Parag Parikh Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 6

- Average annual returns 4.7%

About Parag Parikh Mutual Fund

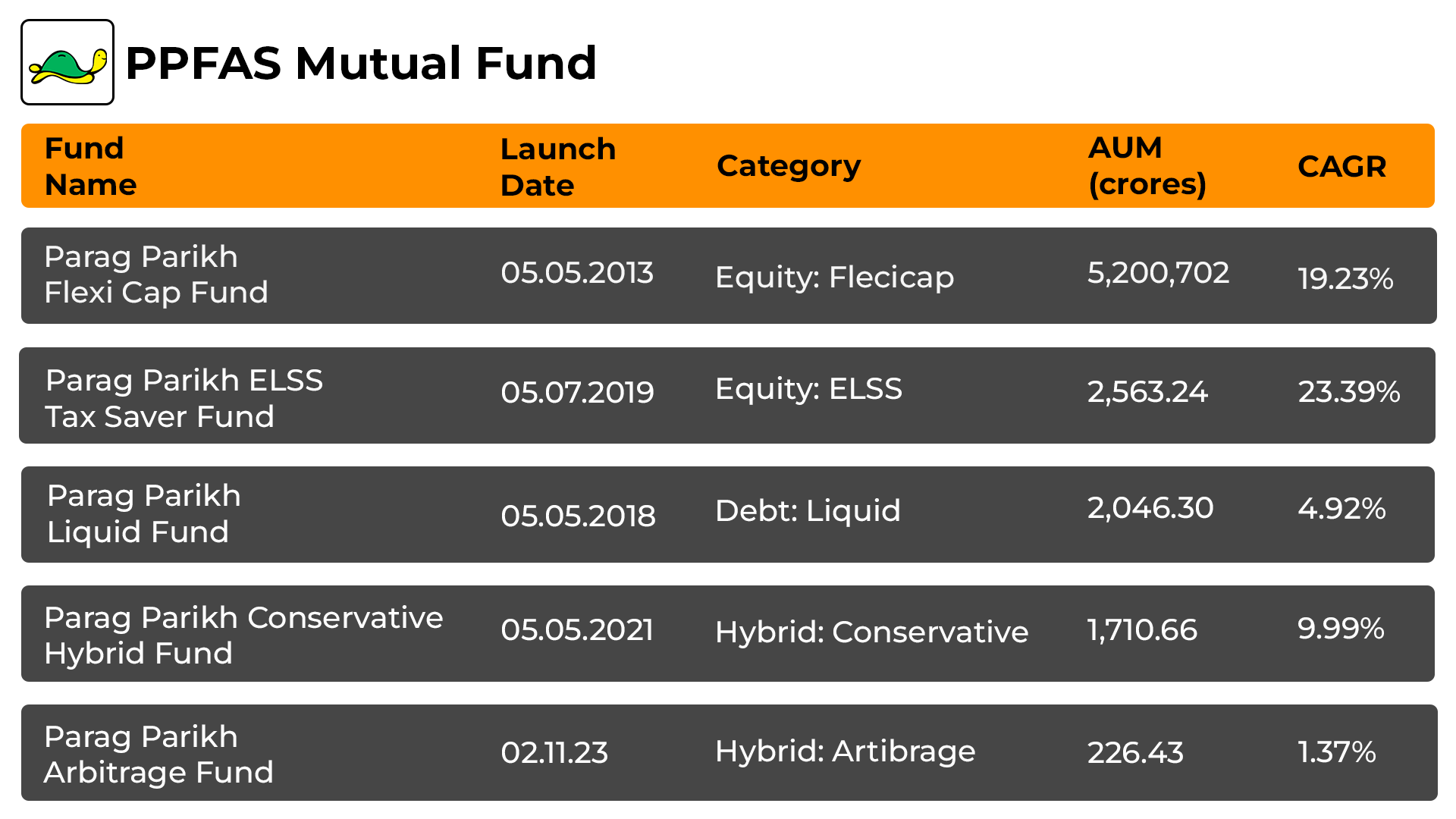

Parag Parikh Financial Advisory Services Limited (PPFAS) mutual fund is one of the first companies in India to be registered with SEBI to provide Portfolio Management Services (PMS). This Asset Management is connected with Parag Parikh Financial Advisory Services Pvt. Ltd. (PPFAS Ltd.), a small investment advisory firm started in 1992. PPFAS ranks 18th among other top asset management companies and offers 5 schemes including 2 Equity, 1 debt, and 2 Hybrid. The AMC employs flexible investment strategies, allowing for dynamic asset allocation based on market conditions, which can help optimize returns and manage risk effectively. The Parag Parikh ELSS Tax Saver Fund, the flagship scheme, has exhibited an impressive average annualized return of 23.98% since its inception.

More-

Launched in

10-Oct-2012

-

AMC Age

12 Years

-

Website

https://amc.ppfas.com -

