Franklin Templeton Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 41

- Average annual returns 4.65%

About Franklin Templeton Mutual Fund

Franklin Templeton Mutual Fund stands as one of India's largest mutual fund companies. It is affiliated with the Franklin Templeton asset management company. It has an extensive overall asset under management, this AMC offers a total of 43 schemes. Among these, there are 16 equity schemes, 20 debt schemes, and 7 hybrid fund schemes. In September 1996, this company launched Templeton India Growth Fund (now Templeton India Value Fund), its first mutual fund offering. This Mutual Fund House holds the 15th position out of other top AMCs. Franklin India Prima Fund, the flagship scheme has exhibited an impressive average annualized return of 19.37% since its inception.

More-

Launched in

19-Feb-1996

-

AMC Age

29 Years

-

Website

https://www.franklintempletonindia.com -

Email Address

services@franklintempleton.com

Top Performing Franklin Templeton Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 11655.69 | 31 years | 5.89% | 6.79% | -2.91% | -8.68% | -8.41% | 13.76% | 30% | 20.08% | 27.49% | 14.28% | Invest | |

| 5948.48 | 25 years | 6.59% | 8.22% | -3.07% | -7.59% | -7.43% | 13.16% | 38.32% | 27.12% | 31.75% | 15.07% | Invest | |

| 61.72 | 10 years | 2.75% | 4.74% | 6.01% | 4.85% | 6.27% | 12.83% | 15.44% | 11.25% | 9.66% | 6.91% | Invest | |

| 17202.58 | 30 years | 6.4% | 7.2% | 1% | -5.78% | -4.05% | 10.61% | 25.95% | 16.93% | 27.58% | 13.26% | Invest | |

| 6438.34 | 26 years | 6.38% | 6.91% | 0.5% | -6.31% | -4.74% | 10.32% | 26.04% | 17.08% | 26.54% | 12.57% | Invest | |

| 151.88 | 23 years | 0.26% | 2.17% | 3.43% | 4.98% | 3.85% | 9.9% | 7.43% | 6.43% | 5.3% | 5.97% | Invest | |

| 3369.56 | 20 years | 5.62% | 5.79% | -1.72% | -8.07% | -4.97% | 9.79% | 21.26% | 12.57% | 24.28% | 10.72% | Invest | |

| 7408.19 | 31 years | 5.88% | 6.18% | 0.86% | -5.59% | -2.38% | 9.75% | 18.67% | 11.85% | 20.5% | 10.41% | Invest | |

| 2031.12 | 25 years | 4.56% | 5.27% | 0.69% | -2.59% | -2.29% | 9.41% | 19.95% | 13.87% | 19.74% | 11.07% | Invest | |

| 199.09 | 24 years | 1.87% | 3.31% | 2.45% | 2.16% | 1.58% | 9.35% | 11.63% | 9.11% | 9.66% | 7.39% | Invest | |

| 199.09 | 24 years | 1.87% | 3.31% | 2.45% | 2.16% | 1.58% | 9.35% | 11.63% | 9.11% | 9.66% | 7.39% | Invest | |

| 287.81 | 23 years | 0.45% | 2.02% | 3.07% | 4.74% | 3.46% | 9.32% | 8.47% | 7.42% | 6.17% | 6.29% | Invest | |

| 2351.98 | 2 years | 3.39% | 4.16% | 0.94% | -0.4% | -1.18% | 8.9% | 17.07% | - | - | - | Invest | |

| 752.85 | 27 years | 0.34% | 1.78% | 2.81% | 4.32% | 2.9% | 8.69% | 7.54% | 6.57% | 6.3% | 7.17% | Invest | |

| 506.27 | 28 years | 2.63% | 3.6% | 1.26% | - | -0.34% | 8.64% | 13.38% | 9.89% | 10.91% | 8% | Invest | |

| 595.56 | 10 years | 0.36% | 1.76% | 2.8% | 4.29% | 2.99% | 8.62% | 7.72% | 6.78% | 6.14% | 7.2% | Invest | |

