WhiteOak Capital Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 20

- Average annual returns 3.43%

About WhiteOak Capital Mutual Fund

White Oak Capital Mutual Fund is a part of white oak asset management company. It was started by Mr. Prashant Khemka in June 2017, known for managing foreign institution money in the Indian market. The rich institutional experience helped it to start mutual funds for domestic retail investors. As of holds the 28th rank in the AUM size. Whiteoak manages 13 mutual funds including 8 equity mutual funds, 2 debt funds, and 3 hybrid funds

The white oak Fund house has investment research teams located in India, Singapore, and Spain, along with sales and distribution offices in Switzerland, the UAE, and the UK. The India AMC team consists of experienced professionals in Financial Services, headed by Mr. Aashish P. Somaiyaa, CEO, who brings over 20 years of experience in the asset management industry.

More-

Launched in

03-Jul-2018

-

AMC Age

7 Years

-

Website

https://mf.whiteoakamc.com -

Email Address

customerservice@whiteoakamc.com

Top Performing WhiteOak Capital Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 3421.65 | 2 years | 0.71% | 2.05% | 3.36% | 11.35% | 11.29% | 14.97% | 17.51% | - | - | - | Invest | |

| 468.18 | 1 years | 1.22% | 0.61% | 0.73% | 16.77% | 8.59% | 9.05% | - | - | - | - | Invest | |

| 423.51 | 1 years | 0.9% | 2.01% | 5.35% | 16.28% | 2.2% | 8.3% | - | - | - | - | Invest | |

| 555.21 | 6 years | 0.07% | 0.39% | 1.34% | 3.43% | 4.66% | 6.8% | 6.74% | 6.53% | 5.32% | - | Invest | |

| 577.86 | 6 years | 0.1% | 0.46% | 1.39% | 3.22% | 4.57% | 6.77% | 6.99% | 6.84% | 5.38% | - | Invest | |

| 586.17 | 1 years | 0.11% | 0.39% | 1.36% | 3.21% | 4.64% | 6.54% | - | - | - | - | Invest | |

| 1132.28 | 1 years | 1.08% | 2.1% | 2.4% | 18.92% | 3.53% | 5.09% | - | - | - | - | Invest | |

| 1811.88 | 2 years | 0.78% | 1.66% | 2.14% | 10.94% | 4.74% | 4.97% | 14.18% | - | - | - | Invest | |

| 2261.56 | 1 years | 1.19% | 2.62% | 3.23% | 18.86% | 2.99% | 4.35% | - | - | - | - | Invest | |

| 215.12 | 1 years | 0.71% | 2.11% | 2.57% | 10.47% | 4.23% | 3.51% | - | - | - | - | Invest | |

| 3581.58 | 3 years | 1.49% | 3.09% | 3.36% | 21.45% | 1.19% | 3.35% | 24.46% | 24.08% | - | - | Invest | |

| 406.58 | 2 years | 1.04% | 2.49% | 2% | 15.68% | 1.26% | 2.75% | 21.2% | - | - | - | Invest | |

| 5743.69 | 3 years | 1.14% | 2.6% | 2.24% | 15.86% | 2.05% | 1.87% | 18.72% | 18.33% | - | - | Invest | |

| 1781.23 | 1 years | 1.51% | 2.77% | 2.55% | 17.78% | 2.82% | 1.81% | - | - | - | - | Invest | |

| 1014.17 | 2 years | 1.25% | 2.57% | 2.17% | 14.26% | 4.22% | 0.89% | 18.21% | - | - | - | Invest | |

| 594.70 | 7 months | 0.33% | 2.53% | 1.44% | 11.01% | - | - | - | - | - | - | Invest | |

| 364.30 | 11 months | 1.45% | 3.51% | 2.42% | 21.43% | -2.62% | - | - | - | - | - | Invest | |

| 67.86 | 10 months | 1.05% | 2.55% | 1.75% | 14.54% | 3.76% | - | - | - | - | - | Invest | |

| 67.86 | 10 months | 1.05% | 2.55% | 1.75% | 14.54% | 3.76% | - | - | - | - | - | Invest | |

| 136.90 | 6 months | 0.52% | 1.07% | 3.93% | - | - | - | - | - | - | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Sep-2025 | Aug-2025 | Jul-2025 | Jun-2025 | May-2025 | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 |

|---|

| Fund Name | 2025-Q3 | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 3421.65 | High |

