Nippon India Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 85

- Average annual returns 3.81%

About Nippon India Mutual Fund

-

Launched in

30-Jun-1995

-

AMC Age

30 Years

-

Website

https://mf.nipponindiaim.com -

Email Address

customercare@nipponindiaim.in

Top Performing Nippon India Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 351.43 | 3 years | 6.17% | 12.57% | 32.87% | 51.91% | 36.3% | 57.7% | 37.14% | 31.96% | - | - | Invest | |

| 3248.15 | 14 years | 2.78% | 8.84% | 12.11% | 25.5% | 40.47% | 48.73% | 33.88% | 27.03% | 14.51% | 13.8% | Invest | |

| 1025.65 | 3 years | 0.22% | 8.86% | 15.88% | 26.98% | 41.64% | 45.8% | 29.13% | 28.91% | - | - | Invest | |

| 273.12 | 11 years | 2.27% | 2.95% | 9.88% | 14.83% | 17.34% | 19.22% | 16.41% | 17.1% | 8.84% | 7.71% | Invest | |

| 705.95 | 10 years | 0.8% | 4.1% | 5.76% | 10.32% | 8.58% | 17.14% | 19.02% | 17.39% | 13.76% | 14.52% | Invest | |

| 6649.41 | 5 years | 1.38% | 3.56% | 4.03% | 15.59% | 11.54% | 11.62% | 19.88% | 18.57% | 17.98% | - | Invest | |

| 108.38 | 11 years | 0.19% | 0.26% | 3.23% | 6.25% | 7.69% | 10.2% | 8.93% | 8.14% | 8.56% | 3.52% | Invest | |

| 907.88 | 4 years | 1.24% | 2.85% | 1.14% | 14.04% | 9.53% | 9.72% | 17.82% | 19.12% | - | - | Invest | |

| 987.43 | 20 years | 0.17% | 0.39% | 1.83% | 5.14% | 6.66% | 9.32% | 8.59% | 8.16% | 8.75% | 6.1% | Invest | |

| 10187.77 | 24 years | 0.18% | 0.12% | 0.8% | 4.75% | 7.47% | 8.47% | 8.24% | 7.79% | 6.71% | 7.3% | Invest | |

| 8223.51 | 21 years | 0.15% | 0.21% | 1.06% | 4.64% | 7.5% | 8.43% | 8.08% | 7.66% | 6.41% | 7.24% | Invest | |

| 143.30 | 2 years | 0.25% | 0.39% | 0.94% | 4.57% | 6.32% | 8.36% | 8.42% | - | - | - | Invest | |

| 8909.94 | 22 years | 0.14% | 0.11% | 0.89% | 4.57% | 5.9% | 8.32% | 8% | 7.36% | 6.22% | 7.06% | Invest | |

| 3352.70 | 3 years | 0.1% | 0.35% | 1.15% | 4.38% | 5.75% | 8.02% | 7.85% | 7.13% | - | - | Invest | |

| 384.15 | 2 years | 0.1% | - | 0.61% | 4.17% | 5.8% | 7.91% | 8.17% | - | - | - | Invest | |

| 397.35 | 2 years | 0.12% | 0.34% | 1.22% | 4.25% | 5.83% | 7.88% | 8.07% | - | - | - | Invest | |

| 22812.39 | 20 years | 0.09% | 0.44% | 1.49% | 4.13% | 7.35% | 7.85% | 7.71% | 7.5% | 6.13% | 6.78% | Invest | |

| 891.72 | 21 years | 0.32% | 0.62% | 1.54% | 5.92% | 6.45% | 7.82% | 8.61% | 8.7% | 8.87% | 5.68% | Invest | |

| 5635.66 | 10 years | 0.18% | 0.04% | 0.57% | 4.42% | 5.61% | 7.8% | 7.71% | 7.21% | 5.98% | 7.36% | Invest | |

| 9943.76 | 18 years | 0.11% | 0.4% | 1.37% | 4.03% | 7.47% | 7.68% | 7.35% | 7.02% | 5.92% | 6.69% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 351.43 | Very High |

