Baroda BNP Paribas Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 43

- Average annual returns 3.22%

About Baroda BNP Paribas Mutual Fund

Baroda BNP Paribas Mutual Fund is a prominent Asset Management Company (AMC). It was formed through a collaboration between the Bank of Baroda and BNP Paribas Asset Management Asia Ltd. The fund offers a total of 37 schemes, comprising 14 equity schemes, 6 hybrid schemes, 23 debt schemes, and 1 commodity scheme. It holds the 22nd rank among its peers. Baroda Pioneer Asset Management Company Limited was established in 1995 as a wholly-owned subsidiary of Bank of Baroda. Its primary objective is to manage the assets of Baroda Pioneer Mutual Fund. Baroda BNP Paribas Value Fund, the flagship scheme, has exhibited an impressive average annualized return of 33.14% since its inception.

More-

Launched in

24-Nov-1994

-

AMC Age

30 Years

-

Website

https://www.barodabnpparibasmf.in -

Email Address

service@barodabnpparibasmf.in

Top Performing Baroda BNP Paribas Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 79.59 | 1 years | 3.4% | 7.16% | 5.64% | 17.31% | 8.78% | 29.67% | - | - | - | - | Invest | |

| 38.36 | 4 years | 0.73% | 0.01% | 5.56% | 12.82% | 17.19% | 9.27% | 14.88% | 16.45% | - | - | Invest | |

| 429.17 | 16 years | 0.17% | 0.43% | 1.15% | 5.2% | 6.55% | 8.67% | 8.3% | 7.78% | 5.66% | 6.04% | Invest | |

| 192.05 | 10 years | 0.29% | 0.72% | 1.59% | 4.7% | 6.18% | 8.31% | 8.22% | 7.86% | 9.75% | 7.77% | Invest | |

| 287.57 | 15 years | 0.05% | 0.32% | 1% | 4.5% | 5.84% | 7.89% | 7.7% | 7.36% | 5.79% | 6.99% | Invest | |

| 2306.06 | 6 years | 0.12% | 0.51% | 1.53% | 4.09% | 5.46% | 7.69% | 7.4% | 7.14% | 5.54% | - | Invest | |

| 2306.06 | 6 years | 0.12% | 0.51% | 1.53% | 4.09% | 5.46% | 7.69% | 7.4% | 7.14% | 5.54% | - | Invest | |

| 26.84 | 4 years | 0.08% | 0.22% | 0.64% | 4.52% | 5.7% | 7.68% | 7.59% | 7.04% | - | - | Invest | |

| 1614.95 | 7 years | 0.11% | 0.5% | 1.5% | 3.81% | 5.18% | 7.4% | 7.35% | 7.27% | 5.93% | - | Invest | |

| 301.44 | 19 years | 0.1% | 0.43% | 1.39% | 3.91% | 5.19% | 7.22% | 7.03% | 6.82% | 5.52% | 6.4% | Invest | |

| 10107.81 | 16 years | 0.11% | 0.49% | 1.41% | 3.22% | 4.64% | 6.78% | 7.02% | 6.95% | 5.61% | 6.2% | Invest | |

| 1345.56 | 23 years | 0.09% | -0.31% | -0.82% | 3.03% | 4.57% | 6.3% | 7.79% | 7.7% | 5.45% | 6.58% | Invest | |

| 1174.74 | 8 years | 0.02% | 0.3% | 1.3% | 2.98% | 4.27% | 6.16% | 6.91% | 6.83% | 5.5% | - | Invest | |

| 741.67 | 6 years | 0.1% | 0.48% | 1.32% | 2.81% | 4.13% | 6.08% | 6.39% | 6.39% | 5.21% | - | Invest | |

| 295.43 | 13 years | 1.49% | 0.52% | -0.42% | 14.93% | 8.7% | 5.78% | 16.93% | 15.34% | 19.57% | 12.39% | Invest | |

