Invesco Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 43

- Average annual returns 3.71%

About Invesco Mutual Fund

Invesco Mutual Fund is an international asset management company, operating as a branch of the well-known US-based investment management firm, Invesco Limited. It offers a diverse range of mutual funds tailored to meet various investment goals. As a foreign Asset Management Company (AMC), Invesco possesses valuable insights into global markets. Led by Chief Investment Officer Mr Taher Badshah, along with key fund managers Amit Ganatra and Amit Nigam. Invesco Mutual Fund is ranked 17th in its category. It provides a total of 37 schemes, comprising 18 equity funds, 4 hybrid funds, 13 debt funds, and 2 other schemes. Invesco India Small Cap Fund, the flagship scheme, has exhibited an impressive average annualized return of 24.78% since its inception.

More-

Launched in

24-Jul-2006

-

AMC Age

19 Years

-

Website

https://www.invescomutualfund.com -

Email Address

mfservices@invesco.com

Top Performing Invesco Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 309.28 | 4 years | 8.45% | 9.98% | 25.42% | 53.07% | 36.13% | 68.45% | 34.34% | 24.74% | - | - | Invest | |

| 179.56 | 13 years | 2.36% | 8.58% | 11.48% | 24.46% | 39.41% | 47.27% | 33.5% | 26.68% | 14.5% | 14.06% | Invest | |

| 401.30 | 3 years | 2.61% | 2.48% | 12.85% | 25.53% | 17.15% | 35.41% | 28.74% | 28.09% | - | - | Invest | |

| 66.66 | 11 years | 1.04% | 2.03% | 5.72% | 13.86% | 20.04% | 22.42% | 22.93% | 23.95% | 19.12% | 11.57% | Invest | |

| 61.05 | 11 years | 1.71% | 2.28% | 4.66% | 10.39% | 28.69% | 20.64% | 14.77% | 19.29% | 14.8% | 7.4% | Invest | |

| 7801.80 | 18 years | 1.09% | 1.76% | 2.73% | 26.18% | 17.05% | 9.44% | 28.09% | 26.34% | 28.47% | 18.54% | Invest | |

| 152.00 | 11 years | 0.13% | 0.42% | 0.99% | 4.02% | 7.44% | 9.44% | 9.17% | 9.13% | 6.57% | 5.84% | Invest | |

| 46.86 | 2 years | 0.05% | -0.14% | 0.13% | 4.22% | 5.97% | 8.19% | 8.84% | - | - | - | Invest | |

| 7230.48 | 18 years | 0.21% | 0.19% | 0.79% | 4.53% | 5.86% | 8.12% | 7.96% | 7.32% | 5.87% | 6.84% | Invest | |

| 8007.10 | 18 years | 0.87% | 1.69% | 2.36% | 24.48% | 13.69% | 8.02% | 28.12% | 24.21% | 24.24% | 16.38% | Invest | |

| 75.89 | 2 years | 0.12% | 0.35% | 1.26% | 4.27% | 5.86% | 7.96% | 8.14% | - | - | - | Invest | |

| 904.80 | 18 years | 0.18% | 0.23% | 0.91% | 4.42% | 5.78% | 7.93% | 7.85% | 7.05% | 5.48% | 6.55% | Invest | |

| 168.55 | 12 years | 0.19% | 0.22% | 0.66% | 4.36% | 5.52% | 7.74% | 7.9% | 7.14% | 5.31% | 6.48% | Invest | |

| 5843.18 | 16 years | 0.09% | 0.41% | 1.42% | 3.96% | 7.28% | 7.51% | 7.4% | 7.16% | 5.65% | 6.43% | Invest | |

| 173.34 | 4 years | 0.16% | 0.27% | 0.61% | 4.03% | 5.38% | 7.38% | 7.56% | 6.76% | - | - | Invest | |

| 1198.92 | 14 years | 0.09% | 0.43% | 1.43% | 3.67% | 5% | 7.26% | 7.22% | 6.91% | 5.46% | 6.53% | Invest | |

