Kotak Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 89

- Average annual returns 4.13%

About Kotak Mutual Fund

Kotak Mutual Fund is a leading mutual fund company owned by Kotak Mahindra Bank Limited. It was established in June 1998 and currently offers over 72 investment schemes, including 17 Equity, 6 Hybrid, and 12 Debt funds. This AMC is ranked as the 5th largest asset management company in the market.

The Kotak Mahindra Group, founded in 1985, is a well-known financial corporation in India. In February 2003, the Reserve Bank of India (RBI) gave Kotak Mahindra Finance Ltd, the group's primary company, a banking license. This approval was a historic moment in banking history, as Kotak Mahindra Finance became an independent bank. The Kotak Bluechip Fund, the flagship scheme, has exhibited an impressive average annualized return of 15.34% since its inception.

-

Launched in

23-Jan-1998

-

AMC Age

27 Years

-

Website

https://www.kotakmf.com -

Email Address

fundaccops@kotakmutual.in

Top Performing Kotak Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2520.47 | 14 years | 5.48% | 6.49% | 16.86% | 21.22% | 20.04% | 26.15% | 21.63% | 18.42% | 11.74% | 11.56% | Invest | |

| 38.89 | 1 years | 4.42% | 11.16% | 8.41% | -0.69% | 6.27% | 16.43% | - | - | - | - | Invest | |

| 14.68 | 11 years | 0.49% | 2.55% | 6.41% | 16.67% | - | 16.32% | 12.36% | 12.41% | 10.84% | - | Invest | |

| 1231.06 | 1 years | 4.17% | 5.49% | -4.46% | -12.87% | -8% | 15.66% | - | - | - | - | Invest | |

| 1027.25 | 2 years | 3.56% | 8.98% | 6.82% | -0.08% | 1.61% | 14.01% | 17.42% | - | - | - | Invest | |

| 415.85 | 1 years | 3.04% | 4.89% | -5.09% | -9.14% | -11.69% | 13.67% | - | - | - | - | Invest | |

| 65.43 | 2 years | 6.05% | -2.74% | 5.94% | 5.57% | 10.02% | 13.52% | 10.37% | - | - | - | Invest | |

| 110.69 | 2 years | 0.61% | 2.65% | 4.33% | 5.64% | 4.4% | 12.19% | 9.97% | - | - | - | Invest | |

| 179.11 | 1 years | 0.46% | 2.8% | 4.65% | 4.36% | 4.28% | 11.96% | - | - | - | - | Invest | |

| 19.46 | 1 years | 0.61% | 2.48% | 4.15% | 5.38% | 4.28% | 11.31% | - | - | - | - | Invest | |

| 2903.51 | 3 years | 0.58% | 2.85% | 4.02% | 5.19% | 4.09% | 11.1% | 9.52% | 8.41% | - | - | Invest | |

| 2573.87 | 2 years | 3.74% | 5.39% | -4.59% | -11.08% | -9.14% | 10.65% | 20.48% | - | - | - | Invest | |

| 208.14 | 2 years | 0.28% | 1.41% | 2.59% | 3.67% | 2.81% | 10.61% | 8.64% | - | - | - | Invest | |

| 4094 | 26 years | 0.46% | 2.67% | 4.33% | 4.04% | 3.94% | 10.61% | 8.53% | 7.6% | 6.52% | 7.3% | Invest | |

| 4094 | 26 years | 0.46% | 2.67% | 4.33% | 4.04% | 3.94% | 10.61% | 8.53% | 7.6% | 6.52% | 7.3% | Invest | |

| 49091.55 | 18 years | 4.37% | 5.82% | -7.01% | -14.44% | -13.07% | 10.5% | 24.36% | 16.49% | 30.25% | 15.86% | Invest | |

| 3035.23 | 16 years | 0.45% | 2.18% | 3.63% | 3.72% | 3.54% | 10.39% | 8.81% | 7.27% | 7.03% | 7.9% | Invest | |

| 2087.67 | 25 years | 0.45% | 2.22% | 3.5% | 4.15% | 3.47% | 9.71% | 8.17% | 7.16% | 6.4% | 6.69% | Invest | |

| 2087.67 | 25 years | 0.45% | 2.22% | 3.5% | 4.15% | 3.47% | 9.71% | 8.17% | 7.16% | 6.4% | 6.69% | Invest | |

| 3051.69 | 21 years | 1.14% | 3.12% | 1.89% | 0.11% | 1.02% | 9.42% | 12.66% | 10.19% | 12.7% | 9.32% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 | Sep-2024 | Aug-2024 | Jul-2024 | Jun-2024 | May-2024 |

|---|

| Fund Name | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 | 2022-Q3 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2520.47 | High |