Email Address

priyah@ppfas.com

Top Performing Parag Parikh Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4572.13 | 5 years | 4.73% | 4.38% | 2.04% | -2.54% | -1.57% | 13.73% | 22.38% | 16.73% | 26.88% | - | Invest | |

| 89703.46 | 11 years | 2.85% | 2.58% | -0.1% | -1.78% | -2.42% | 12.66% | 24.54% | 17.02% | 27.46% | 16.8% | Invest | |

| 2397.73 | 3 years | 1.03% | 2.54% | 2.92% | 3.33% | 3.25% | 10.68% | 13.61% | 11.53% | - | - | Invest | |

| 1610.19 | 1 years | 1.18% | 2.83% | 2.79% | 3.22% | 2.82% | 10.54% | - | - | - | - | Invest | |

| 1204.44 | 1 years | 0.23% | 0.84% | 1.8% | 3.57% | 2.14% | 7.12% | - | - | - | - | Invest | |

| 2256.94 | 6 years | 0.12% | 0.66% | 1.72% | 3.41% | 2.07% | 6.91% | 6.86% | 6.38% | 5.08% | - | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 | Sep-2024 | Aug-2024 | Jul-2024 | Jun-2024 | May-2024 |

|---|

| Fund Name | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 | 2022-Q3 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 4572.13 | Very High |