| 268.52 | 6 years | 0.83% | 1.1% | 1.19% | 8.22% | 4.22% | 4.1% | 10.3% | 9.91% | 8.44% | - | Invest | |

| 1193.95 | 2 years | 0.87% | 3.16% | 2.63% | 13.73% | 8.39% | 4.03% | 16.54% | - | - | - | Invest | |

| 812.90 | 20 years | 0.38% | 0.68% | 0.66% | 5.72% | 3.31% | 4.01% | 8.49% | 8.37% | 7.61% | 7.33% | Invest | |

| 4331.79 | 6 years | 1.87% | 1.77% | 0.84% | 13.26% | 4.03% | 2.79% | 13.39% | 14.07% | 14.15% | - | Invest | |

| 380.63 | 1 years | 1.11% | 1.47% | 1.56% | 12.45% | 2.34% | 0.88% | - | - | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 79.59 | High |

-

|

-

|

-

|

-

|

-

|

-

|

-

|

Invest | |

| 38.36 | Very High |

7.67%

|

22.4%

|

15.51%

|

14.27%

|

-

|

-

|

11.59%

|

Invest | |

| 429.17 | Moderate |

1.4%

|

8.35%

|

8.66%

|

8.32%

|

6.89%

|

5.94%

|

6.44%

|

Invest | |

| 192.05 | Moderately High |

1.66%

|

8.08%

|

8.29%

|

8.12%

|

8.32%

|

7.72%

|

7.73%

|

Invest | |

| 287.57 | Moderate |

1.28%

|

7.56%

|

7.89%

|

7.71%

|

6.72%

|

6.6%

|

7.13%

|

Invest | |

| 2306.06 | Low to Moderate |

1.59%

|

7.44%

|

7.49%

|

7.38%

|

6.58%

|

-

|

6.12%

|

Invest | |

| 2306.06 | Low to Moderate |

1.59%

|

7.44%

|

7.49%

|

7.38%

|

6.58%

|

-

|

6.12%

|

Invest | |

| 26.84 | Moderate |

1.01%

|

7.11%

|

7.74%

|

7.52%

|

-

|

-

|

6.5%

|

Invest | |

| 1614.95 | Low to Moderate |

1.55%

|

7.1%

|

7.31%

|

7.32%

|

6.75%

|

-

|

6.33%

|

Invest | |

| 301.44 | Low to Moderate |

1.46%

|

7%

|

7.09%

|

7.03%

|

6.29%

|

6.14%

|

6.98%

|

Invest | |

| 10107.81 | Low to Moderate |

1.42%

|

6.37%

|

6.79%

|

6.91%

|

6.43%

|

5.97%

|

37.17%

|

Invest | |

| 1345.56 | Moderate |

-0.54%

|

4.32%

|

7.06%

|

7.44%

|

6.53%

|

6.31%

|

7.1%

|

Invest | |

| 1174.74 | Low to Moderate |

1.34%

|

5.96%

|

6.49%

|

6.8%

|

6.25%

|

-

|

5.74%

|

Invest | |

| 741.67 | Low |

1.33%

|

5.73%

|

6.13%

|

6.29%

|

5.92%

|

-

|

5.55%

|

Invest | |

| 295.43 | Very High |

1.12%

|

12.84%

|

14.33%

|

16.32%

|

15.21%

|

13.24%

|

12.84%

|

Invest | |

| 268.52 | Moderately High |

1.88%

|

7.57%

|

8.21%

|

9.64%

|

8.95%

|

-

|

8.93%

|

Invest | |

| 1193.95 | Very High |

4.08%

|

13.36%

|

12.81%

|

-

|

-

|

-

|

15.34%

|

Invest | |

| 812.90 | Moderately High |

1.1%

|

5.86%

|

6.89%

|

8.05%

|

7.53%

|

7.3%

|

7.44%

|

Invest | |

| 4331.79 | Very High |

2.27%

|

9.33%

|

9.93%

|

12.81%

|

12.61%

|

-

|

13.84%

|

Invest | |

| 380.63 | Very High |

2.71%

|

8.45%

|

-

|

-

|

-

|

-

|

6.57%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

16.87%

|

-

|

-

|

0.52%

|

Invest | |

