LIC Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 41

- Average annual returns 3.68%

About LIC Mutual Fund

The LIC Mutual Fund Asset Management Company (AMC) started in April 1994, has been well-regarded for over 30 years. It is consistently earning above-average returns and building a strong connection with investors. LIC MF is the world's largest life insurer, having insured over 250 million people.

It manages more than 39 mutual fund schemes, with 19 in equity, 11 in debt, and 7 in hybrid categories. Among its peers, LIC Mutual Fund holds the 23rd position, highlighting its presence and performance in the mutual fund industry. LIC Multi Cap Fund, the flagship scheme, has exhibited an impressive average annualized return of 24.19% since its inception.

More-

Launched in

20-Apr-1994

-

AMC Age

31 Years

-

Website

https://www.licmf.com -

Email Address

cs.co@licmf.com

Top Performing LIC Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 213.98 | 13 years | 3.12% | 9.26% | 12.9% | 25.92% | 43.93% | 49.42% | 34.23% | 27.55% | 15.1% | 13.32% | Invest | |

| 1851.38 | 18 years | 0.21% | 0.11% | 0.62% | 4.64% | 7.12% | 8.01% | 7.71% | 7.08% | 5.56% | 6.73% | Invest | |

| 1851.38 | 18 years | 0.21% | 0.11% | 0.62% | 4.64% | 7.12% | 8.01% | 7.71% | 7.08% | 5.56% | 6.73% | Invest | |

| 168.26 | 6 years | 0.13% | 0.13% | 0.8% | 4.18% | 5.8% | 7.56% | 7.41% | 6.72% | 5.21% | - | Invest | |

| 1730.30 | 22 years | 0.09% | 0.37% | 1.32% | 3.83% | 5.05% | 7.27% | 7.04% | 6.74% | 5.55% | 6.1% | Invest | |

| 204.28 | 26 years | 0.25% | -0.4% | -0.51% | 3.7% | 4.69% | 6.9% | 7.5% | 7.04% | 5.22% | 6.31% | Invest | |

| 12006.60 | 23 years | 0.1% | 0.46% | 1.39% | 3.24% | 4.56% | 6.81% | 7.07% | 6.94% | 5.57% | 6.15% | Invest | |

| 220.83 | 5 years | 0.09% | 0.42% | 1.37% | 3.46% | 4.68% | 6.81% | 6.71% | 6.41% | 5.21% | - | Invest | |

| 2055.87 | 3 years | 0.09% | 0.44% | 1.48% | 3.77% | 6.17% | 6.65% | 6.44% | 6.22% | - | - | Invest | |

| 191.72 | 6 years | - | 0.37% | 1.26% | 2.97% | 5.13% | 6.24% | 6.66% | 6.58% | 5.24% | - | Invest | |

| 786.04 | 6 years | 0.1% | 0.45% | 1.32% | 2.82% | 4.94% | 6.06% | 6.35% | 6.33% | 5.14% | - | Invest | |

| 275.43 | 10 years | 1.42% | -0.25% | -2.69% | 16.48% | 6.93% | 4.02% | 7.31% | 9.98% | 16.85% | 8.51% | Invest | |

| 275.43 | 10 years | 1.42% | -0.25% | -2.69% | 16.48% | 6.93% | 4.02% | 7.31% | 9.98% | 16.85% | 8.51% | Invest | |

| 58.27 | 21 years | 0.13% | -0.15% | -1.22% | 1.16% | 2.21% | 3.49% | 6.14% | 5.72% | 4.63% | 6.53% | Invest | |

| 58.27 | 25 years | 0.13% | -0.15% | -1.22% | 1.16% | 7.11% | 3.49% | 6.14% | 5.72% | 4.63% | 6.51% | Invest | |

| 58.27 | 21 years | 0.13% | -0.15% | -1.22% | 1.16% | 2.21% | 3.49% | 6.14% | 5.72% | 4.63% | 6.53% | Invest | |

| 58.27 | 25 years | 0.13% | -0.15% | -1.22% | 1.16% | 7.11% | 3.49% | 6.14% | 5.72% | 4.63% | 6.51% | Invest | |