15.06%

|

45.96%

|

33.55%

|

27.19%

|

19.26%

|

15.16%

|

11.54%

|

Invest | |

| 38.89 | Very High |

3.53%

|

7.03%

|

-

|

-

|

-

|

-

|

11.77%

|

Invest | |

| 14.68 | High |

-

|

-

|

-

|

-

|

-

|

4.21%

|

4.71%

|

Invest | |

| 1231.06 | Very High |

-4.38%

|

-9.77%

|

-

|

-

|

-

|

-

|

2.03%

|

Invest | |

| 1027.25 | Very High |

1.95%

|

3.48%

|

10.46%

|

-

|

-

|

-

|

11.57%

|

Invest | |

| 415.85 | Very High |

-4.91%

|

-4.85%

|

-

|

-

|

-

|

-

|

2.32%

|

Invest | |

| 65.43 | Very High |

-0.5%

|

6.52%

|

14.28%

|

-

|

-

|

-

|

13.87%

|

Invest | |

| 110.69 | Moderate |

3.87%

|

12.55%

|

11.01%

|

-

|

-

|

-

|

10.76%

|

Invest | |

| 179.11 | Moderate |

3.76%

|

11.29%

|

-

|

-

|

-

|

-

|

11.37%

|

Invest | |

| 19.46 | Moderate |

3.65%

|

11.91%

|

-

|

-

|

-

|

-

|

10.97%

|

Invest | |

| 2903.51 | Moderate |

3.42%

|

11.51%

|

10.16%

|

9.57%

|

-

|

-

|

9.28%

|

Invest | |

| 2573.87 | Very High |

-5.48%

|

-11.77%

|

7.93%

|

-

|

-

|

-

|

11.56%

|

Invest | |

| 208.14 | Moderate |

2.45%

|

9.3%

|

9.1%

|

-

|

-

|

-

|

8.93%

|

Invest | |

| 4094 | Low to Moderate |

3.47%

|

10.49%

|

9.34%

|

8.71%

|

6.97%

|

7.17%

|

8.09%

|

Invest | |

| 4094 | Low to Moderate |

3.47%

|

10.49%

|

9.34%

|

8.71%

|

6.97%

|

7.17%

|

8.09%

|

Invest | |

| 49091.55 | Very High |

-7.61%

|

-17.08%

|

7.89%

|

14.92%

|

19.39%

|

17.85%

|

17.61%

|

Invest | |

| 3035.23 | Moderately High |

2.99%

|

9.9%

|

9.38%

|

8.69%

|

7.06%

|

7.44%

|

7.98%

|

Invest | |

| 2087.67 | Moderate |

3.02%

|

9.75%

|

8.87%

|

8.27%

|

6.62%

|

6.68%

|

7.59%

|

Invest | |

| 2087.67 | Moderate |

3.02%

|

9.75%

|

8.87%

|

8.27%

|

6.62%

|

6.68%

|

7.59%

|

Invest | |

| 3051.69 | Moderately High |

1.22%

|

4.31%

|

9.17%

|

10.4%

|

10.26%

|

9.91%

|

9.05%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| High |

10.94%

|

-

|

0.93%

|

0.62%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

17.609%

|

-

|

-

|

0.093%

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

2.22%

|

-

|

0.52%

|

-

|

Invest | |

| Low to Moderate |

2.22%

|

-

|

0.52%

|

-

|

Invest | |

| Very High |

15.958%

|

-

|

0.86%

|

0.648%

|

Invest | |

| Moderately High |

2.14%

|

-

|

1.08%

|

-

|

Invest | |

| Moderate |

2.18%

|

-

|

1.17%

|

-

|

Invest | |

| Moderate |

2.18%

|

-

|

1.17%

|

-

|

Invest | |

| Moderately High |

4.678%

|

1.38%

|

1.294%

|

0.56%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹100

|

₹100

|

0.5%

|

Abhishek Bisen

|

25-Mar 2011

|

Invest | |

|

₹100

|

₹100

|

0.74%

|

Abhishek Bisen