| Moderate |

1.39%

|

-

|

1.54%

|

0.64%

|

Invest | |

| Moderately High |

4.42%

|

1.59%

|

-

|

0.74%

|

Invest | |

| Moderate |

1.22%

|

4.3%

|

2.35%

|

-

|

Invest | |

| Low to Moderate |

0.35%

|

-

|

3.66%

|

1.02%

|

Invest | |

| Low to Moderate |

0.35%

|

-

|

3.66%

|

1.02%

|

Invest | |

| Moderate |

1.38%

|

-

|

1.48%

|

0.18%

|

Invest | |

| Low to Moderate |

0.27%

|

-

|

2.77%

|

1.96%

|

Invest | |

| Low to Moderate |

0.40%

|

-

|

4.25%

|

0.15%

|

Invest | |

| Low to Moderate |

0.47%

|

2.07%

|

0.95%

|

0.36%

|

Invest | |

| Moderate |

2.32%

|

-

|

0.58%

|

-

|

Invest | |

| Low to Moderate |

0.41%

|

-

|

-

|

0.36%

|

Invest | |

| Low |

0.13%

|

-

|

0.03%

|

-

|

Invest | |

| Very High |

15.28%

|

1.76%

|

0.95%

|

0.71%

|

Invest | |

| Moderately High |

5.00%

|

-

|

-

|

0.50%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderately High |

3.43%

|

-

|

1.01%

|

0.35%

|

Invest | |

| Very High |

9.43%

|

-

|

-

|

0.66%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹100

|

0.48%

|

|

19-Dec 2023

|

Invest | |

|

₹100

|

₹5000

|

1.57%

|

Miten Vora

|

07-May 2021

|

Invest | |

|

₹100

|

₹5000

|

0.58%

|

Mayank Prakash

|

08-Nov 2008

|

Invest | |

|

₹500

|

₹5000

|

1.61%

|

Prashant R Pimple

|

23-Jan 2015

|

Invest | |

|

₹500

|

₹5000

|

1.05%

|

Prashant R Pimple

|

30-Jun 2010

|

Invest | |

|

₹500

|

₹5000

|

0.43%

|

Mayank Prakash

|

19-Jun 2019

|

Invest | |

|

₹500

|

₹5000

|

0.43%

|

Mayank Prakash

|

19-Jun 2019

|

Invest | |

|

₹500

|

₹5000

|

0.79%

|

Prashant R Pimple

|

17-Dec 2020

|

Invest | |

|

₹500

|

₹5000

|

0.48%

|

Mayank Prakash

|

01-Jun 2018

|

Invest | |

|

₹100

|

₹5000

|

1.1%

|

Mayank Prakash

|

21-Oct 2005

|

Invest | |

|

₹500

|

₹5000

|

0.31%

|

Mayank Prakash

|

05-Feb 2009

|

Invest | |

|

₹500

|

₹5000

|

0.45%

|

Mayank Prakash

|

21-Mar 2002

|

Invest | |

|

₹100

|

₹5000

|

1.18%

|

Vikram Pamnani

|

28-Dec 2016

|

Invest | |

|

₹500

|

₹5000

|

0.17%

|

Vikram Pamnani

|

25-Apr 2019

|

Invest | |

|

₹500

|

₹5000

|

2.41%

|

Sandeep Jain

|

22-Jun 2012

|

Invest | |

|

₹500

|

₹5000

|

2.48%

|

Mayank Prakash

|

29-Jul 2019

|

Invest | |

|

₹100

|

₹5000

|

2.1%

|

Jitendra Sriram

|

19-Dec 2022

|

Invest | |

|

₹100

|

₹1000

|

2.04%

|

Prashant R Pimple

|

23-Sep 2004

|

Invest | |

|

₹500

|

₹5000

|

1.89%

|

Prashant R Pimple

|

13-Nov 2018

|

Invest | |

|

₹500

|

₹1000

|

2.27%

|

Mayank Prakash

|

31-May 2024

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

107.7111

(16-09-2025)

