ITI Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 19

- Average annual returns 2.78%

About ITI Mutual Fund

ITI Mutual Fund, founded in 2018, provides outstanding investing options for long-term wealth growth. With a team of experienced professionals, including researchers and investment managers, the fund addresses client requirements and aims for the best investment performance. This Mutual Fund is committed to offering strong financial growth to customers via innovation and quality.

This Asset Management Company (AMC), a part of the ITI Group of companies, is supported by the Investment Trust of India Ltd. The AMC is ranked 30th among its peers, offering a total of 10 equity schemes, 5 debt schemes, and 2 hybrid mutual funds. ITI ELSS Tax Saver Fund, the flagship scheme, has exhibited an impressive average annualized return of 17.98% since its inception.

More-

Launched in

14-May-2018

-

AMC Age

6 Years

-

Website

https://www.itiamc.com -

Email Address

mfassist@itiorg.com

Top Performing ITI Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 216.51 | 3 years | -0.09% | 2.09% | -9.08% | -10.69% | -13.2% | 9.85% | 29.1% | 16.07% | - | - | Invest | |

| 47.38 | 3 years | 0.06% | 1.88% | 3.18% | 4.5% | 3.37% | 9.48% | 8.04% | 6.95% | - | - | Invest | |

| 30.73 | 4 years | 0.19% | 1.46% | 2.56% | 4.11% | 2.72% | 8.11% | 7.43% | 6.69% | - | - | Invest | |

| 43.18 | 5 years | 0.08% | 0.73% | 1.83% | 3.52% | 2.07% | 6.99% | 7.24% | 5.86% | 4.48% | - | Invest | |

| 80.55 | 5 years | 0.13% | 0.73% | 1.79% | 3.5% | 2.03% | 6.99% | 6.91% | 6.45% | 5.06% | - | Invest | |

| 317.43 | 3 years | 0.16% | 0.88% | 1.86% | 3.38% | 2% | 6.7% | 6.58% | 5.97% | - | - | Invest | |

| 18.29 | 5 years | 0.1% | 0.52% | 1.47% | 3.05% | 1.7% | 6.26% | 6.36% | 6.02% | 4.8% | - | Invest | |

| 265.94 | 3 years | -0.66% | 6.05% | 6.37% | 1.06% | 2.28% | 5.46% | 14.51% | 11.5% | - | - | Invest | |

| 2253.76 | 5 years | 0.51% | 4.56% | -9.6% | -14.74% | -15.39% | 3.39% | 31.58% | 20.76% | 29.21% | - | Invest | |

| 482.56 | 1 years | -0.22% | 2.43% | -5.14% | -11.48% | -9.65% | 2.91% | - | - | - | - | Invest | |

| 378.3 | 5 years | 0.16% | 0.9% | -2.76% | -5.44% | -4.57% | 0.87% | 13.34% | 8.5% | 10.98% | - | Invest | |

| - | 1 months | 1.21% | 4.85% | - | - | - | - | - | - | - | - | Invest | |

| 783.37 | 7 months | -0.65% | 1.3% | -7.65% | -14.78% | -12.65% | - | - | - | - | - | Invest | |

| 1200.6 | 2 years | 0.17% | 2.65% | -8.31% | -15.75% | -12.98% | -0.13% | 23.69% | - | - | - | Invest | |

| 1095.38 | 4 years | -0.31% | 2.28% | -8.61% | -15.81% | -12.74% | -0.85% | 28.47% | 18.69% | - | - | Invest | |

| 374.22 | 5 years | -0.51% | 2.93% | -5.43% | -16.47% | -11.2% | -1.76% | 23.12% | 16.26% | 21.89% | - | Invest | |

| 364.35 | 4 years | -0.6% | 1.22% | -4.77% | -10.95% | -8.24% | -4.35% | 16.18% | 10.4% | - | - | Invest | |

| 1312.94 | 5 years | -0.14% | 2.37% | -9.13% | -17.22% | -13.63% | -5.39% | 21.53% | 15.11% | 19.33% | - | Invest | |

| 301.03 | 3 years | 0.06% | 2.22% | -8.49% | -14.64% | -12.37% | -6.14% | 20.29% | 15.17% | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 | Sep-2024 | Aug-2024 | Jul-2024 | Jun-2024 | May-2024 |

|---|

| Fund Name | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 | 2022-Q3 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 216.51 | Very High |