40.54%

|

85.09%

|

44.95%

|

38.23%

|

-

|

-

|

31.63%

|

Invest | |

| 3248.15 | Very High |

10.6%

|

48.19%

|

38.31%

|

31.29%

|

23.01%

|

16.64%

|

12.46%

|

Invest | |

| 1025.65 | Very High |

20.69%

|

57.75%

|

39.05%

|

30.33%

|

-

|

-

|

26.95%

|

Invest | |

| 273.12 | Very High |

12.63%

|

27.94%

|

19.18%

|

17.29%

|

11.19%

|

9.01%

|

8.66%

|

Invest | |

| 705.95 | Very High |

9.08%

|

15.74%

|

16.91%

|

19.25%

|

14.32%

|

14.83%

|

14.8%

|

Invest | |

| 6649.41 | Very High |

6%

|

16.43%

|

16.34%

|

18.66%

|

16.87%

|

-

|

16.9%

|

Invest | |

| 108.38 | Moderately High |

2.28%

|

10.65%

|

9.91%

|

9.12%

|

8.49%

|

4.15%

|

4.08%

|

Invest | |

| 907.88 | High |

3.94%

|

13.42%

|

14.79%

|

18.2%

|

-

|

-

|

17.67%

|

Invest | |

| 987.43 | Moderately High |

1.81%

|

9.04%

|

8.96%

|

8.68%

|

8.26%

|

6.32%

|

6.71%

|

Invest | |

| 10187.77 | Moderate |

1.05%

|

7.58%

|

8.32%

|

8.16%

|

7.33%

|

7.15%

|

7.37%

|

Invest | |

| 8223.51 | Moderate |

1.32%

|

7.79%

|

8.25%

|

8.09%

|

7.12%

|

7.1%

|

7.56%

|

Invest | |

| 143.30 | Moderate |

1.26%

|

7.95%

|

8.46%

|

-

|

-

|

-

|

8.27%

|

Invest | |

| 8909.94 | Average |

1.2%

|

7.68%

|

8.18%

|

7.94%

|

6.93%

|

6.84%

|

7.61%

|

Invest | |

| 3352.70 | Low to Moderate |

1.48%

|

7.68%

|

7.98%

|

7.76%

|

-

|

-

|

7.57%

|

Invest | |

| 384.15 | Low to Moderate |

1.04%

|

7.25%

|

8.13%

|

-

|

-

|

-

|

8%

|

Invest | |

| 397.35 | Moderate |

1.44%

|

7.7%

|

8.05%

|

-

|

-

|

-

|

7.9%

|

Invest | |

| 22812.39 | Moderate |

1.6%

|

7.61%

|

7.74%

|

7.69%

|

7.01%

|

6.66%

|

39.06%

|

Invest | |

| 891.72 | High |

1.87%

|

8.41%

|

8.38%

|

8.64%

|

8.38%

|

6.04%

|

7.71%

|

Invest | |

| 5635.66 | Moderate |

0.82%

|

6.92%

|

7.7%

|

7.6%

|

6.7%

|

6.98%

|

7.02%

|

Invest | |

| 9943.76 | Moderate |

1.51%

|

7.31%

|

7.46%

|

7.34%

|

6.6%

|

6.43%

|

7.14%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

28.82%

|

-

|

-

|

0.77%

|

Invest | |

| Very High |

11.75%

|

-

|

-

|

1.37%

|

Invest | |

| Very High |

20.46%

|

-

|

-

|

0.96%

|

Invest | |

| Very High |

13.47%

|

-

|

0.99%

|

0.64%

|

Invest | |

| Very High |

15.46%

|

-

|

0.99%

|

0.72%

|

Invest | |

| Very High |

8.15%

|

-

|

-

|

1.26%

|

Invest | |

| Moderately High |

1.96%

|

0.11%

|

1.59%

|

0.64%

|

Invest | |

| High |

7.55%

|

-

|

-

|

1.45%

|

Invest | |

| Moderately High |

0.79%

|

0.71%

|

0.88%

|

1.74%

|

Invest | |

| Moderate |

1.09%

|

0.42%

|

0.52%

|

0.36%

|

Invest | |

| Moderate |

0.91%

|

3.61%

|

1.78%

|

0.05%

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Average |