-1.97%

|

-2.34%

|

11.48%

|

15.69%

|

18.21%

|

-

|

19.37%

|

Invest | |

| 89703.46 | Very High |

-3%

|

-2.72%

|

12.8%

|

18.05%

|

18.94%

|

18.77%

|

18.46%

|

Invest | |

| 2397.73 | Moderately High |

2.54%

|

8.35%

|

11.52%

|

12.06%

|

-

|

-

|

11.47%

|

Invest | |

| 1610.19 | Moderate |

2.53%

|

7.7%

|

-

|

-

|

-

|

-

|

8.29%

|

Invest | |

| 1204.44 | Low |

1.68%

|

6.9%

|

-

|

-

|

-

|

-

|

7.06%

|

Invest | |

| 2256.94 | Low to Moderate |

1.76%

|

7%

|

6.95%

|

6.81%

|

5.99%

|

-

|

5.55%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

10.084%

|

4.826%

|

0.659%

|

0.992%

|

Invest | |

| Very High |

10.686%

|

5.189%

|

0.676%

|

1.004%

|

Invest | |

| Moderately High |

3.23%

|

3.435%

|

0.76%

|

1.412%

|

Invest | |

| Moderate |

-

|

-

|

-

|

-

|

Invest | |

| Low |

-

|

-

|

-

|

-

|

Invest | |

| Low to Moderate |

0.338%

|

-

|

0.967%

|

-

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹1000

|

₹500

|

1.73%

|

Rajeev Thakkar

|

24-Jul 2019

|

Invest | |

|

₹1000

|

₹1000

|

1.33%

|

Rajeev Thakkar

|

24-May 2013

|

Invest | |

|

₹1000

|

₹5000

|

0.65%

|

Rajeev Thakkar

|

26-May 2021

|

Invest | |

|

₹1000

|

₹5000

|

0.63%

|

Rajeev Thakkar

|

27-Feb 2024

|

Invest | |

|

₹1000

|

₹1000

|

0.66%

|

Rajeev Thakkar

|

02-Nov 2023

|

Invest | |

|

₹1000

|

₹5000

|

0.27%

|

Raj Mehta

|

11-May 2018

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

30.0745

(17-04-2025)

|

29.7931

(16-04-2025)

|

0.94%

|

32.0171

|

26.4499

|

Invest | |

|

79.0298

(17-04-2025)

|

78.3515

(16-04-2025)

|

0.87%

|

82.668

|

70.3049

|

Invest | |

|

14.8017

(17-04-2025)

|

14.7817

(16-04-2025)

|

0.14%

|

14.8017

|

13.364

|

Invest | |

|

11.1832

(17-04-2025)

|

11.1640

(16-04-2025)

|

0.17%

|

11.1832

|

10.1293

|

Invest | |

|

11.0922

(17-04-2025)

|

11.0861

(16-04-2025)

|

0.06%

|

11.0922

|

10.3529

|

Invest | |

|

1431.5858

(20-04-2025)

|

1431.3511

(19-04-2025)

|

0.02%

|

1431.59

|

1339.12

|

Invest |

Parag Parikh Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top Parag Parikh Mutual Fund

Parag Parikh Arbitrage Fund Regular - Growth

3Y Returns 0%

VS

Parag Parikh Arbitrage Fund Regular - Growth

3Y Returns 0%

VS

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 6.88%

SBI Arbitrage Opportunities Fund - Regular Plan - Gr

3Y Returns 6.88%

Parag Parikh Tax Saver Fund Regular - Growth

3Y Returns 16.73%

VS

Parag Parikh Tax Saver Fund Regular - Growth

3Y Returns 16.73%

VS

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 12.75%

Quant ELSS Tax Saver Fund Regular Plan-Growth

3Y Returns 12.75%

Parag Parikh Flexi Cap Fund Regular-Growth

3Y Returns 17.02%

VS

Parag Parikh Flexi Cap Fund Regular-Growth

3Y Returns 17.02%

VS

Franklin India Flexi Cap Fund - Growth

3Y Returns 16.93%

Franklin India Flexi Cap Fund - Growth

3Y Returns 16.93%

Parag Parikh Conservative Hybrid Fund Regular - Growth

3Y Returns 11.53%

VS

Parag Parikh Conservative Hybrid Fund Regular - Growth

3Y Returns 11.53%

VS

HDFC Hybrid Debt Fund - Growth Plan

3Y Returns 10.53%

HDFC Hybrid Debt Fund - Growth Plan

3Y Returns 10.53%

Investment Strategy

To generate long-term capital growth, the fund management actively manages a portfolio primarily comprised of equities and equity-related securities (ERS). This means that the manager selects and controls investments in stocks and other stock-related instruments, to increase the portfolio's overall value over time. The active management method entails making strategic decisions depending on market conditions, company performance, and other factors to optimize long-term returns to investors.

Head of Equity & Debt Team (CIO)

Mr. Rajeev Thakkar (CIO)

The current Chief Investment Officer of Parag Parikh Mutual Fund began his career in 1994 and has extensive experience in financial services. Joining PPFAS Limited in 2001, he initially served as a Fund Manager for its Portfolio Management Services (PMS). During his tenure, he ascended to the role of Chief Executive Officer, a position he held until 2012.

