Edelweiss Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 52

- Average annual returns 3.06%

About Edelweiss Mutual Fund

Edelweiss Mutual Fund is a dynamic player in the mutual fund business, managed by Edelweiss Asset Management Limited and part of Edelweiss Services Ltd. The group was founded in 1996 and gained a mutual fund license in 2008, resulting in the formation of Edelweiss Asset Management Ltd.

Despite economic issues, the mutual funds grew in popularity, and EAML has developed to become one of India's most important AMCs. As of December 2023, there are 24 Equity funds, 24 Debt Funds, 6 hybrid funds, and 3 commodities. This Mutual Fund is ranked 10th among its peers. The flagship plan, Edelweiss Small Cap Fund, has generated a remarkable average annualized return of 29.6% since its inception.

More-

Launched in

30-Apr-2008

-

AMC Age

17 Years

-

Website

https://www.edelweissmf.com -

Email Address

emfhelp@edelweissfin.com

Top Performing Edelweiss Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2245.02 | 16 years | 3.95% | 8.1% | 22.61% | 23.72% | 33.32% | 54.46% | 21.23% | 13.22% | 3.16% | 10.76% | Invest | |

| 562.67 | 3 years | 1.57% | 10.17% | 13.81% | 26.92% | 43.61% | 46.18% | 32.38% | 28.28% | - | - | Invest | |

| 3245.55 | 5 years | 2.94% | 7.78% | 17.42% | 33.15% | 22.03% | 41.23% | 33.3% | 32.45% | 18.31% | - | Invest | |

| 136.70 | 11 years | 4.41% | 6.36% | 15.63% | 22.9% | 28.47% | 28.87% | 18.34% | 14.6% | 5.64% | 8.54% | Invest | |

| 147.17 | 11 years | 2.09% | 0.9% | 4.84% | 17.72% | 36.67% | 27.13% | 24.26% | 23.9% | 16.18% | 9.35% | Invest | |

| 126.76 | 14 years | 1.54% | 2.18% | 10.38% | 16.65% | 14.86% | 14.04% | 15.21% | 11.53% | 11.24% | 8.5% | Invest | |

| 177.82 | 12 years | 1.51% | 3.27% | 9.06% | 9.62% | 10.4% | 12.6% | 14.7% | 13.44% | 15.16% | 11.21% | Invest | |

| 2297.68 | 3 years | 0.08% | 0.35% | 1.21% | 4.38% | 5.79% | 7.99% | 7.8% | 7.29% | - | - | Invest | |

| 2142.65 | 2 years | 0.15% | 0.34% | 1.26% | 3.87% | 5.46% | 7.86% | 7.66% | - | - | - | Invest | |

| 94.66 | 2 years | 0.13% | 0.35% | 1.19% | 4.18% | 5.77% | 7.81% | 7.85% | - | - | - | Invest | |

| 263.74 | 12 years | 0.21% | 0.29% | 0.85% | 4.54% | 5.78% | 7.79% | 7.84% | 7.15% | 6.06% | 7.51% | Invest | |

| 143.44 | 2 years | 0.06% | 0.26% | 0.79% | 3.99% | 5.56% | 7.5% | 7.66% | - | - | - | Invest | |

| 7132.15 | 4 years | 0.13% | 0.43% | 1.35% | 3.88% | 5.29% | 7.48% | 7.4% | 7.06% | - | - | Invest | |

| 2062.41 | 17 years | 0.11% | 0.39% | 1.35% | 3.76% | 5.04% | 7.16% | 6.95% | 6.63% | 5.13% | 6.37% | Invest | |

| 10217.51 | 17 years | 0.1% | 0.48% | 1.42% | 3.33% | 4.7% | 6.88% | 7.07% | 6.93% | 5.54% | 68% | Invest | |

| 758.80 | 3 years | 0.15% | 0.47% | 1.4% | 3.36% | 4.72% | 6.85% | 7.02% | 6.83% | - | - | Invest | |

| 750.38 | 10 years | 0.46% | 1.22% | 3.22% | 7.96% | 5.65% | 6.78% | 11.78% | 10.95% | 10.77% | 9.08% | Invest | |

| 977.26 | 2 years | 0.06% | -0.61% | -0.6% | 3.05% | 4.56% | 6.63% | 8.13% | - | - | - | Invest | |

| 977.26 | 2 years | 0.06% | -0.61% | -0.6% | 3.05% | 4.56% | 6.63% | 8.13% | - | - | - | Invest | |

| 15930.88 | 11 years | 0.05% | 0.28% | 1.2% | 3% | 4.42% | 6.51% | 7.07% | 7.01% | 5.7% | 5.85% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2245.02 | Very High |