-5.17%

|

-4.59%

|

15.98%

|

20.38%

|

-

|

-

|

18.76%

|

Invest | |

| 47.38 | Moderate |

3.08%

|

10.24%

|

9.05%

|

8.17%

|

-

|

-

|

7.52%

|

Invest | |

| 30.73 | Low to Moderate |

2.51%

|

8.73%

|

8%

|

7.52%

|

-

|

-

|

6.68%

|

Invest | |

| 43.18 | Very High |

1.82%

|

7.02%

|

7.16%

|

6.82%

|

5.6%

|

-

|

5.32%

|

Invest | |

| 80.55 | Low to Moderate |

1.78%

|

7.1%

|

7%

|

6.85%

|

6.02%

|

-

|

5.69%

|

Invest | |

| 317.43 | Low to Moderate |

1.82%

|

6.94%

|

6.72%

|

6.54%

|

-

|

-

|

6.07%

|

Invest | |

| 18.29 | Low |

1.47%

|

6.16%

|

6.29%

|

6.27%

|

5.61%

|

-

|

5.45%

|

Invest | |

| 265.94 | Very High |

3.99%

|

6.76%

|

9.42%

|

11.69%

|

-

|

-

|

11.57%

|

Invest | |

| 2253.76 | Very High |

-5.64%

|

-14.66%

|

12.04%

|

21.57%

|

20.86%

|

-

|

21.43%

|

Invest | |

| 482.56 | Very High |

-3.88%

|

-10.92%

|

-

|

-

|

-

|

-

|

6.87%

|

Invest | |

| 378.3 | Very High |

-2.19%

|

-4.08%

|

6.25%

|

9.24%

|

9.13%

|

-

|

8.99%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

-

|

-

|

76.46%

|

Invest | ||

| 783.37 | Very High |

-6%

|

-

|

-

|

-

|

-

|

-

|

-23.71%

|

Invest | |

| 1200.6 | Very High |

-6.24%

|

-16.7%

|

6.8%

|

-

|

-

|

-

|

9.7%

|

Invest | |

| 1095.38 | Very High |

-5.57%

|

-18.64%

|

9.63%

|

18.12%

|

-

|

-

|

16.82%

|

Invest | |

| 374.22 | Very High |

-4.76%

|

-16.63%

|

7.23%

|

15.04%

|

15.28%

|

-

|

15.56%

|

Invest | |

| 364.35 | Very High |

-4.04%

|

-13.66%

|

3.88%

|

9.83%

|

-

|

-

|

9.53%

|

Invest | |

| 1312.94 | Very High |

-6.69%

|

-20.38%

|

3.39%

|

12.6%

|

13.77%

|

-

|

13.71%

|

Invest | |

| 301.03 | Moderately High |

-5.8%

|

-19.15%

|

3.45%

|

12.51%

|

-

|

-

|

12.43%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

15.667%

|

-

|

0.959%

|

0.739%

|

Invest | |

| Moderate |

1.572%

|

-

|

0.417%

|

-

|

Invest | |

| Low to Moderate |

0.705%

|

-

|

0.371%

|

-

|

Invest | |

| Very High |

0.745%

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

0.322%

|

-

|

0.461%

|

-

|

Invest | |

| Low to Moderate |

0.429%

|

-

|

2.415%

|

-

|

Invest | |

| Low |

0.29%

|

-

|

0.003%

|

-

|

Invest | |

| Very High |

13.993%

|

0.817%

|

0.91%

|

0.274%

|

Invest | |

| Very High |

16.273%

|

3.041%

|

0.804%

|

0.897%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

7.494%

|

-

|

-

|

0.221%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

15.396%

|

0.547%

|

0.903%

|

0.922%

|

Invest | |

| Very High |

13.905%

|

3.597%

|

0.917%

|

0.774%

|

Invest | |

| Very High |

13.325%

|

-

|

0.955%

|

0.377%

|

Invest | |

| Very High |

13.806%

|

2.853%

|

0.935%

|

0.754%

|

Invest | |

| Moderately High |

14.044%

|

2.519%

|

0.956%

|

0.729%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹500

|

₹5000

|

2.35%

|

Dhimant Shah

|