|

106.3578

(15-09-2025)

|

1.27%

|

-

|

-

|

Invest | |

|

13.8519

(16-09-2025)

|

13.9050

(15-09-2025)

|

-0.38%

|

14.0167

|

11.0266

|

Invest | |

|

27.8841

(16-09-2025)

|

27.8794

(15-09-2025)

|

0.02%

|

27.8841

|

25.6863

|

Invest | |

|

22.5396

(16-09-2025)

|

22.5241

(15-09-2025)

|

0.07%

|

22.5396

|

20.8332

|

Invest | |

|

29.5966

(16-09-2025)

|

29.5930

(15-09-2025)

|

0.01%

|

29.5966

|

27.4584

|

Invest | |

|

1399.2319

(16-09-2025)

|

1398.8201

(15-09-2025)

|

0.03%

|

1399.23

|

1300.08

|

Invest | |

|

1399.2319

(16-09-2025)

|

1398.8201

(15-09-2025)

|

0.03%

|

1399.23

|

1300.08

|

Invest | |

|

12.7681

(16-09-2025)

|

12.7688

(15-09-2025)

|

-0.01%

|

12.7791

|

11.8717

|

Invest | |

|

1563.0597

(16-09-2025)

|

1562.6274

(15-09-2025)

|

0.03%

|

1563.06

|

1456.33

|

Invest | |

|

40.6067

(16-09-2025)

|

40.5960

(15-09-2025)

|

0.03%

|

40.6067

|

37.9008

|

Invest | |

|

3037.7106

(16-09-2025)

|

3037.0817

(15-09-2025)

|

0.02%

|

3037.71

|

2846.44

|

Invest | |

|

42.5845

(16-09-2025)

|

42.5439

(15-09-2025)

|

0.1%

|

43.2629

|

40.1055

|

Invest | |

|

16.2249

(16-09-2025)

|

16.2252

(15-09-2025)

|

-0%

|

16.2279

|

15.2892

|

Invest | |

|

1369.8062

(16-09-2025)

|

1369.6075

(15-09-2025)

|

0.01%

|

1369.81

|

1292

|

Invest | |

|

47.6543

(16-09-2025)

|

47.5081

(15-09-2025)

|

0.31%

|

49.2936

|

40.9269

|

Invest | |

|

16.7219

(16-09-2025)

|

16.6792

(15-09-2025)

|

0.26%

|

16.7219

|

15.3004

|

Invest | |

|

15.2344

(16-09-2025)

|

15.1451

(15-09-2025)

|

0.59%

|

15.2344

|

13.1967

|

Invest | |

|

44.8809

(16-09-2025)

|

44.8240

(15-09-2025)

|

0.13%

|

45.0848

|

42.232

|

Invest | |

|

24.5231

(16-09-2025)

|

24.3969

(15-09-2025)

|

0.52%

|

24.8758

|

21.2798

|

Invest | |

|

11.1963

(16-09-2025)

|

11.1490

(15-09-2025)

|

0.42%

|

11.2986

|

9.8195

|

Invest |

Baroda BNP Paribas Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Baroda BNP Paribas Mutual Fund

