PGIM India Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 23

- Average annual returns 3.35%

About PGIM India Mutual Fund

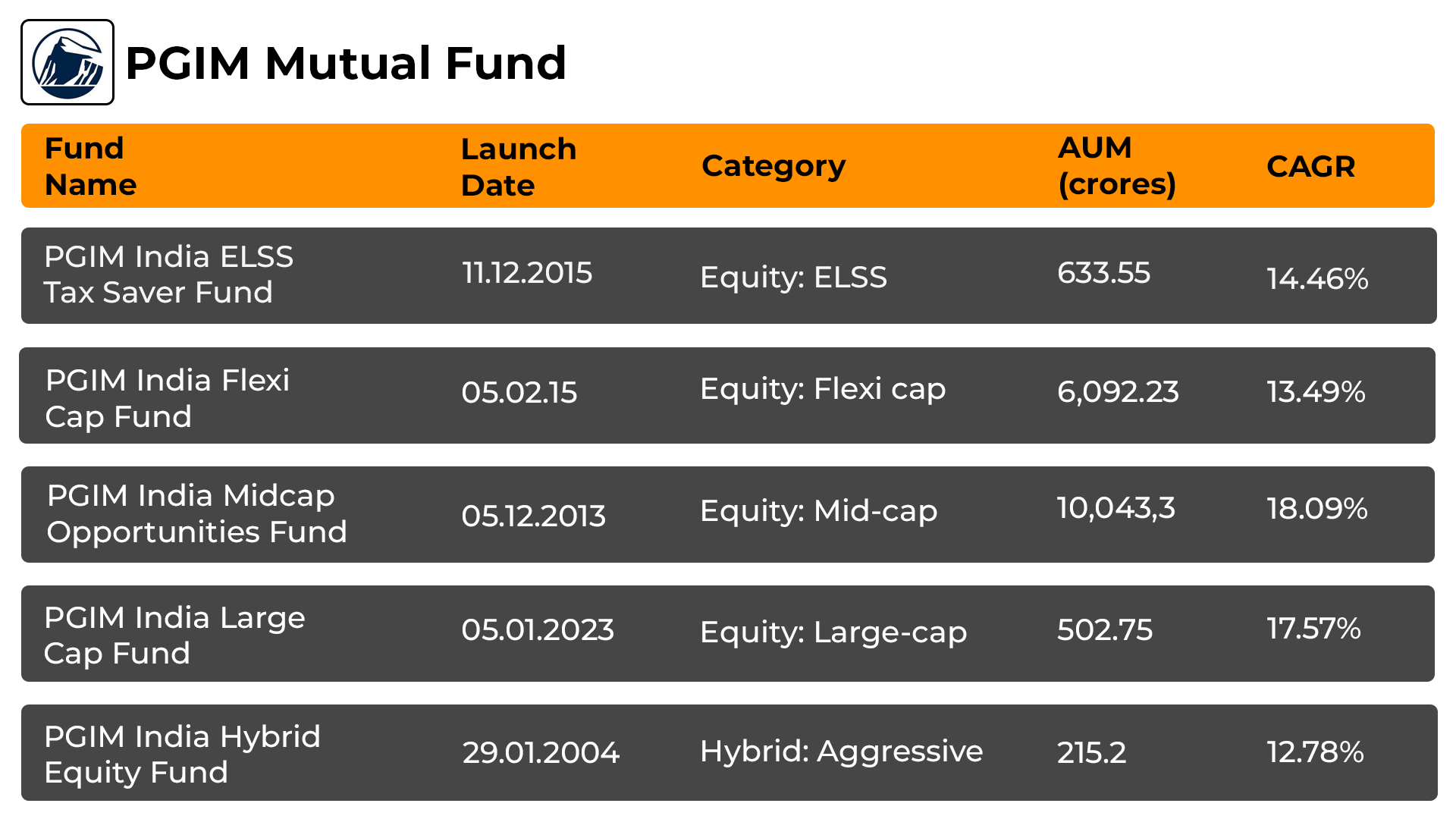

PGIM (Prudential Investment Management) India Mutual Fund, a wholly owned subsidiary of PGIM, the global investment management arm of Prudential Financial, Inc. (PFI) based in the US, was founded a decade ago, drawing on the 140-year legacy of PGIM. PGIM Mutual Fund provides a diverse portfolio with 22 schemes, including 8 equity schemes, 10 debt schemes, and 4 hybrid schemes. This AMC holds the 24th position, which underlines its commitment to leveraging global expertise and heritage for the benefit of investors in India. The PGIM India Midcap Opportunities Fund, the flagship scheme, has exhibited an impressive average annualized return of 17.89% since its inception.