08-Nov 2021

|

Invest | |

|

₹500

|

₹5000

|

1.2%

|

Vikrant Mehta

|

09-Jul 2021

|

Invest | |

|

₹500

|

₹5000

|

0.7%

|

Vikrant Mehta

|

20-Oct 2020

|

Invest | |

|

₹500

|

₹5000

|

0.93%

|

Vikrant Mehta

|

09-Sep 2019

|

Invest | |

|

₹500

|

₹5000

|

0.25%

|

Vikrant Mehta

|

24-Apr 2019

|

Invest | |

|

₹500

|

₹5000

|

0.96%

|

Vikrant Mehta

|

07-May 2021

|

Invest | |

|

₹500

|

₹5000

|

0.18%

|

Vikrant Mehta

|

25-Oct 2019

|

Invest | |

|

₹500

|

₹5000

|

2.34%

|

Rohan Korde

|

06-Dec 2021

|

Invest | |

|

₹500

|

₹5000

|

1.95%

|

Dhimant Shah

|

14-Feb 2020

|

Invest | |

|

₹500

|

₹5000

|

2.34%

|

Dhimant Shah

|

19-Jun 2023

|

Invest | |

|

₹500

|

₹5000

|

2.37%

|

Vikrant Mehta

|

30-Dec 2019

|

Invest | |

|

₹5000

|

₹5000

|

-

|

Rohan Korde

|

06-Mar 2025

|

Invest | |

|

₹500

|

₹5000

|

2.19%

|

Vishal Jajoo

|

13-Sep 2024

|

Invest | |

|

₹500

|

₹5000

|

2.03%

|

Dhimant Shah

|

17-Feb 2023

|

Invest | |

|

₹500

|

₹5000

|

2.06%

|

Dhimant Shah

|

05-Mar 2021

|

Invest | |

|

₹500

|

₹500

|

2.32%

|

Dhimant Shah

|

18-Oct 2019

|

Invest | |

|

₹500

|

₹5000

|

2.37%

|

Rohan Korde

|

24-Dec 2020

|

Invest | |

|

₹500

|

₹1000

|

2.01%

|

Dhimant Shah

|

15-May 2019

|

Invest | |

|

₹500

|

₹5000

|

2.37%

|

Dhimant Shah

|

14-Jun 2021

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

15.2184

(11-04-2025)

|

14.8456

(09-04-2025)

|

2.51%

|

17.6024

|

13.0389

|

Invest | |

|

12.5227

(11-04-2025)

|

12.5157

(09-04-2025)

|

0.06%

|

12.5227

|

11.3632

|

Invest | |

|

12.8439

(11-04-2025)

|

12.8366

(09-04-2025)

|

0.06%

|

12.8439

|

11.8639

|

Invest | |

|

12.7809

(11-04-2025)

|

12.7798

(09-04-2025)

|

0.01%

|

12.7809

|

11.9525

|

Invest | |

|

1342.5708

(14-04-2025)

|

1341.9224

(11-04-2025)

|

0.05%

|

1342.57

|

1255.28

|

Invest | |

|

1219.9792

(11-04-2025)

|

1219.4397

(09-04-2025)

|

0.04%

|

1219.98

|

1144.54

|

Invest | |

|

1290.7500

(14-04-2025)

|

1290.1751

(11-04-2025)

|

0.04%

|

1290.75

|

1215.15

|

Invest | |

|

13.7996

(11-04-2025)

|

13.5737

(09-04-2025)

|

1.66%

|

14.4958

|

12.207

|

Invest | |

|

24.9359

(11-04-2025)

|

24.1004

(09-04-2025)

|

3.47%

|

30.3971

|

22.9805

|

Invest | |

|

13.3738

(11-04-2025)

|

13.0466

(09-04-2025)

|

2.51%

|

15.5421

|

12.5823

|

Invest | |

|

13.5720

(11-04-2025)

|

13.4346

(09-04-2025)

|

1.02%

|

14.6169

|

12.8647

|

Invest | |

|

10.4205

(11-04-2025)

|

10.2704

(09-04-2025)

|

1.46%

|

10.4255

|

9.8775

|

Invest | |

|

8.5565

(11-04-2025)

|

8.3776

(09-04-2025)

|

2.14%

|

10.2915

|

8.1837

|

Invest | |

|

15.5756

(11-04-2025)

|

15.1551

(09-04-2025)

|

2.77%

|

18.9294

|

14.7587

|

Invest | |

|

18.5969

(11-04-2025)

|

18.1697

(09-04-2025)

|

2.35%

|

22.7883

|

17.5616

|

Invest | |

|

21.3151

(11-04-2025)

|

20.8112

(09-04-2025)