|

14-Aug 2023

|

Invest | |

|

₹1000

|

₹0

|

1.26%

|

Arjun Khanna

|

20-Dec 2013

|

Invest | |

|

₹100

|

₹100

|

2.12%

|

Abhishek Bisen

|

16-Nov 2023

|

Invest | |

|

₹100

|

₹100

|

2.19%

|

Abhishek Bisen

|

27-Feb 2023

|

Invest | |

|

₹100

|

₹100

|

2.39%

|

Abhishek Bisen

|

11-Dec 2023

|

Invest | |

|

₹100

|

₹100

|

0.6%

|

Abhishek Bisen

|

31-Mar 2023

|

Invest | |

|

₹0

|

₹5000

|

-

|

Deepak Agrawal

|

30-Dec 2022

|

Invest | |

|

₹100

|

₹100

|

0.62%

|

Abhishek Bisen

|

06-Mar 2024

|

Invest | |

|

₹100

|

₹100

|

0.39%

|

Abhishek Bisen

|

11-Oct 2023

|

Invest | |

|

₹100

|

₹100

|

0.36%

|

Abhishek Bisen

|

11-Feb 2022

|

Invest | |

|

₹100

|

₹100

|

1.96%

|

Abhishek Bisen

|

28-Sep 2022

|

Invest | |

|

₹100

|

₹100

|

0.3%

|

Abhishek Bisen

|

17-Nov 2022

|

Invest | |

|

₹100

|

₹100

|

1.48%

|

Abhishek Bisen

|

29-Dec 1998

|

Invest | |

|

₹100

|

₹100

|

1.48%

|

Abhishek Bisen

|

29-Dec 1998

|

Invest | |

|

₹100

|

₹100

|

1.44%

|

Atul Bhole

|

30-Mar 2007

|

Invest | |

|

₹100

|

₹100

|

1.33%

|

Deepak Agrawal

|

26-May 2008

|

Invest | |

|

₹100

|

₹100

|

1.65%

|

Abhishek Bisen

|

25-Nov 1999

|

Invest | |

|

₹100

|

₹100

|

1.65%

|

Abhishek Bisen

|

25-Nov 1999

|

Invest | |

|

₹100

|

₹100

|

1.66%

|

Abhishek Bisen

|

02-Dec 2003

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

36.004

(15-04-2025)

|

36.1298

(11-04-2025)

|

-0.35%

|

36.1298

|

27.0804

|

Invest | |

|

13.9

(15-04-2025)

|

13.428

(11-04-2025)

|

3.52%

|

14.6

|

11.236

|

Invest | |

|

19.216

(25-02-2020)

|

19.216

(25-02-2020)

|

0%

|

-

|

-

|

Invest | |

|

12.467

(15-04-2025)

|

12.226

(11-04-2025)

|

1.97%

|

14.922

|

10.813

|

Invest | |

|

14.432

(15-04-2025)

|

14.034

(11-04-2025)

|

2.84%

|

15.156

|

12.452

|

Invest | |

|

12.679

(15-04-2025)

|

12.43

(11-04-2025)

|

2%

|

14.424

|

10.844

|

Invest | |

|

12.8695

(15-04-2025)

|

12.5099

(11-04-2025)

|

2.87%

|

13.5658

|

10.7874

|

Invest | |

|

12.4035

(15-04-2025)

|

12.373

(11-04-2025)

|

0.25%

|

12.4035

|

11.0014

|

Invest | |

|

11.1043

(15-04-2025)

|

11.0728

(11-04-2025)

|

0.28%

|

11.1043

|

9.8863

|

Invest | |

|

11.6541

(15-04-2025)

|

11.6211

(11-04-2025)

|

0.28%

|

11.6541

|

10.4448

|

Invest | |

|

12.6199

(15-04-2025)

|

12.5711

(11-04-2025)

|

0.39%

|

12.6199

|

11.3386

|

Invest | |

|

14.394

(15-04-2025)

|

14.028

(11-04-2025)

|

2.61%

|

16.632

|

13.023

|

Invest | |

|

12.1512

(15-04-2025)

|

12.1384

(11-04-2025)

|

0.11%

|

12.1512

|

10.9584

|

Invest | |

|

96.7162

(15-04-2025)

|

96.4829

(11-04-2025)