| 827.64 | 3 years | 0.82% | 1.01% | -2.46% | 8.14% | 2.14% | 3.3% | 9.49% | 9.52% | - | - | Invest | |

| 50.64 | 22 years | 0.52% | 0.07% | -1% | 3.76% | 7.99% | 3.13% | 6.71% | 6% | 6.4% | 6.38% | Invest | |

| 50.64 | 22 years | 0.52% | 0.07% | -1% | 3.76% | 7.99% | 3.13% | 6.71% | 6% | 6.4% | 6.38% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 213.98 | Average |

10.65%

|

52.44%

|

39.37%

|

31.89%

|

23.48%

|

16.56%

|

13.43%

|

Invest | |

| 1851.38 | Moderate |

0.92%

|

7.16%

|

7.82%

|

7.62%

|

6.56%

|

6.52%

|

6.86%

|

Invest | |

| 1851.38 | Moderate |

0.92%

|

7.16%

|

7.82%

|

7.62%

|

6.56%

|

6.52%

|

6.86%

|

Invest | |

| 168.26 | Low to Moderate |

1.05%

|

6.97%

|

7.51%

|

7.29%

|

6.13%

|

-

|

5.85%

|

Invest | |

| 1730.30 | Low to Moderate |

1.42%

|

6.96%

|

7.14%

|

7.03%

|

6.29%

|

5.9%

|

6.53%

|

Invest | |

| 204.28 | Low to Moderate |

-0.14%

|

5.02%

|

7.2%

|

7.33%

|

6.44%

|

6.15%

|

7.04%

|

Invest | |

| 12006.60 | Low to Moderate |

1.44%

|

6.44%

|

6.86%

|

6.96%

|

6.42%

|

5.94%

|

34.88%

|

Invest | |

| 220.83 | Low to Moderate |

1.42%

|

6.55%

|

6.74%

|

6.64%

|

6%

|

-

|

5.76%

|

Invest | |

| 2055.87 | Low to Moderate |

1.56%

|

6.85%

|

6.54%

|

6.46%

|

-

|

-

|

6.43%

|

Invest | |

| 191.72 | Low |

1.27%

|

5.95%

|

6.39%

|

6.59%

|

6.05%

|

-

|

5.6%

|

Invest | |

| 786.04 | Low to Moderate |

1.33%

|

5.75%

|

6.11%

|

6.26%

|

5.86%

|

-

|

5.53%

|

Invest | |

| 275.43 | Very High |

1.42%

|

8.68%

|

6.45%

|

8.78%

|

11.28%

|

9.96%

|

9.69%

|

Invest | |

| 275.43 | Very High |

1.42%

|

8.68%

|

6.45%

|

8.78%

|

11.28%

|

9.96%

|

9.69%

|

Invest | |

| 58.27 | Moderate |

-1.49%

|

1.21%

|

4.76%

|

5.6%

|

5.18%

|

5.96%

|

6.34%

|

Invest | |

| 58.27 | Moderate |

-1.49%

|

1.21%

|

4.76%

|

5.6%

|

5.18%

|

5.95%

|

6.42%

|

Invest | |

| 58.27 | Moderate |

-1.49%

|

1.21%

|

4.76%

|

5.6%

|

5.18%

|

5.96%

|

6.34%

|

Invest | |

| 58.27 | Moderate |

-1.49%

|

1.21%

|

4.76%

|

5.6%

|

5.18%

|

5.95%

|

6.42%

|

Invest | |

| 827.64 | Very High |

0.77%

|

3.67%

|

6.89%

|

8.76%

|

-

|

-

|

9.1%

|

Invest | |

| 50.64 | Moderately High |

0.06%

|

2.26%

|

5.13%

|

5.95%

|

5.75%

|

6.18%

|

6.76%

|

Invest | |

| 50.64 | Moderately High |

0.06%

|

2.26%

|

5.13%

|

5.95%

|

5.75%

|

6.18%

|

6.76%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Average |

11.85%

|

-

|

-

|

1.36%

|

Invest | |

| Moderate |

1.02%

|

3.36%

|

2%

|

-

|

Invest | |

| Moderate |

1.02%

|

3.36%

|

2%

|

-

|

Invest | |

| Low to Moderate |

1.17%

|

3.31%