1.10%

|

-

|

1.32%

|

0.55%

|

Invest | |

| Low to Moderate |

1.15%

|

-

|

-

|

0.33%

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

0.54%

|

2.82%

|

1.18%

|

0.84%

|

Invest | |

| High |

1.97%

|

0.91%

|

0.54%

|

0.93%

|

Invest | |

| Moderate |

1.31%

|

-

|

1.49%

|

0.34%

|

Invest | |

| Moderate |

0.6%

|

2.51%

|

1.3%

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹500

|

2.44%

|

Kinjal Desai

|

11-Dec 2021

|

Invest | |

|

₹100

|

₹100

|

0.35%

|

Himanshu Mange

|

07-Mar 2011

|

Invest | |

|

₹100

|

₹100

|

0.59%

|

Himanshu Mange

|

03-Feb 2022

|

Invest | |

|

₹100

|

₹5000

|

2.46%

|

Kinjal Desai

|

26-Aug 2014

|

Invest | |

|

₹100

|

₹100

|

2.39%

|

Kinjal Desai

|

23-Jul 2015

|

Invest | |

|

₹100

|

₹5000

|

1.49%

|

Vikram Dhawan

|

27-Aug 2020

|

Invest | |

|

₹100

|

₹5000

|

1.1%

|

Kinjal Desai

|

26-Jun 2014

|

Invest | |

|

₹100

|

₹5000

|

1.22%

|

Ashutosh Bhargava

|

05-Feb 2021

|

Invest | |

|

₹100

|

₹500

|

1.47%

|

Sushil Budhia

|

08-Jun 2005

|

Invest | |

|

₹100

|

₹1000

|

0.74%

|

Vivek Sharma

|

25-Sep 2000

|

Invest | |

|

₹100

|

₹5000

|

0.65%

|

Anju Chhajer

|

02-Sep 2004

|

Invest | |

|

₹100

|

₹1000

|

0.36%

|

Siddharth Deb

|

06-Mar 2023

|

Invest | |

|

₹100

|

₹100

|

0.93%

|

Vivek Sharma

|

23-Dec 2002

|

Invest | |

|

₹100

|

₹1000

|

0.31%

|

Siddharth Deb

|

29-Mar 2022

|

Invest | |

|

₹100

|

₹1000

|

0.4%

|

Siddharth Deb

|

24-Nov 2022

|

Invest | |

|

₹100

|

₹1000

|

0.4%

|

Siddharth Deb

|

06-Dec 2022

|

Invest | |

|

₹100

|

₹500

|

0.37%

|

Anju Chhajer

|

15-Jun 2005

|

Invest | |

|

₹500

|

₹5000

|

1.9%

|

Dhrumil Shah

|

29-Dec 2003

|

Invest | |

|

₹100

|

₹5000

|

0.76%

|

Vivek Sharma

|

15-May 2015

|

Invest | |

|

₹100

|

₹500

|

0.96%

|

Anju Chhajer

|

21-Mar 2007

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

16.1668

(12-09-2025)

|

16.2825

(11-09-2025)

|

-0.71%

|

16.2892

|

7.6183

|

Invest | |

|

42.1137

(12-09-2025)

|

41.8191

(11-09-2025)

|

0.7%

|

42.1137

|

28.5653

|

Invest | |

|

19.6247

(12-09-2025)

|

18.9376

(11-09-2025)

|

3.63%

|

19.6247

|

13.233

|

Invest | |

|

22.1780

(12-09-2025)

|

22.0702

(11-09-2025)

|

0.49%

|

22.178

|

16.7916

|

Invest | |

|

36.8042

(11-09-2025)

|

36.4082

(10-09-2025)

|

1.09%

|

36.8208

|

29.8972

|

Invest | |

|

22.3543

(11-09-2025)

|

22.3170

(10-09-2025)

|

0.17%

|

22.3543

|

19.0483

|

Invest | |

|

15.9493

(12-09-2025)

|

15.9422

(11-09-2025)

|

0.04%

|

15.9493

|

14.5017

|

Invest | |

|

21.8804

(12-09-2025)

|

21.7990

(11-09-2025)

|

0.37%

|

21.8804

|

18.8537

|

Invest | |

|

35.5771

(12-09-2025)