| 2547.83 | 23 years | 0.19% | 1.22% | 2.36% | 4.17% | 2.67% | 8% | 7.7% | 7% | 5.92% | 6.84% | Invest | |

| 1270.93 | 21 years | 2.51% | 4.05% | 1.02% | -1.75% | -1.06% | 7.95% | 16.8% | 12.57% | 16.6% | 9.74% | Invest | |

| 11553.45 | 17 years | 6.84% | 6.3% | 1.07% | -6.96% | -3.82% | 7.63% | 22.03% | 15.43% | 25.1% | 12.93% | Invest | |

| 724.43 | 6 years | 1.27% | 2.01% | 1.63% | 1.66% | 1.08% | 7.5% | 10.35% | 7.65% | 11.2% | 6.83% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 | Sep-2024 | Aug-2024 | Jul-2024 | Jun-2024 | May-2024 |

|---|

| Fund Name | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 | 2022-Q3 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 11655.69 | Very High |

-4.62%

|

-10.82%

|

12.53%

|

19.25%

|

19.95%

|

16.12%

|

20.08%

|

Invest | |

| 5948.48 | Very High |

-4.66%

|

-12.06%

|

16.66%

|

25.99%

|

24.9%

|

18.76%

|

16.59%

|

Invest | |

| 61.72 | High |

3.98%

|

11.32%

|

13.88%

|

13.68%

|

13.26%

|

8.62%

|

8.45%

|

Invest | |

| 17202.58 | Very High |

-3.41%

|

-8.96%

|

9.84%

|

15.71%

|

18.55%

|

15.54%

|

19.52%

|

Invest | |

| 6438.34 | Very High |

-3.92%

|

-9.83%

|

9.64%

|

15.72%

|

18.3%

|

14.81%

|

17.85%

|

Invest | |

| 151.88 | Low to Moderate |

3.3%

|

10.7%

|

8.8%

|

7.79%

|

6.13%

|

5.82%

|

6.91%

|

Invest | |

| 3369.56 | Very High |

-4.8%

|

-11.44%

|

6.87%

|

11.89%

|

14.62%

|

12.56%

|

13.26%

|

Invest | |

| 7408.19 | Very High |

-3.72%

|

-8.98%

|

6.43%

|

10.66%

|

12.53%

|

11.62%

|

15.27%

|

Invest | |

| 2031.12 | Very High |

-1.95%

|

-4.22%

|

9.08%

|

12.97%

|

14.06%

|

12.45%

|

14.24%

|

Invest | |

| 199.09 | Moderately High |

1.33%

|

4.97%

|

8.69%

|

9.45%

|

8.67%

|

7.75%

|

8.59%

|

Invest | |

| 199.09 | Moderately High |

1.33%

|

4.97%

|

8.69%

|

9.45%

|

8.67%

|

7.75%

|

8.59%

|

Invest | |

| 287.81 | Moderate |

2.81%

|

9.67%

|

8.85%

|

8.36%

|

7.03%

|

6.43%

|

6.15%

|

Invest | |

| 2351.98 | Very High |

-0.84%

|

-0.94%

|

8.95%

|

-

|

-

|

-

|

11.14%

|

Invest | |

| 752.85 | Moderate |

2.62%

|

9.26%

|

8.23%

|

7.68%

|

6.51%

|

6.82%

|

7.75%

|

Invest | |

| 506.27 | High |

-0.17%

|

0.84%

|

7.95%

|

9.76%

|

9.26%

|

8.45%

|

10.62%

|

Invest | |

| 595.56 | Moderate |

2.68%

|

9.29%

|

8.33%

|

7.83%

|

6.59%

|

6.96%

|

7.04%

|

Invest | |

| 2547.83 | Low to Moderate |

2.33%

|

8.51%

|

8%

|

7.72%

|

6.67%

|

6.56%

|

7.23%

|

Invest | |

| 1270.93 | High |

-0.36%

|

-0.3%

|

8.73%

|

11.99%

|

14.69%

|

11.3%

|

11.55%

|

Invest | |

| 11553.45 | Very High |

-4.36%

|

-12.89%

|

5.9%

|

11.95%

|

16.37%

|

14.83%

|

15.86%

|

Invest | |

| 724.43 | Average |

0.64%

|

3.71%

|

7.02%

|

7.98%

|

8.33%

|

-

|

8.3%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