|

0.24%

|

96.7162

|

87.1757

|

Invest | |

|

96.7162

(15-04-2025)

|

96.4829

(11-04-2025)

|

0.24%

|

93.3235

|

87.1757

|

Invest | |

|

117.131

(15-04-2025)

|

113.812

(11-04-2025)

|

2.92%

|

137.749

|

106.026

|

Invest | |

|

37.2167

(15-04-2025)

|

37.1448

(11-04-2025)

|

0.19%

|

37.2167

|

33.6623

|

Invest | |

|

76.2626

(15-04-2025)

|

76.1078

(11-04-2025)

|

0.2%

|

76.2626

|

69.3428

|

Invest | |

|

76.2626

(15-04-2025)

|

76.1078

(11-04-2025)

|

0.2%

|

73.3116

|

69.3428

|

Invest | |

|

57.2447

(15-04-2025)

|

56.8508

(11-04-2025)

|

0.69%

|

57.5926

|

52.2484

|

Invest |

Kotak Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Kotak Mutual Fund

Kotak Corporate Bond Fund- Regular Plan-Growth Option

3Y Returns 7.16%

VS

Kotak Corporate Bond Fund- Regular Plan-Growth Option

3Y Returns 7.16%

VS

ICICI Prudential Corporate Bond Fund - Growth

3Y Returns 7.65%

ICICI Prudential Corporate Bond Fund - Growth

3Y Returns 7.65%

Kotak Multi Asset Allocator Fund of Fund - Dynamic - Growth

3Y Returns 16.4%

VS

Kotak Multi Asset Allocator Fund of Fund - Dynamic - Growth

3Y Returns 16.4%

VS

HSBC Aggressive Hybrid Active FOF - Growth

3Y Returns 11.63%

HSBC Aggressive Hybrid Active FOF - Growth

3Y Returns 11.63%

Kotak Low Duration Fund- Regular Plan-Growth Option

3Y Returns 6.52%

VS

Kotak Low Duration Fund- Regular Plan-Growth Option

3Y Returns 6.52%

VS

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 6.97%

UTI Low Duration Fund - Regular Plan - Growth Option

3Y Returns 6.97%

Kotak Bluechip Fund - Growth

3Y Returns 12.59%

VS

Kotak Bluechip Fund - Growth

3Y Returns 12.59%

VS

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

Nippon India Large Cap Fund- Growth Plan Bonus Option

3Y Returns 18.29%

Investment Strategy

The long-term investing strategy of Kotak Mutual Fund is long-term investing to achieve better performance and has a strong historical track record. They use the BMV model, in which B refers to scalable and growing business, M stands for corporate governance management, and V stands for appropriate valuation. This approach has helped AMC become one of the top asset management companies (AMCs). This strategy is the secret success strategy of this mutual fund house.