|

35.5692

(11-09-2025)

|

0.02%

|

35.5771

|

32.5916

|

Invest | |

|

60.7161

(12-09-2025)

|

60.7020

(11-09-2025)

|

0.02%

|

60.7482

|

56.1126

|

Invest | |

|

45.7864

(12-09-2025)

|

45.7734

(11-09-2025)

|

0.03%

|

45.7864

|

42.2831

|

Invest | |

|

12.2785

(12-09-2025)

|

12.2737

(11-09-2025)

|

0.04%

|

12.2785

|

11.3498

|

Invest | |

|

53.4458

(12-09-2025)

|

53.4160

(11-09-2025)

|

0.06%

|

53.4458

|

49.4111

|

Invest | |

|

12.3198

(12-09-2025)

|

12.3187

(11-09-2025)

|

0.01%

|

12.3198

|

11.417

|

Invest | |

|

12.3607

(12-09-2025)

|

12.3566

(11-09-2025)

|

0.03%

|

12.3802

|

11.4736

|

Invest | |

|

12.2318

(12-09-2025)

|

12.2289

(11-09-2025)

|

0.02%

|

12.2318

|

11.3508

|

Invest | |

|

4210.1869

(12-09-2025)

|

4209.8687

(11-09-2025)

|

0.01%

|

4210.19

|

3907.36

|

Invest | |

|

58.4617

(12-09-2025)

|

58.4251

(11-09-2025)

|

0.06%

|

58.4617

|

54.3595

|

Invest | |

|

20.9603

(12-09-2025)

|

20.9575

(11-09-2025)

|

0.01%

|

20.9941

|

19.486

|

Invest | |

|

3792.4190

(12-09-2025)

|

3792.6912

(11-09-2025)

|

-0.01%

|

3792.69

|

3525.76

|

Invest |

Nippon India Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Nippon India Mutual Fund

Nippon India Japan Equity Fund- Growth Plan- Growth Option

3Y Returns 17.1%

VS

Nippon India Japan Equity Fund- Growth Plan- Growth Option

3Y Returns 17.1%

VS

ICICI Prudential US Bluechip Equity Fund - Growth

3Y Returns 15.3%

ICICI Prudential US Bluechip Equity Fund - Growth

3Y Returns 15.3%

Nippon India Ultra Short Duration Fund- Growth Option

3Y Returns 6.85%

VS

Nippon India Ultra Short Duration Fund- Growth Option

3Y Returns 6.85%

VS

UTI Ultra Short Duration Fund- Regular Plan - Growth Option

3Y Returns 6.82%

UTI Ultra Short Duration Fund- Regular Plan - Growth Option

3Y Returns 6.82%

Nippon India Nivesh Lakshya Long Duration Fund- Growth Option

3Y Returns 7.5%

VS

Nippon India Nivesh Lakshya Long Duration Fund- Growth Option

3Y Returns 7.5%

VS

ICICI Prudential Long Term Bond Fund - Growth

3Y Returns 7%

ICICI Prudential Long Term Bond Fund - Growth

3Y Returns 7%

Nippon India Index Fund - Nifty 50 Plan - Growth Plan - Growth Option

3Y Returns 12.5%

VS

Nippon India Index Fund - Nifty 50 Plan - Growth Plan - Growth Option

3Y Returns 12.5%

VS

Aditya Birla Sun Life Nifty Midcap 150 Index Fund-Regular Growth

3Y Returns 20.6%

Aditya Birla Sun Life Nifty Midcap 150 Index Fund-Regular Growth

3Y Returns 20.6%

Investing Strategy

This Fund's core philosophy is about earning good returns while carefully managing risks. This fund's goal is to invest for three to five years, and they employ a systematic approach to find attractive new companies. Nippon India Mutual Fund prioritizes expert portfolio management, and its track record demonstrates its capacity to succeed in generating returns and efficiently managing risks.