13.68%

|

0.86%

|

0.93%

|

0.8%

|

Invest | |

| Very High |

14.87%

|

11.18%

|

1.01%

|

1.08%

|

Invest | |

| High |

4.866%

|

-

|

-

|

0.803%

|

Invest | |

| Very High |

13.548%

|

2.972%

|

0.914%

|

0.672%

|

Invest | |

| Very High |

13.786%

|

3.459%

|

0.94%

|

0.692%

|

Invest | |

| Low to Moderate |

1.54%

|

-

|

0.684%

|

-

|

Invest | |

| Very High |

13.96%

|

0.015%

|

0.94%

|

0.436%

|

Invest | |

| Very High |

10.81%

|

-

|

0.89%

|

0.36%

|

Invest | |

| Very High |

9%

|

3.39%

|

0.98%

|

0.65%

|

Invest | |

| Moderately High |

3.684%

|

0.733%

|

1.005%

|

0.461%

|

Invest | |

| Moderately High |

3.684%

|

0.733%

|

1.005%

|

0.461%

|

Invest | |

| Moderate |

0.8%

|

3.07%

|

1.48%

|

0.14%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

0.97%

|

-

|

0.796%

|

-

|

Invest | |

| High |

5.735%

|

-

|

-

|

0.445%

|

Invest | |

| Moderate |

1.087%

|

-

|

0.926%

|

-

|

Invest | |

| Low to Moderate |

0.497%

|

-

|

3.522%

|

0.435%

|

Invest | |

| High |

7.125%

|

-

|

-

|

0.778%

|

Invest | |

| Very High |

11.81%

|

1.68%

|

0.87%

|

0.58%

|

Invest | |

| Average |

3.684%

|

-

|

-

|

0.321%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹500

|

₹5000

|

1.78%

|

R Janakiraman

|

01-Dec 1993

|

Invest | |

|

₹500

|

₹5000

|

1.8%

|

R Janakiraman

|

21-Feb 2000

|

Invest | |

|

₹500

|

₹5000

|

1.45%

|

Varun Sharma

|

28-Nov 2014

|

Invest | |

|

₹500

|

₹5000

|

1.71%

|

R Janakiraman

|

29-Sep 1994

|

Invest | |

|

₹500

|

₹500

|

1.81%

|

R Janakiraman

|

10-Apr 1999

|

Invest | |

|

₹500

|

₹10000

|

1.15%

|

Rahul Goswami

|

07-Dec 2001

|

Invest | |

|

₹500

|

₹5000

|

2.02%

|

R Janakiraman

|

02-Mar 2005

|

Invest | |

|

₹500

|

₹5000

|

1.86%

|

Ajay Argal

|

01-Dec 1993

|

Invest | |

|

₹500

|

₹5000

|

2.09%

|

Anuj Tagra

|

10-Dec 1999

|

Invest | |

|

₹500

|

₹10000

|

1.4%

|

Rahul Goswami

|

28-Sep 2000

|

Invest | |

|

₹500

|

₹10000

|

1.4%

|

Rahul Goswami

|

28-Sep 2000

|

Invest | |

|

₹500

|

₹1000

|

0.96%

|

Pallab Roy

|

23-Apr 2001

|

Invest | |

|

₹500

|

₹5000

|

1.97%

|

Rahul Goswami

|

06-Sep 2022

|

Invest | |

|

₹500

|

₹10000

|

0.81%

|

Rahul Goswami

|

23-Jun 1997

|

Invest | |

|

₹500

|

₹500

|

2.27%

|

Pallab Roy

|

31-Mar 1997

|

Invest | |

|

₹500

|

₹5000

|

0.53%

|

Anuj Tagra

|

25-Apr 2014

|

Invest | |

|

₹500

|

₹10000

|

0.29%

|

Rahul Goswami

|

11-Feb 2002

|

Invest | |

|

₹500

|

₹5000

|

1.44%

|

Varun Sharma

|

31-Oct 2003

|

Invest | |

|

₹500

|

₹5000

|

1.78%

|

Ajay Argal

|

26-Jul 2007

|

Invest | |

|

₹500

|

₹5000

|

1.12%

|

Pallab Roy

|

27-Aug 2018

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

2537.2557

(17-04-2025)