|

2.42%

|

26.2735

|

20.1797

|

Invest | |

|

16.0301

(11-04-2025)

|

15.6971

(09-04-2025)

|

2.12%

|

18.796

|

15.3413

|

Invest | |

|

20.4127

(11-04-2025)

|

19.8617

(09-04-2025)

|

2.77%

|

25.3941

|

19.3909

|

Invest | |

|

14.8028

(11-04-2025)

|

14.4400

(09-04-2025)

|

2.51%

|

18.0389

|

14.0284

|

Invest |

ITI Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top ITI Mutual Fund

ITI Pharma and Healthcare Fund Regular - Growth

3Y Returns 16.07%

VS

ITI Pharma and Healthcare Fund Regular - Growth

3Y Returns 16.07%

VS

DSP Healthcare Fund - Regular Plan - Growth

3Y Returns 17.39%

DSP Healthcare Fund - Regular Plan - Growth

3Y Returns 17.39%

ITI Liquid Fund Regular - Growth

3Y Returns 6.45%

VS

ITI Liquid Fund Regular - Growth

3Y Returns 6.45%

VS

Axis Liquid Fund - Regular Plan - Growth Option

3Y Returns 6.83%

Axis Liquid Fund - Regular Plan - Growth Option

3Y Returns 6.83%

ITI Banking and PSU Fund Regular - Growth

3Y Returns 6.69%

VS

ITI Banking and PSU Fund Regular - Growth

3Y Returns 6.69%

VS

UTI Banking & PSU Fund- Regular Plan - Growth Option

3Y Returns 8.97%

UTI Banking & PSU Fund- Regular Plan - Growth Option

3Y Returns 8.97%

ITI Multi Cap Fund Regular - Growth

3Y Returns 15.11%

VS

ITI Multi Cap Fund Regular - Growth

3Y Returns 15.11%

VS

Nippon India Multi Cap Fund-Growth Plan-Bonus Option

3Y Returns 25.99%

Nippon India Multi Cap Fund-Growth Plan-Bonus Option

3Y Returns 25.99%

Investment Strategy

The aggressive portfolio management strategy employed by ITI Mutual Fund is aimed at increasing investor profits. This technique allows fund managers to continuously examine and alter the fund's holdings in response to market circumstances, emerging opportunities, and potential risks. The Mutual Fund house strives to establish a balance between risk and return by regularly monitoring and managing the portfolio, to mitigate downside risks while maximizing possible profits. This dynamic methodology enables the fund to respond quickly to changing market dynamics, improve asset allocation, and seize investment opportunities across many asset classes and sectors. The ultimate aim is to provide investors with steady and attractive long-term returns.