22.08%

|

56.76%

|

36.64%

|

23.01%

|

9.54%

|

9.98%

|

10.4%

|

Invest | |

| 562.67 | Very High |

14.62%

|

54.29%

|

39.66%

|

-

|

-

|

-

|

31.53%

|

Invest | |

| 3245.55 | Very High |

19.44%

|

43.57%

|

34.37%

|

35.64%

|

22.79%

|

-

|

22.46%

|

Invest | |

| 136.70 | Very High |

15.1%

|

41.64%

|

25.1%

|

18.75%

|

9.48%

|

7.87%

|

7.52%

|

Invest | |

| 147.17 | Very High |

7.48%

|

39.6%

|

28.16%

|

23.89%

|

17.73%

|

13.06%

|

11.71%

|

Invest | |

| 126.76 | Very High |

10.44%

|

25.17%

|

20.78%

|

15.23%

|

10.78%

|

8.21%

|

7.53%

|

Invest | |

| 177.82 | Very High |

8.21%

|

15.33%

|

15.29%

|

14.24%

|

12.52%

|

12.31%

|

11.62%

|

Invest | |

| 2297.68 | Low to Moderate |

1.47%

|

7.67%

|

7.99%

|

7.79%

|

-

|

-

|

7.31%

|

Invest | |

| 2142.65 | Low to Moderate |

1.31%

|

7.13%

|

7.7%

|

-

|

-

|

-

|

7.69%

|

Invest | |

| 94.66 | Low to Moderate |

1.38%

|

7.49%

|

7.92%

|

-

|

-

|

-

|

7.76%

|

Invest | |

| 263.74 | Low to Moderate |

1.03%

|

7.15%

|

7.9%

|

7.72%

|

6.81%

|

7.32%

|

7.46%

|

Invest | |

| 143.44 | Low to Moderate |

1.05%

|

6.95%

|

7.65%

|

-

|

-

|

-

|

7.58%

|

Invest | |

| 7132.15 | Low to Moderate |

1.47%

|

7.11%

|

7.42%

|

7.35%

|

-

|

-

|

6.67%

|

Invest | |

| 2062.41 | Low to Moderate |

1.4%

|

6.83%

|

6.98%

|

6.91%

|

6.11%

|

6.14%

|

6.51%

|

Invest | |

| 10217.51 | Low to Moderate |

1.49%

|

6.57%

|

6.92%

|

6.98%

|

6.42%

|

66.06%

|

45.88%

|

Invest | |

| 758.80 | Low to Moderate |

1.41%

|

6.43%

|

6.88%

|

6.95%

|

-

|

-

|

6.82%

|

Invest | |

| 750.38 | Moderate |

3.05%

|

10.71%

|

10.6%

|

11.54%

|

10.46%

|

9.83%

|

9.63%

|

Invest | |

| 977.26 | Moderate |

-0.68%

|

4.19%

|

7.38%

|

-

|

-

|

-

|

7.85%

|

Invest | |

| 977.26 | Moderate |

-0.68%

|

4.19%

|

7.38%

|

-

|

-

|

-

|

7.85%

|

Invest | |

| 15930.88 | Low |

1.34%

|

6.15%

|

6.71%

|

6.97%

|

6.46%

|

5.88%

|

5.91%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

26.36%

|

-

|

1.04%

|

0.22%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

25.58%

|

-

|

-

|

0.86%

|

Invest | |

| Very High |

15.66%

|

-

|

0.97%

|

0.32%

|

Invest | |

| Very High |

14.53%

|

-

|

-

|

1.07%

|

Invest | |

| Very High |

12.16%

|

-

|

-

|

0.34%

|

Invest | |

| Very High |

13.93%

|

-

|

0.80%

|

0.47%

|

Invest | |

| Low to Moderate |

1.22%

|

-

|

-

|

0.37%

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

1.77%

|

-

|

2.07%

|

0.22%

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

0.98%

|

-

|

-

|

0.18%

|

Invest | |

| Low to Moderate |

0.42%

|

-

|

4.61%

|

-

|

Invest | |

| Low to Moderate |

0.17%

|

-

|

1.53%

|

1.49%

|

Invest | |

| Low to Moderate |

0.80%

|

-

|

-

|

-

|

Invest | |

| Moderate |

3.74%