|

2521.9718

(16-04-2025)

|

0.61%

|

2856.59

|

2219.86

|

Invest | |

|

233.6134

(17-04-2025)

|

231.4479

(16-04-2025)

|

0.94%

|

261.13

|

207.048

|

Invest | |

|

20.3093

(17-04-2025)

|

20.1425

(16-04-2025)

|

0.83%

|

20.3093

|

17.737

|

Invest | |

|

1553.4894

(17-04-2025)

|

1531.7306

(16-04-2025)

|

1.42%

|

1713.01

|

1400.1

|

Invest | |

|

1402.2487

(17-04-2025)

|

1382.5885

(16-04-2025)

|

1.42%

|

1556.69

|

1267.02

|

Invest | |

|

58.5991

(17-04-2025)

|

58.6112

(16-04-2025)

|

-0.02%

|

58.6112

|

53.303

|

Invest | |

|

174.2018

(17-04-2025)

|

172.1841

(16-04-2025)

|

1.17%

|

198.318

|

157.547

|

Invest | |

|

963.1527

(17-04-2025)

|

946.9332

(16-04-2025)

|

1.71%

|

1072.65

|

873.55

|

Invest | |

|

259.4033

(17-04-2025)

|

257.0184

(16-04-2025)

|

0.93%

|

272.838

|

236.456

|

Invest | |

|

88.6454

(17-04-2025)

|

88.4250

(16-04-2025)

|

0.25%

|

88.6454

|

80.9884

|

Invest | |

|

88.6454

(17-04-2025)

|

88.4250

(16-04-2025)

|

0.25%

|

88.6454

|

80.9884

|

Invest | |

|

40.3124

(17-04-2025)

|

40.3001

(16-04-2025)

|

0.03%

|

40.3124

|

36.8862

|

Invest | |

|

13.8679

(17-04-2025)

|

13.7793

(16-04-2025)

|

0.64%

|

14.1492

|

12.7156

|

Invest | |

|

97.0728

(17-04-2025)

|

97.1665

(16-04-2025)

|

-0.1%

|

97.1665

|

89.3116

|

Invest | |

|

212.0740

(17-04-2025)

|

211.0474

(16-04-2025)

|

0.49%

|

214.549

|

194.924

|

Invest | |

|

22.1507

(17-04-2025)

|

22.1673

(16-04-2025)

|

-0.07%

|

22.1673

|

20.3918

|

Invest | |

|

49.5210

(17-04-2025)

|

49.5052

(16-04-2025)

|

0.03%

|

49.521

|

45.8718

|

Invest | |

|

159.1512

(17-04-2025)

|

157.9732

(16-04-2025)

|

0.75%

|

162.323

|

146.121

|

Invest | |

|

101.4696

(17-04-2025)

|

99.6760

(16-04-2025)

|

1.8%

|

115.079

|

94.1358

|

Invest | |

|

16.0374

(17-04-2025)

|

15.9960

(16-04-2025)

|

0.26%

|

16.0374

|

14.9259

|

Invest |

Franklin Templeton Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Franklin Templeton Mutual Fund