|

2.15%

|

-

|

Invest | |

| Low to Moderate |

0.44%

|

-

|

4.69%

|

0.06%

|

Invest | |

| Low to Moderate |

2.42%

|

-

|

1.23%

|

0.12%

|

Invest | |

| Low to Moderate |

0.18%

|

-

|

1.42%

|

1.74%

|

Invest | |

| Low to Moderate |

0.26%

|

-

|

2.86%

|

-

|

Invest | |

| Low to Moderate |

0.97%

|

-

|

-

|

-

|

Invest | |

| Low |

0.66%

|

0.55%

|

0.19%

|

1.79%

|

Invest | |

| Low to Moderate |

0.42%

|

1.34%

|

0.79%

|

-

|

Invest | |

| Very High |

15.29%

|

-

|

0.94%

|

0.42%

|

Invest | |

| Very High |

15.29%

|

-

|

0.94%

|

0.42%

|

Invest | |

| Moderate |

3.47%

|

-

|

1.41%

|

-

|

Invest | |

| Moderate |

1.87%

|

-

|

0.42%

|

-

|

Invest | |

| Moderate |

3.47%

|

-

|

1.41%

|

-

|

Invest | |

| Moderate |

1.87%

|

-

|

0.42%

|

-

|

Invest | |

| Very High |

7.77%

|

-

|

-

|

0.33%

|

Invest | |

| Moderately High |

3.48%

|

-

|

0.06%

|

0.04%

|

Invest | |

| Moderately High |

3.48%

|

-

|

0.06%

|

0.04%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹1000

|

₹5000

|

0.66%

|

Sumit Bhatnagar

|

14-Aug 2012

|

Invest | |

|

₹1000

|

₹5000

|

0.78%

|

Marzban Irani

|

30-May 2007

|

Invest | |

|

₹1000

|

₹5000

|

0.78%

|

Marzban Irani

|

30-May 2007

|

Invest | |

|

₹1000

|

₹5000

|

1.32%

|

Marzban Irani

|

01-Feb 2019

|

Invest | |

|

₹1000

|

₹5000

|

0.96%

|

Rahul Singh

|

04-Jun 2003

|

Invest | |

|

₹1000

|

₹5000

|

1.22%

|

Marzban Irani

|

26-Mar 1999

|

Invest | |

|

₹1000

|

₹5000

|

0.3%

|

Rahul Singh

|

13-Mar 2002

|

Invest | |

|

₹1000

|

₹5000

|

0.95%

|

Rahul Singh

|

27-Nov 2019

|

Invest | |

|

₹1000

|

₹5000

|

0.49%

|

Rahul Singh

|

01-Aug 2022

|

Invest | |

|

₹1000

|

₹5000

|

0.99%

|

Sumit Bhatnagar

|

25-Jan 2019

|

Invest | |

|

₹1000

|

₹5000

|

0.2%

|

Rahul Singh

|

17-Jul 2019

|

Invest | |

|

₹1000

|

₹5000

|

2.42%

|

Jaiprakash Toshniwal

|

27-Mar 2015

|

Invest | |

|

₹1000

|

₹5000

|

2.42%

|

Jaiprakash Toshniwal

|

27-Mar 2015

|

Invest | |

|

₹1000

|

₹10000

|

1.48%

|

Marzban Irani

|

29-Dec 2003

|

Invest | |

|

₹1000

|

₹10000

|

1.48%

|

Marzban Irani

|

11-Dec 1999

|

Invest | |

|

₹1000

|

₹10000

|

1.48%

|

Marzban Irani

|

29-Dec 2003

|

Invest | |

|

₹1000

|

₹10000

|

1.48%

|

Marzban Irani

|

11-Dec 1999

|

Invest | |

|

₹1000

|

₹5000

|

2.28%

|

Yogesh Patil

|

12-Nov 2021

|

Invest | |

|

₹1000

|

₹5000

|

2.25%

|

Karan Doshi

|

02-Jun 2003

|

Invest | |

|

₹1000

|

₹5000

|

2.25%

|

Karan Doshi

|

02-Jun 2003

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

28.6423

(12-09-2025)

