Canara Robeco Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 26

- Average annual returns 3.61%

About Canara Robeco Mutual Fund

Canara Robeco Mutual Fund, established in 2007, is a joint venture between Canara Bank and Robeco of the Netherlands, and the globally recognized asset management business, Robeco is a global leader in sustainable investing. Currently, This Mutual Fund is ranked 16th among mutual fund companies based on Assets Under Management (AUM).

- Canara Robeco Mutual Fund offers 23 schemes, including 11 Equity, 10 Debt, and 2 Hybrid Schemes.

- Their schemes are highly consistent performers, reflecting their commitment to delivering value to investors.

- Canara Robeco Small Cap Fund, the flagship scheme, has exhibited an impressive average annualized return of 26.46% since its inception.

-

Launched in

01-Jul-2015

-

AMC Age

10 Years

-

Website

https://www.canararobeco.com -

Email Address

crmf@canararobeco.com

Top Performing Canara Robeco Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1506.24 | 20 years | 0.11% | 0.37% | 1.36% | 4.06% | 5.3% | 7.56% | 7.36% | 7.09% | 5.66% | 6.58% | Invest | |

| 483.32 | 14 years | 0.14% | 0.27% | 0.91% | 4% | 5.29% | 7.37% | 7.18% | 6.66% | 5.34% | 6.55% | Invest | |

| 227.67 | 3 years | 0.2% | 0.22% | 0.88% | 3.82% | 5% | 7.21% | 7.21% | 6.64% | - | - | Invest | |

| 7415.06 | 17 years | 0.1% | 0.47% | 1.41% | 3.3% | 6.94% | 6.91% | 7.12% | 7.01% | 5.62% | 6.08% | Invest | |

| 730.46 | 17 years | 0.08% | 0.39% | 1.33% | 3.53% | 4.73% | 6.87% | 6.72% | 6.5% | 5.07% | 5.69% | Invest | |

| 115.16 | 11 years | 0.17% | 0.09% | 0.65% | 3.59% | 4.64% | 6.74% | 6.97% | 6.47% | 5.27% | 6.5% | Invest | |

| 293.04 | 6 years | 0.1% | 0.45% | 1.33% | 2.82% | 4.04% | 6.07% | 6.38% | 6.37% | 5.2% | - | Invest | |

| 950.43 | 24 years | 0.1% | 0.45% | 0.59% | 6.13% | 4.08% | 5.31% | 8.79% | 8.21% | 8.56% | 8.08% | Invest | |

| 125.81 | 22 years | 0.12% | 0.02% | 0.09% | 2.63% | 3.77% | 5.08% | 6.51% | 5.84% | 4.57% | 6.3% | Invest | |

| 154.44 | 25 years | 0.15% | 0.1% | -0.52% | 2.04% | 3.15% | 4.32% | 6.78% | 6.45% | 4.97% | 6.86% | Invest | |

| 111.64 | 16 years | -0.05% | -0.45% | -0.96% | 1.54% | 2.57% | 3.47% | 5.83% | 5.66% | 4.35% | 6.08% | Invest | |

| 2720.25 | 4 years | 0.45% | 1.56% | 1.67% | 15.75% | 4.14% | 2.97% | 18.19% | 16.9% | - | - | Invest | |

| 13389.36 | 21 years | 0.7% | 2.09% | 1.36% | 16.45% | 17.45% | 2.28% | 16.3% | 14.85% | 18.97% | 14.28% | Invest | |

| 25550.61 | 20 years | 0.52% | 3% | 1.11% | 17.04% | 17.24% | 2.11% | 18.12% | 16.19% | 21.33% | 16.25% | Invest | |

| 11059.16 | 27 years | 0.87% | 1.51% | -0.39% | 11.89% | 12.67% | 1.77% | 13.42% | 12.94% | 15.72% | 12.76% | Invest | |

| 3132.66 | 2 years | 0.92% | 2.46% | 1.63% | 23.27% | 5.24% | 1.75% | 20.31% | - | - | - | Invest | |