More-

Launched in

13-May-2010

-

AMC Age

15 Years

-

Website

https://www.pgimindiamf.com -

Email Address

care@pgimindia.co.in

Top Performing PGIM India Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 342.76 | 18 years | 2.78% | 7.73% | 11.45% | 13.33% | 16.91% | 27% | 23.9% | 13.79% | 3.4% | 3.75% | Invest | |

| 1496.53 | 15 years | 2.91% | 5.21% | 10.04% | 20.57% | 8.9% | 13.83% | 20.28% | 20.72% | 10.34% | 12.08% | Invest | |

| 27.04 | 2 years | 0.02% | 0.42% | 1.13% | 4.25% | 5.93% | 7.96% | 8.1% | - | - | - | Invest | |

| 88.63 | 7 months | 0.15% | 0.24% | 0.77% | 4.37% | 5.62% | 7.81% | 7.57% | 6.92% | 5.88% | 6.52% | Invest | |

| 268.01 | 5 years | 0.09% | 0.42% | 1.42% | 3.95% | 5.23% | 7.48% | 7.27% | 7.13% | 5.55% | - | Invest | |

| 544.58 | 18 years | 0.1% | 0.47% | 1.41% | 3.31% | 4.66% | 6.91% | 7.08% | 6.97% | 5.6% | 6.21% | Invest | |

| 202.36 | 17 years | 0.08% | 0.42% | 1.37% | 3.46% | 4.69% | 6.83% | 6.76% | 6.6% | 5.37% | 7.05% | Invest | |

| 109.71 | 11 years | 0.05% | 0.36% | 1.12% | 2.93% | 4.25% | 6.14% | 6.62% | 6.55% | 5.31% | 5.46% | Invest | |

| 55.48 | 6 years | 0.1% | 0.44% | 1.31% | 2.82% | 4.06% | 6.1% | 6.41% | 6.38% | 5.21% | - | Invest | |

| 44.64 | 3 years | 2.94% | 6.16% | 7.75% | 10.85% | 11.5% | 5.97% | 14.23% | 8.38% | - | - | Invest | |

| 109.34 | 13 years | 0.08% | 0.33% | -0.12% | 2.89% | 4.15% | 5.57% | 7.4% | 6.69% | 5.21% | 6.9% | Invest | |

| 73.13 | 7 months | 0.23% | 0.79% | 1.2% | 4.77% | 4.31% | 4.79% | 7.25% | 7.05% | 8.63% | 7.18% | Invest | |

| 108.93 | 7 months | -0.09% | 0.41% | -0.64% | 2.08% | 3.39% | 4.52% | 7.09% | 6.49% | 5.13% | 6.72% | Invest | |

| 216.84 | 21 years | 0.71% | 1.71% | 1.79% | 11.92% | 4.2% | 4.29% | 12.14% | 12.45% | 14.01% | 9.12% | Invest | |

| 90.78 | 1 years | 1.16% | 2.61% | 2.52% | 17.74% | 3.83% | 2.18% | - | - | - | - | Invest | |

| 730.52 | 1 years | 1.04% | 2.69% | 2.35% | 17.29% | 4.56% | 2.1% | - | - | - | - | Invest | |

| 964.70 | 4 years | 0.92% | 1.98% | 1.18% | 11.32% | 5.18% | 1.45% | 9.86% | 9.03% | - | - | Invest | |

| 11468.11 | 11 years | 1.13% | 2.97% | 3.37% | 20.12% | 3.04% | 0.65% | 15.84% | 12.4% | 25.1% | 15.8% | Invest | |

| 6271.27 | 10 years | 1.24% | 3.19% | 3.07% | 17.04% | 4.24% | 0.24% | 13.78% | 12.05% | 19.19% | 14.03% | Invest | |

| 779.08 | 9 years | 1.39% | 2.54% | 1.62% | 13.73% | 1.71% | 0.06% | 12.29% | 12.78% | 20.09% | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 342.76 | Average |

