Tata Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 62

- Average annual returns 3.6%

About Tata Mutual Fund

Tata Mutual Fund is a subsidiary of Tata Asset Management Private Limited was established on March 15, 1994, This Asset Management Company (AMC) is under the leadership of Mr Prathit Bhobe, renowned for his expertise in the financial market. He has over 29 years of experience in investment management and provides a range of services to investors.

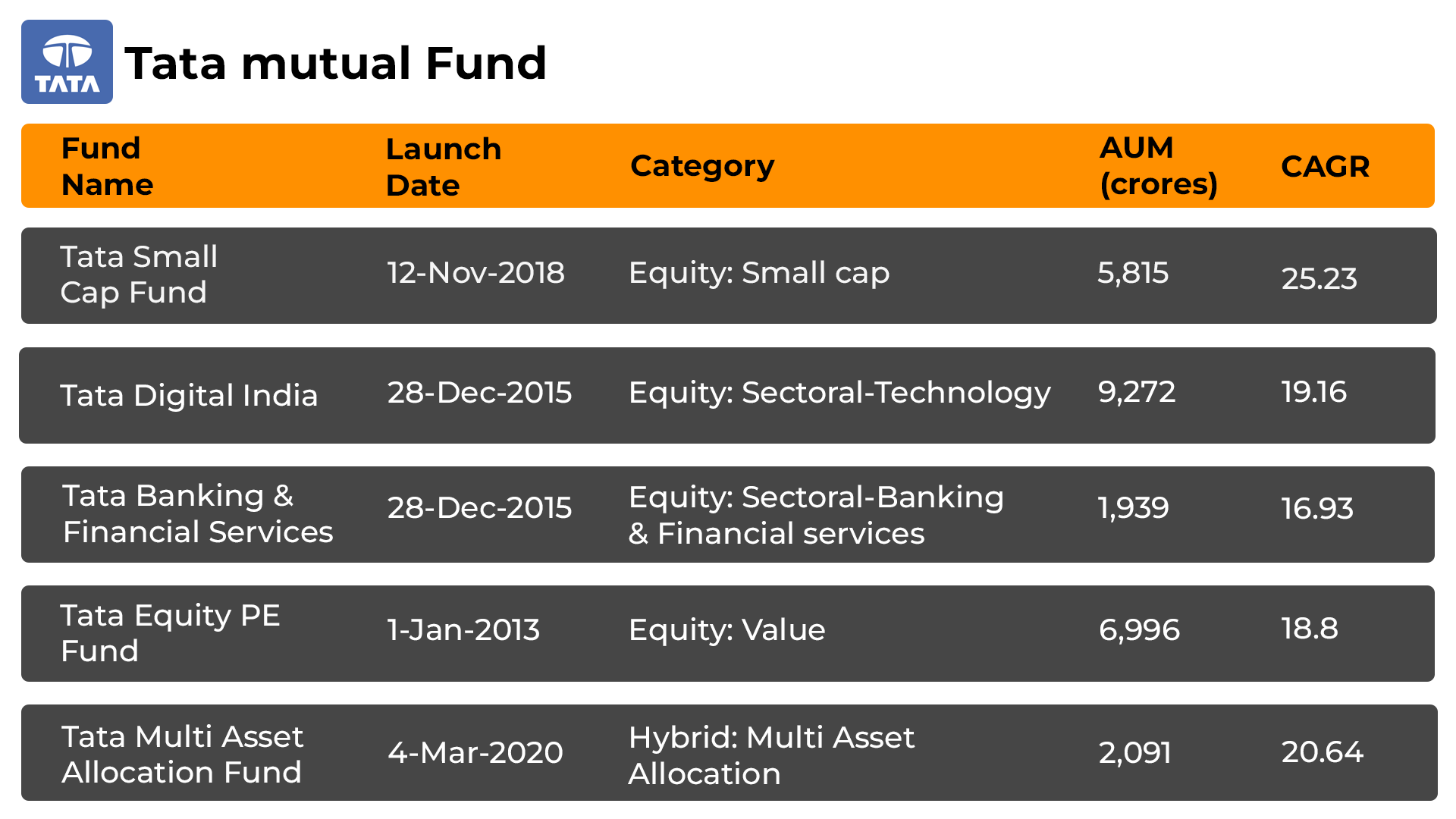

This AMC provides a broad selection of 153 products, including 58 equity schemes, 14 debt schemes, and 7 hybrid schemes. Tata Mutual Fund ranks 12th among the top mutual fund companies. Tata Small Cap Fund, the flagship scheme, has exhibited an impressive average annualized return of 25.87% since its inception.