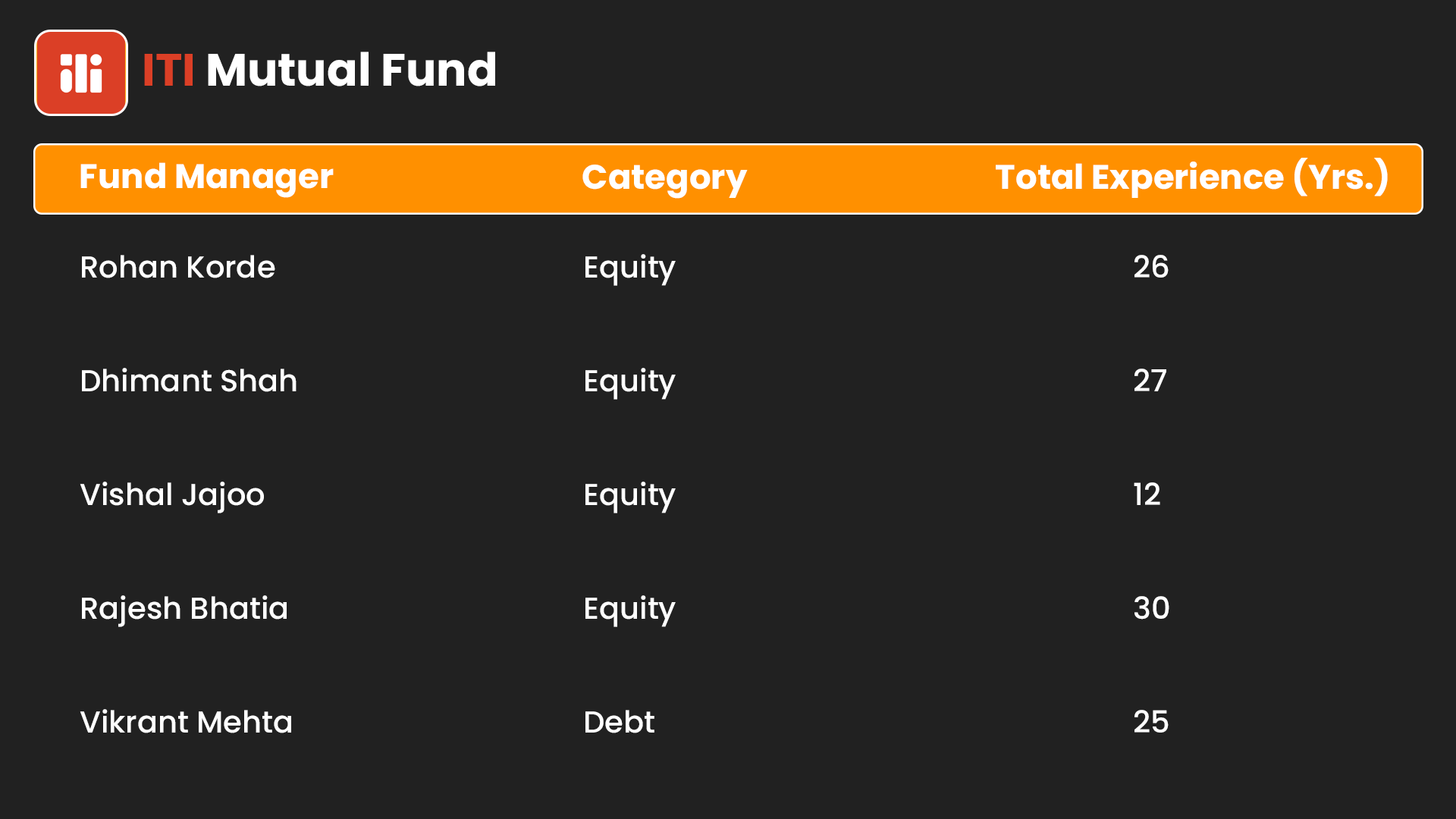

Head of Equity & Debt Team

Mr. Rajesh Bhatia (CIO)

Before joining ITI Asset Management Company Limited, Mr. Bhatia, a B.Com, ACMA, and CFA, worked for The Investment Trust Of India Ltd, Simto Investment Company Ltd, ProAlpha Systematic Capital, Heritage India Advisors Ltd, and Reliance Capital Asset Management.