13.61%

|

31.51%

|

25.11%

|

22.19%

|

9.97%

|

5.8%

|

5.15%

|

Invest | |

| 1496.53 | Average |

12.07%

|

21.55%

|

17.13%

|

20.41%

|

13.32%

|

14.82%

|

11.64%

|

Invest | |

| 27.04 | Low to Moderate |

1.32%

|

7.63%

|

8.06%

|

-

|

-

|

-

|

7.91%

|

Invest | |

| 88.63 | Moderate |

1.08%

|

7.17%

|

7.66%

|

7.45%

|

6.52%

|

6.43%

|

6.84%

|

Invest | |

| 268.01 | Low to Moderate |

1.5%

|

7.2%

|

7.3%

|

7.26%

|

6.55%

|

-

|

6.33%

|

Invest | |

| 544.58 | Low to Moderate |

1.44%

|

6.51%

|

6.88%

|

6.98%

|

6.45%

|

5.98%

|

19.21%

|

Invest | |

| 202.36 | Low to Moderate |

1.41%

|

6.52%

|

6.71%

|

6.71%

|

6.14%

|

6.62%

|

7.39%

|

Invest | |

| 109.71 | Low |

1.16%

|

5.7%

|

6.28%

|

6.5%

|

5.98%

|

5.44%

|

5.47%

|

Invest | |

| 55.48 | Low |

1.32%

|

5.73%

|

6.14%

|

6.3%

|

5.92%

|

-

|

5.62%

|

Invest | |

| 44.64 | Very High |

9.11%

|

18.94%

|

15.57%

|

13.34%

|

-

|

-

|

10.21%

|

Invest | |

| 109.34 | Moderate |

-0.08%

|

4.31%

|

6.51%

|

6.81%

|

6.03%

|

6.33%

|

6.84%

|

Invest | |

| 73.13 | Low to Moderate |

1.5%

|

6.52%

|

6.71%

|

7.14%

|

7%

|

7.23%

|

7.68%

|

Invest | |

| 108.93 | Moderate |

-0.66%

|

2.88%

|

5.72%

|

6.37%

|

5.79%

|

6.13%

|

6.76%

|

Invest | |

| 216.84 | Average |

3.23%

|

10.73%

|

10.82%

|

12.44%

|

11.29%

|

10.5%

|

10.8%

|

Invest | |

| 90.78 | Very High |

4.2%

|

14.15%

|

-

|

-

|

-

|

-

|

11.39%

|

Invest | |

| 730.52 | Very High |

4.3%

|

14.64%

|

-

|

-

|

-

|

-

|

12.48%

|

Invest | |

| 964.70 | Very High |

2.75%

|

9.82%

|

9.13%

|

10.28%

|

-

|

-

|

9.7%

|

Invest | |

| 11468.11 | Average |

5.58%

|

16.14%

|

13.72%

|

15.86%

|

16.42%

|

18.74%

|

17.68%

|

Invest | |

| 6271.27 | Very High |

4.74%

|

13.93%

|

12.12%

|

14.02%

|

13.18%

|

15.51%

|

15.2%

|

Invest | |

| 779.08 | Very High |

2.95%

|

9.6%

|

10.29%

|

12.59%

|

13.72%

|

-

|

14.5%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Average |

14.76%

|

0.02%

|

0.74%

|

0.43%

|

Invest | |

| Average |

17.45%

|

-

|

1.04%

|

0.76%

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

1.23%

|

-

|

1.40%

|

0.08%

|

Invest | |

| Low to Moderate |

0.36%

|

-

|

3.84%

|

1.08%

|

Invest | |

| Low to Moderate |

0.18%

|

-

|

1.38%

|

1.97%

|

Invest | |

| Low to Moderate |

0.25%

|

-

|

2.69%

|

-

|

Invest | |

| Low |

0.45%

|

-

|

-

|

-

|

Invest | |

| Low |

0.14%

|

-

|

0.04%

|

-

|

Invest | |

| Very High |

15.80%

|

-

|

0.92%

|

0.14%

|

Invest | |

| Moderate |

2.35%

|

-

|

1.10%

|

-

|

Invest | |

| Low to Moderate |

2.20%

|

-

|

-

|

0.10%

|

Invest | |

| Moderate |

2.92%

|

-

|

1.25%

|

-

|

Invest | |

| Average |

8.76%

|

0.85%

|

0.90%

|

0.60%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

8.38%

|

-

|

-

|

0.28%

|

Invest | |

| Average |

13.72%

|

-

|

0.77%

|

0.47%

|

Invest | |