-

Launched in

30-Jun-1995

-

AMC Age

30 Years

-

Website

https://www.tatamutualfund.com -

Email Address

service@tataamc.com

Top Performing Tata Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 327.64 | 1 years | 2.66% | 8.49% | 11.58% | 25.33% | 39.51% | 47.94% | - | - | - | - | Invest | |

| 169.50 | 1 years | 0.56% | 9.16% | 15.79% | 27.33% | 41.76% | 46.38% | - | - | - | - | Invest | |

| 140.15 | 1 years | 0.69% | 9.16% | 16.67% | 26.84% | 41.18% | 45.94% | - | - | - | - | Invest | |

| 81.02 | 1 years | 1.24% | -0.75% | -1.88% | 13.02% | 10.62% | 10.39% | - | - | - | - | Invest | |

| 161.56 | 2 years | 0.34% | 0.34% | 0.82% | 4.62% | 6.31% | 8.32% | 8.64% | - | - | - | Invest | |

| 41420.81 | 22 years | 0.09% | 0.44% | 1.5% | 4.1% | 6.76% | 7.81% | 7.69% | 7.48% | 6.11% | 6% | Invest | |

| 140.60 | 4 years | 0.07% | 0.07% | 0.74% | 4.21% | 5.26% | 7.74% | 7.45% | 7.15% | - | - | Invest | |

| 4219.80 | 3 years | 0.19% | 0.15% | 0.72% | 4.16% | 5.39% | 7.7% | 7.79% | 7.31% | - | - | Invest | |

| 2894.89 | 9 years | 1.44% | 0.27% | -2.98% | 15.64% | 15.93% | 7.56% | 13.01% | 16.4% | 20.21% | - | Invest | |

| 3429.61 | 20 years | 0.1% | 0.35% | 1.3% | 3.95% | 7.14% | 7.55% | 7.34% | 7.04% | 5.8% | 6.2% | Invest | |

| 93.10 | 2 years | 0.08% | 0.32% | 1.03% | 3.93% | 5.36% | 7.4% | 7.64% | - | - | - | Invest | |

| 3440.88 | 23 years | 0.12% | 0.09% | 0.73% | 3.78% | 5.18% | 7.28% | 7.26% | 6.81% | 5.44% | 6.02% | Invest | |

| 902.45 | 2 years | 0.11% | 0.41% | 1.27% | 3.59% | 4.98% | 7.04% | 7.34% | - | - | - | Invest | |

| 4907.76 | 6 years | 0.09% | 0.42% | 1.4% | 3.52% | 4.75% | 6.98% | 6.87% | 6.63% | 5.32% | - | Invest | |

| 24038.47 | 21 years | 0.1% | 0.47% | 1.41% | 3.3% | 4.64% | 6.9% | 7.09% | 6.95% | 5.57% | 6.18% | Invest | |

| 17291.12 | 6 years | -0.01% | 0.36% | 1.39% | 3.24% | 4.46% | 6.52% | 7.04% | 6.94% | 5.61% | - | Invest | |

| 4013.58 | 5 years | 0.99% | 2.1% | 1.67% | 12.89% | 6.88% | 6.16% | 14.18% | 14.1% | 16.93% | - | Invest | |

| 3779.14 | 6 years | 0.1% | 0.44% | 1.32% | 2.82% | 4.04% | 6.08% | 6.38% | 6.35% | 5.16% | - | Invest | |

| 267.80 | 22 years | 0.18% | 0.63% | 0.89% | 5.24% | 4.33% | 5.61% | 10.25% | 9.62% | 10% | 7.62% | Invest | |

| 161.04 | 1 years | 1.69% | 2.28% | 5.47% | 17.62% | 0.85% | 5.47% | - | - | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 327.64 | High |