4.21%

|

17.11%

|

17.15%

|

-

|

-

|

-

|

17.19%

|

Invest | |

| 468.18 | Very High |

2.59%

|

17.06%

|

-

|

-

|

-

|

-

|

16.12%

|

Invest | |

| 423.51 | Very High |

6.09%

|

16.91%

|

-

|

-

|

-

|

-

|

21.66%

|

Invest | |

| 555.21 | Low to Moderate |

1.39%

|

6.45%

|

6.68%

|

6.67%

|

6.07%

|

-

|

5.72%

|

Invest | |

| 577.86 | Low to Moderate |

1.41%

|

6.35%

|

6.76%

|

6.86%

|

6.29%

|

-

|

5.8%

|

Invest | |

| 586.17 | Low |

1.39%

|

6.34%

|

-

|

-

|

-

|

-

|

6.36%

|

Invest | |

| 1132.28 | Very High |

5.04%

|

17.03%

|

-

|

-

|

-

|

-

|

14.33%

|

Invest | |

| 1811.88 | Very High |

2.91%

|

10.82%

|

11.89%

|

-

|

-

|

-

|

13.54%

|

Invest | |

| 2261.56 | Very High |

5.72%

|

16.25%

|

-

|

-

|

-

|

-

|

17.19%

|

Invest | |

| 215.12 | Very High |

3.28%

|

10.41%

|

-

|

-

|

-

|

-

|

10.56%

|

Invest | |

| 3581.58 | Very High |

6.69%

|

17.73%

|

18.11%

|

24.37%

|

-

|

-

|

24.35%

|

Invest | |

| 406.58 | Very High |

4.11%

|

11.99%

|

15.32%

|

-

|

-

|

-

|

20.17%

|

Invest | |

| 5743.69 | Very High |

4.31%

|

12.5%

|

14.04%

|

18.61%

|

-

|

-

|

18.59%

|

Invest | |

| 1781.23 | Very High |

5.01%

|

14.57%

|

-

|

-

|

-

|

-

|

12.99%

|

Invest | |

| 1014.17 | Very High |

3.84%

|

11.83%

|

13.23%

|

-

|

-

|

-

|

16.71%

|

Invest | |

| 594.70 | Very High |

3.15%

|

-

|

-

|

-

|

-

|

-

|

15.19%

|

Invest | |

| 364.30 | Very High |

7.06%

|

-

|

-

|

-

|

-

|

-

|

15.83%

|

Invest | |

| 67.86 | Very High |

3.7%

|

-

|

-

|

-

|

-

|

-

|

13.92%

|

Invest | |

| 67.86 | Very High |

3.7%

|

-

|

-

|

-

|

-

|

-

|

13.92%

|

Invest | |

| 136.90 | Moderately High |

3.95%

|

-

|

-

|

-

|

-

|

-

|

16.34%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

0.27%

|

-

|

2.86%

|

-

|

Invest | |

| Low to Moderate |

0.19%

|

-

|

1.51%

|

0.82%

|

Invest | |

| Low |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

12.50%

|

3.94%

|

0.89%

|

0.88%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderately High |

-

|

-

|

-

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹500

|

1.88%

|

Piyush Baranwal

|

19-May 2023

|

Invest | |

|

₹100

|

₹500

|

2.39%

|

Piyush Baranwal

|

06-Feb 2024

|

Invest | |

|

₹100

|

₹500

|

2.39%

|

Piyush Baranwal

|

06-Feb 2024

|

Invest | |

|

₹500

|

₹500

|

1.03%

|

Piyush Baranwal

|

06-Jun 2019

|

Invest | |

|

₹500

|

₹500

|

0.29%

|

Piyush Baranwal

|

16-Jan 2019

|

Invest | |

|

₹100

|

₹500

|

1.14%

|

Ramesh Mantri