| Very High |

12.57%

|

-

|

0.88%

|

0.44%

|

Invest | |

| Very High |

12.03%

|

-

|

0.86%

|

0.50%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹1000

|

₹5000

|

2.38%

|

Chetan Gindodia

|

11-Sep 2007

|

Invest | |

|

₹1000

|

₹5000

|

2.36%

|

Chetan Gindodia

|

13-May 2010

|

Invest | |

|

₹1000

|

₹5000

|

0.41%

|

Puneet Pal

|

22-Feb 2023

|

Invest | |

|

₹1000

|

₹5000

|

1.01%

|

Puneet Pal

|

14-Feb 2025

|

Invest | |

|

₹1000

|

₹5000

|

0.46%

|

Puneet Pal

|

06-Mar 2020

|

Invest | |

|

₹1000

|

₹5000

|

0.22%

|

Puneet Pal

|

04-Sep 2007

|

Invest | |

|

₹1000

|

₹5000

|

0.92%

|

Puneet Pal

|

04-Jul 2008

|

Invest | |

|

₹1000

|

₹5000

|

1.09%

|

Puneet Pal

|

27-Aug 2014

|

Invest | |

|

₹1000

|

₹5000

|

0.15%

|

Puneet Pal

|

27-Aug 2019

|

Invest | |

|

₹1000

|

₹5000

|

2.12%

|

Chetan Gindodia

|

03-Dec 2021

|

Invest | |

|

₹1000

|

₹5000

|

1.64%

|

Puneet Pal

|

12-Jan 2012

|

Invest | |

|

₹1000

|

₹5000

|

1.32%

|

Puneet Pal

|

14-Feb 2025

|

Invest | |

|

₹1000

|

₹5000

|

1.49%

|

Puneet Pal

|

14-Feb 2025

|

Invest | |

|

₹1000

|

₹5000

|

2.33%

|

Puneet Pal

|

05-Feb 2004

|

Invest | |

|

₹1000

|

₹5000

|

2.31%

|

Puneet Pal

|

09-Apr 2024

|

Invest | |

|

₹1000

|

₹5000

|

2.33%

|

Puneet Pal

|

12-Feb 2024

|

Invest | |

|

₹1000

|

₹5000

|

2.18%

|

Puneet Pal

|

04-Feb 2021

|

Invest | |

|

₹1000

|

₹5000

|

1.7%

|

Puneet Pal

|

02-Dec 2013

|

Invest | |

|

₹1000

|

₹5000

|

1.78%

|

Puneet Pal

|

04-Mar 2015

|

Invest | |

|

₹500

|

₹500

|

2.25%

|

Bhupesh Kalyani

|

11-Dec 2015

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

18.11

(11-09-2025)

|

17.9

(10-09-2025)

|

1.17%

|

18.11

|

13.09

|

Invest | |

|

47.01

(11-09-2025)

|

46.87

(10-09-2025)

|

0.3%

|

47.01

|

34.45

|

Invest | |

|

12.1943

(12-09-2025)

|

12.1933

(11-09-2025)

|

0.01%

|

12.1943

|

11.3152

|

Invest | |

|

43.619

(12-09-2025)

|

43.6038

(11-09-2025)

|

0.03%

|

43.6391

|

40.5422

|

Invest | |

|

1344.9664

(12-09-2025)

|

1344.8256

(11-09-2025)

|

0.01%

|

1344.97

|

1252.38

|

Invest | |

|

343.7939

(12-09-2025)

|

343.7419

(11-09-2025)

|

0.02%

|

343.794

|

321.825

|

Invest | |

|

34.4657

(12-09-2025)

|

34.4625

(11-09-2025)

|

0.01%

|

34.4657

|

32.2866

|

Invest | |

|

18.5297

(12-09-2025)

|

18.5201

(11-09-2025)

|

0.05%

|

18.5297

|

17.4582

|

Invest | |

|

1344.6669

(12-09-2025)

|

1344.4774

(11-09-2025)

|

0.01%

|

1344.67

|

1268.2

|

Invest | |

|

11.54

(11-09-2025)

|

11.4

(10-09-2025)

|

1.23%

|

11.54

|

9.33

|

Invest | |

|

2632.5445

(12-09-2025)

|

2630.5155

(11-09-2025)

|

0.08%

|

2666.96

|

2498.61

|

Invest | |

|

49.5746

(12-09-2025)

|

49.5251

(11-09-2025)

|

0.1%

|

49.5746

|

47.0045

|

Invest | |

|

30.0522

(12-09-2025)

|

30.0392

(11-09-2025)

|

0.04%

|

30.7307

|

28.8108

|

Invest | |

|

131.68

(11-09-2025)

|

131.55

(10-09-2025)