| 16406.92 | 15 years | 0.8% | 1.45% | -0.17% | 12.09% | 13% | 1.53% | 15.48% | 14.77% | 17.99% | 14.16% | Invest | |

| 4547.62 | 2 years | 0.83% | 2.02% | 0.41% | 16.96% | 2.52% | 1.04% | 18.31% | - | - | - | Invest | |

| 1643.88 | 1 years | 0.95% | 4.09% | 3.41% | 22.17% | 2.74% | 0.24% | - | - | - | - | Invest | |

| 950.74 | 3 months | 0.59% | 2.18% | 2.69% | - | - | - | - | - | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1506.24 | Low to Moderate |

1.51%

|

7.31%

|

7.45%

|

7.37%

|

6.58%

|

6.31%

|

7.14%

|

Invest | |

| 483.32 | Low to Moderate |

1.08%

|

6.82%

|

7.28%

|

7.11%

|

6.16%

|

6.18%

|

6.45%

|

Invest | |

| 227.67 | Moderate |

0.92%

|

6.32%

|

7.13%

|

7.06%

|

-

|

-

|

7.04%

|

Invest | |

| 7415.06 | Low to Moderate |

1.45%

|

6.54%

|

6.92%

|

7.02%

|

6.48%

|

5.91%

|

39.56%

|

Invest | |

| 730.46 | Low to Moderate |

1.41%

|

6.6%

|

6.75%

|

6.7%

|

6%

|

5.52%

|

39.3%

|

Invest | |

| 115.16 | Moderate |

0.68%

|

5.73%

|

6.76%

|

6.76%

|

5.96%

|

6.14%

|

6.3%

|

Invest | |

| 293.04 | Low |

1.34%

|

5.76%

|

6.12%

|

6.28%

|

5.9%

|

-

|

5.59%

|

Invest | |

| 950.43 | Moderately High |

1.55%

|

6.35%

|

7.82%

|

8.55%

|

8.01%

|

8.39%

|

9.33%

|

Invest | |

| 125.81 | Moderate |

0.03%

|

4.11%

|

5.95%

|

6.13%

|

5.35%

|

5.73%

|

7.38%

|

Invest | |

| 154.44 | Moderate |

-0.92%

|

2.58%

|

5.61%

|

6.26%

|

5.74%

|

6.08%

|

7.47%

|

Invest | |

| 111.64 | Moderate |

-1.2%

|

1.83%

|

4.78%

|

5.42%

|

5.05%

|

5.4%

|

6.46%

|

Invest | |

| 2720.25 | Average |

5.2%

|

11.23%

|

14.23%

|

17.53%

|

-

|

-

|

16.73%

|

Invest | |

| 13389.36 | Very High |

5.13%

|

11.21%

|

12.08%

|

15.23%

|

14.71%

|

15.46%

|

15.05%

|

Invest | |

| 25550.61 | Average |

6.01%

|

11.26%

|

14.03%

|

17.57%

|

16.78%

|

16.7%

|

17.96%

|

Invest | |

| 11059.16 | Very High |

2.58%

|

6.53%

|

9.31%

|

12.47%

|

12.47%

|

13.14%

|

14.48%

|

Invest | |

| 3132.66 | Very High |

8.56%

|

16.64%

|

15.74%

|

-

|

-

|

-

|

20.52%

|

Invest | |

| 16406.92 | Average |

2.45%

|

6.34%

|

10.25%

|

13.96%

|

13.88%

|

14.99%

|

14.19%

|

Invest | |

| 4547.62 | Very High |

5.38%

|

9.74%

|

12.37%

|

-

|

-

|

-

|

13.48%

|

Invest | |

| 1643.88 | Very High |

8.79%

|

14.34%

|

-

|

-

|

-

|

-

|

10.02%

|

Invest | |

| 950.74 | Average |

-

|

-

|

-

|

-

|

-

|

-

|

9.18%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Low to Moderate |

0.45%

|

-

|

4.84%

|

0.80%

|

Invest | |

| Low to Moderate |

0.96%

|

-

|

1.13%