|

09-Sep 2024

|

Invest | |

|

₹100

|

₹500

|

2.29%

|

Piyush Baranwal

|

04-Jun 2024

|

Invest | |

|

₹100

|

₹500

|

2.09%

|

Piyush Baranwal

|

10-Feb 2023

|

Invest | |

|

₹100

|

₹500

|

2.06%

|

Piyush Baranwal

|

22-Sep 2023

|

Invest | |

|

₹100

|

₹500

|

2.14%

|

Piyush Baranwal

|

27-Oct 2023

|

Invest | |

|

₹100

|

₹500

|

1.91%

|

Piyush Baranwal

|

07-Sep 2022

|

Invest | |

|

₹500

|

₹500

|

2.34%

|

Piyush Baranwal

|

14-Oct 2022

|

Invest | |

|

₹100

|

₹500

|

1.84%

|

Piyush Baranwal

|

02-Aug 2022

|

Invest | |

|

₹100

|

₹500

|

2.04%

|

Piyush Baranwal

|

22-Dec 2023

|

Invest | |

|

₹100

|

₹500

|

2.31%

|

Piyush Baranwal

|

01-Dec 2022

|

Invest | |

|

₹500

|

₹500

|

-

|

Ramesh Mantri

|

30-Jan 2025

|

Invest | |

|

₹500

|

₹500

|

2.37%

|

Ramesh Mantri

|

14-Oct 2024

|

Invest | |

|

₹500

|

₹500

|

2.36%

|

Ramesh Mantri

|

31-Oct 2024

|

Invest | |

|

₹500

|

₹500

|

2.36%

|

Ramesh Mantri

|

31-Oct 2024

|

Invest | |

|

₹500

|

₹500

|

-

|

Ramesh Mantri

|

13-Mar 2025

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

14.481

(11-09-2025)

|

14.478

(10-09-2025)

|

0.02%

|

14.481

|

12.688

|

Invest | |

|

12.466

(12-09-2025)

|

12.416

(11-09-2025)

|

0.4%

|

12.752

|

10.508

|

Invest | |

|

14.088

(12-09-2025)

|

14.074

(11-09-2025)

|

0.1%

|

14.29

|

11.715

|

Invest | |

|

1377.1556

(12-09-2025)

|

1377.1130

(11-09-2025)

|

0%

|

1377.16

|

1290.47

|

Invest | |

|

1420.1177

(12-09-2025)

|

1419.9118

(11-09-2025)

|

0.01%

|

1420.12

|

1331.08

|

Invest | |

|

10.671

(12-09-2025)

|

10.670

(11-09-2025)

|

0.01%

|

10.671

|

10.02

|

Invest | |

|

12.960

(12-09-2025)

|

12.952

(11-09-2025)

|

0.06%

|

13.171

|

10.664

|

Invest | |

|

14.415

(12-09-2025)

|

14.390

(11-09-2025)

|

0.17%

|

14.474

|

12.847

|

Invest | |

|

15.179

(12-09-2025)

|

15.166

(11-09-2025)

|

0.09%

|

15.25

|

12.542

|

Invest | |

|

12.993

(12-09-2025)

|

12.977

(11-09-2025)

|

0.12%

|

12.993

|

11.641

|

Invest | |

|

19.458

(12-09-2025)

|

19.439

(11-09-2025)

|

0.1%

|

19.571

|

15.719

|

Invest | |

|

17.540

(12-09-2025)

|

17.515

(11-09-2025)

|

0.14%

|

17.846

|

14.873

|

Invest | |

|

17.415

(12-09-2025)

|

17.389

(11-09-2025)

|

0.15%

|

17.611

|

14.774

|

Invest | |

|

13.185

(12-09-2025)

|

13.148

(11-09-2025)

|

0.28%

|

13.269

|

11.043

|

Invest | |

|

14.932

(12-09-2025)

|

14.885

(11-09-2025)

|

0.32%

|

15.26

|

12.842

|

Invest | |

|

10.583

(12-09-2025)

|

10.601

(11-09-2025)