| 1432.76 | 17 years | 1.02% | -1.19% | -2.55% | 17.42% | 5.83% | 6.99% | 20.45% | 18.85% | 21.93% | 15.48% | Invest | |

| 2003.14 | 18 years | 0.1% | 0.35% | 1.23% | 3.7% | 6.79% | 6.94% | 6.76% | 6.44% | 5.1% | 6.15% | Invest | |

| 14077.41 | 18 years | 0.1% | 0.46% | 1.41% | 3.29% | 7.09% | 6.9% | 7.11% | 6.98% | 5.61% | 6.17% | Invest | |

| 5843.18 | 16 years | 0.07% | 0.34% | 1.22% | 3.56% | 6.45% | 6.69% | 6.58% | 6.37% | 4.89% | 5.68% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 309.28 | Very High |

29.2%

|

64.86%

|

44.71%

|

33.78%

|

-

|

-

|

17.45%

|

Invest | |

| 179.56 | High |

10.2%

|

46.91%

|

37.65%

|

30.82%

|

22.79%

|

16.7%

|

12.94%

|

Invest | |

| 401.30 | Very High |

17.1%

|

35.42%

|

29.39%

|

30.43%

|

-

|

-

|

29.28%

|

Invest | |

| 66.66 | Very High |

11.38%

|

28.72%

|

24.75%

|

23.46%

|

19.1%

|

14.55%

|

13.48%

|

Invest | |

| 61.05 | Very High |

10.43%

|

31.89%

|

19.14%

|

16.47%

|

13.97%

|

10.34%

|

9.21%

|

Invest | |

| 7801.80 | Very High |

9.12%

|

20.92%

|

23.86%

|

28.13%

|

25.34%

|

21.3%

|

19.7%

|

Invest | |

| 152.00 | Moderately High |

1.12%

|

9.15%

|

9.04%

|

9.22%

|

8.02%

|

6.09%

|

6.07%

|

Invest | |

| 46.86 | Moderate |

0.35%

|

6.92%

|

8.65%

|

-

|

-

|

-

|

8.58%

|

Invest | |

| 7230.48 | Moderate |

0.98%

|

7.29%

|

8.02%

|

7.83%

|

6.76%

|

6.65%

|

42.02%

|

Invest | |

| 8007.10 | Very High |

8.29%

|

19.69%

|

22.08%

|

26.29%

|

22.81%

|

18.62%

|

16.24%

|

Invest | |

| 75.89 | Low to Moderate |

1.47%

|

7.76%

|

8.12%

|

-

|

-

|

-

|

7.98%

|

Invest | |

| 904.80 | Moderate |

1.16%

|

7.37%

|

7.88%

|

7.63%

|

6.47%

|

6.33%

|

41.64%

|

Invest | |

| 168.55 | Moderate |

0.89%

|

6.87%

|

7.76%

|

7.64%

|

6.4%

|

6.34%

|

6.46%

|

Invest | |

| 5843.18 | Low to Moderate |

1.52%

|

7.28%

|

7.42%

|

7.37%

|

6.59%

|

6.21%

|

44.75%

|

Invest | |

| 173.34 | Moderate |

0.75%

|

6.55%

|

7.48%

|

7.33%

|

-

|

-

|

6.67%

|

Invest | |

| 1198.92 | Low to Moderate |

1.5%

|

6.97%

|

7.2%

|

7.16%

|

6.41%

|

6.09%

|

44.34%

|

Invest | |

| 1432.76 | Very High |

1.63%

|

9.49%

|

13.4%

|

17.93%

|

17.48%

|

15.6%

|

15.65%

|

Invest | |

| 2003.14 | Moderately High |

1.36%

|

6.65%

|

6.83%

|

6.74%

|

5.96%

|

5.84%

|

37.82%

|

Invest | |

| 14077.41 | Low to Moderate |

1.46%

|

6.53%

|

6.92%

|

7.01%

|

6.47%

|

5.96%

|

38.18%

|

Invest | |

| 5843.18 | Low to Moderate |

1.33%

|

6.47%

|

6.61%

|

6.57%

|

5.81%

|

5.44%

|

43.51%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

23.07%

|

-

|

-

|

0.69%

|

Invest | |

| High |

11.57%

|

-

|

-

|

1.36%

|

Invest | |

| Very High |

17.23%

|

-

|

-

|

1.11%

|

Invest | |