|

-

|

Invest | |

| Moderate |

1.09%

|

-

|

1.28%

|

-

|

Invest | |

| Low to Moderate |

0.49%

|

2.11%

|

0.97%

|

0.33%

|

Invest | |

| Low to Moderate |

0.29%

|

-

|

3.26%

|

-

|

Invest | |

| Moderate |

1.13%

|

-

|

1.20%

|

-

|

Invest | |

| Low |

0.13%

|

-

|

-

|

-

|

Invest | |

| Moderately High |

3.60%

|

-

|

1.08%

|

0.41%

|

Invest | |

| Moderate |

2.25%

|

-

|

1.14%

|

-

|

Invest | |

| Moderate |

3.23%

|

-

|

1.36%

|

-

|

Invest | |

| Moderate |

3.08%

|

-

|

1.49%

|

-

|

Invest | |

| Average |

12.31%

|

2.96%

|

0.88%

|

0.80%

|

Invest | |

| Very High |

11.94%

|

0.4%

|

0.9%

|

0.71%

|

Invest | |

| Average |

12%

|

-

|

0.94%

|

0.73%

|

Invest | |

| Very High |

9.11%

|

6.04%

|

0.12%

|

0.71%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Average |

11.41%

|

1.89%

|

0.89%

|

0.73%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Average |

-

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹1000

|

₹5000

|

0.65%

|

Avnish Jain

|

04-Mar 2005

|

Invest | |

|

₹1000

|

₹5000

|

1.02%

|

Suman Prasad

|

25-Apr 2011

|

Invest | |

|

₹1000

|

₹5000

|

0.71%

|

Avnish Jain

|

22-Aug 2022

|

Invest | |

|

₹1000

|

₹5000

|

0.19%

|

Avnish Jain

|

15-Jul 2008

|

Invest | |

|

₹500

|

₹500

|

0.95%

|

Suman Prasad

|

14-Jul 2008

|

Invest | |

|

₹1000

|

₹5000

|

1.03%

|

Suman Prasad

|

07-Feb 2014

|

Invest | |

|

₹1000

|

₹5000

|

0.11%

|

Suman Prasad

|

24-Jul 2019

|

Invest | |

|

₹1000

|

₹5000

|

1.85%

|

Avnish Jain

|

03-Apr 2001

|

Invest | |

|

₹1000

|

₹5000

|

1.88%

|

Avnish Jain

|

19-Sep 2002

|

Invest | |

|

₹1000

|

₹5000

|

1.25%

|

Avnish Jain

|

06-Jan 2000

|

Invest | |

|

₹1000

|

₹5000

|

1.75%

|

Avnish Jain

|

29-May 2009

|

Invest | |

|

₹1000

|

₹5000

|

1.96%

|

Shridatta Bhandwaldar

|

17-May 2021

|

Invest | |

|

₹100

|

₹5000

|

1.69%

|

Pranav Gokhale

|

16-Sep 2003

|

Invest | |

|

₹1000

|

₹5000

|

1.61%

|

Shridatta Bhandwaldar

|

11-Mar 2005

|

Invest | |

|

₹1000

|

₹5000

|

1.72%

|

Avnish Jain

|

20-Mar 1998

|

Invest | |

|

₹1000

|

₹5000

|

1.96%

|

Pranav Gokhale

|

02-Dec 2022

|

Invest | |

|

₹100

|

₹100

|

1.65%

|

Vishal Mishra

|

20-Aug 2010

|

Invest | |

|

₹1000

|

₹5000

|

1.87%

|

Vishal Mishra

|

28-Jul 2023

|

Invest | |

|

₹1000

|

₹5000

|

2.08%

|

Pranav Gokhale

|

11-Mar 2024

|

Invest | |

|

₹5000

|

₹5000

|

-

|

|

06-Jun 2025

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

42.6999

(12-09-2025)

|

42.6970

(11-09-2025)