|

28.6107

(11-09-2025)

|

0.11%

|

31.2626

|

19.422

|

Invest | |

|

35.1819

(12-09-2025)

|

35.1799

(11-09-2025)

|

0.01%

|

35.1989

|

32.6389

|

Invest | |

|

35.1819

(12-09-2025)

|

35.1799

(11-09-2025)

|

0.01%

|

35.1989

|

32.6389

|

Invest | |

|

14.7246

(12-09-2025)

|

14.7245

(11-09-2025)

|

0%

|

14.735

|

13.7151

|

Invest | |

|

40.0332

(12-09-2025)

|

40.0268

(11-09-2025)

|

0.02%

|

40.0332

|

37.3518

|

Invest | |

|

72.3874

(12-09-2025)

|

72.4187

(11-09-2025)

|

-0.04%

|

73.1663

|

67.9812

|

Invest | |

|

4773.1497

(12-09-2025)

|

4772.4651

(11-09-2025)

|

0.01%

|

4773.15

|

4470.87

|

Invest | |

|

1336.8419

(12-09-2025)

|

1336.6815

(11-09-2025)

|

0.01%

|

1336.84

|

1252.54

|

Invest | |

|

1205.2373

(12-09-2025)

|

1205.1002

(11-09-2025)

|

0.01%

|

1205.24

|

1130.88

|

Invest | |

|

13.9556

(12-09-2025)

|

13.9518

(11-09-2025)

|

0.03%

|

13.9556

|

13.1331

|

Invest | |

|

1346.2232

(12-09-2025)

|

1346.0311

(11-09-2025)

|

0.01%

|

1346.22

|

1269.75

|

Invest | |

|

20.7334

(12-09-2025)

|

20.6283

(11-09-2025)

|

0.51%

|

21.7185

|

17.4986

|

Invest | |

|

20.7334

(12-09-2025)

|

20.6283

(11-09-2025)

|

0.51%

|

21.7185

|

17.4986

|

Invest | |

|

34.0027

(12-09-2025)

|

33.9545

(11-09-2025)

|

0.14%

|

35.0983

|

32.9361

|

Invest | |

|

58.8726

(12-09-2025)

|

58.7892

(11-09-2025)

|

0.14%

|

60.7695

|

57.0259

|

Invest | |

|

34.0027

(12-09-2025)

|

33.9545

(11-09-2025)

|

0.14%

|

35.0983

|

32.9361

|

Invest | |

|

58.8726

(12-09-2025)

|

58.7892

(11-09-2025)

|

0.14%

|

60.7695

|

57.0259

|

Invest | |

|

13.6579

(12-09-2025)

|

13.6213

(11-09-2025)

|

0.27%

|

14.0028

|

12.384

|

Invest | |

|

81.5734

(12-09-2025)

|

81.4584

(11-09-2025)

|

0.14%

|

82.6554

|

78.3236

|

Invest | |

|

81.5734

(12-09-2025)

|

81.4584

(11-09-2025)