|

0.1%

|

131.9

|

116.5

|

Invest | |

|

12.21

(12-09-2025)

|

12.17

(11-09-2025)

|

0.33%

|

12.33

|

10.2

|

Invest | |

|

12.62

(12-09-2025)

|

12.57

(11-09-2025)

|

0.4%

|

12.71

|

10.63

|

Invest | |

|

15.44

(12-09-2025)

|

15.4

(11-09-2025)

|

0.26%

|

15.61

|

13.73

|

Invest | |

|

66.16

(12-09-2025)

|

66.03

(11-09-2025)

|

0.2%

|

67.39

|

54.2

|

Invest | |

|

36.88

(12-09-2025)

|

36.75

(11-09-2025)

|

0.35%

|

37.82

|

31.1

|

Invest | |

|

35.13

(12-09-2025)

|

34.97

(11-09-2025)

|

0.46%

|

36.17

|

30.55

|

Invest |

PGIM India Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top PGIM India Mutual Fund

PGIM India Money Market Fund - Regular Plan - Growth Option

3Y Returns 7.13%

VS

PGIM India Money Market Fund - Regular Plan - Growth Option

3Y Returns 7.13%

VS

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.5%

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.5%

PGIM India Large Cap Fund - Growth

3Y Returns 11.84%

VS

PGIM India Large Cap Fund - Growth

3Y Returns 11.84%

VS

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

PGIM India Flexi Cap Fund - Regular Plan - Growth Option

3Y Returns 12.05%

VS

PGIM India Flexi Cap Fund - Regular Plan - Growth Option

3Y Returns 12.05%

VS

Quant Flexi Cap Fund-Growth

3Y Returns 15.26%

Quant Flexi Cap Fund-Growth

3Y Returns 15.26%

PGIM India Ultra Short Duration Fund - Growth

3Y Returns 6.6%

VS

PGIM India Ultra Short Duration Fund - Growth

3Y Returns 6.6%

VS

Nippon India Ultra Short Duration Fund- Growth Option

3Y Returns 6.85%

Nippon India Ultra Short Duration Fund- Growth Option

3Y Returns 6.85%

Investment Strategy

Extensive research is used to inform this Mutual Fund's house investing strategy, which carefully considers risk and return aspects. This approach is instrumental in constructing portfolios designed to provide investors with consistent and superior risk-adjusted returns over the long term.