| Very High |

14.41%

|

-

|

-

|

1.10%

|

Invest | |

| Very High |

15.96%

|

-

|

-

|

0.77%

|

Invest | |

| Very High |

13.27%

|

4.69%

|

0.95%

|

1.2%

|

Invest | |

| Moderately High |

2.81%

|

1.06%

|

1.60%

|

0.80%

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

1.26%

|

-

|

1.44%

|

0.41%

|

Invest | |

| Very High |

12.64%

|

5.8%

|

1%

|

1.14%

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

1.12%

|

-

|

1.28%

|

0.25%

|

Invest | |

| Moderate |

1.39%

|

-

|

1.56%

|

0.26%

|

Invest | |

| Low to Moderate |

0.71%

|

3%

|

1.55%

|

-

|

Invest | |

| Moderate |

1.59%

|

-

|

1.84%

|

-

|

Invest | |

| Low to Moderate |

0.35%

|

-

|

3.88%

|

0.52%

|

Invest | |

| Very High |

12.90%

|

8.51%

|

0.83%

|

0.90%

|

Invest | |

| Moderately High |

0.65%

|

2.1%

|

1.42%

|

-

|

Invest | |

| Low to Moderate |

0.48%

|

2.09%

|

0.97%

|

0.3%

|

Invest | |

| Low to Moderate |

0.71%

|

2.27%

|

1.54%

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹500

|

₹1000

|

1.54%

|

Amit Nigam

|

24-Dec 2020

|

Invest | |

|

₹500

|

₹1000

|

0.45%

|

Krishna Venkat Cheemalapati

|

05-Dec 2011

|

Invest | |

|

₹500

|

₹1000

|

0.4%

|

Amit Nigam

|

21-Apr 2022

|

Invest | |

|

₹500

|

₹1000

|

1.4%

|

Amit Nigam

|

05-May 2014

|

Invest | |

|

₹500

|

₹1000

|

0.95%

|

Amit Nigam

|

30-Jan 2014

|

Invest | |

|

₹500

|

₹1000

|

1.8%

|

Aditya Khemani

|

19-Apr 2007

|

Invest | |

|

₹1000

|

₹1000

|

1.45%

|

Krishna Venkat Cheemalapati

|

04-Sep 2014

|

Invest | |

|

₹500

|

₹1000

|

0.29%

|

Krishna Venkat Cheemalapati

|

27-Mar 2023

|

Invest | |

|

₹100

|

₹1000

|

0.68%

|

Krishna Venkat Cheemalapati

|

02-Aug 2007

|

Invest | |

|

₹100

|

₹1000

|

1.8%

|

Aditya Khemani

|

09-Aug 2007

|

Invest | |

|

₹500

|

₹1000

|

0.29%

|

Krishna Venkat Cheemalapati

|

20-Mar 2023

|

Invest | |

|

₹1000

|

₹1000

|

1.05%

|

Krishna Venkat Cheemalapati

|

24-Mar 2007

|

Invest | |

|

₹1000

|

₹1000

|

0.63%

|

Krishna Venkat Cheemalapati

|

29-Dec 2012

|

Invest | |

|

₹1000

|

₹1000

|

0.48%

|

Krishna Venkat Cheemalapati

|

28-Aug 2009

|

Invest | |

|

₹1000

|

₹1000

|

1.15%

|

Krishna Venkat Cheemalapati

|

17-Jul 2021

|

Invest | |

|

₹1000

|

₹1000

|

0.79%

|

Krishna Venkat Cheemalapati

|

30-Dec 2010

|

Invest | |

|

₹100

|

₹1000

|

2.19%

|

Dhimant Kothari

|

14-Jul 2008

|

Invest | |

|

₹500

|

₹5000

|

0.6%

|

Krishna Venkat Cheemalapati

|

18-Jan 2007

|

Invest | |

|

₹500

|

₹1000

|

0.22%

|

Krishna Venkat Cheemalapati

|

17-Nov 2006

|

Invest | |

|

₹500

|

₹5000

|

0.48%

|

Krishna Venkat Cheemalapati

|

28-Aug 2009

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

12.5998

(12-09-2025)