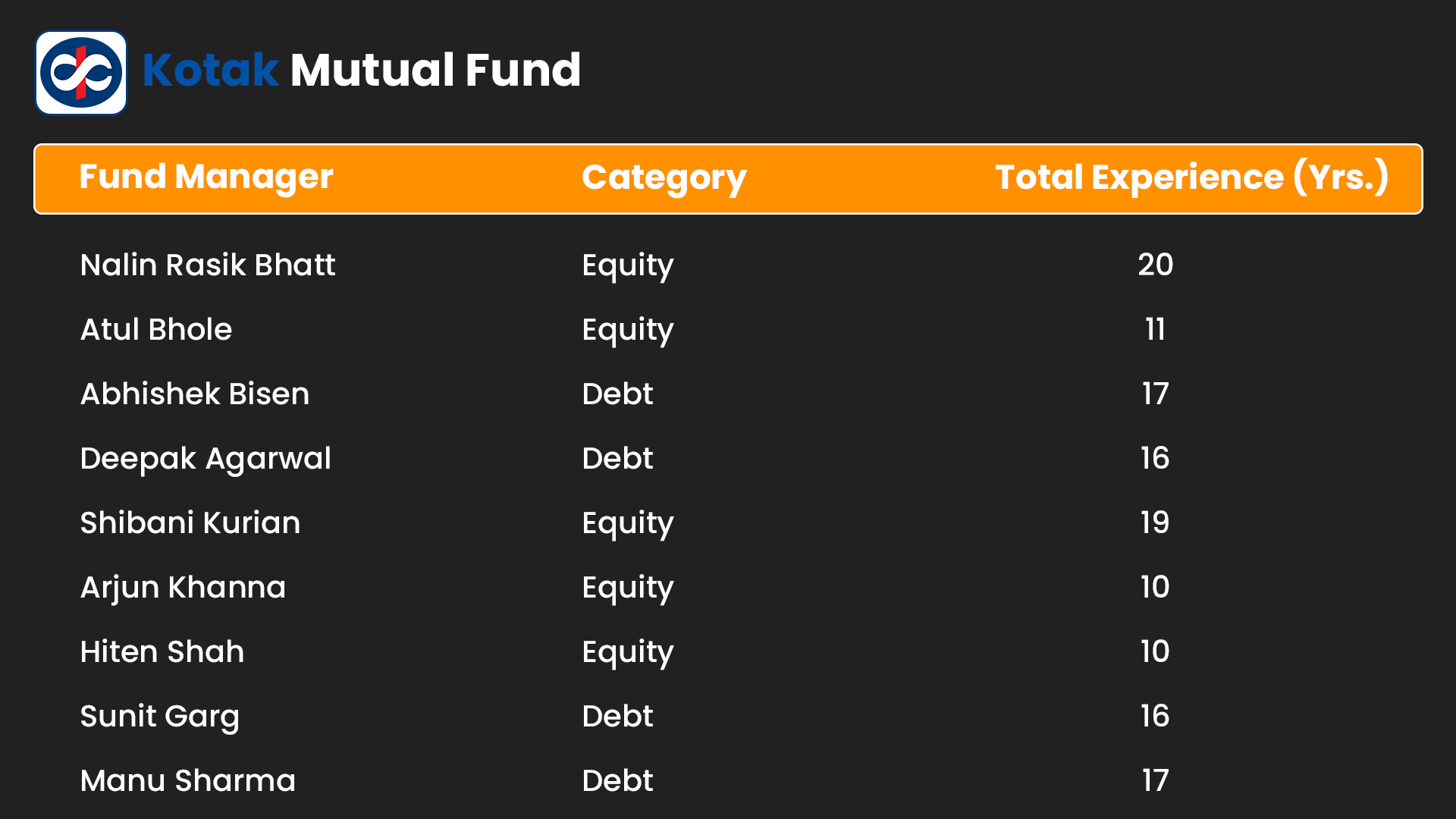

CIO and Fund management team

Mr. Harsha Upadhyaya- (CIO - Equity and Debt)

Mr. Harsha Upadhyaya is the Chief Investment Officer (CIO) for both Equity and Debt at Kotak Mahindra AMC. He has 26 years of rich experience in Equity Research and Fund Management. Previously, he worked at renowned firms including DSP BlackRock, UTI Asset Management, Reliance Group, and SG Asia Securities.