10.36%

|

46.9%

|

-

|

-

|

-

|

-

|

39.09%

|

Invest | |

| 169.50 | Very High |

20.52%

|

57.54%

|

-

|

-

|

-

|

-

|

42.26%

|

Invest | |

| 140.15 | Very High |

20.43%

|

56.42%

|

-

|

-

|

-

|

-

|

42.02%

|

Invest | |

| 81.02 | Very High |

0.08%

|

10.08%

|

-

|

-

|

-

|

-

|

10.96%

|

Invest | |

| 161.56 | Moderate |

0.95%

|

7.58%

|

8.48%

|

-

|

-

|

-

|

8.33%

|

Invest | |

| 41420.81 | Low to Moderate |

1.59%

|

7.57%

|

7.71%

|

7.67%

|

6.98%

|

6.13%

|

26.2%

|

Invest | |

| 140.60 | Moderate |

0.95%

|

6.8%

|

7.52%

|

7.46%

|

-

|

-

|

7.09%

|

Invest | |

| 4219.80 | Moderate |

0.79%

|

6.65%

|

7.68%

|

7.64%

|

-

|

-

|

7.26%

|

Invest | |

| 2894.89 | Very High |

0.4%

|

9.28%

|

11.53%

|

14.25%

|

14.95%

|

-

|

14.45%

|

Invest | |

| 3429.61 | Low to Moderate |

1.45%

|

7.19%

|

7.42%

|

7.33%

|

6.58%

|

6.02%

|

38.94%

|

Invest | |

| 93.10 | Low to Moderate |

1.39%

|

7.17%

|

7.55%

|

-

|

-

|

-

|

7.46%

|

Invest | |

| 3440.88 | Moderate |

0.88%

|

6.51%

|

7.23%

|

7.16%

|

6.27%

|

5.9%

|

6.89%

|

Invest | |

| 902.45 | Low to Moderate |

1.41%

|

6.75%

|

7.15%

|

-

|

-

|

-

|

7.15%

|

Invest | |

| 4907.76 | Moderate |

1.45%

|

6.69%

|

6.87%

|

6.83%

|

6.17%

|

-

|

5.79%

|

Invest | |

| 24038.47 | Low to Moderate |

1.46%

|

6.54%

|

6.9%

|

6.99%

|

6.44%

|

5.97%

|

38.54%

|

Invest | |

| 17291.12 | Low |

1.39%

|

6.34%

|

6.76%

|

6.96%

|

6.37%

|

-

|

5.99%

|

Invest | |

| 4013.58 | Average |

3.94%

|

11.1%

|

11.1%

|

13.52%

|

13.7%

|

-

|

14.76%

|

Invest | |

| 3779.14 | Low |

1.33%

|

5.76%

|

6.13%

|

6.28%

|

5.88%

|

-

|

5.49%

|

Invest | |

| 267.80 | Low to Moderate |

1.53%

|

6.34%

|

8.13%

|

9.54%

|

9.07%

|

8.35%

|

7.58%

|

Invest | |

| 161.04 | Very High |

5.98%

|

10.85%

|

-

|

-

|

-

|

-

|

13.56%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

0.58%

|

2.96%

|

1.28%

|

0.69%

|

Invest | |

| Moderate |

1.00%

|

-

|

4.89%

|

0.38%

|

Invest | |

| Moderate |

1.27%

|

-

|

1.38%

|

0.41%

|

Invest | |

| Very High |

15.02%

|

3.08%

|

0.94%

|

0.79%

|

Invest | |

| Low to Moderate |

0.62%

|

2.57%

|

1.33%

|

-

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

1.13%

|

-

|

1.28%

|

0.06%

|

Invest | |

| Low to Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

0.27%

|

-

|

2.89%

|

-

|

Invest | |

| Low to Moderate |

0.18%

|

-

|

1.50%

|

1.76%

|

Invest | |

| Low |

0.38%

|

-

|

-

|

0.59%

|

Invest | |

| Average |

7.86%

|

-

|

-

|

0.86%

|

Invest | |

| Low |

0.13%

|

-

|

0.04%

|

-

|

Invest | |

| Low to Moderate |

3.69%

|

-

|

-

|

0.72%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹150

|

₹5000

|

0.7%

|

Tapan Patel

|

19-Jan 2024

|

Invest | |

|

₹150

|

₹5000

|

0.61%

|

Tapan Patel

|

19-Jan 2024

|

Invest | |

|

₹0

|

₹100

|

0.47%

|

Tapan Patel

|

09-Jan 2024

|

Invest | |

|

₹100

|

₹5000

|

1.04%

|

Kapil Menon

|

22-Apr 2024

|

Invest | |

|

₹500

|

₹5000

|

0.46%

|