Baroda BNP Paribas Equity Savings Fund - Regular Plan - Growth

3Y Returns 9.91%

VS

Baroda BNP Paribas Equity Savings Fund - Regular Plan - Growth

3Y Returns 9.91%

VS

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns 15.51%

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns 15.51%

Baroda BNP Paribas LIQUID FUND - Regular Plan - GROWTH OPTION

3Y Returns 6.95%

VS

Baroda BNP Paribas LIQUID FUND - Regular Plan - GROWTH OPTION

3Y Returns 6.95%

VS

Axis Liquid Fund - Regular Plan - Growth Option

3Y Returns 7.03%

Axis Liquid Fund - Regular Plan - Growth Option

3Y Returns 7.03%

Baroda BNP Paribas Money Market Fund-Regular Plan - Growth

3Y Returns 7.14%

VS

Baroda BNP Paribas Money Market Fund-Regular Plan - Growth

3Y Returns 7.14%

VS

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.52%

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.52%

Baroda BNP Paribas Credit Risk Fund -Regular-Growth Option

3Y Returns 7.86%

VS

Baroda BNP Paribas Credit Risk Fund -Regular-Growth Option

3Y Returns 7.86%

VS

UTI Credit Risk Fund - Regular Plan - Growth Option

3Y Returns 7.26%

UTI Credit Risk Fund - Regular Plan - Growth Option

3Y Returns 7.26%

Investment Strategy

This fund focuses on generating long-term revenue by majorly investing in equity-related funds. it has a well-defined framework to manage risk during market shifts.