|

0.01%

|

42.6999

|

39.7343

|

Invest | |

|

25.6597

(12-09-2025)

|

25.6653

(11-09-2025)

|

-0.02%

|

25.6653

|

23.95

|

Invest | |

|

12.1833

(12-09-2025)

|

12.1820

(11-09-2025)

|

0.01%

|

12.1833

|

11.3812

|

Invest | |

|

3179.5561

(14-09-2025)

|

3178.1108

(11-09-2025)

|

0.05%

|

3179.56

|

2974.45

|

Invest | |

|

3842.8170

(12-09-2025)

|

3842.2926

(11-09-2025)

|

0.01%

|

3842.82

|

3598.99

|

Invest | |

|

21.8896

(12-09-2025)

|

21.8902

(11-09-2025)

|

-0%

|

21.9167

|

20.5494

|

Invest | |

|

1350.8056

(14-09-2025)

|

1350.2222

(11-09-2025)

|

0.04%

|

1350.81

|

1273.55

|

Invest | |

|

97.5298

(12-09-2025)

|

97.4391

(11-09-2025)

|

0.09%

|

97.6743

|

91.0046

|

Invest | |

|

55.4659

(12-09-2025)

|

55.4446

(11-09-2025)

|

0.04%

|

55.8861

|

52.8816

|

Invest | |

|

75.0415

(12-09-2025)

|

74.9861

(11-09-2025)

|

0.07%

|

76.9519

|

72.1303

|

Invest | |

|

29.0832

(12-09-2025)

|

29.0442

(11-09-2025)

|

0.13%

|

29.9178

|

28.1081

|

Invest | |

|

20.2300

(12-09-2025)

|

20.1400

(11-09-2025)

|

0.45%

|

20.51

|

17.03

|

Invest | |

|

345.7100

(12-09-2025)

|

344.6100

(11-09-2025)

|

0.32%

|

352.91

|

289.86

|

Invest | |

|

261.6100

(12-09-2025)

|

261.2800

(11-09-2025)

|

0.13%

|

266.88

|

217.12

|

Invest | |

|

361.8200

(12-09-2025)

|

360.8900

(11-09-2025)

|

0.26%

|

366.1

|

317.33

|

Invest | |

|

17.4800

(12-09-2025)

|

17.4800

(11-09-2025)

|

0%

|

17.74

|

13.89

|

Invest | |

|

63.3500

(12-09-2025)

|

63.1200

(11-09-2025)

|

0.36%

|

65.27

|

55.32

|

Invest | |

|

14.6600

(12-09-2025)

|

14.6200

(11-09-2025)

|

0.27%

|

15.01

|

12.19

|

Invest | |

|

12.8000

(12-09-2025)

|

12.7300

(11-09-2025)

|

0.55%

|

13.33

|

10.04

|

Invest | |

|

10.3500

(12-09-2025)

|

10.3100

(11-09-2025)

|

0.39%

|

10.35

|

10

|

Invest |

Canara Robeco Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Canara Robeco Mutual Fund

Canara Robeco Gilt Fund - Regular Plan - Growth Option

3Y Returns 6.45%

VS

Canara Robeco Gilt Fund - Regular Plan - Growth Option

3Y Returns 6.45%

VS

ICICI Prudential Gilt Fund - Growth

3Y Returns 7.65%

ICICI Prudential Gilt Fund - Growth

3Y Returns 7.65%

Canara Robeco Large Cap Fund - Regular Plan - Growth Option

3Y Returns 14.77%

VS

Canara Robeco Large Cap Fund - Regular Plan - Growth Option

3Y Returns 14.77%

VS

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

Canara Robeco Focused Fund - Regular Plan - Growth Option

3Y Returns 16.9%

VS

Canara Robeco Focused Fund - Regular Plan - Growth Option

3Y Returns 16.9%

VS

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.73%

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.73%

Canara Robeco Dynamic Bond Fund - Regular Plan - Growth Option

3Y Returns 5.66%

VS

Canara Robeco Dynamic Bond Fund - Regular Plan - Growth Option

3Y Returns 5.66%

VS

UTI Dynamic Bond Fund - Regular Plan - Growth Option

3Y Returns 6.79%

UTI Dynamic Bond Fund - Regular Plan - Growth Option

3Y Returns 6.79%

Investment Strategy

This mutual fund invests in companies showing both growth and value traits, aiming for high revenue. It seizes market downturns to buy undervalued stocks from value companies at discounted prices, balancing potential growth opportunities with risk management.