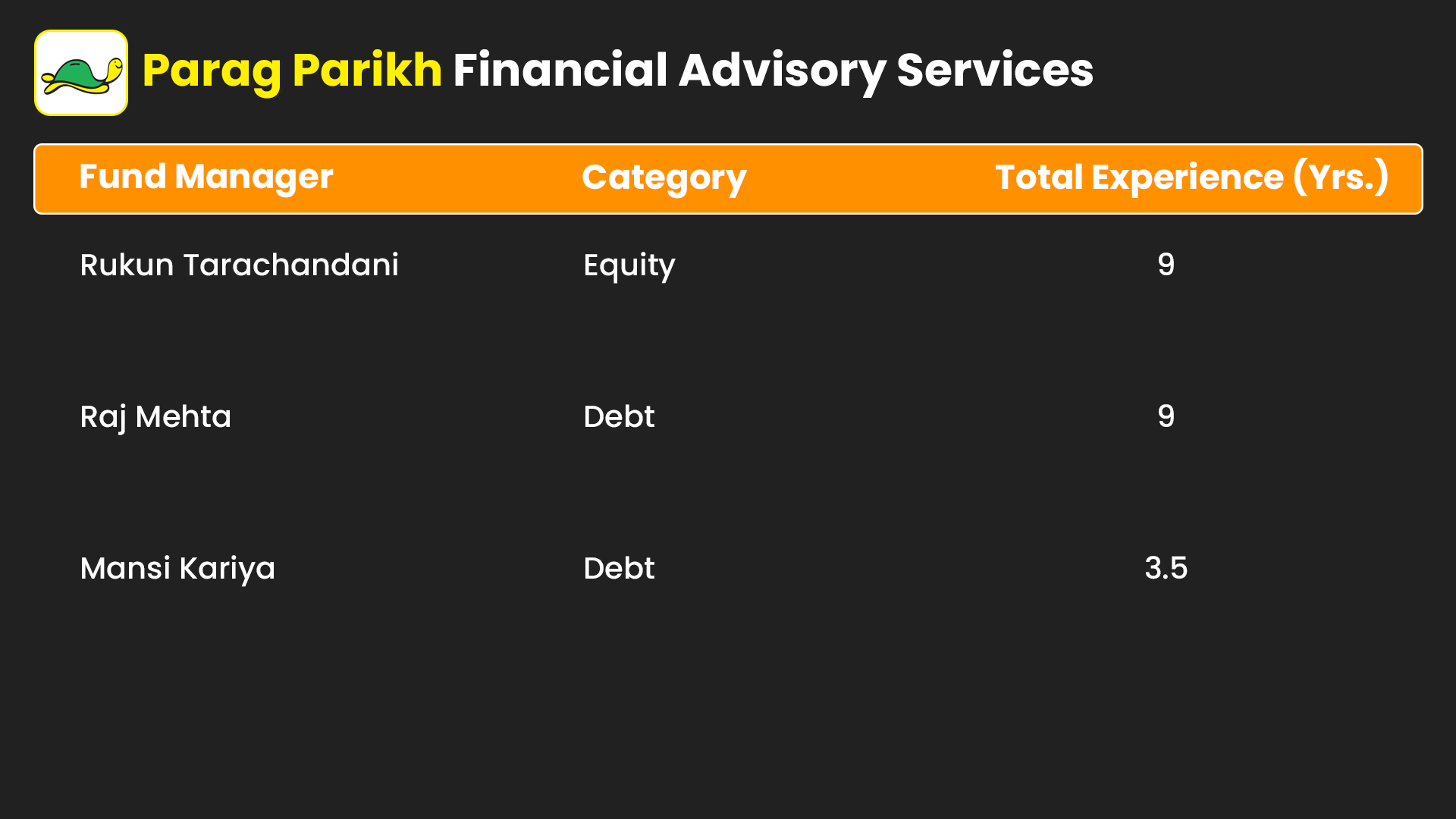

List of all Fund Manager

Top 5 Parag Parikh Mutual Fund

History Of Parag Parikh Mutual Fund

This Asset Management (PPFAS AMC) is supported by PPFAS Ltd., an investment advisory firm founded in 1992 and an early SEBI Registered Portfolio Management Service (PMS) provider in India. PPFAS Asset Management Private Limited, established under the Companies Act, of 1956, has SEBI approval to serve as the Asset Management Company for the Parag Parikh Mutual Fund.