|

-

|

-

|

1.04%

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low |

0.42%

|

-

|

0.51%

|

0.71%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹100

|

2.33%

|

Bhavesh Jain

|

26-Aug 2009

|

Invest | |

|

₹100

|

₹100

|

0.5%

|

Bhavesh Jain

|

14-Sep 2022

|

Invest | |

|

₹100

|

₹100

|

2.35%

|

Bhavesh Jain

|

05-Mar 2020

|

Invest | |

|

₹100

|

₹100

|

2.33%

|

Bhavesh Jain

|

07-Jul 2014

|

Invest | |

|

₹100

|

₹100

|

2.33%

|

Bhavesh Jain

|

07-Feb 2014

|

Invest | |

|

₹100

|

₹100

|

2.34%

|

Bhavesh Jain

|

01-Jul 2011

|

Invest | |

|

₹100

|

₹100

|

2.33%

|

Bhavesh Jain

|

07-Aug 2013

|

Invest | |

|

₹100

|

₹100

|

0.4%

|

Dhawal Dalal

|

13-Oct 2021

|

Invest | |

|

₹100

|

₹100

|

0.72%

|

Dhawal Dalal

|

23-Jun 2023

|

Invest | |

|

₹100

|

₹100

|

0.45%

|

Dhawal Dalal

|

17-Oct 2022

|

Invest | |

|

₹100

|

₹100

|

0.7%

|

Dhawal Dalal

|

13-Sep 2013

|

Invest | |

|

₹100

|

₹100

|

0.63%

|

Dhawal Dalal

|

15-Feb 2023

|

Invest | |

|

₹100

|

₹100

|

0.4%

|

Dhawal Dalal

|

18-Mar 2021

|

Invest | |

|

₹100

|

₹100

|

0.82%

|

Dhawal Dalal

|

27-Jun 2008

|

Invest | |

|

₹100

|

₹100

|

0.2%

|

Rahul Dedhia

|

21-Sep 2007

|

Invest | |

|

₹100

|

₹100

|

0.4%

|

Dhawal Dalal

|

10-Mar 2022

|

Invest | |

|

₹100

|

₹100

|

1.6%

|

Dhawal Dalal

|

13-Oct 2014

|

Invest | |

|

₹100

|

₹100

|

0.46%

|

Dhawal Dalal

|

12-Oct 2022

|

Invest | |

|

₹100

|

₹100

|

0.46%

|

Dhawal Dalal

|

12-Oct 2022

|

Invest | |

|

₹100

|

₹100

|

1.05%

|

Dhawal Dalal

|

27-Jun 2014

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

50.81

(15-09-2025)

|

50.733

(12-09-2025)

|

0.15%

|

50.81

|

33.612

|

Invest | |

|

21.138

(15-09-2025)

|

21.187

(12-09-2025)

|

-0.23%

|

21.187

|

14.511

|

Invest | |

|

32.0964

(15-09-2025)

|

31.812

(12-09-2025)

|

0.89%

|

32.0964

|

20.4379

|

Invest | |

|

19.3229

(15-09-2025)

|

19.2485

(12-09-2025)

|

0.39%

|

19.3229

|

13.9512

|

Invest | |

|

25.1499

(15-09-2025)

|

25.1124

(12-09-2025)

|

0.15%

|

25.1817

|

18.1141

|

Invest | |

|

32.009

(15-09-2025)

|

31.946

(12-09-2025)

|

0.2%

|

32.009

|

24.423

|

Invest | |

|

34.4291

(15-09-2025)

|

34.5184

(12-09-2025)

|

-0.26%

|

34.5184

|

28.096

|

Invest | |

|

12.5534

(15-09-2025)

|

12.5523

(12-09-2025)

|

0.01%

|

12.5534

|

11.6355

|

Invest | |

|

11.7901

(15-09-2025)

|

11.7887

(12-09-2025)

|

0.01%

|

11.7901

|

10.9665

|

Invest | |

|

12.4404

(15-09-2025)

|

12.435

(12-09-2025)

|

0.04%

|

12.4404

|

11.5525

|

Invest | |

|

24.9012

(15-09-2025)

|

24.8915

(12-09-2025)

|

0.04%

|

24.9184

|

23.1202

|

Invest | |

|

12.0991

(15-09-2025)

|

12.0955

(12-09-2025)

|

0.03%

|

12.1048

|

11.2669

|

Invest | |

|

13.1234

(15-09-2025)

|

13.1184

(12-09-2025)