Franklin India Dynamic Asset Allocation Fund of Funds-Growth

3Y Returns 12.57%

VS

Franklin India Dynamic Asset Allocation Fund of Funds-Growth

3Y Returns 12.57%

VS

HSBC Aggressive Hybrid Active FOF - Growth

3Y Returns 11.79%

HSBC Aggressive Hybrid Active FOF - Growth

3Y Returns 11.79%

FRANKLIN INDIA MONEY MARKET FUND-GROWTH

3Y Returns 7%

VS

FRANKLIN INDIA MONEY MARKET FUND-GROWTH

3Y Returns 7%

VS

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.17%

Nippon India Money Market Fund-Growth Plan-Growth Option

3Y Returns 7.17%

Franklin India Pension Plan-Growth

3Y Returns 9.89%

VS

Franklin India Pension Plan-Growth

3Y Returns 9.89%

VS

ICICI Prudential Retirement Fund - Pure Equity - Growth Option

3Y Returns 18.44%

ICICI Prudential Retirement Fund - Pure Equity - Growth Option

3Y Returns 18.44%

Franklin India Opportunities Fund - Growth

3Y Returns 27.12%

VS

Franklin India Opportunities Fund - Growth

3Y Returns 27.12%

VS

Quant Quantamental Fund Regular - Growth

3Y Returns 18.96%

Quant Quantamental Fund Regular - Growth

3Y Returns 18.96%

Investment Strategy

Franklin Templeton Mutual Fund provides a diverse array of alternative products encompassing both private and public investments, offering strategies ranging from unconstrained to hedged. Additionally, we venture into real assets, including real estate and infrastructure.

Head of Equity & Debt Team (CIO)