- This AMC invests in top-notch companies for long-term growth.

- This PPFAS Fund house has a wide range of varieties of fund schemes.

- PPFAS AMC places a high value on loyalty to strong moral principles.

- PPFAS fund house provide consistently excels in their categories.

How to Select the Best Parag Parikh Mutual Fund?

It is the initial step in beginning your financial journey by selecting the Best Parag Parikh Mutual Fund. Thus, making the right call is critical for making an informed decision. Here are a few areas where you can do it properly:

- Establishing Goals : Before investing, define your objectives, set realistic goals, and plan accordingly.

- Assess Risk : Manage ris and establish boundaries to manage risk for potential rewards.

- Diversification : Spread investments across various sectors to mitigate risk and enhance returns.

- Increase Awareness : Research potential funds, analyzing historical performance for insights.

- Keep Eye on Investments : Monitor investments to safeguard assets and minimize potential losses.

- Professional Advice : Seeking guidance from financial experts, particularly in the realm of mutual funds.

In the end, considering the above factors and also learning to use an SIP calculator without any complex formula.

How to Invest in Parag Parikh Mutual Fund Schemes via MySIPonline?

You can invest in Parag Parikh mutual fund in various ways where mysiponline stands out for its easy and simple way of investing-

- Visit mysiponline.com, to select PPFAS's top mutual funds.

- Register for a free account, and fill out your profile details.

- Verify KYC with PAN, Aadhar card, Signature, and Bank proof.

- Browse and add the mutual funds you want to your cart.

- Finalize your payment and await confirmation of your investment.

- Keep track of your investments using your mysiponline.com account.

In conclusion,Online SIP provides the discipline investment and long-term capital wealth.

What is the Taxation on Parag Parikh Mutual Fund?

The taxation of PPFAS mutual funds depends on which category they fall under equity or debt.

Equity-Oriented Mutual Funds

-

Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

-

Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

-

Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

-

Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Can I invest for a very short-term duration in Parag Parikh Mutual Fund?

What are the different Parag Parikh mutual funds available?

What is the advantage of investing in amc Funds?

Are all SIPs in Parag Parikh Funds online tax-free?

How to analyse the performance of Parag Parikh Mutual Fund?

Why do I need a financial adviser?

Explore Other AMC’s

Top Videos and Blogs of Parag Parikh Mutual Fund

Videos

Blogs

Best Flexi Cap Mutual Funds 2023 | Parag Parikh Flexi Cap Fund vs Top Flexi Cap Funds 2023

Best Flexi Cap Mutual Funds 2023 | Parag Parikh Flexi Cap Fund vs Top Flexi Cap Funds 2023

Best Flexi Cap Mutual Funds 2023 | Parag Parikh Flexi Cap Fund vs Top Flexi Cap Funds 2023

Best Flexi Cap Mutual Funds 2023 | Parag Parikh Flexi Cap Fund vs Top Flexi Cap Funds 2023

Parag Parikh Flexi Cap Fund Vs Quant Active Fund Vs PGIM India Flexi Cap Fund - Best Comparison

Parag Parikh Flexi Cap Fund Vs Quant Active Fund Vs PGIM India Flexi Cap Fund - Best Comparison

Parag Parikh Flexi Cap Fund Vs Quant Active Fund Vs PGIM India Flexi Cap Fund - Best Comparison

Parag Parikh Flexi Cap Fund Vs Quant Active Fund Vs PGIM India Flexi Cap Fund - Best Comparison

You can select three funds for compare.

You can select three funds for compare.