|

0.04%

|

13.1234

|

12.219

|

Invest | |

|

28.8056

(15-09-2025)

|

28.7936

(12-09-2025)

|

0.04%

|

28.8056

|

26.9007

|

Invest | |

|

3378.7919

(15-09-2025)

|

3378.2029

(14-09-2025)

|

0.02%

|

3378.79

|

3162.41

|

Invest | |

|

12.2169

(15-09-2025)

|

12.2112

(12-09-2025)

|

0.05%

|

12.2169

|

11.442

|

Invest | |

|

25.6009

(15-09-2025)

|

25.5817

(12-09-2025)

|

0.08%

|

25.6009

|

23.5762

|

Invest | |

|

12.7643

(15-09-2025)

|

12.7661

(12-09-2025)

|

-0.01%

|

13.0475

|

12.0074

|

Invest | |

|

12.7643

(15-09-2025)

|

12.7661

(12-09-2025)

|

-0.01%

|

13.0475

|

12.0074

|

Invest | |

|

19.5793

(15-09-2025)

|

19.5836

(12-09-2025)

|

-0.02%

|

19.5836

|

18.3834

|

Invest |

Edelweiss Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Edelweiss Mutual Fund

Edelweiss Asean Equity Off-shore Fund - Regular Plan - Growth Option

3Y Returns 11.53%

VS

Edelweiss Asean Equity Off-shore Fund - Regular Plan - Growth Option

3Y Returns 11.53%

VS

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 30.48%

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 30.48%

Edelweiss Equity Savings Fund - Regular Plan - Growth Option

3Y Returns 10.95%

VS

Edelweiss Equity Savings Fund - Regular Plan - Growth Option

3Y Returns 10.95%

VS

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns 15.51%

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns 15.51%

Edelweiss Europe Dynamic Equity Offshore Fund - Growth Option - Regular Plan

3Y Returns 23.9%

VS

Edelweiss Europe Dynamic Equity Offshore Fund - Growth Option - Regular Plan

3Y Returns 23.9%

VS

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 30.48%

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 30.48%

Edelweiss Recently Listed IPO Fund Regular Plan Growth

3Y Returns 14.45%

VS

Edelweiss Recently Listed IPO Fund Regular Plan Growth

3Y Returns 14.45%

VS

Quant Quantamental Fund Regular - Growth

3Y Returns 18.83%

Quant Quantamental Fund Regular - Growth

3Y Returns 18.83%

Investment Strategy

In the Edelweiss mutual fund, the fund manager implements a strategy that focuses on purchasing inexpensive companies and using quality analysis to maximize the benefits of compounding investment value. By picking high-quality equities trading below their real value, the fund hopes to see long-term growth as the market recognizes its full potential. This emphasis on quality analysis enables the selection of equities with strong fundamentals and attractive development prospects, resulting in long-term growth for investors via the compounding effect.