Head of Equity and Debt Fund

MR.SAILESH RAJ BHAN (CIO Equity)

Mr Sailesh Raj Bhan is the CIO of Equity investments in Nippon India Mutual Fund. He has over 27 years of expertise in Indian equity markets, including 19 years at Nippon Life India Asset Management Ltd. With a background in finance and a CFA designation, he has managed the following flagship funds for more than 15 years:

- Nippon India Pharma Fund

- Nippon India Large Cap Fund

- Nippon India Multi Cap Fund

Mr. Amit Tripathi (CIO Debt)

Mr Amit Tripathi is now the Chief Investment Officer (CIO) for Fixed Income (Debt Mutual funds), leading a team of 20 highly driven and experienced individuals who specialize in fixed income. He has established himself as an extraordinary portfolio manager over his 14-year tenure at Nippon India Mutual Funds.

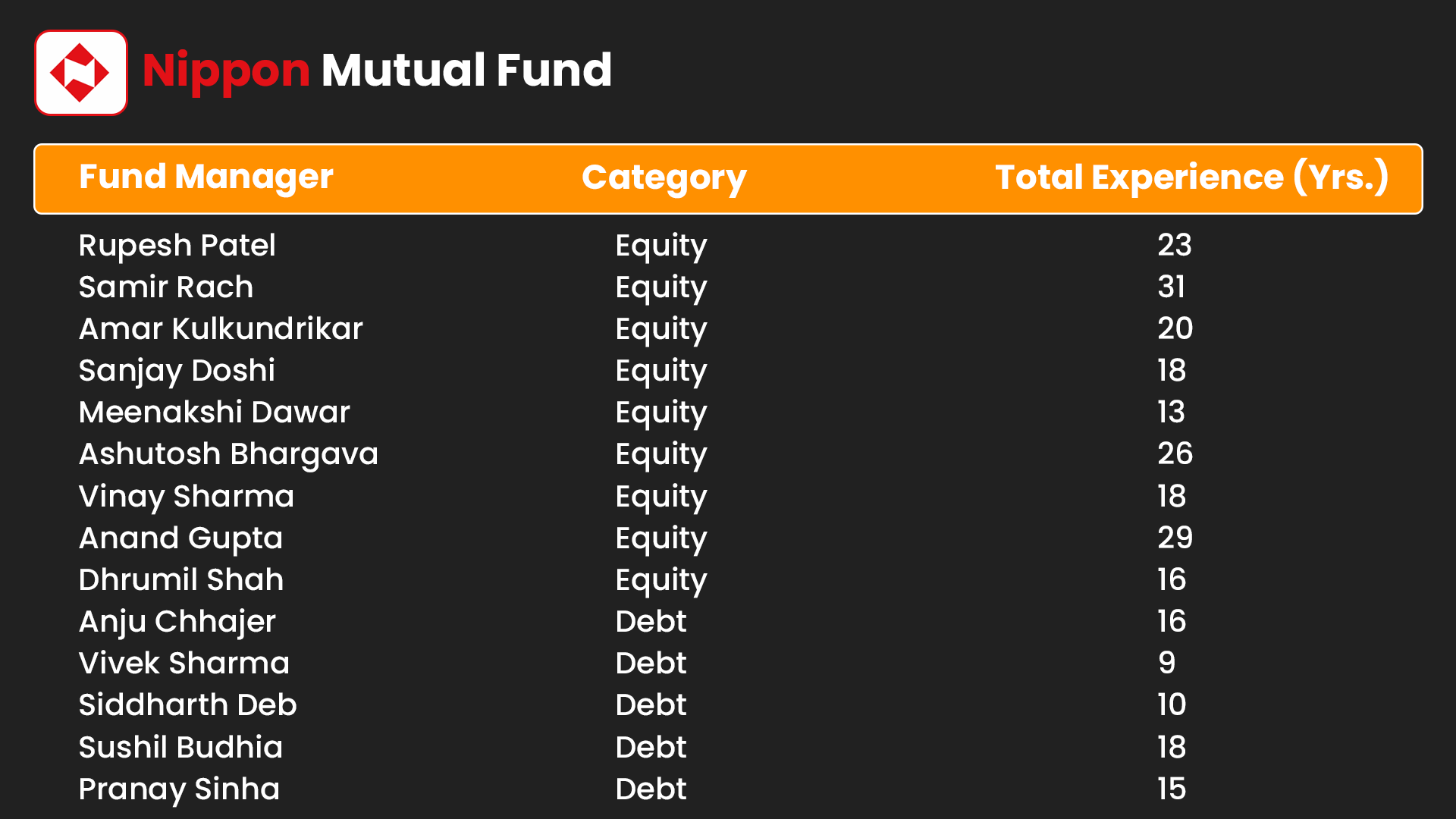

Fund Management Team

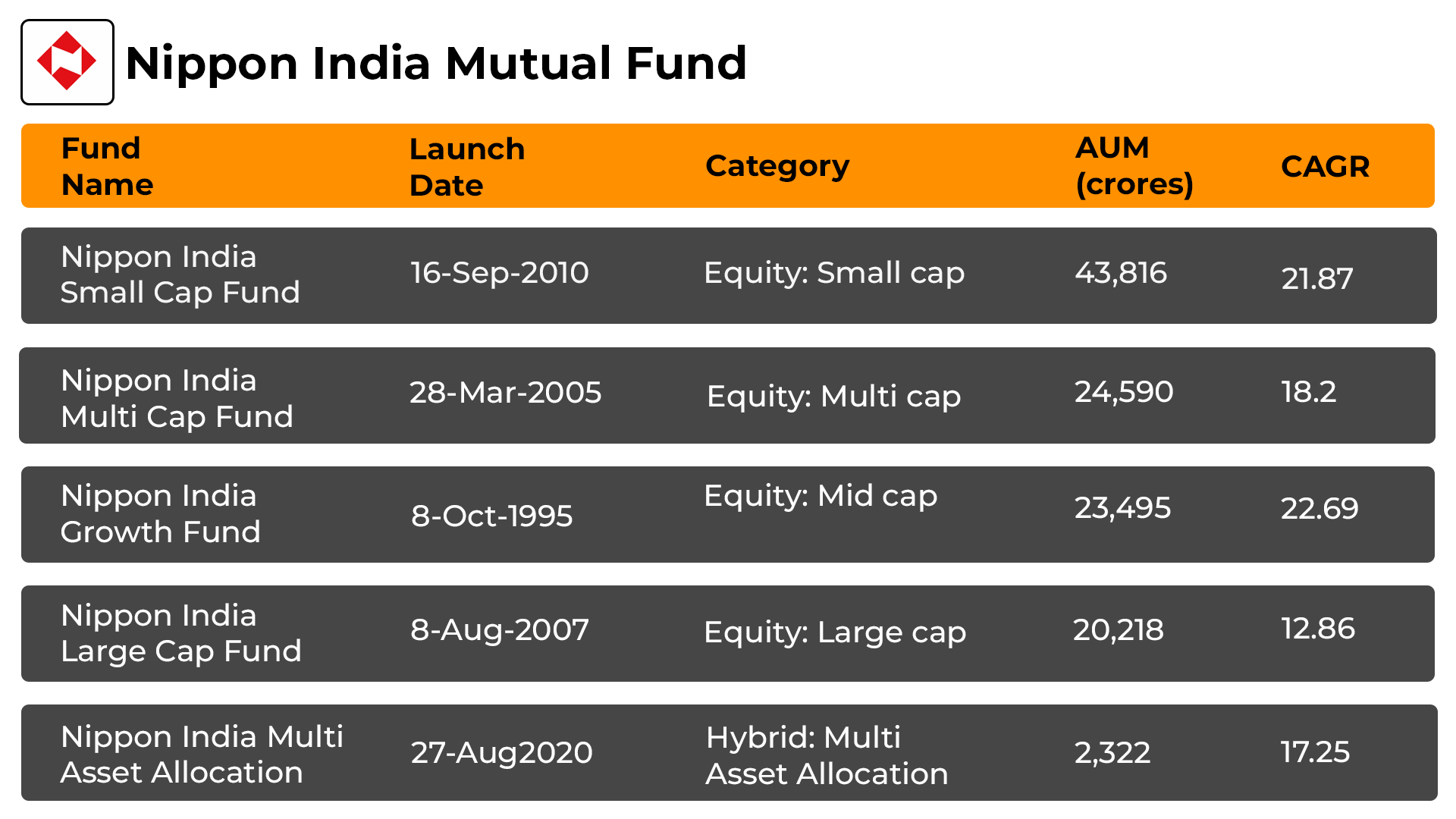

Top 5 Nippon India Mutual Fund

History of Nippon India Mutual Fund

Nippon India MF was originally established as a collaboration between Reliance Capital and Japan's Nippon Life Insurance Company. Reliance Capital Ltd established its mutual fund or asset management company on 24th Feb 1995.