|

0.14%

|

82.6554

|

78.3236

|

Invest |

LIC Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top LIC Mutual Fund

LIC MF LOW DURATION FUND-Regular Plan-Growth

3Y Returns 6.74%

VS

LIC MF LOW DURATION FUND-Regular Plan-Growth

3Y Returns 6.74%

VS

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 7.33%

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 7.33%

LIC MF Government Securities Fund-Regular Plan-Growth

3Y Returns 5.72%

VS

LIC MF Government Securities Fund-Regular Plan-Growth

3Y Returns 5.72%

VS

ICICI Prudential Gilt Fund - Growth

3Y Returns 7.65%

ICICI Prudential Gilt Fund - Growth

3Y Returns 7.65%

LIC MF ELSS Tax Saver - Regular Plan - Growth

3Y Returns 14.24%

VS

LIC MF ELSS Tax Saver - Regular Plan - Growth

3Y Returns 14.24%

VS

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 13.48%

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 13.48%

LIC MF Arbitrage Fund Regular - Growth

3Y Returns 6.58%

VS

LIC MF Arbitrage Fund Regular - Growth

3Y Returns 6.58%

VS

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.17%

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 7.17%

Investment Strategy

The company prioritizes customer and partner satisfaction, aiming to deliver a superior investment experience. Upholding a systematic investment discipline and maintaining high standards of financial ethics and corporate governance, LIC Mutual Fund strives to ensure the trust and satisfaction of its stakeholders.

Head of Equity and Debt

Mr. Yogesh Patil (CIO: Equity)

Mr. Patil, with an MBA in Finance, has garnered valuable experience in the financial sector. His professional journey includes notable contributions at Canara Robeco Mutual Fund, Sahara Mutual Fund, and Religare Enterprise Limited. Commendations are due for his dedication and expertise in the field. His strategies have generated high profits for Life Insurance Corporation.

Mr. Marzban Irani (CIO: Debt)

Mr Marzban Irani is a B. Com (H) graduate from Mumbai University and holds a PGDBM from Chetna's Institute of Management & Research, Mumbai. Before joining LIC Mutual Fund, he held various roles in reputable financial institutions, including DSP Investment Managers as VP Fixed Income (Jun 2014-Jul 2016), Tata Asset Management as Senior Fund Manager Fixed Income (Jun 2011-May 2014), PNB MetLife India Insurance as Fund Manager Fixed Income (Sep 2010-May 2011), Mirae Asset Global Investment Management India Pvt. Ltd.

