HSBC Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 57

- Average annual returns 4.49%

About HSBC Mutual Fund

HSBC Mutual Fund is one of the leading AMCs in the Indian investing industry, serving as a division of HSBC Securities and Capital Markets (India) Private Limited, this AMC was established on 12 December 2001.

This mutual fund house provides a comprehensive portfolio of 117 schemes, among these schemes, there are 18 equity funds, 15 debt funds, and 8 hybrid category funds. The managing director of this AMC, Mr. Kailash Kulkarni brings his expertise to secure the 14th position in the mutual fund industry.

As their leading asset manager, they are beginning to establish a place in the top ten, HSBC AMC plans to attract more customers by offering a wider range of investment products. They want to improve their reputation in India by providing high-quality international investment products and services.

More-

Launched in

27-May-2002

-

AMC Age

22 Years

-

Website

https://www.assetmanagement.hsbc.co.in -

Email Address

hsbcmf@camsonline.com

Top Performing HSBC Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1480.05 | 1 years | 6.18% | 9.2% | -1.73% | -8.87% | -9.1% | 12.14% | - | - | - | - | Invest | |

| 995.4 | 10 years | 7.53% | 9.77% | -2.54% | -11.28% | -9.24% | 11.82% | 26.99% | 19.69% | 27.71% | 12.28% | Invest | |

| 3977.42 | 19 years | 7.46% | 6.86% | -3.42% | -9.45% | -9.18% | 11.34% | 25.44% | 16.04% | 23.51% | 12.54% | Invest | |

| 157.91 | 14 years | 0.53% | 2.72% | 4.29% | 5.1% | 4.4% | 11.1% | 8.66% | 7.41% | 6.13% | 7.06% | Invest | |

| 8.25 | 11 years | 7.99% | -6.29% | -4.2% | -8.16% | -3.55% | 10.81% | 6.79% | 3.39% | 7.78% | 6.49% | Invest | |

| 150.95 | 21 years | 2.05% | 3.81% | 0.88% | 0.15% | -1.1% | 10.61% | 12.21% | 9.12% | 9.81% | 7.4% | Invest | |

| 260.95 | 25 years | 0.45% | 2.56% | 4.18% | 4.43% | 4.15% | 10.29% | 7.83% | 6.87% | 5.64% | 6.63% | Invest | |

| 48.51 | 22 years | 0.52% | 2.58% | 3.9% | 4.71% | 4.06% | 9.97% | 7.54% | 6.49% | 5.11% | 5.85% | Invest | |

| 744.08 | 10 years | 0.43% | 2.03% | 3.4% | 4.93% | 3.69% | 9.76% | 8.34% | 7.14% | 6.67% | 7.08% | Invest | |

| 1883.78 | 3 years | 0.58% | 1.82% | 3.14% | 4.67% | 3.52% | 9.72% | 8.18% | 7.37% | - | - | Invest | |

| 583.92 | 15 years | 0.35% | 2.74% | 3.88% | 5.36% | 4.13% | 9.54% | 7.91% | 6.85% | 6.22% | 6.27% | Invest | |

| 5826.55 | 28 years | 0.48% | 2.03% | 3.07% | 4.49% | 3.36% | 9.44% | 7.88% | 7.07% | 6.58% | 7.04% | Invest | |

| 3785.73 | 13 years | 0.45% | 1.92% | 3.1% | 4.56% | 3.38% | 9.17% | 7.71% | 6.6% | 5.98% | 6.87% | Invest | |

| 12848.97 | 15 years | 7.04% | 8.71% | -1.02% | -8.62% | -6.36% | 9.03% | 28.45% | 19.82% | 29.86% | 15.27% | Invest | |

| 4680.33 | 21 years | 6.47% | 7.89% | -3.75% | -9.95% | -9.35% | 8.71% | 23.96% | 14.7% | 23.78% | 11.8% | Invest | |

| 4128.58 | 12 years | 0.43% | 1.96% | 2.96% | 4.51% | 3.2% | 8.48% | 7.46% | 6.32% | 5.88% | 6.86% | Invest | |