Later on September 28, 2019, it was fully acquired by Nippon Group & changed its name to Nippon India Mutual Funds. Nippon India offers a unique SIP insurance feature with its particular mutual fund schemes.

Nippon India operates in 159 cities across the country.

- Nippon India Mutual Fund distinguishes itself from standard strategies with a unique investing style.

- Nippon India MF's governance policies emphasize responsible and transparent management.

- This fund consistently ranks as a top performer in their respective categories, providing value to investors.

How to Choose the Best Nippon India Mutual Fund?

It is the first step you take to start your investment adventure by selecting the Best Nippon India Funds. Therefore, making the appropriate call is essential for making an informed decision. Here are several aspects where you can achieve it properly:

- Set achievable investment goals that are consistent with objectives.

- Assess risk tolerance according to your preferences.

- Diversify investments into different sectors, reducing risk.

- Research the fund's track record, operations and past performance.

- Monitor investments regularly for safety and adapt to changes.

- Seek expert advice to properly navigate market turbulence.

To summarize, these components mentioned above will help you understand the process of selecting the correct fund. Before you begin your investment adventure, make sure that you do an accurate assessment. Also, you can choose to access the SIP Calculator to get an approximate idea on your investment.

How to Invest in Nippon India Mutual Fund Schemes via MySIPonline?

Investing in the Best Nippon India Fund with mysiponline is simple and uncomplicated. This is a simple guide:

- Go to mysiponline.com and select the top mutual funds that meet your investment objectives.

- Sign up for a free account, provide your profile information, and add your preferred fund.

- Completing the online and paperless KYC process takes only a few minutes.

- You will require a PAN, Aadhar card, signature, and bank evidence.

- Discover and add the Best of Nippon India's Top Mutual Funds to your basket.

- Make the payment and await confirmation of your investment.

- Keep track of your investments using your mysiponline.com account.

Our website makes it simple and quick to start investing right away, with all services available in one handy location. You can invest in Online SIP through our website and build yourself a good portfolio.

What is the Taxation on Nippon India Mutual Fund?

The taxation of Nippon India Mutual Funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Nippon India Mutual Fund?

What are the different Nippon mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in Nippon Funds online tax-free?

How to analyse the performance of Nippon India Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Videos and Blogs of Nippon India Mutual Fund

Videos

Blogs

Comparison of Best Smallcap Funds | SBI smallcap | Nippon smallcap | Axis smallcap | Quant | BOI

Comparison of Best Smallcap Funds | SBI smallcap | Nippon smallcap | Axis smallcap | Quant | BOI

Nippon India Small Cap Fund | Mutual Fund Analysis | Top Performing Mutual Fund

Nippon India Small Cap Fund | Mutual Fund Analysis | Top Performing Mutual Fund

Comparison of Best Smallcap Funds | SBI smallcap | Nippon smallcap | Axis smallcap | Quant | BOI

Comparison of Best Smallcap Funds | SBI smallcap | Nippon smallcap | Axis smallcap | Quant | BOI

Best Small Cap Mutual Fund 2023 |Compare SBI small cap vs Nippon Small Cap vs Quant small cap & More

Best Small Cap Mutual Fund 2023 |Compare SBI small cap vs Nippon Small Cap vs Quant small cap & More

Comparison of Best Smallcap Funds | SBI smallcap | Nippon smallcap | Axis smallcap | Quant | BOI

Comparison of Best Smallcap Funds | SBI smallcap | Nippon smallcap | Axis smallcap | Quant | BOI

Best Small Cap Mutual Fund 2023 |Compare SBI small cap vs Nippon Small Cap vs Quant small cap & More

Best Small Cap Mutual Fund 2023 |Compare SBI small cap vs Nippon Small Cap vs Quant small cap & More

You can select three funds for compare.

You can select three funds for compare.