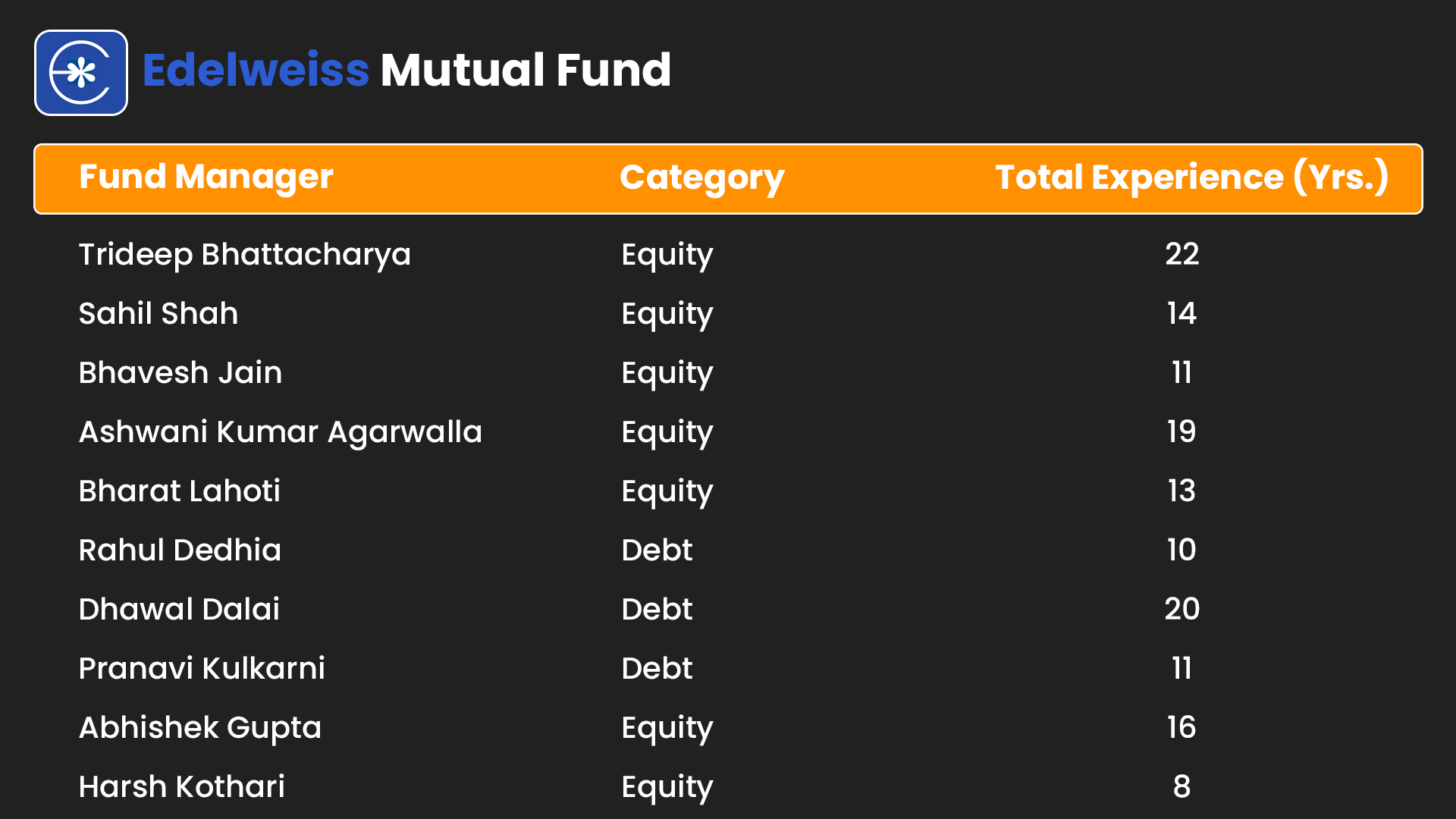

Key Management Team

Mr Vinit Sambre (Head of Equity)

Vinit Sambre the fund manager of Edelweiss MF has been managing the DSP Micro Cap Fund since June 2010 and is also the Fund Manager for the DSP Small and Mid-Cap Funds. With more than 16 years of experience in small and mid-cap investments, he joined DSP Investment Managers in July 2007. Vinit, a Chartered Accountant, has previously worked with DSP Merrill Lynch and IL&FS Invest Smart Limited.