|

12.6992

(11-09-2025)

|

-0.78%

|

12.6992

|

7.117

|

Invest | |

|

30.9457

(12-09-2025)

|

30.7186

(11-09-2025)

|

0.74%

|

31.0003

|

21.1249

|

Invest | |

|

19.761

(12-09-2025)

|

19.7541

(11-09-2025)

|

0.03%

|

19.761

|

13.7662

|

Invest | |

|

31.5054

(12-09-2025)

|

31.2573

(11-09-2025)

|

0.79%

|

31.5054

|

23.9904

|

Invest | |

|

20.1378

(12-09-2025)

|

20.0729

(11-09-2025)

|

0.32%

|

20.3063

|

15.1199

|

Invest | |

|

181.44

(12-09-2025)

|

181.51

(11-09-2025)

|

-0.04%

|

184.33

|

141.23

|

Invest | |

|

1949.9165

(12-09-2025)

|

1950.0396

(11-09-2025)

|

-0.01%

|

1950.04

|

1785.93

|

Invest | |

|

1229.324

(12-09-2025)

|

1226.3736

(11-09-2025)

|

0.24%

|

1236.9

|

1138.27

|

Invest | |

|

3215.2914

(12-09-2025)

|

3214.1165

(11-09-2025)

|

0.04%

|

3215.94

|

2980.09

|

Invest | |

|

102.09

(12-09-2025)

|

102.07

(11-09-2025)

|

0.02%

|

103.67

|

80.96

|

Invest | |

|

1206.2387

(12-09-2025)

|

1205.9526

(11-09-2025)

|

0.02%

|

1206.24

|

1118.74

|

Invest | |

|

3609.0371

(12-09-2025)

|

3608.6414

(11-09-2025)

|

0.01%

|

3609.04

|

3350.22

|

Invest | |

|

2288.6269

(12-09-2025)

|

2288.7848

(11-09-2025)

|

-0.01%

|

2288.78

|

2129.35

|

Invest | |

|

3087.5091

(12-09-2025)

|

3087.3342

(11-09-2025)

|

0.01%

|

3087.51

|

2874.37

|

Invest | |

|

1248.7461

(12-09-2025)

|

1248.749

(11-09-2025)

|

-0%

|

1250.12

|

1165.69

|

Invest | |

|

2730.1316

(12-09-2025)

|

2729.9293

(11-09-2025)

|

0.01%

|

2730.13

|

2547.53

|

Invest | |

|

135.58

(12-09-2025)

|

134.8

(11-09-2025)

|

0.58%

|

141.55

|

113.73

|

Invest | |

|

3409.6411

(12-09-2025)

|

3409.6975

(11-09-2025)

|

-0%

|

3409.7

|

3191.29

|

Invest | |

|

3629.6403

(12-09-2025)

|

3629.115

(11-09-2025)

|

0.01%

|

3629.64

|

3396.93

|

Invest | |

|

2725.9571

(12-09-2025)

|

2725.8602

(11-09-2025)