|

-0.17%

|

10.744

|

9.367

|

Invest | |

|

10.464

(12-09-2025)

|

10.509

(11-09-2025)

|

-0.43%

|

10.926

|

8.317

|

Invest | |

|

10.551

(12-09-2025)

|

10.525

(11-09-2025)

|

0.25%

|

10.707

|

9.084

|

Invest | |

|

10.551

(12-09-2025)

|

10.525

(11-09-2025)

|

0.25%

|

10.707

|

9.084

|

Invest | |

|

10.919

(12-09-2025)

|

10.905

(11-09-2025)

|

0.13%

|

10.919

|

9.993

|

Invest |

WhiteOak Capital Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top WhiteOak Capital Mutual Fund

WhiteOak Capital Special Opportunities Fund-Reg (G)

3Y Returns 0%

VS

WhiteOak Capital Special Opportunities Fund-Reg (G)

3Y Returns 0%

VS

AXIS Nifty Bank Index Fund - Regular (G)

3Y Returns 0%

AXIS Nifty Bank Index Fund - Regular (G)

3Y Returns 0%

WhiteOak Capital Flexi Cap Fund Regular Plan Growth

3Y Returns 18.33%

VS

WhiteOak Capital Flexi Cap Fund Regular Plan Growth

3Y Returns 18.33%

VS

Quant Flexi Cap Fund-Growth

3Y Returns 15.26%

Quant Flexi Cap Fund-Growth

3Y Returns 15.26%

WhiteOak Capital Balanced Advantage Fund Regular Plan Growth

3Y Returns 0%

VS

WhiteOak Capital Balanced Advantage Fund Regular Plan Growth

3Y Returns 0%

VS

HDFC Balanced Advantage Fund Regular Growth

3Y Returns 18.15%

HDFC Balanced Advantage Fund Regular Growth

3Y Returns 18.15%

WOC LARGE AND MID CAP FUND REGULAR PLAN GROWTH

3Y Returns 0%

VS

WOC LARGE AND MID CAP FUND REGULAR PLAN GROWTH

3Y Returns 0%

VS

Quant Large and Mid Cap Fund-Growth

3Y Returns 15.3%

Quant Large and Mid Cap Fund-Growth

3Y Returns 15.3%

Investment Strategy

The investment strategy is centered on obtaining higher returns on extra capital, capitalizing on scalable long-term possibilities, and prioritizing good execution and governance processes. The white oak group valuation framework is built around the idea that an asset's intrinsic value is determined by the present value of its future cash flows. This strategy ensures that investment ideas are thoroughly evaluated in terms of their ability to create long-term cash flows