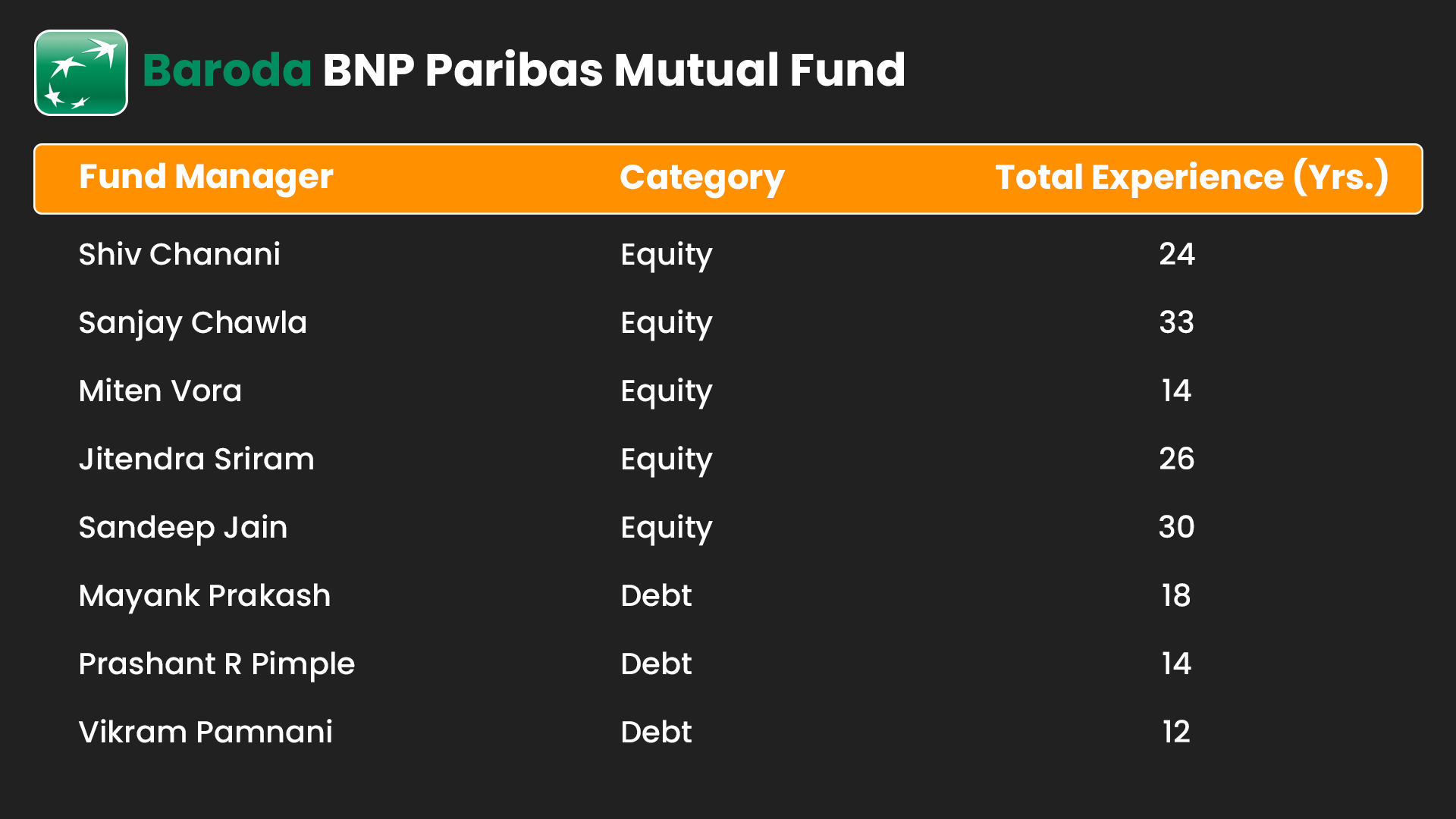

Head of Equity & Debt Team

Mr. Sanjay Chawla (CIO of Equity)

MR Sanjay Chawla is the CIO at Baroda Paribas AMC with 33 years of experience. He has managed many significant roles throughout his career, including HOD at SBI Capital Markets. His extensive knowledge and experience add great value to the Mutual Fund house.