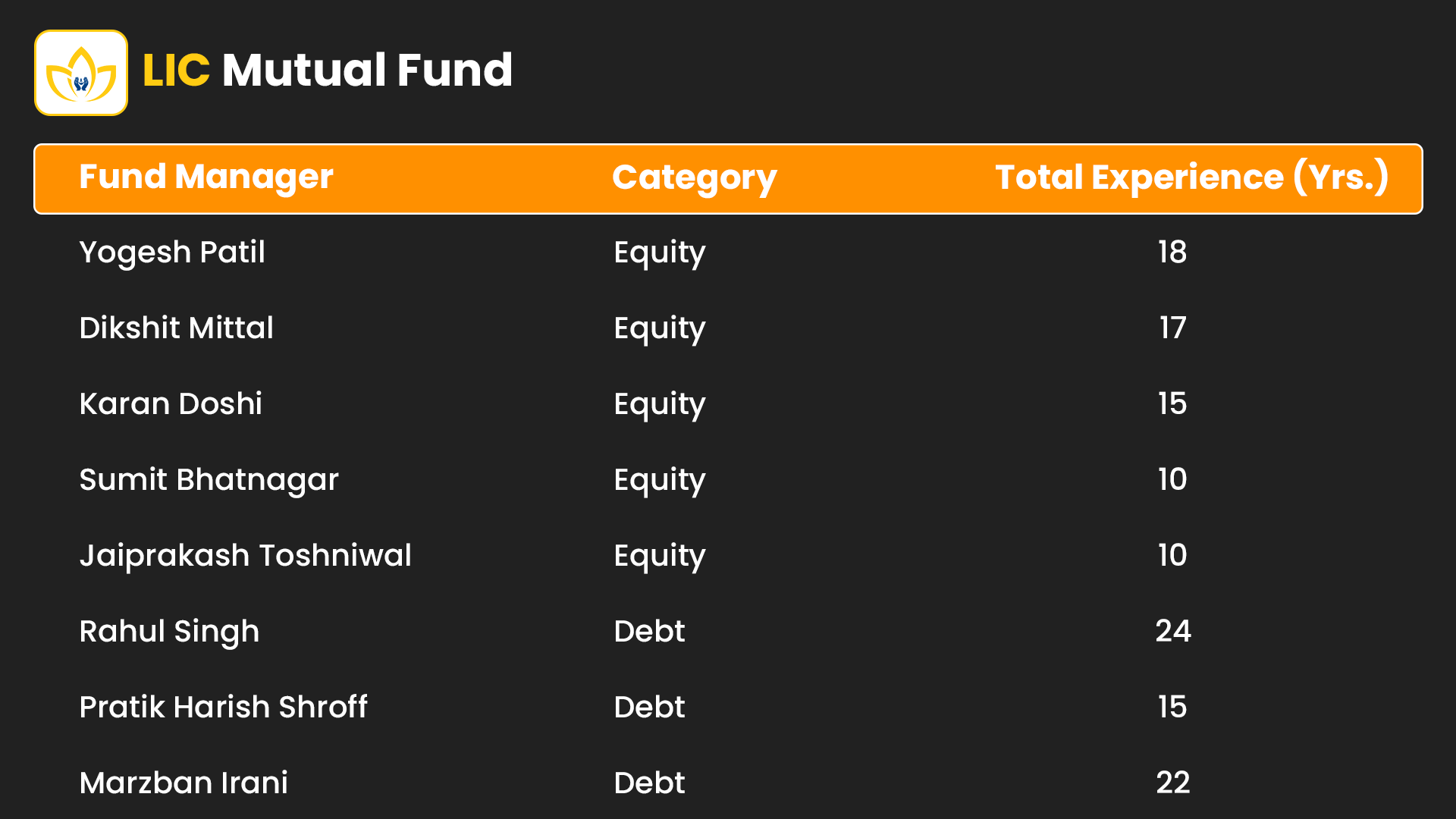

Key Fund Management Team

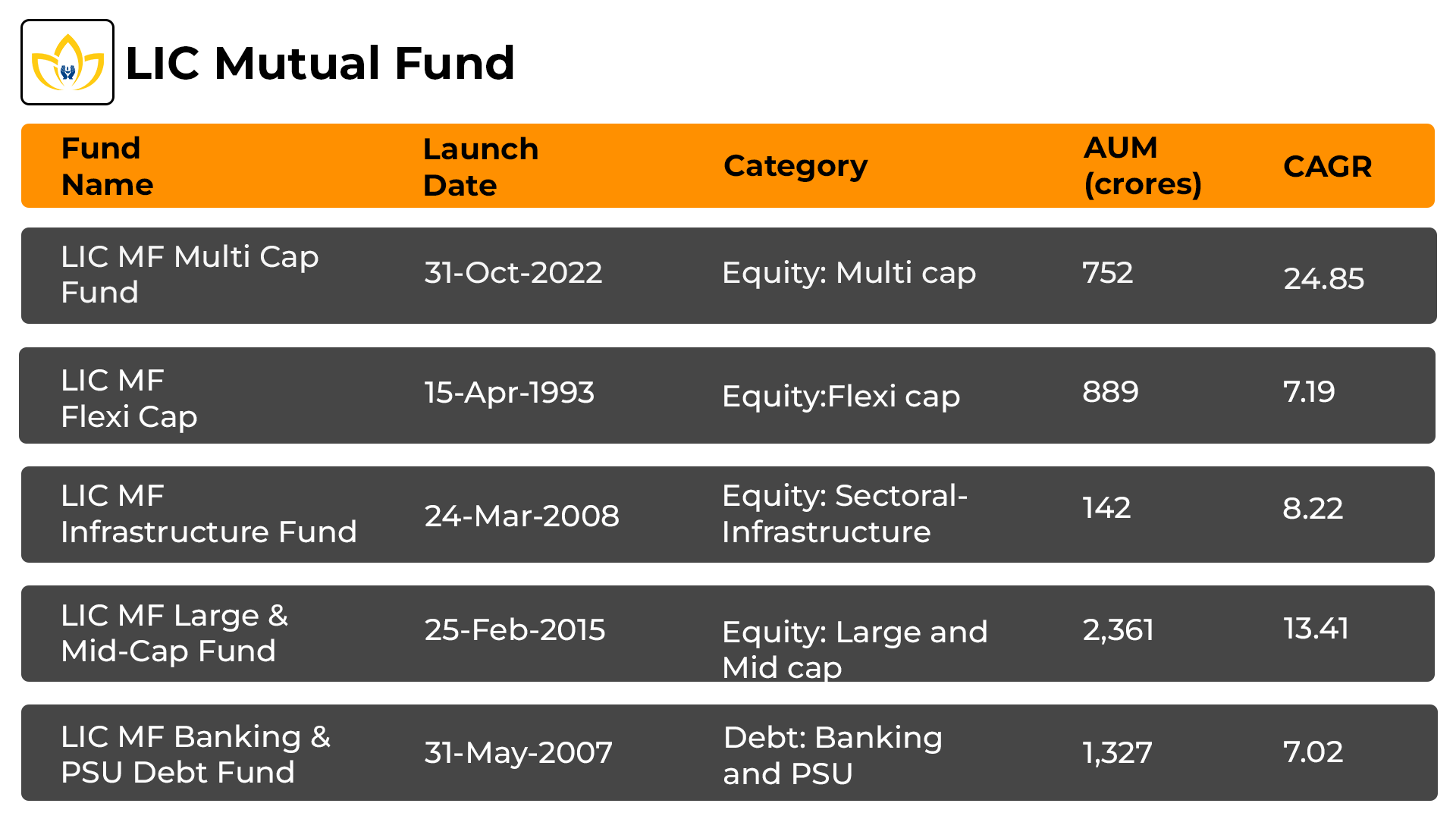

Top 5 LIC Mutual Funds

History of LIC Mutual Funds

The LIC Mutual Fund was established by the Life Insurance Corporation of India on June 19, 1989, and it was set up as a Company under the Indian Trust Act, of 1882. On April 20, 1994, LIC Mutual Fund Asset Management Limited. was established under the Securities and Exchange Board of India (Mutual Funds) Regulations, 1993. The company opened for business on April 29, 1994.

- LIC adopts a different investing approach that sets it apart from other traditional investments.

- This AMC has a wide range of varieties of fund schemes.

- It believes in following strong work ethics.

- LIC Schemes are top-performing in their respective categories.

How to Select the Best LIC Mutual Fund?

Starting your investment journey is like taking the first step into a new adventure. To make this step count, here are some things you should think about:

- Set Goals: Figure out what you want to achieve with your investment. Plan things step by step so you can reach your goals.

- Risk Check: Decide how much risk you're comfortable with. Remember, higher risk might mean better results.

- Spread Your Money: Spread your money across different things. It helps lower the risk, and you can make more money.

- Learn Stuff: Before diving in, learn about the mutual fund you are interested in. Check its past performance.

- Keep an Eye: Regularly check on your investments. If things need adjusting, do it.

- Ask for Help: Professionals know the ins and outs of mutual funds, especially when things in the market change.

So, before jumping in, these tips will help you choose the right Mutual Fund. You can also use the SIP Calculator to check the annual returns of your investment.

How to Invest in LIC Fund Schemes via MySIPonline?

Here's a simple step-by-step guide to investing in LIC AMC through mysiponline:

- Visit mysiponline.com: Pick LIC's top Mutual Funds that suit your investment goal.

- Sign Up: Create a free account, fill in your details, and add the funds you want.

- Complete Your Profile: Finish your profile and Know Your Customer (KYC) process.

- Add Funds to Your Cart: Explore and add the mutual funds you like to your cart.

- Make the Payment: Complete payment and wait for the confirmation of your investment.

- Monitor Investments: Keep an eye on your investments through your mysiponline.com account.

In a nutshell, our platform provides an Online SIP to give a simple and quick approach to getting your investments started now. Consider it an all-in-one bundle where we supply everything you require in one location.

What is the Taxation on LIC Mutual Fund?

The taxation of LIC mutual funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in LIC Mutual Fund?

What are the different LIC mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in LIC Funds online tax-free?

How to analyse the performance of LIC Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of LIC Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.