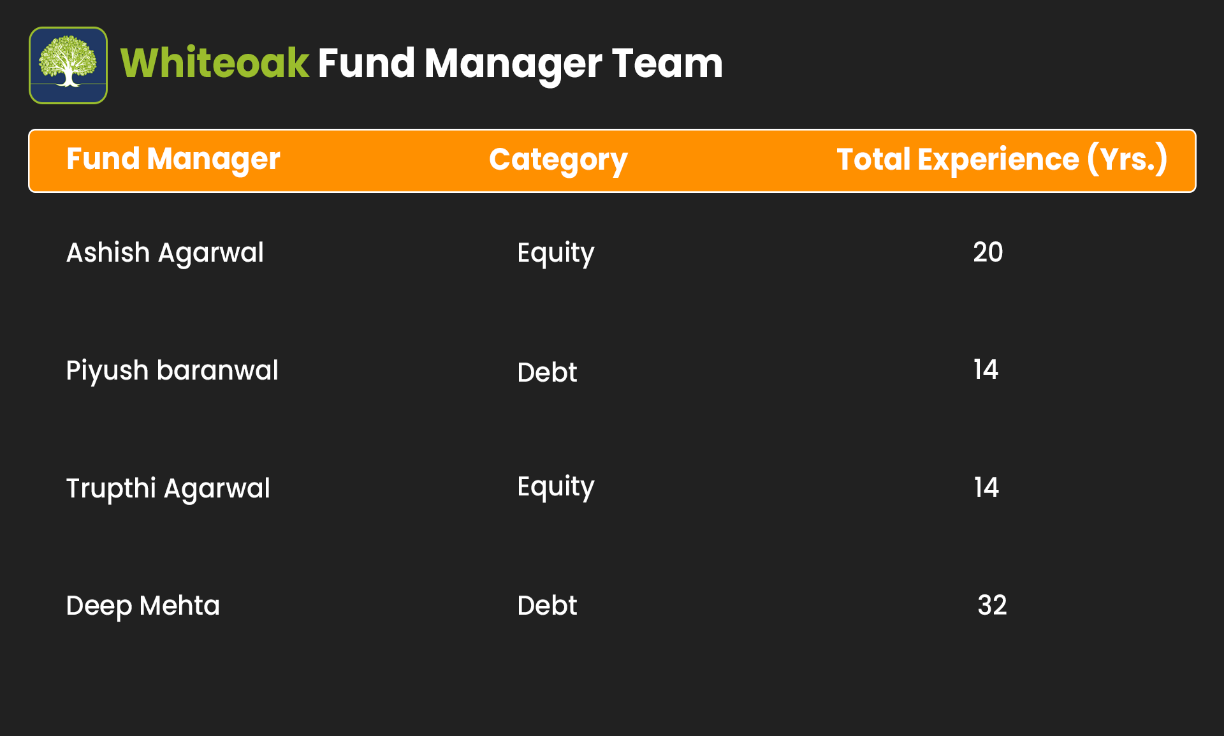

Fund Management Team

Mr. Ramesh Mantri (CIO)

Ramesh Mantri, the Chief Investment Officer (CIO) at Whiteoak Capital Asset Management, highlighted the significance of portfolio construction in achieving consistent outperformance for a fund. Mr. Mantri is an MBA, CFA, and CA. Before joining White Oak Capital Mutual Fund, he accumulated experience working with White Oak Capital Management, Ashoka Capital Advisers, Smith Management, and CRISIL.