List of all fund managers

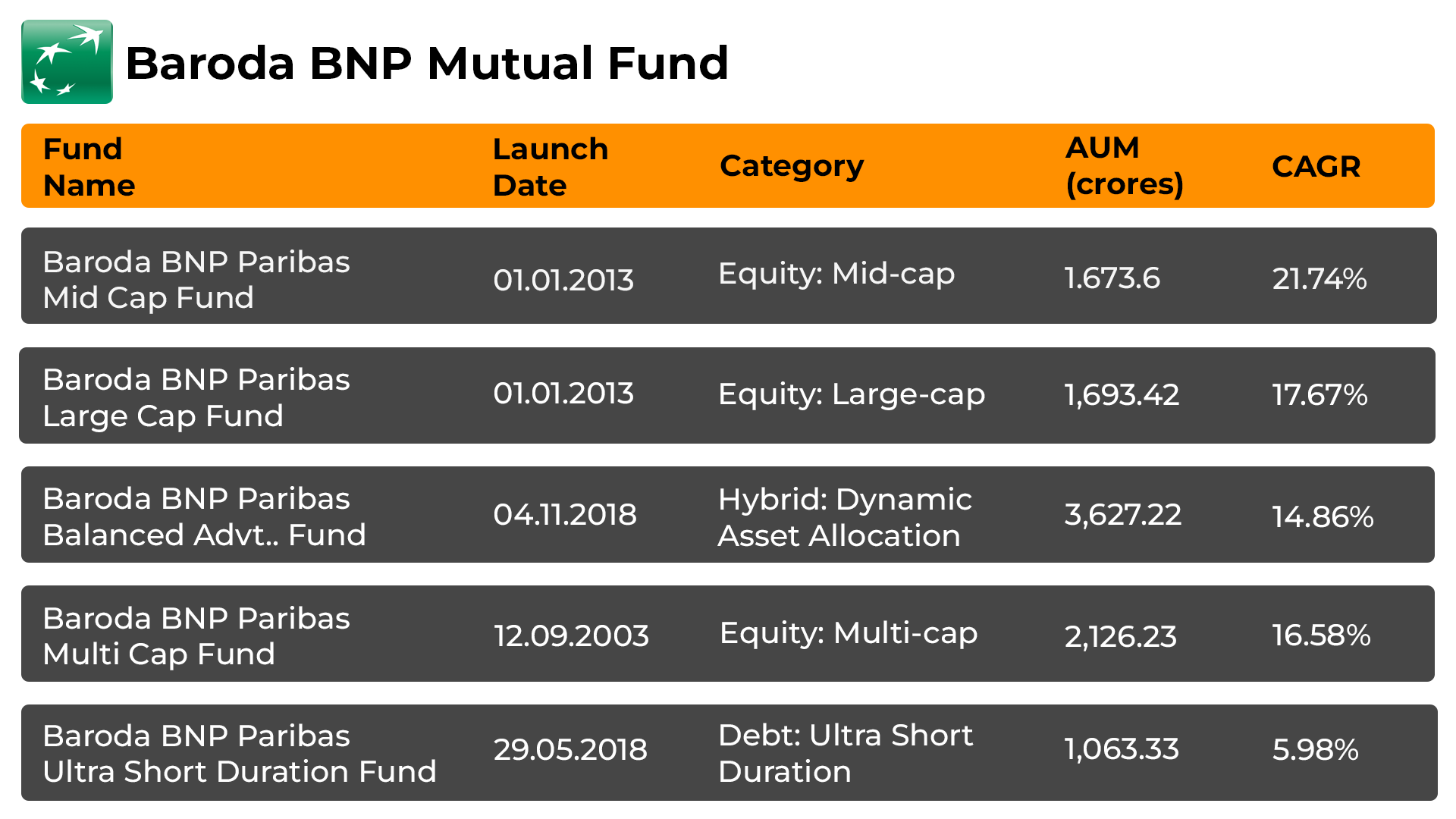

Top 5 Baroda BNP Paribas Mutual Fund

History of Baroda BNP Paribas Mutual Fund

Baroda BNP Paribas Mutual Fund is a collaboration between the Bank of Baroda and BNP Paribas Asset Management Asia Limited. It obtained registration with SEBI on August 12, 2008. They chose to work together on October 11, 2019, and formally formed one team on March 14, 2022.

In this cooperation, Bank of Baroda (the parent company of Baroda AMC) holds 50.1% of the team, while BNP Paribas AMC owns 49.9%. The United team now has a strong presence in 90 cities throughout India.

Baroda BNP Paribas Mutual Fund has approximately 34 distinct mutual fund plans, including those for stocks, a combination of investments, and fixed-income choices. It's like having a selection of options to fulfil different investment requirements.

How to Select Baroda BNP Paribas Mutual Fund?

The selection of the right fund depends upon various fundamentals. Make sure you properly assess the following aspects before starting your investment journey.

- Ensure investment objectives are achievable and plan accordingly.

- Balance risk and reward by determining risk tolerance before investing.

- Set and adjust limits based on needs, utilizing diversification across sectors.

- Educate yourself through research before investing in a specific fund.

- Analyse historical performance to understand its operational styles.

- Regularly monitor investments and make necessary modifications.

- Seek expert advice due to market volatility in mutual funds.

In the end, these above factors must be kept in mind for the smooth functioning of investments. Use a SIP Calculator to assess the returns on your investments.

How to Invest in Baroda BNP Paribas Mutual Fund via MySIPonline?

Investing in Baroda BNP Paribas Mutual Funds is made simple with mysiponline:

- Visit mysiponline.com and choose mutual fund plans based on goals.

- Register for free, complete your profile, and add preferred funds.

- Complete your KYC procedure, for the further procedure

- Select and add funds to your basket based on your risk tolerance.

- Make your payment, wait for confirmation of your investment.

- Keep track of your investments at mysiponline.com.

To summarize, every investor looks for a platform that provides simplified solutions. With MySIPonline investors are offered an Online SIP for quick and easy suggestions to combat their difficulties.

What is the Taxation on The Baroda BNP Mutual Fund?

The taxation of Baroda BNP Paribas Mutual Funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding RS 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Baroda BNP Paribas Mutual Fund?

What are the different Baroda BNP Paribas mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in Baroda BNP Paribas Funds online tax-free?

How to analyse the performance of Baroda BNP Paribas Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of Baroda BNP Paribas Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.