Amit Somani

|

18-Jan 2023

|

Invest | |

|

₹500

|

₹5000

|

0.42%

|

Amit Somani

|

23-May 2003

|

Invest | |

|

₹500

|

₹5000

|

0.73%

|

Akhil Mittal

|

07-Jul 2021

|

Invest | |

|

₹500

|

₹5000

|

0.86%

|

Abhishek Sonthalia

|

01-Dec 2021

|

Invest | |

|

₹100

|

₹5000

|

1.94%

|

Amey Sathe

|

28-Dec 2015

|

Invest | |

|

₹500

|

₹5000

|

0.58%

|

Akhil Mittal

|

06-Sep 2005

|

Invest | |

|

₹500

|

₹5000

|

0.45%

|

Amit Somani

|

16-Jan 2023

|

Invest | |

|

₹500

|

₹5000

|

1.19%

|

Murthy Nagarajan

|

09-Aug 2002

|

Invest | |

|

₹500

|

₹5000

|

0.36%

|

Amit Somani

|

30-Sep 2022

|

Invest | |

|

₹500

|

₹5000

|

1.15%

|

Akhil Mittal

|

22-Jan 2019

|

Invest | |

|

₹500

|

₹5000

|

0.32%

|

Amit Somani

|

01-Sep 2004

|

Invest | |

|

₹150

|

₹5000

|

1.08%

|

Sailesh Jain

|

18-Dec 2018

|

Invest | |

|

₹100

|

₹5000

|

1.87%

|

Murthy Nagarajan

|

04-Mar 2020

|

Invest | |

|

₹500

|

₹5000

|

0.18%

|

Amit Somani

|

26-Mar 2019

|

Invest | |

|

₹100

|

₹5000

|

1.13%

|

Murthy Nagarajan

|

18-Aug 2003

|

Invest | |

|

₹100

|

₹5000

|

1.11%

|

Kapil Menon

|

22-Apr 2024

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

16.9039

(12-09-2025)

|

16.7817

(11-09-2025)

|

0.73%

|

16.9039

|

11.4371

|

Invest | |

|

17.2300

(12-09-2025)

|

16.7241

(11-09-2025)

|

3.02%

|

17.23

|

11.6914

|

Invest | |

|

12.4074

(12-09-2025)

|

12.0679

(11-09-2025)

|

2.81%

|

12.4074

|

8.4389

|

Invest | |

|

12.2681

(12-09-2025)

|

12.1826

(11-09-2025)

|

0.7%

|

12.7125

|

10.4242

|

Invest | |

|

12.3304

(12-09-2025)

|

12.3302

(11-09-2025)

|

0%

|

12.3393

|

11.4086

|

Invest | |

|

4789.1065

(12-09-2025)

|

4788.7783

(11-09-2025)

|

0.01%

|

4789.11

|

4446.06

|

Invest | |

|

12.8820

(12-09-2025)

|

12.8766

(11-09-2025)

|

0.04%

|

12.8873

|

11.9708

|

Invest | |

|

12.4904

(12-09-2025)

|

12.4909

(11-09-2025)

|

-0%

|

12.5054

|

11.626

|

Invest | |

|

42.3946

(12-09-2025)

|

42.2031

(11-09-2025)

|

0.45%

|

44.5937

|

36.2821

|

Invest | |

|

3980.2721

(12-09-2025)

|

3979.8680

(11-09-2025)

|

0.01%

|

3980.27

|

3704.15

|

Invest | |

|

12.0573

(12-09-2025)

|

12.0553

(11-09-2025)

|

0.02%

|

12.0573

|

11.2443

|

Invest | |

|

48.3218

(12-09-2025)

|

48.3156

(11-09-2025)

|

0.01%

|

48.3433

|

45.1302

|

Invest | |

|

12.2872

(12-09-2025)

|

12.2855

(11-09-2025)

|

0.01%

|

12.2872

|

11.4962

|

Invest | |

|

14.3392

(12-09-2025)

|

14.3382

(11-09-2025)

|

0.01%

|

14.3392

|

13.4147

|

Invest | |

|

4159.3228

(12-09-2025)

|

4158.7574

(11-09-2025)

|

0.01%

|

4159.32

|

3892.46

|

Invest | |

|

14.5218

(12-09-2025)

|

14.5153

(11-09-2025)

|

0.04%

|

14.5218

|

13.6237

|

Invest | |

|

23.8426

(11-09-2025)

|

23.7932

(10-09-2025)

|

0.21%

|

23.8426

|

20.7951

|

Invest | |

|

1371.5507

(12-09-2025)

|

1371.3543

(11-09-2025)

|

0.01%

|

1371.55

|

1293.36

|

Invest | |

|

55.4011

(11-09-2025)

|

55.3563

(10-09-2025)

|

0.08%

|

55.4011

|

52.378

|

Invest | |

|

13.1833

(12-09-2025)