List of all Fund Managers

Top 5 White Oak Capital Mutual Funds

History of Whiteoak Capital Mutual Fund

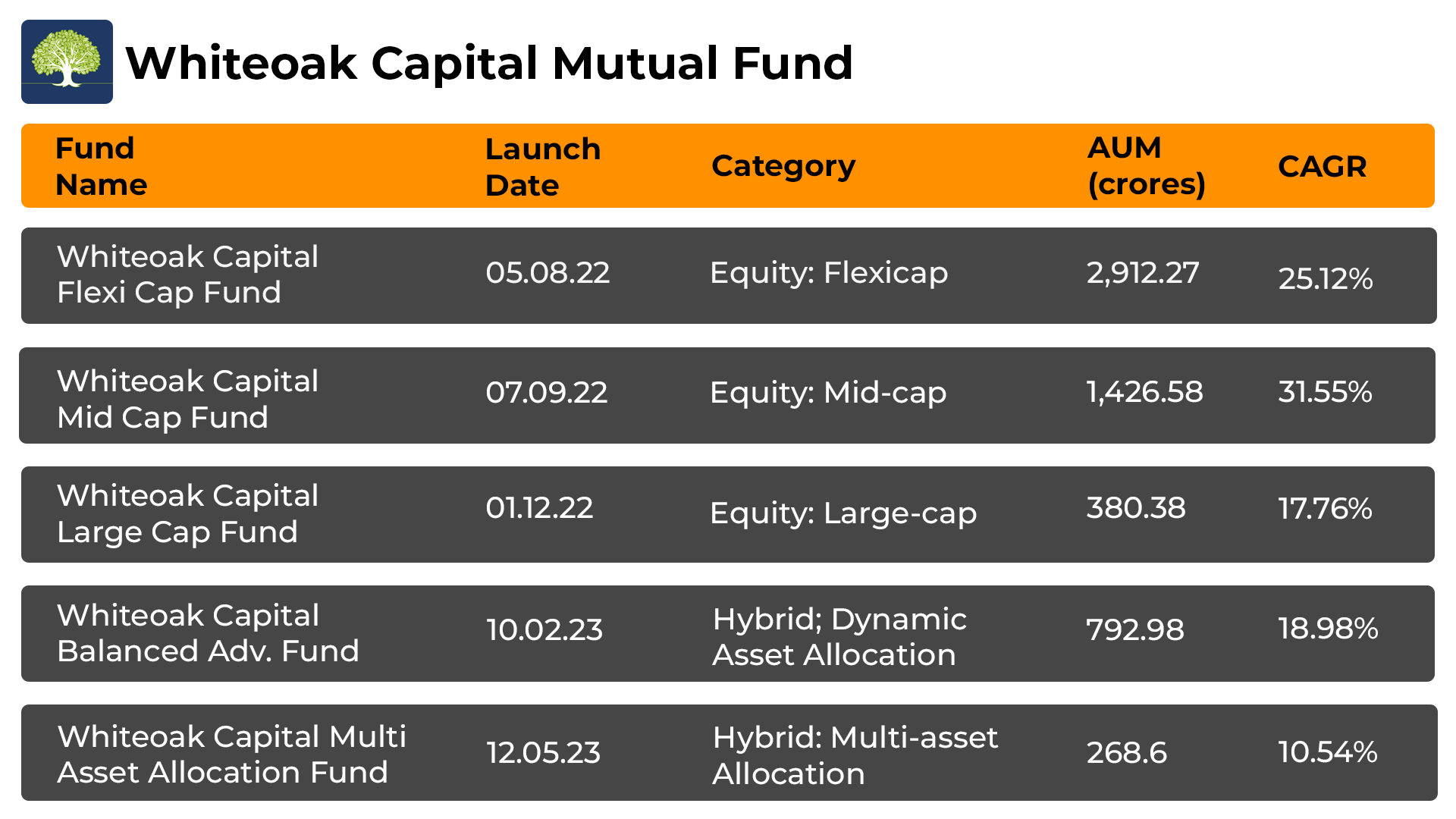

Whiteoak Asset Management Company received SEBI registration for Portfolio Management Services (PMS) and consulting services in October 2017. Since then, it has offered products for both local and International investors, pioneering the first local portfolio management system in April 2019. In November 2021, the business increased its presence by purchasing YES Asset Management. Following that, WhiteOak created its first equity fund, the WhiteOak Capital Flexi Cap Fund, which is now open for subscriptions.

- White Oak Fund House has unique investment strategy.

- This AMC has a wide range of varieties of Funds

- This fund house values strong governance principles.

- White Oak AMC does well in all fund categories.

How to Select Best Whiteoak Capital Mutual Fund?

Here are the ways to select the best white oak mutual fund:

- Set clear investment goals, then devise a strategy to achieve them.

- Assess your risk tolerance being prepared to adjust them if necessary.

- Diversify your investments across multiple industries to lower overall risk.

- Assess available funds, review their performance, and choose wisely.

- Monitor your assets closely and make necessary adjustments as needed.

- Given market volatility, seeking professional financial advice is wise.

To sum up, before investing in a mutual fund keep these points in mind and use an easy and simple SIP calculator to analyze your fund returns

How to Invest in Whiteoak Capital Fund Schemes via Mysiponline?

Investing in White Oak Capital mutual funds offers various convenient avenues, with mysiponline.com standing out for its user-friendly approach:

- Visit mysiponline.com for top mutual funds from White Oak Capital.

- Register for a free account, enter profile details, select preferred fund.

- Complete your profile with a quick and paperless KYC process.

- Explore and add selected mutual funds to your cart for investment.

- Confirm your payment and await confirmation of your investment.

- Monitor your investments through your mysiponline.com account

In conclusion, if you pick the correct platform and do Online SIP, you can generate an investment in a hassle-free and simple manner.

What is the Taxation on Whiteoak Capital Mutual Fund?

The taxation of White Oak Capital mutual funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in WhiteOak Capital Mutual Fund?

What are the different WOC mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in WOC Funds online tax-free?

How to analyse the performance of WhiteOak Capital Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of WhiteOak Capital Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.