| 292.73 | 5 years | 6.47% | 5.85% | 2.8% | -3.52% | 0.52% | 8.4% | 16.83% | 11.59% | 21.39% | - | Invest | |

| 22.74 | 10 years | 0.37% | 1.55% | 1.9% | 2.25% | 1.69% | 8.21% | 8.32% | 6.85% | 6.66% | 6.29% | Invest | |

| 35.18 | 17 years | 6.02% | -8.05% | -0.82% | -4.56% | -0.28% | 8.19% | 6.3% | 0.7% | 6.14% | 4.29% | Invest | |

| 1503.94 | 14 years | 3.08% | 4.53% | 0.29% | -1.74% | -2.77% | 8.02% | 14.6% | 10.67% | 12.08% | 7.4% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 | Sep-2024 | Aug-2024 | Jul-2024 | Jun-2024 | May-2024 |

|---|

| Fund Name | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 | 2022-Q3 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1480.05 | Very High |

-3.57%

|

-7.62%

|

-

|

-

|

-

|

-

|

7.36%

|

Invest | |

| 995.4 | Very High |

-4.71%

|

-12.99%

|

10.7%

|

17.49%

|

19.83%

|

15.04%

|

14.59%

|

Invest | |

| 3977.42 | Very High |

-6.04%

|

-13.84%

|

9.26%

|

15.4%

|

16.07%

|

13.66%

|

13.73%

|

Invest | |

| 157.91 | Moderate |

3.63%

|

11.24%

|

9.77%

|

8.76%

|

6.87%

|

6.77%

|

6.87%

|

Invest | |

| 8.25 | Very High |

-11.81%

|

-20.47%

|

-2.47%

|

1.4%

|

1.61%

|

5.29%

|

5.45%

|

Invest | |

| 150.95 | Moderately High |

0.47%

|

2.77%

|

8.84%

|

9.81%

|

8.69%

|

7.89%

|

8.45%

|

Invest | |

| 260.95 | Moderate |

3.46%

|

10.19%

|

9.03%

|

8.07%

|

6.22%

|

6.25%

|

7.18%

|

Invest | |

| 48.51 | Moderate |

3.34%

|

10.14%

|

8.64%

|

7.79%

|

5.87%

|

5.78%

|

6.55%

|

Invest | |

| 744.08 | Moderate |

3.09%

|

10.22%

|

8.99%

|

8.4%

|

7.06%

|

6.76%

|

6.78%

|

Invest | |

| 1883.78 | Moderate |

2.69%

|

9.54%

|

8.74%

|

8.29%

|

-

|

-

|

8.23%

|

Invest | |

| 583.92 | Moderately High |

3.63%

|

11.02%

|

8.93%

|

8.11%

|

6.98%

|

5.97%

|

6.61%

|

Invest | |

| 5826.55 | Moderate |

2.76%

|

9.56%

|

8.54%

|

8.04%

|

6.6%

|

7.1%

|

6.59%

|

Invest | |

| 3785.73 | Moderate |

2.77%

|

9.45%

|

8.37%

|

7.77%

|

6.36%

|

6.55%

|

6.9%

|

Invest | |

| 12848.97 | Very High |

-4.68%

|

-13.32%

|

9.73%

|

18.06%

|

20.67%

|

16.87%

|

17.41%

|

Invest | |

| 4680.33 | Very High |

-5.75%

|

-14.03%

|

8.06%

|

14.64%

|

16.04%

|

13.66%

|

13.37%

|

Invest | |

| 4128.58 | Low to Moderate |

2.73%

|

9.11%

|

8.04%

|

7.53%

|

6.04%

|

6.43%

|

5.82%

|

Invest | |

| 292.73 | Very High |

-2.38%

|

-7.46%

|

5.24%

|

9.62%

|

-

|

-

|

12.3%

|

Invest | |

| 22.74 | Moderately High |

1.49%

|

6.01%

|

7.56%

|