List of All Fund Managers

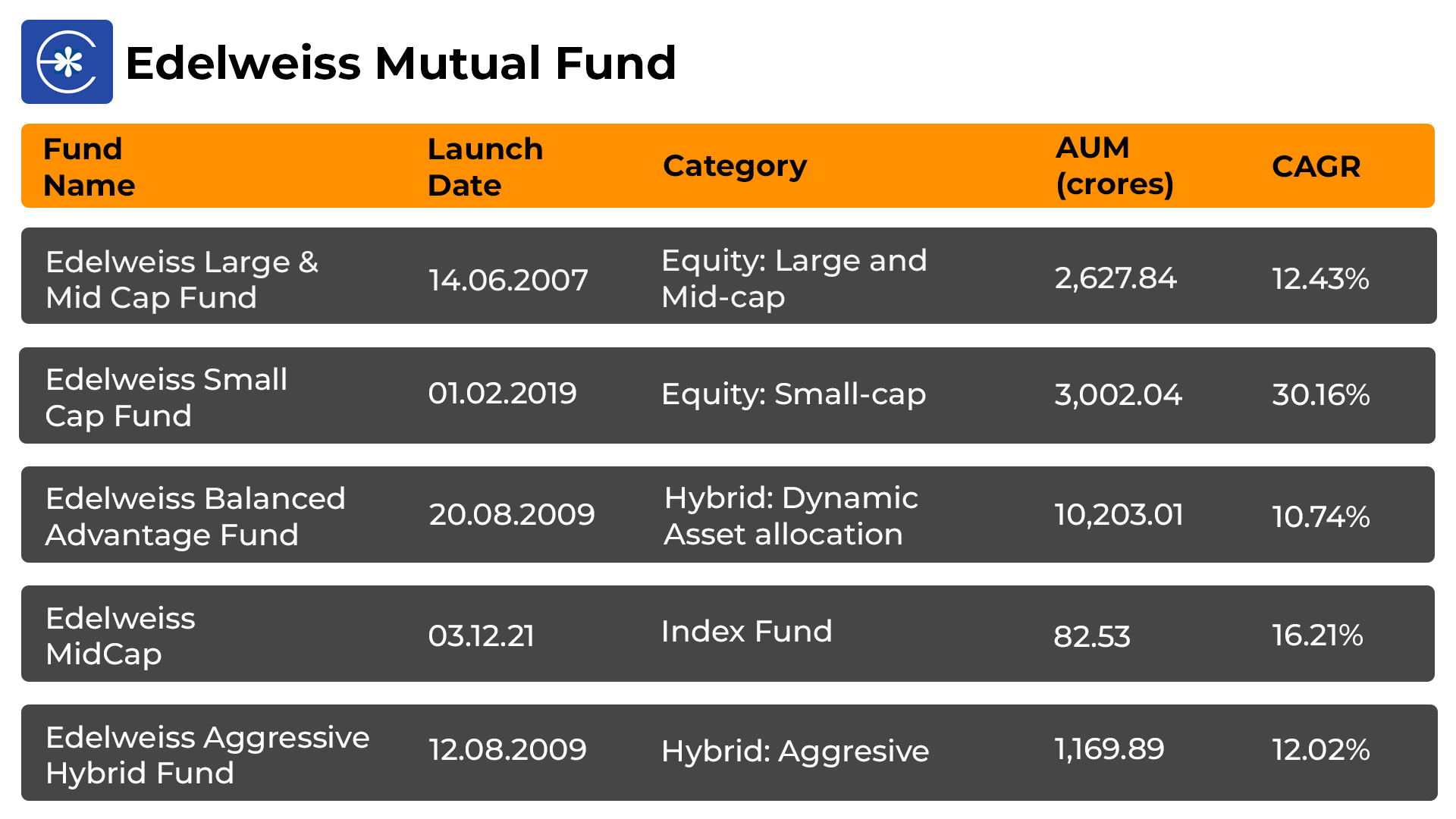

Top 5 Edelweiss Mutual Funds

History of Edelweiss Mutual Fund

This AMC operated by Edelweiss Asset Management Limited, are a driving force in India's Mutual Fund industry. Since 1996, the conglomerate has been a major player in the financial sector, led by its main business, Edelweiss Financial Services Ltd.

Despite the tough economic conditions, Edelweiss secured a mutual fund license in 2008 and founded Edelweiss Asset Management Ltd. Edelweiss Funds House has seen consistent growth because of prudent investments and a wide product portfolio.

Sponsored by Edelweiss Financial Services Limited, the conglomerate provides a wide range of financial goods and services worldwide, focusing on corporate social responsibility through the Edel Give Foundation. In 2016, Edelweiss made a historic acquisition of JP Morgan Asset Management India's full portfolio of funds.

How to Select Edelweiss Mutual Funds?

The Best Edelweiss mutual fund selection is based on these points:

- Set clear investment goals and plan accordingly.

- Assess risk tolerance before investing and do adjust.

- Diversify investments for a reduced risk and balance.

- Consider financial education for informed decisions.

- Monitor the market portfolio, adjust it when needed.

- Consult financial experts for a mutual fund guidance.

In conclusion, investing through Online SIP prioritizes informed decision-making and continuous monitoring to ensure successful investment outcomes.

How To Invest In Edelweiss Mutual Fund Via MySIPonline?

Access Edelweiss mutual fund investment options through various platforms:

- Opt for mysiponline.com for user-friendly investment process.

- Visit mysiponline.com and select top-performing mutual funds.

- Create a free account and provide the necessary profile details.

- Complete online KYC with PAN, Aadhar, signature, bank proof.

- Explore Mutual Funds and add your desired fund to your cart.

- Proceed to the complete the payment for your selected funds.

- Await confirmation of your investment, and you are all done.

- Monitor investments through your mysiponline.com account.

In mutual fund investment, you can also consider using an SIP Calculator for hassle-free investment.

What Is The Taxation On Edelweiss Mutual Fund?

The taxation of Edelweiss mutual funds depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Edelweiss Mutual Fund?

What are the different EDELWEISS mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in EDELWEISS Funds online tax-free?

How to analyse the performance of Edelweiss Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of Edelweiss Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.