaj Finserv mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in Bajaj Finserv Funds online tax-free?

How to analyse the performance of Bajaj Finserv Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of Bajaj Finserv Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.