7.68%

|

6.62%

|

6.29%

|

6.35%

|

Invest | |

| 35.18 | Very High |

-8.48%

|

-14.72%

|

-0.93%

|

0.99%

|

-0.58%

|

3.58%

|

4.26%

|

Invest | |

| 1503.94 | Moderately High |

-1.31%

|

-1.48%

|

7.72%

|

10.32%

|

9.7%

|

8.87%

|

9.99%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

16.92%

|

-

|

-

|

0.627%

|

Invest | |

| Very High |

15.421%

|

2.056%

|

0.99%

|

0.548%

|

Invest | |

| Moderate |

1.606%

|

-

|

0.578%

|

-

|

Invest | |

| Very High |

15.677%

|

-

|

-

|

-

|

Invest | |

| Moderately High |

4.639%

|

0.18%

|

1.191%

|

0.397%

|

Invest | |

| Moderate |

2.044%

|

-

|

0.741%

|

-

|

Invest | |

| Moderate |

2.279%

|

-

|

1.036%

|

-

|

Invest | |

| Moderate |

1.516%

|

-

|

1.306%

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderately High |

0.932%

|

-

|

0.761%

|

-

|

Invest | |

| Moderate |

2.005%

|

-

|

1.825%

|

-

|

Invest | |

| Moderate |

1.171%

|

-

|

0.975%

|

-

|

Invest | |

| Very High |

15.41%

|

4.795%

|

0.998%

|

0.746%

|

Invest | |

| Very High |

15.323%

|

0.255%

|

1.003%

|

0.455%

|

Invest | |

| Low to Moderate |

1.777%

|

-

|

1.6%

|

-

|

Invest | |

| Very High |

13.095%

|

-

|

-

|

0.338%

|

Invest | |

| Moderately High |

2.403%

|

-

|

-

|

-

|

Invest | |

| Very High |

16.647%

|

-

|

-

|

-

|

Invest | |

| Moderately High |

6.954%

|

-

|

-

|

0.453%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹500

|

₹5000

|

2.08%

|

Gautam Bhupal

|

31-Aug 2023

|

Invest | |

|

₹500

|

₹5000

|

2.28%

|

Venugopal Manghat

|

20-Aug 2014

|

Invest | |

|

₹500

|

₹500

|

1.89%

|

Gautam Bhupal

|

27-Feb 2006

|

Invest | |

|

₹1000

|

₹5000

|

0.77%

|

Shriram Ramanathan

|

27-Sep 2010

|

Invest | |

|

₹1000

|

₹5000

|

2.03%

|

Sonal Gupta

|

24-Feb 2014

|

Invest | |

|

₹1000

|

₹5000

|

2.17%

|

Mahesh A Chhabria

|

24-Feb 2004

|

Invest | |

|

₹1000

|

₹5000

|

1.7%

|

Shriram Ramanathan

|

29-Mar 2000

|

Invest | |

|

₹1000

|

₹5000

|

1.9%

|

Shriram Ramanathan

|

10-Dec 2002

|

Invest | |

|

₹1000

|

₹5000

|

1.1%

|

Shriram Ramanathan

|

02-Feb 2015

|

Invest | |

|

₹1000

|

₹5000

|

0.43%

|

Mahesh A Chhabria

|

31-Mar 2022

|

Invest | |

|

₹0

|

₹5000

|

1.68%

|

Shriram Ramanathan

|

08-Oct 2009

|

Invest | |

|

₹1000

|

₹5000

|

0.64%

|

Shriram Ramanathan

|

31-Mar 1997

|

Invest | |

|

₹1000

|

₹5000

|

0.75%

|

Shriram Ramanathan

|

27-Dec 2011

|

Invest | |