|

0%

|

2725.96

|

2557.12

|

Invest |

Invesco Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Invesco Mutual Fund

Invesco India ELSS Tax Saver Fund - Growth

3Y Returns 16.75%

VS

Invesco India ELSS Tax Saver Fund - Growth

3Y Returns 16.75%

VS

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 13.48%

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 13.48%

Invesco India Arbitrage Fund - Growth Option

3Y Returns 7.14%

VS

Invesco India Arbitrage Fund - Growth Option

3Y Returns 7.14%

VS

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.17%

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.17%

Invesco India Money Market Fund - Growth

3Y Returns 7.16%

VS

Invesco India Money Market Fund - Growth

3Y Returns 7.16%

VS

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.5%

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.5%

INVESCO INDIA ESG INTEGRATION STRATEGY FUND REGULAR GROWTH

3Y Returns 12.51%

VS

INVESCO INDIA ESG INTEGRATION STRATEGY FUND REGULAR GROWTH

3Y Returns 12.51%

VS

Quant Quantamental Fund Regular - Growth

3Y Returns 18.96%

Quant Quantamental Fund Regular - Growth

3Y Returns 18.96%

Investment Strategy

Invesco India MF follows an asset selection philosophy, targeting stable companies in large-cap, growth-oriented companies in mid-cap, and good potential companies in the small-cap category. Its major focus is on earning high growth potential in the long term with passive portfolio management.

Head of Equity & Debt Team

Mr. Taher Badshah (CIO)

MR Taher has over 29 years of experience in the Indian equities markets and is currently the Chief Investment Officer at Invesco AMC in India, where he has been a key member for over six years. Taher previously served as Head of Equity at Motilal Oswal Asset Management. His vast professional career includes employment with notable companies such as Kotak Mahindra Investment Advisors, ICICI Prudential Asset Management, and Alliance Capital Asset Management. Taher has a Master of Management Studies (MMS) with a speciality in finance from the S.P. Jain Institute of Management and a Bachelor of Engineering (B.E.) in Electronics from the University of Mumbai.