List of Fund Managers

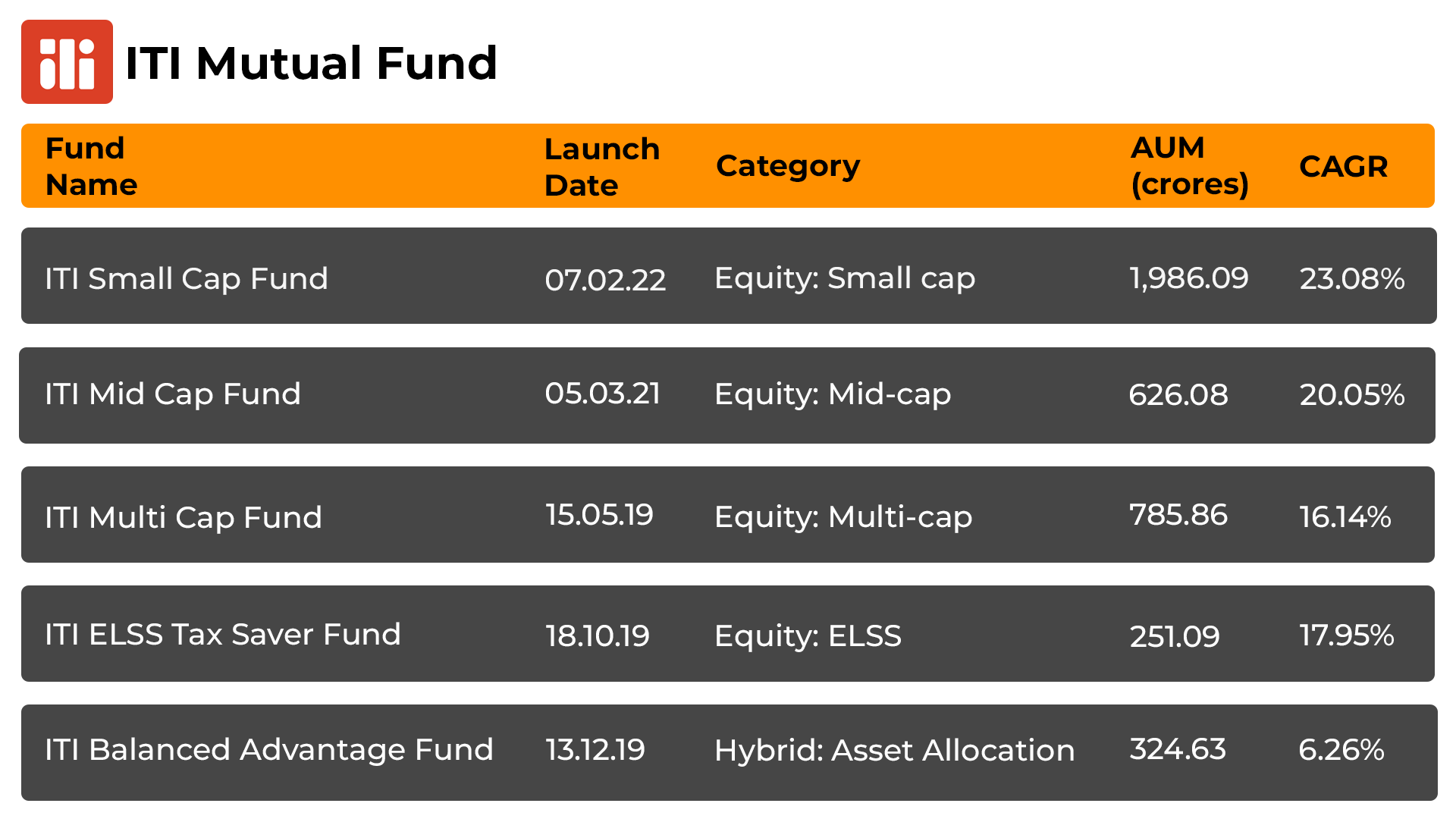

Top 5 ITI Mutual Funds

History of ITI Mutual Fund

ITI Mutual Fund has been granted registration under SEBI (Mutual Funds) Regulations on May 14-2018-1996. ITI Asset Management Limited was incorporated under the Companies Act, in 1996.

This Mutual Fund house is supported by the ITI Group, a prominent corporation with a strong presence across India. The group operates 180 offices and has a team of 3000 employees in all major cities of India. ITI has played a crucial role in shaping the mutual fund industry in India.

It established Pioneer ITI company the first private-sector Mutual Fund in the country. Although Franklin Templeton Mutual Fund acquired Pioneer ITI AMC in 2002, ITI continues to be the promoter of ITI Fund house.

How to select ITI Mutual Fund?

To select the best ITI mutual fund follow these steps:

- Set realistic investing goals and create a plan to achieve them.

- Assess risk tolerance before investing and adjust as needed.

- Diversify your portfolio across the industries for stability.

- Educate about past performance and working methods.

- Regularly monitor your assets to align with the goals.

- Consult financial professionals for volatile mutual funds.

In conclusion, set realistic goals, assess risk tolerance, diversify portfolios and You can also calculate your annual return by using the SIP calculator to acquire knowledge.

How to invest in ITI Mutual Fund via Mysiponline?

Make an investment in ITI mutual funds through mysiponline is simple:

Step 1: Sign in to MySIPonline to start your investing experience.

Step 2: Confirm your KYC; if you have not registered, use Video KYC.

Step 3: Complete your profile by adding a nominee, signature, bank information, Aadhar, and PAN.

Step 4: Explore top funds from respective AMC or consult an expert

Step 5: From the list of alternatives, choose the fund that you want.

Step 6: Choose the investment choice (lump sum or SIP) and add funds to the cart.

Step 7: Use online banking and UPI to finish your payment.

Step 8: Use dashboard analysis to track your investments every day.

In conclusion, investing in mutual funds through Online SIP offers a convenient and efficient way to achieve your financial goals.

What is the Taxation on Iti Mutual Fund?

The taxation of ITI mutual fund depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in ITI Mutual Fund?

What are the different ITI mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in ITI Funds online tax-free?

How to analyse the performance of ITI Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Videos and Blogs of ITI Mutual Fund

Videos

Blogs

You can select three funds for compare.

You can select three funds for compare.