|

₹500

|

₹5000

|

1.72%

|

Venugopal Manghat

|

08-Jan 2010

|

Invest | |

|

₹500

|

₹5000

|

1.93%

|

Venugopal Manghat

|

24-Feb 2004

|

Invest | |

|

₹1000

|

₹5000

|

0.61%

|

Mahesh A Chhabria

|

12-Sep 2012

|

Invest | |

|

₹500

|

₹5000

|

0.45%

|

Praveen Ayathan

|

16-Apr 2020

|

Invest | |

|

₹1000

|

₹5000

|

1.3%

|

Gautam Bhupal

|

30-Apr 2014

|

Invest | |

|

₹1000

|

₹5000

|

2.33%

|

Sonal Gupta

|

17-Mar 2008

|

Invest | |

|

₹500

|

₹5000

|

2.11%

|

Mahesh A Chhabria

|

07-Feb 2011

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

13.6798

(17-04-2025)

|

13.5804

(16-04-2025)

|

0.73%

|

15.8061

|

12.1164

|

Invest | |

|

39.5131

(17-04-2025)

|

39.1508

(16-04-2025)

|

0.93%

|

45.4412

|

34.7163

|

Invest | |

|

124.0485

(17-04-2025)

|

122.7665

(16-04-2025)

|

1.04%

|

140.84

|

112.221

|

Invest | |

|

29.5832

(17-04-2025)

|

29.5566

(16-04-2025)

|

0.09%

|

29.5832

|

26.6433

|

Invest | |

|

20.6526

(17-04-2025)

|

20.5063

(16-04-2025)

|

0.71%

|

23.4093

|

18.6597

|

Invest | |

|

59.5825

(17-04-2025)

|

59.4453

(16-04-2025)

|

0.23%

|

60.6006

|

54.2058

|

Invest | |

|

66.3304

(17-04-2025)

|

66.2989

(16-04-2025)

|

0.05%

|

66.3304

|

60.1716

|

Invest | |

|

42.033

(17-04-2025)

|

41.9878

(16-04-2025)

|

0.11%

|

42.033

|

38.2313

|

Invest | |

|

20.2087

(17-04-2025)

|

20.1888

(16-04-2025)

|

0.1%

|

20.2087

|

18.4278

|

Invest | |

|

12.2709

(17-04-2025)

|

12.2642

(16-04-2025)

|

0.05%

|

12.2709

|

11.1876

|

Invest | |

|

28.7326

(17-04-2025)

|

28.7084

(16-04-2025)

|

0.08%

|

28.7326

|

26.2564

|

Invest | |

|

72.16

(17-04-2025)

|

72.0603

(16-04-2025)

|

0.14%

|

72.16

|

65.9527

|

Invest | |

|

26.1404

(17-04-2025)

|

26.1122

(16-04-2025)

|

0.11%

|

26.1404

|

23.9612

|

Invest | |

|

100.9541

(17-04-2025)

|

100.0239

(16-04-2025)

|

0.93%

|

113.435

|

90.8276

|

Invest | |

|

200.2474

(17-04-2025)

|

198.4281

(16-04-2025)

|

0.92%

|

229.693

|

182.044

|

Invest | |

|

23.9525

(17-04-2025)

|

23.9274

(16-04-2025)

|

0.1%

|

23.9525

|

22.0917

|

Invest | |

|

27.3348

(17-04-2025)

|

26.8602

(16-04-2025)

|

1.77%

|

30.0208

|

24.9987

|

Invest | |

|

21.1948

(17-04-2025)

|

21.1783

(16-04-2025)

|

0.08%

|

21.1948

|

19.6088

|

Invest | |

|

18.4859

(17-04-2025)

|

18.3693

(16-04-2025)

|

0.63%

|

20.4485

|

16.9951

|

Invest | |

|

41.9

(17-04-2025)

|

41.7035

(16-04-2025)