|

13.1333

(11-09-2025)

|

0.38%

|

13.396

|

10.8631

|

Invest |

Tata Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Tata Mutual Fund

Tata Focused Fund-Regular Plan-Growth

3Y Returns 15.07%

VS

Tata Focused Fund-Regular Plan-Growth

3Y Returns 15.07%

VS

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.73%

HDFC Focused Fund - GROWTH PLAN

3Y Returns 21.73%

Tata Silver Exchange Traded Fund

3Y Returns 0%

VS

Tata Silver Exchange Traded Fund

3Y Returns 0%

VS

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 27.74%

Kotak US Specific Equity Passive FOF - Regular Plan - Growth

3Y Returns 27.74%

Tata Flexi Cap Fund -Regular Plan-Growth

3Y Returns 14.96%

VS

Tata Flexi Cap Fund -Regular Plan-Growth

3Y Returns 14.96%

VS

Quant Flexi Cap Fund-Growth

3Y Returns 15.4%

Quant Flexi Cap Fund-Growth

3Y Returns 15.4%

Tata Dividend Yield Fund-Regular Plan-Growth

3Y Returns 16.19%

VS

Tata Dividend Yield Fund-Regular Plan-Growth

3Y Returns 16.19%

VS

ICICI Prudential Dividend Yield Equity Fund Growth Option

3Y Returns 22.9%

ICICI Prudential Dividend Yield Equity Fund Growth Option

3Y Returns 22.9%

Investing Strategy

Tata Mutual Funds core strategy is to invest in companies that show significant growth potential at reasonable valuations. However, each fund may have a unique strategy and management style. The AMC specializes in bottom-up analysis, thoroughly evaluating companies based on factors like business growth, management governance, and valuations. Their approach focuses on compounding money, and they typically adopt a buy-and-hold approach with active tracking and management.

Head of Equity Team (CIO)

Mr. Rahul Singh (CIO of Equity)

Mr. Rahul Singh is the Chief Investment Officer (CIO) and has over 27 years of excellent experience in the industry. When he first joined the company in October 2018, he was given the position of CIO-Equities. In his current role, Mr Singh sets the standard by expertly and assiduously managing the teams responsible for fund management and stock research.