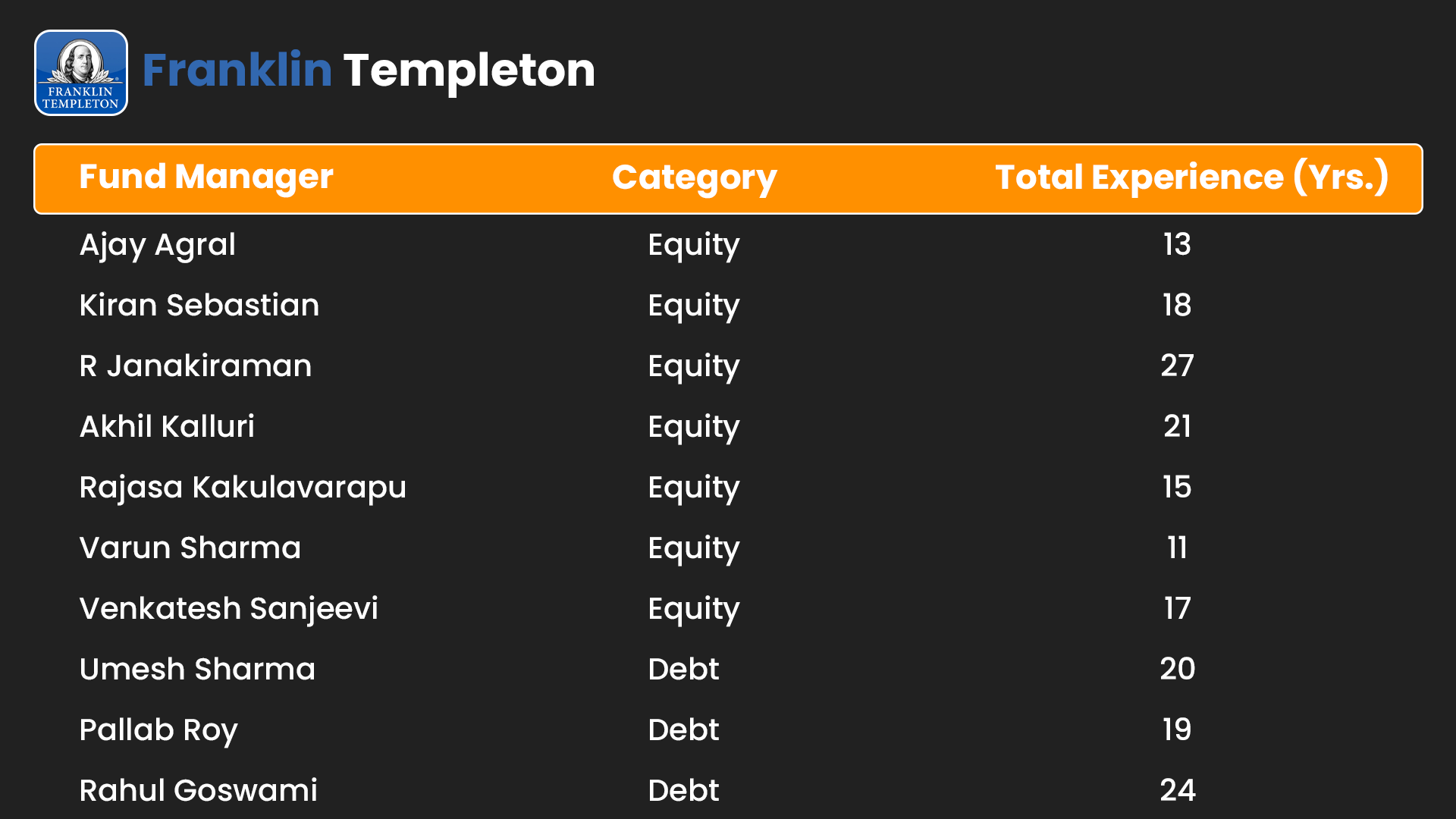

Mr. R Janakiraman (CIO equity)

R. Janakiraman is the Chief Investment Officer for Emerging Market Equities at Franklin Templeton. Joining the firm in 2007, he brings nearly 27 years of investment management experience and has excelled in managing diverse funds during his 16 years with Franklin Templeton. With a proven track record, currently overseeing multiple equity funds, Janakiraman is well-prepared to lead the investment strategy for Emerging Market Equities at the firm.

Mr. Rahul Goswami (CIO of debt)

Mr Rahul Goswami, the Chief Investment Officer (CIO) of fixed income at Franklin Templeton Asset Management, bringing a wealth of experience with over 24 years in managing fixed-income funds. His expertise spans investments in government securities, and corporate bonds, and includes a keen focus on monitoring key economic developments.