|

0.47%

|

43.8019

|

38.2369

|

Invest |

HSBC Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top HSBC Mutual Fund

HSBC Large Cap Fund - Regular Growth

3Y Returns 12.84%

VS

HSBC Large Cap Fund - Regular Growth

3Y Returns 12.84%

VS

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

HSBC Value Fund - Regular Growth

3Y Returns 19.82%

VS

HSBC Value Fund - Regular Growth

3Y Returns 19.82%

VS

Nippon India Value Fund- Growth Plan

3Y Returns 19.31%

Nippon India Value Fund- Growth Plan

3Y Returns 19.31%

HSBC Midcap Fund - Regular Growth

3Y Returns 18.08%

VS

HSBC Midcap Fund - Regular Growth

3Y Returns 18.08%

VS

Motilal Oswal Midcap Fund-Regular Plan-Growth Option

3Y Returns 24.46%

Motilal Oswal Midcap Fund-Regular Plan-Growth Option

3Y Returns 24.46%

HSBC Low Duration Fund - Regular Growth

3Y Returns 6.73%

VS

HSBC Low Duration Fund - Regular Growth

3Y Returns 6.73%

VS

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 6.98%

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 6.98%

Investment Strategy

The employs the SAPM process for fund management: Selection of ideas (S), Analysis of Companies (A), Portfolio creation (P), and Regular monitoring (M). Their expertise lies in both top-down and bottom-up research. In top-down, they assess macro factors and analyze the business cycle to identify strong industries and opportune entry points. In the bottom-up, they focus on individual companies with scalable businesses, competent management, strong governance, and financial strength to benefit from industry growth. This approach ensures a well-rounded and informed investment strategy

Head of Equity & Debt Team (CIO)

Mr. Venugopal Manghat (CIO Equity)

Venugopal Manghat, Chief Investment Officer of HSBC Mutual Fund, offers insights into his career path and more than 28 years of expertise in the financial arena. He talks about his early professional days, navigating the ever-changing financial world, and his present position at the fund company managing the equities investment business in the interview.