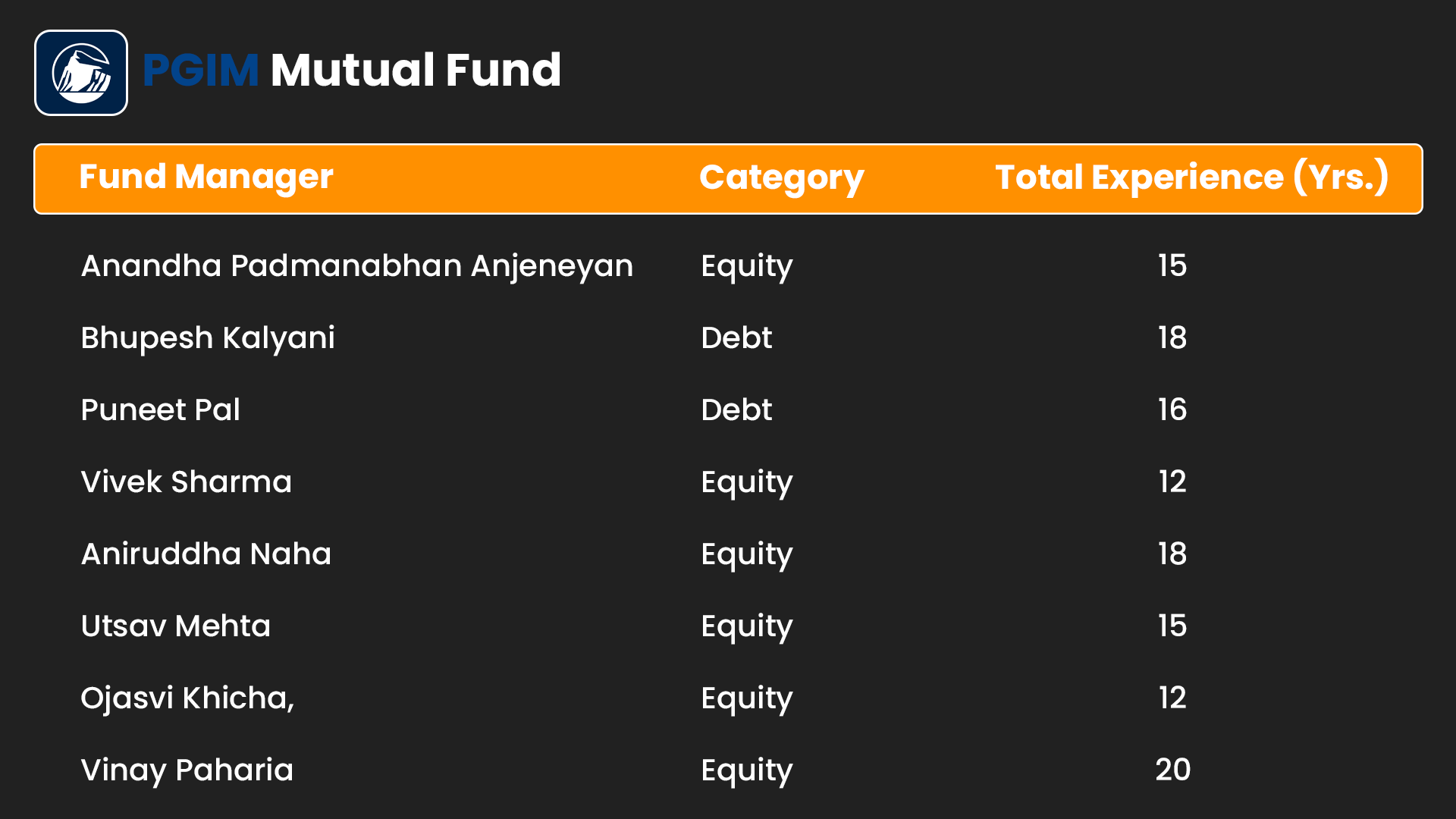

Key Management Team

Mr. Vinay Paharia (CIO both debt and equity)

PGIM India Mutual Fund has appointed Vinay Paharia as its new Chief Investment Officer (CIO), where he will oversee both the equity and fixed income divisions. With nearly two decades of experience in equity research and fund management, Vinay brings valuable expertise to his new role. Prior to joining this AMC, he served as the CIO for Union Mutual Fund.

List of all Fund Managers

Top 5 PGIM Mutual Funds

History of Pgim Mutual Fund

PGIM fund house harnesses the 140-year legacy of PGIM, leveraging its strength and stability to build upon a decade-long history in India. Constituted as a trust under the Indian Trusts Act, of 1882, this Mutual Fund has Prudential Financial, Inc. (PFI) as its sponsor and Pramerica Trustees Private Limited as the trustee. The Trust Deed is registered under the Indian Registration Act, 1908. Pramerica Mutual Fund obtained registration with the Securities and Exchange Board of India (SEBI) on May 13, 2010.

- This AMC offers a unique investing strategy, that sets it apart.

- The Fund House operates globally 1,300+ investment experts.

- PGIM MF offers a range of funds, giving the investors options.

- PGIM AMC India mutual funds elevate governance principles.

- This fund house consistently ranks among the top performers.

How to Select Pgim Mutual Fund?

Visit these steps to select the best PGIM AMC schemes:

- Set specific goals aligned with financial desires.

- Assess risk tolerance and adjust investment plan.

- Diversify portfolio across industries to lower risk.

- Research before investing to understand funds

- Regularly monitor assets' optimal performance.

- Seek professional guidance to manage market risks.

In summary, is important to choose wisely when investing in mutual funds and calculate the annualized returns with a SIP calculator for smart investing.

How to Invest in Pgim Mutual Fund via Mysiponline?

Investing in PGIM mutual fund through mysiponline is hassle-free with these simple steps:

- Visit mysiponline.com for choose PGIM mutual funds.

- Register for free account, complete profile, add funds.

- Verify KYC with PAN, Aadhar, Signature, and Bank proof.

- Explore, add funds to the cart, then make payment.

- Monitor investments through mysiponline.com account.

To sum up, invest easily in PGIM asset management company schemes using Online SIP for a smooth and efficient investing experience.

What is the Taxation on Pgim Mutual Fund?

The taxation of PGIM mutual funds depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs.1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in PGIM India Mutual Fund?

What are the different PGIM mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in PGIM Funds online tax-free?

How to analyse the performance of PGIM India Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Videos and Blogs of PGIM India Mutual Fund

Videos

Blogs

You can select three funds for compare.

You can select three funds for compare.