Head of Equity & Debt Team

MR. Anup Maheshwari (CIO)

MR Anup Maheshwari is the co-founder and Chief Investment Officer (CIO). He obtained a Post Graduate Diploma in Management (PGDM) from the Indian Institute of Management in Lucknow. Mr Maheshwari brings plenty of knowledge to the financial services sector, having spent over 24 years there. Before joining IIFL Asset Management Limited, he was an Executive Vice President and Chief Investment Officer at DSP Investment Managers Private Limited for nearly 11 years. His professional experience includes positions with HSBC Asset Management (India) Private Limited and Merrill Lynch India Equities Fund (Mauritius) Limited. Mr. Maheshwari is a Commerce graduate from Bombay University.

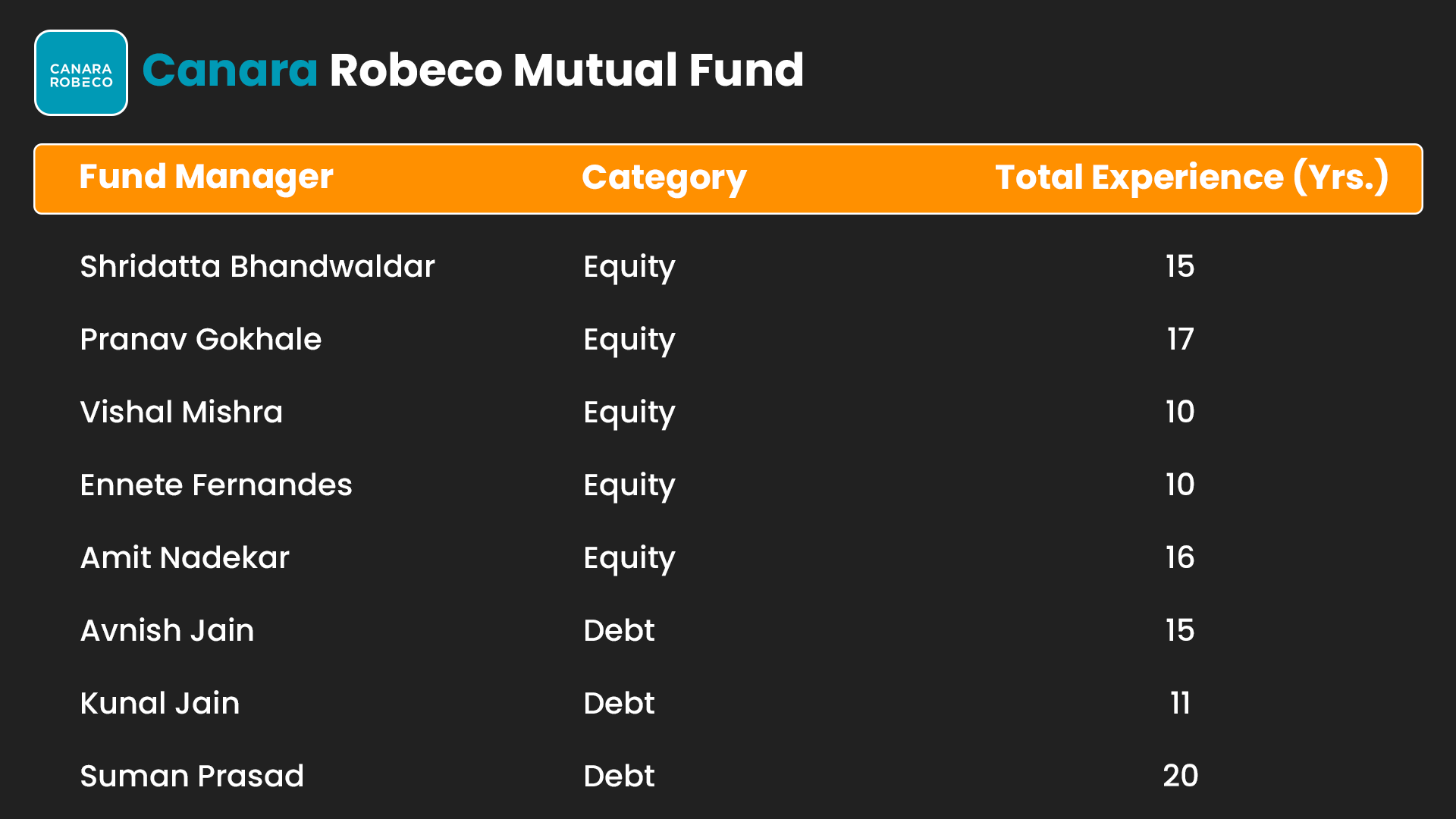

List of Fund Managers

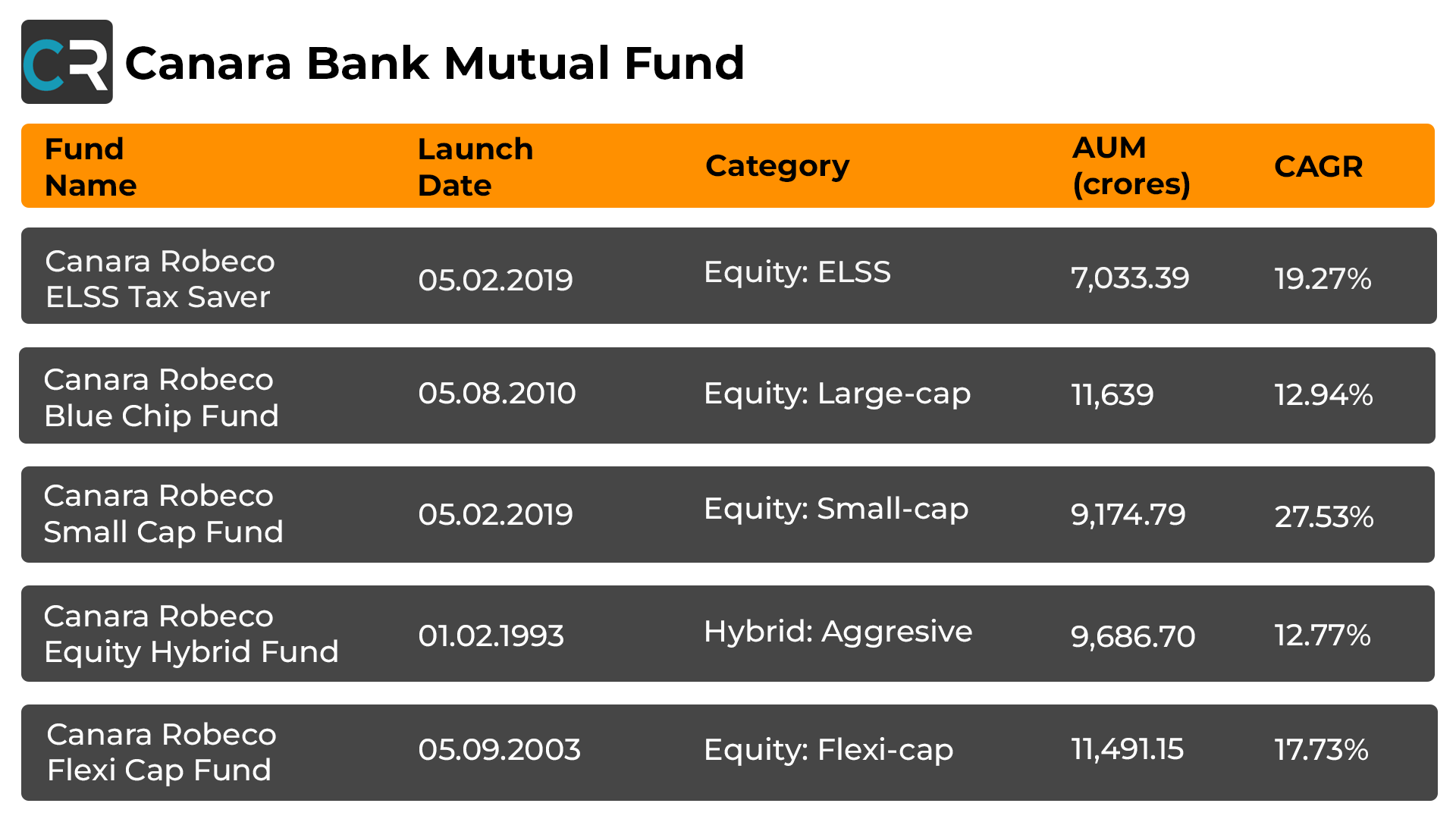

Top 5 Canara Robeco Funds

History of Canara Robeco Mutual Fund

Canara Robeco Asset Management Company (CRAMC), which manages Canara Robeco Mutual Fund, is a collaboration between Canara Bank and Robeco of the Netherlands. Combining Canara Bank's Indian market expertise with Robeco's global knowledge, the company manages a portfolio worth around US$180 billion worldwide.