Key Fund Management Team

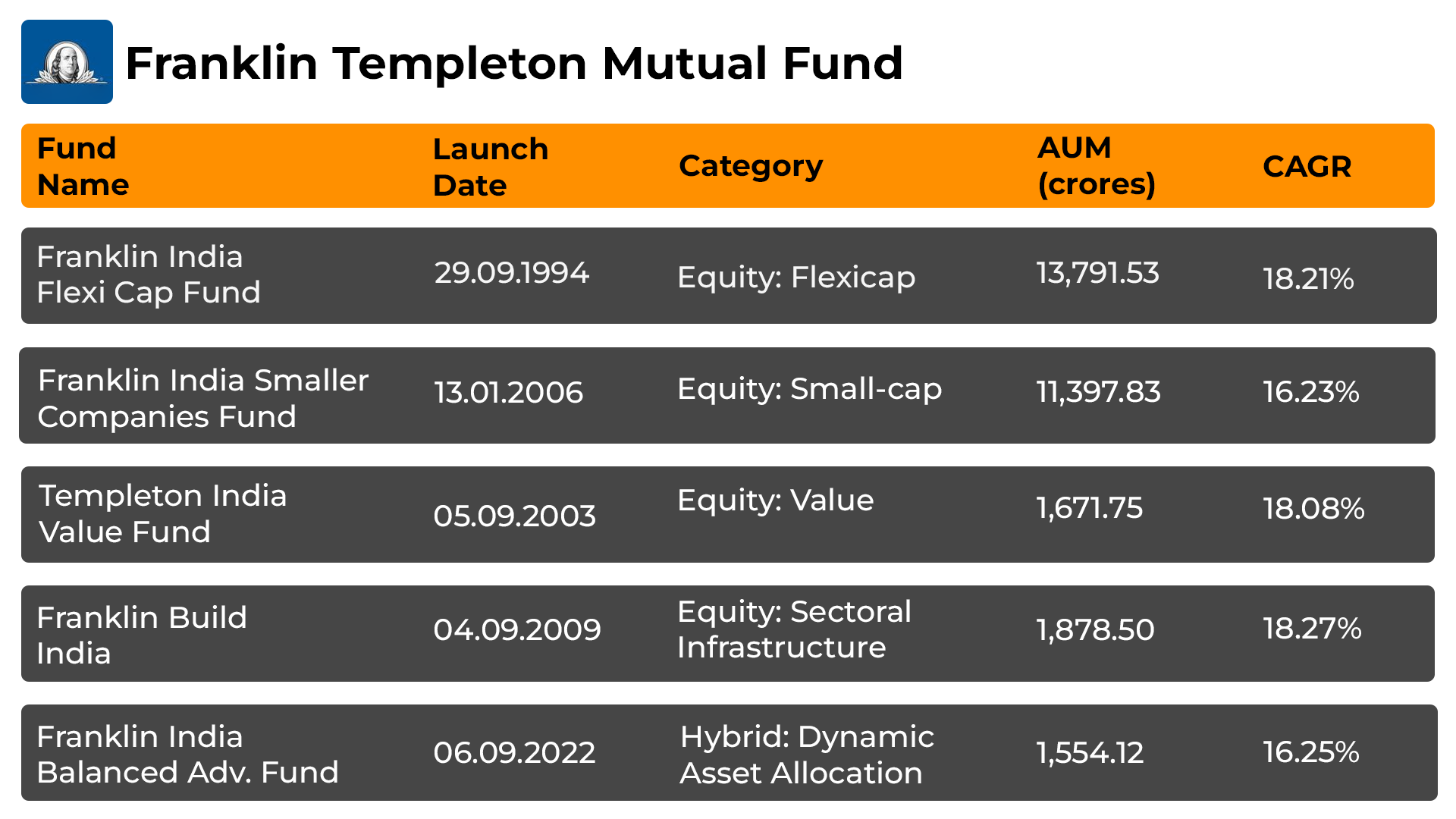

Top 5 Franklin Templeton Mutual Funds

History of Franklin Templeton Mutual Fund

Franklin Templeton began its investment journey in India over two decades ago when it established the India office in 1996 as Templeton Asset Management India Pvt Limited. The Mutual Fund business took off in September 1996 with the launch of Templeton India Growth Fund. Since then, the business has steadily grown as part of the group's broader focus on global market investments.

- It adopts a different investing approach that sets it apart from other traditional investments.

- This AMC has a wide range of varieties of fund schemes.

- Franklin Templeton Investments believes in following strong work ethics.

- Franklin Templeton all funds are top performing in their respective categories.

How to Select the Best Franklin Templeton Mutual Fund?

Beginning with investing is an important first step, and making sound decisions is essential. Here are some simple yet crucial points to consider:

- Defining Objectives: Set reasonable goals for your financial choices. Identify them and design a plan to meet their needs.

- Risk Tolerance Assessment: Assess your risk comfort level, knowing higher risk can lead to higher returns within your chosen limits.

- Implementing Diversification: Spread your assets across other sectors to reduce risk and increase possible profits.

- Self-education: Prioritize understanding funds through self-education. Analyse past performance and fund workings.

- Regular Monitoring: Consistently monitor your investments and make changes as the market conditions change.

- Seeking Advice: Because fluctuations in the market might have an impact on mutual funds, connect with professionals.

In summary, these elements assist you in making the best investment decision. To increase your chances of success, use the SIP Calculator for thorough research before embarking on your financial path.

How to invest in Franklin Templeton Mutual Fund with mysiponline?

You can invest in Top Franklin Templeton Mutual Funds in various ways where mysiponline stands out for its easy and simple way of investing -

- Go to mysiponline.com main website.

- Select the top Franklin Templeton Fund Schemes.

- Make sure it matches your investment objectives.

- Sign up for a free account, and enter your profile information.

- Add your desired fund to your cart.

- Complete the Know Your Customer (KYC) process online.

- It which is paperless and only takes a few minutes.

- You will require PAN, Aadhar card, signature, and bank evidence.

- Explore the website and add your preferred funds to your cart.

- Make the payment and wait for confirmation of your investment.

- Keep track of investments using your mysiponline.com account.

Lastly, our platform offers a simple and quick approach to begin investing immediately. It's like a package deal, where we offer all of our services at one location. Hurry now to take benefit of Online SIP in Franklin Templeton Investments Schemes.

What is the Taxation of Franklin Templeton Mutual fund?

The taxation of Franklin Templeton Mutual Funds in India depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding RS. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Explore Other AMC’s

Top Blogs of Franklin Templeton Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.