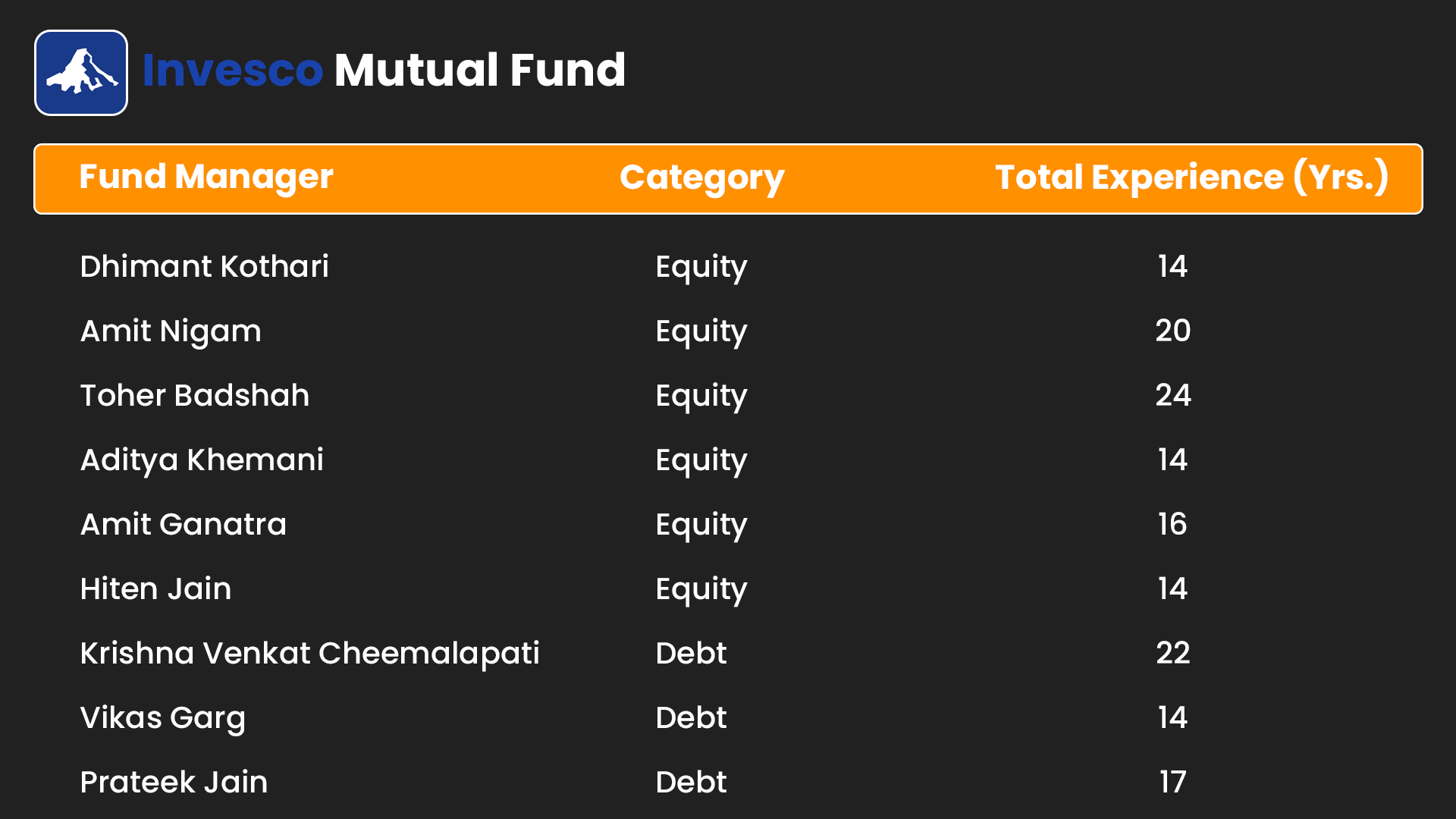

List of Fund Managers

Top 5 Invesco Mutual Fund

History of Invesco Mutual Fund

In 2013, Invesco partnered with Religare Securities Ltd. to form Religare Invesco Asset Management Limited., later rebranded as Invesco Mutual Fund after Invesco acquired the remaining 51% in 2016. Registered with SEBI, it operates as a trust.

Invesco aims to meet diverse investment needs through Mutual Fund and sub-advised portfolios, emphasizing sustainability and adaptability. Founded in 1935, Invesco is an independent investment management firm managing $1.35 trillion globally. With a presence in over 25 countries, Invesco offers a range of investment products and services, committing to strong, long-term performance.

How to Select the Best Invesco Mutual Fund?

The selection of the fund depends upon several critical aspects. Following is a step-by-step guide to determine the process:

- Defining Objectives: Set reasonable goals for your financial choices. Identify them and design a plan to meet their needs.

- Risk Tolerance Assessment: Assess your risk comfort level, knowing higher risk can lead to higher returns within your chosen limits.

- Implementing Diversification: Spread your assets across other sectors to reduce risk and increase possible profits.

- Self-education: Prioritize understanding funds through self-education. Analyze past performance and fund workings.

- Regular Monitoring: Consistently monitor your investments and make changes as the market conditions change.

- Seeking Advice: Because fluctuations in the market might have an impact on mutual funds, connect with professionals.

To wrap up, these guidelines will help you make careful decisions. Proper evaluation is important to get a good investment. There are tools like SIP Calculator which help in predicting the profits. You can visit MySIPonline to use this tool available on our website.

How to Invest in Invesco Mutual Fund via MySIPonline?

Mysiponline makes it simple to invest in Invesco mutual funds. Let us understand by following a step-by-step guide:

- Step 1: Log in to MySIPonline

- Step 2: Check your KYC and if it is not registered do Video KYC

- Step3: Complete profile (PAN card, aadhar, bank details, nominee, signature)

- Step 4: Explore top funds from Respective AMC Name or Talk to expert

- Step 5: Select your preferred Fund

- Step 6: Add funds to the cart and choose your investment option.

- Step 7: Make a payment from UPI or net banking

- Step 8: Track your investments and adjust accordingly.

To conclude, MySIPonline has stood out among its competitors and provided simplified solutions. Our efficient team of experts offers well-analysed investing advice. You can also start an Online SIP through our mobile app.

What is the Taxation on Invesco Mutual Fund?

The taxation of Invesco Mutual Fund depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding RS 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Explore Other AMC’s

Top Videos and Blogs of Invesco Mutual Fund

Videos

Blogs

You can select three funds for compare.

You can select three funds for compare.