Canbank Mutual Fund was founded in December 1987 and was renamed Canara Robeco Mutual Fund in 2007 after a cooperation with Robeco. Since then, it has continuously been one of India's fastest-growing mutual funds, with an impressive 94% year-on-year gain from March 2009 to March 2010. Canara Robeco Asset Management Company Ltd. provides a variety of investment choices, including equity schemes, hybrid funds, and debt products, to fulfil the different demands of investors.

How to Select Canara Robeco Mutual Fund?

It is the most important step when entering into the Canara Robeco MF. It takes a clear understanding of various factors such as:

- Creating Goals: Establish attainable objectives for your financial decisions. Identify and create a strategy to address their requirements.

- Risk Tolerance Assessment: Determine how comfortable you are with risk, keeping in mind that higher risk can provide higher rewards.

- Applying Diversification: To lower risk and boost potential earnings, distribute your investments among several industries.

- Self-education: Make it a priority to educate yourself about finances. Examine historical results and financial operations.

- Regular Monitoring: Keep a close eye on your investments and adjust them as needed in response to shifts in the market.

- Seeking Advice: Speak with experts because changes in the market could affect mutual funds.

You may use the SIP Calculator to view annual returns and get help making better financial decisions, which can help you create achievable goals when it comes to mutual funds.

How to Invest in Canara Robeco Mutual Fund via MySIPonline?

You can Invest in Canara Robeco Mutual Funds in a variety of methods, with mysiponline standing out for its easy and simple means of investing.

- Step 1: Log in to MySIPonline

- Step 2: Check your KYC and if it is not registered do Video KYC

- Step 3: Complete profile (PAN card, aadhar, bank details, nominee, signature)

- Step 4: Explore top funds from Respective AMC Name or Talk to an expert.

- Step 5: Select your preferred Fund.

- Step 6: Add funds to the cart and choose the investment option.

- Step 7: Make a payment from UPI or net banking.

- Step 8: Track investment daily on a dashboard and use our analysis to manage it.

In the end, every investor needs an easy source to conduct their investment journey smoothly. MySIPonline provides all such services including investments through Online SIP.

What is the Taxation on the Canara Robeco Mutual Fund?

The taxation of Canara Robeco Mutual Funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Explore Other AMC’s

Top Videos and Blogs of Canara Robeco Mutual Fund

Videos

Blogs

You can select three funds for compare.

You can select three funds for compare.