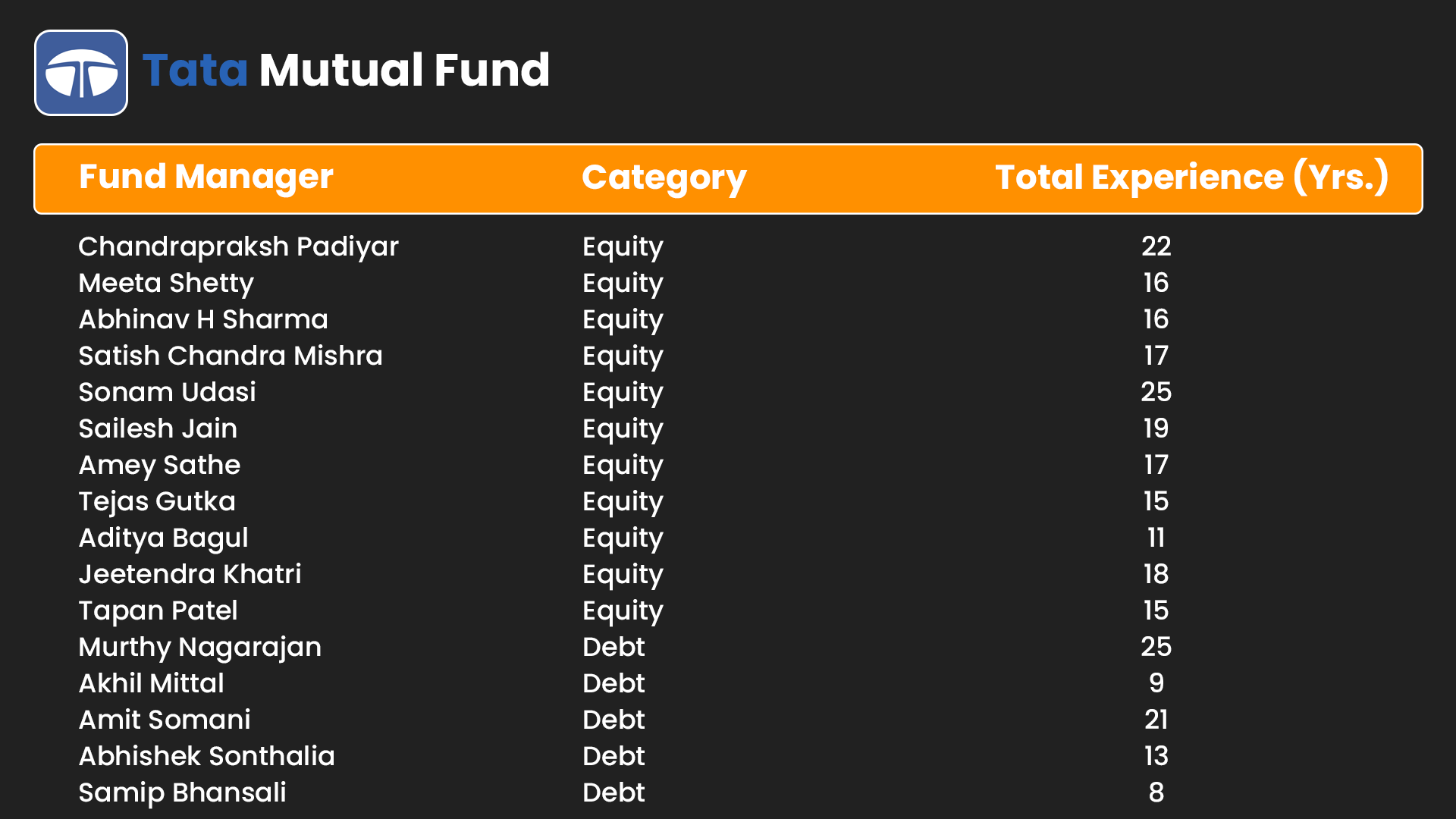

List of Fund Managers

Best Tata Mutual Fund For SIP In 2025

History of Tata Mutual Fund

Tata Mutual Fund was created through a Trust Deed dated May 9, 1995, following the regulations set out in The Indian Trusts Act, of 1882. Mutual Fund is officially registered with SEBI (Securities and Exchange Board of India). Significantly, philanthropic trusts own nearly two-thirds of the equity in Tata Sons, the main company of the Tata Group. These charitable trusts have played a crucial role in establishing national institutions focused on natural sciences, healthcare, energy, and the arts.

- Fund Management Team: Tata Mutual Fund has a large fund management team.

- Branch Network: With over 64+ branches, Tata has a widespread presence across the globe.

- Variety of Schemes: Tata Mutual Fund offers a diverse portfolio of 153 schemes.

- Prudent Philosophy: The fund's philosophy centres on achieving consistent and long-term results.

- Strong Governance: Emphasis on strong governance practices. It helps in running operations smoothly.

- Best Fundamental Research: Known for conducting best-in-class fundamental research.

- Digital Platforms: Utilizes digital platforms for enhanced accessibility and services.

How to Select the Best Tata Mutual Funds?

Starting your investment journey by choosing the Best Tata Mutual Funds is a crucial first step, and making an informed decision is essential. Here are some aspects you should consider to do it properly:

- Establish attainable investment targets that align with your goals.

- Determine your risk tolerance based on personal preferences.

- To lower risk, diversify your investments across several industries.

- Examine the fund’s history, performance and consistency.

- Regularly check investments for safety and make any adjustments.

- To effectively handle market turmoil, seek professional advice.

In summary, the above-mentioned elements will aid in your comprehension of the process involved in choosing the appropriate fund. Make sure you complete a precise assessment before you embark on your investing journey. You can also use the SIP Calculator to obtain an estimate of your investment.

How to Invest in Tata Mutual Funds via MySIPonline?

Investing in Tata Mutual Funds is made easy with MySIPonline, known for its straightforward approach. Here's a simple guide:

- Step 1: Log in to MySIPonline.

- Step 2: Check your KYC and if it is not registered do Video KYC.

- Step 3: Complete profile (PAN, aadhar, bank details, nominee, signature)

- Step 4: Explore top funds from Respective AMC Name or Talk to an expert.

- Step 5: Select your preferred Fund.

- Step 6: Add funds to the cart and choose your investment option.

- Step 7: Make a payment from UPI or net banking.

- Step 8: Track investment daily at a dashboard and use our analysis.

Our website offers all the services you need in one convenient location, making it quick and easy to start investing right immediately. By using our website, you can invest in Online SIP and develop a strong portfolio for yourself.

What is the Taxation on Tata Mutual Fund?

The taxation of Tata Mutual Funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding RS 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Explore Other AMC’s

Top Blogs of Tata Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.