List of all fund manager

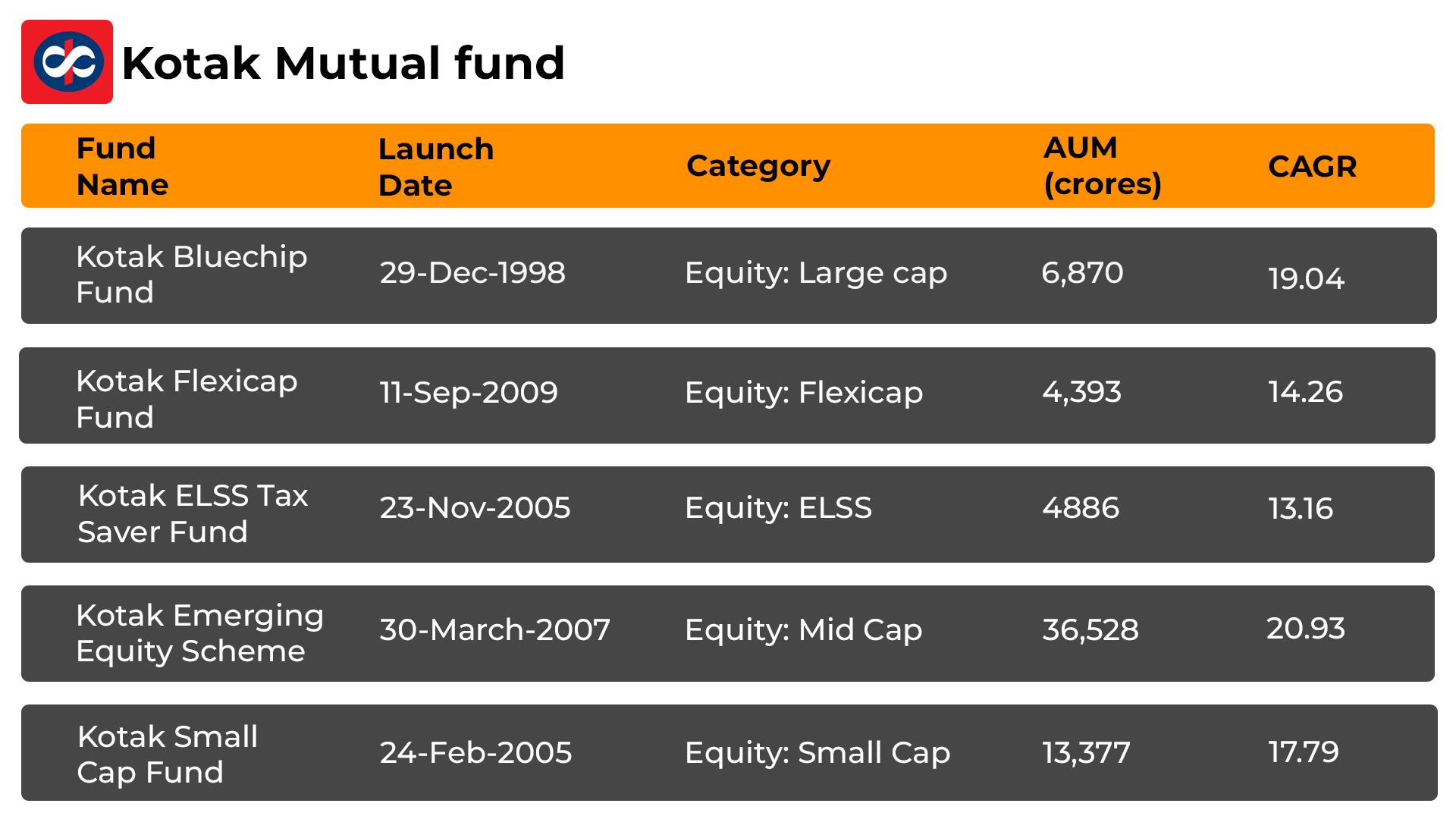

Top 5 Kotak Mutual Funds

History of Kotak Mutual Fund?

Kotak Mahindra Mutual Fund is a trust that operates under the Indian Trusts Act of 1882. The Asset Management Company, also known as Kotak Mahindra Asset Management Company Limited, is incorporated under the Companies Act of 1956. It has authorization from SEBI to serve as the Investment Manager for the Schemes of this assets management company

- Kotak MF has a large funds management staff team.

- Kotak Fund House has 86 branches over a nationwide.

- Kotak AMC offers diverse funds to meet investor needs.

- Kotak's philosophy is bottom-up with a top-down cover.

- Kotak AMC is a strong performer in basic of the research.

How to select the best Kotak Mutual Fund?

To choose the best Kotak mutual funds, take the following actions

- Set financial goals and adjust the plan accordingly.

- Assess your risk tolerance and adjust your strategy.

- Diversify the investments to reduce risk management

- Before investing, research fund performance methods.

- Monitor your portfolio regularly and adjust as needed.

- Consult financial experts for market recommendation

Setting achievable financial goals using the SIP Calculator allows you to identify the future analysis of returns.

How to invest in Kotak Mutual Fund with mysiponline?

Making an investment in Kotak mutual funds is simple and convenient through mysiponline

- Explore mysiponline.com to pick Kotak mutual funds for goals.

- Register for free account, fill out your profile, add chosen fund.

- Verify online KYC with a PAN, Aadhar, signature, a bank proof.

- Explore the funds and add to desired mutual funds to the cart.

- Do a payment of funds, and wait for investment confirmation

- Monitor your assets daily with your mysiponline.com account.

Investing in Kotak Mahindra mutual funds through Online SIP is easy, from picking funds to tracking investments, making it convenient for investors.

Taxation of Kotak Mutual Fund?

The taxation of these Kotak mutual funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Explore Other AMC’s

Top Blogs of Kotak Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.