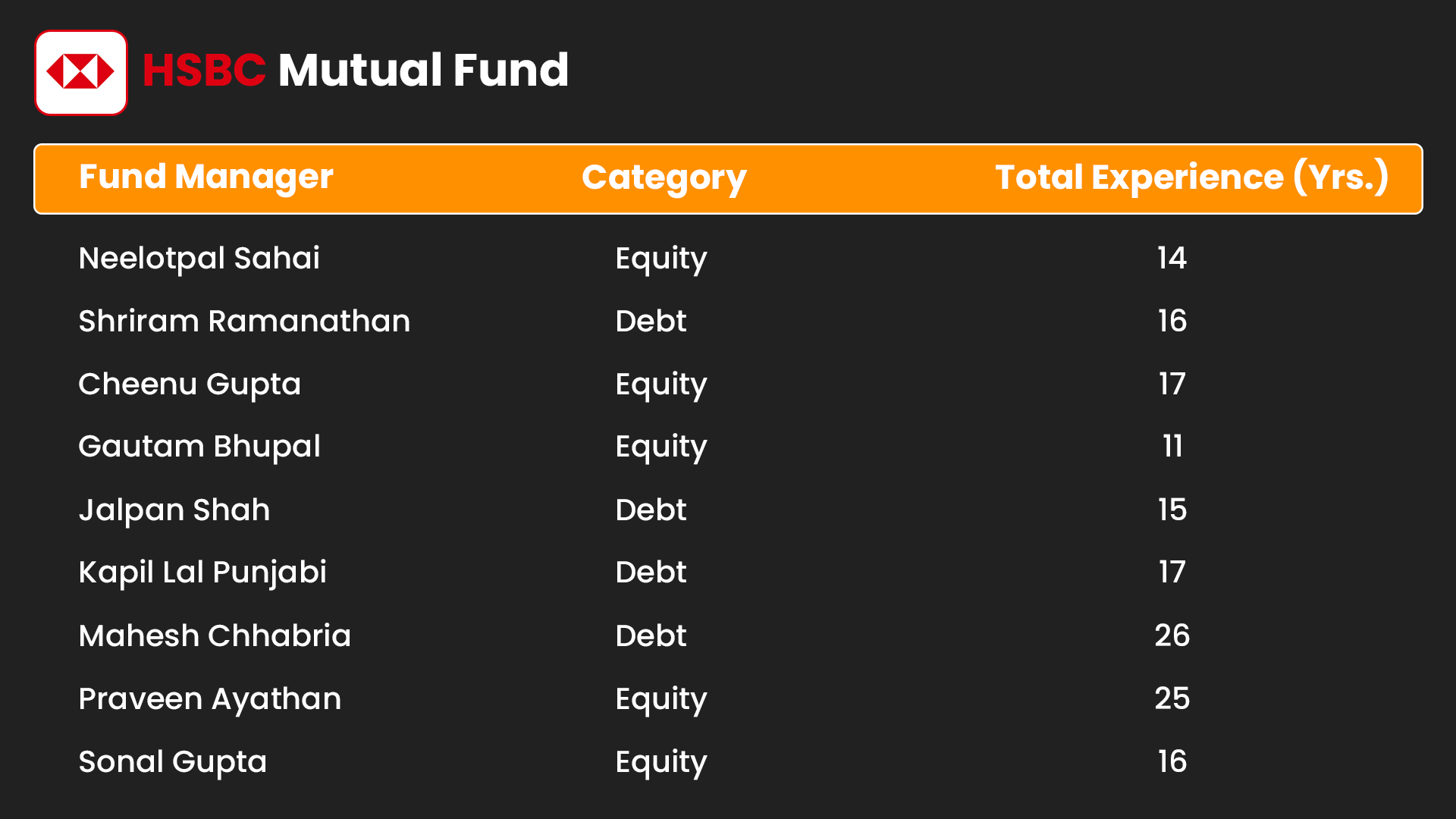

List of fund managers

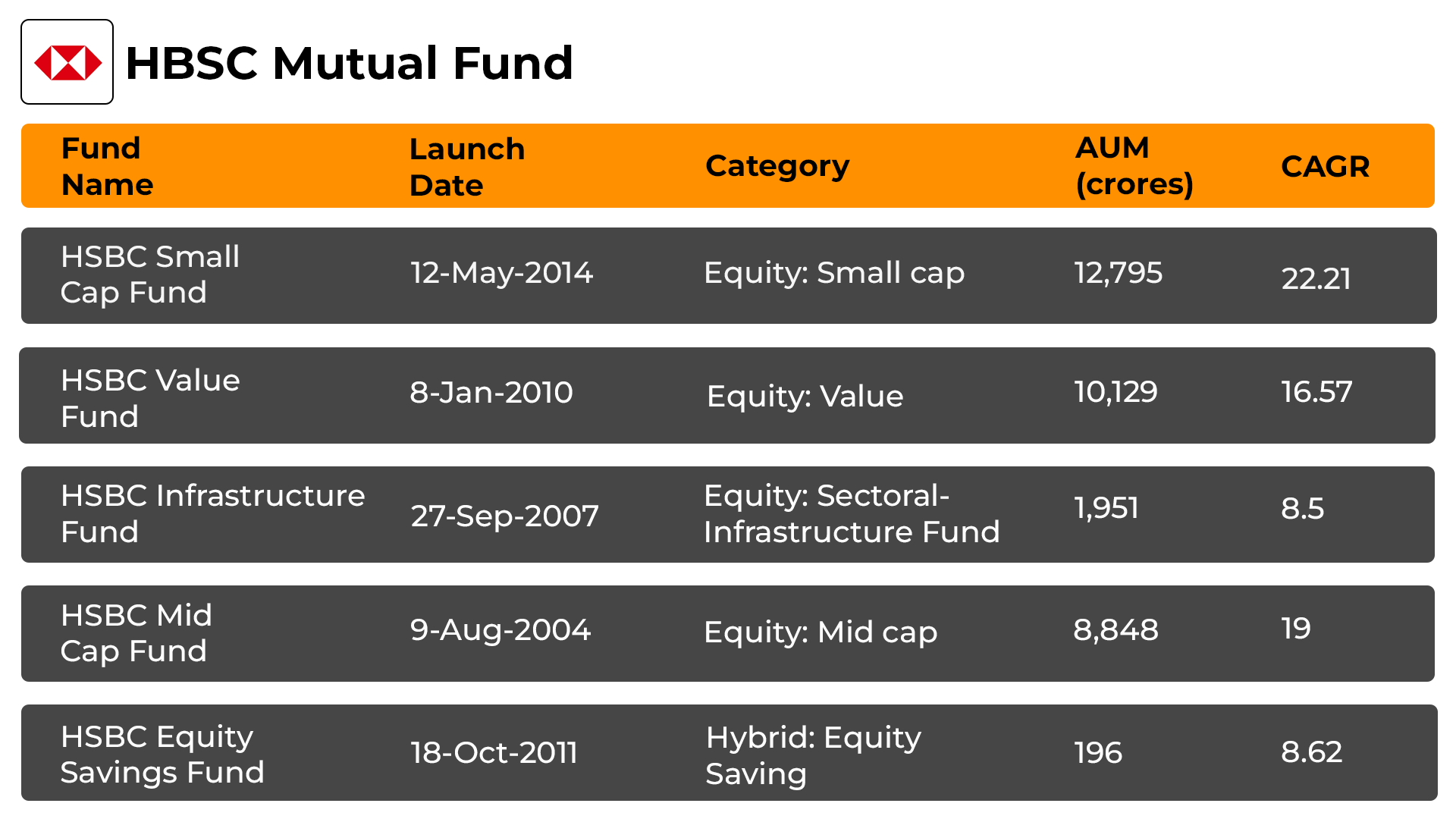

Top 5 HBSC Mutual Funds

History of HSBC Mutual Fund

The HSBC mutual fund empire, which stands for Hong Kong and Shanghai Banking Corporation, has a rich history spanning more than a century. Sir Thomas Sutherland founded it in 1886, and it has grown to become the world's seventh-biggest bank by total assets and revenues. Despite being controlled by the British, HSBC Mutual Fund house has built an unrivaled track record in wealth and asset management in South Asia, expanding its expertise beyond retail and corporate banking throughout time.

- This mutual fund house Operates 23 countries and territories.

- AMC priority is risk management, liquidity, interest rate risks.

- HSBC offers a variety of schemes, that provides better wealth.

- This AMC prioritizes are strong and clear governance system.

- This AMC has a top performance in their respective category

How to Select the Best HBSC Mutual Fund?

Follow these steps to select the Best HSBC Mutual Fund:

- Establish Objectives: Identify financial goals, create a plan to reach them.

- Access Risk: Assess your risk tolerance to make informed financial decisions.

- Diversification: Diversify assets across industries to minimize risk & rewards.

- Educate Yourself: Before investing, research the fund's performance, operations.

- Remain Alert: Assess and adjust investments to align with the objective

- Expert Advice: Seek expert advice for mutual funds during market changes.

In summary, clear goals, a SIP calculator, risk assessment, and expert guidance lead to successful mutual investing.

How to Invest in HBSC Mutual Fund with mysiponline?

Investing in HSBC mutual funds through mysiponline.com offers a convenient and straightforward process:

- Start by visiting mysiponline.com to explore HSBC funds that match your objectives.

- Register for a free account, fill in your profile details, and proceed to preferred fund.

- Complete your KYC verification during registration with the essential documents required.

- Browse the website and add selected funds to the cart based on your risk tolerance.

- Complete your payment transaction and wait for confirmation of your investment.

- Monitor investments through mysiponline.com account for convenience and management.

Investing in the best HSBC mutual funds through Online SIP is straightforward. Monitoring tools aid in management, while online KYC adds convenience.

What is the Taxation of HBSC Mutual fund?

The taxation of HBSC mutual funds depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

- Long-term Capital Gains (LTCG): Gains exceeding Rs.1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

- Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

- Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in HSBC Mutual Fund?

What are the different HSBC mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in HSBC Funds online tax-free?

How to analyse the performance of HSBC Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Blogs of HSBC Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.