UTI Mutual Fund

Check list of all schemes, latest NAV, Returns and other important information

- Total Funds 70

- Average annual returns 4.9%

About UTI Mutual Fund

Unit Trust of India (UTI) is the oldest asset management company (AMC) in India. UTI existed since 1980 under the banner of the Unit Trust of India, it currently ranks 7th among all mutual fund companies in India. Mr. Vetri Subramaniam serves as the key fund manager and Chief Investment Officer (Equity). UTI Mutual Fund manages a total of 91 schemes, including 33 equity schemes, 34 debt schemes, and 10 hybrid schemes. UTI master share fund is the oldest running fund started in 1986.

More-

Launched in

01-Feb-2003

-

AMC Age

22 Years

-

Website

https://www.utimf.com -

Email Address

service@uti.co.in

Top Performing UTI Mutual Fund in India for High Returns

Returns

SIP Returns

Risk

Information

NAV Details

Data in this table : Get historical returns. If 1Y column is 10% that means, fund has given 10% returns in last 1 year.

Select date points :

Submit| Fund Name | AUM (Cr.) | Fund Age | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1150.43 | 19 years | 5.38% | 4.12% | -3.83% | -6.75% | -8.8% | 20.92% | 34.55% | 18.94% | 22.35% | 10.5% | Invest | |

| 1127.8 | 19 years | 7.59% | 11.05% | 12% | 5.06% | 6.99% | 18.41% | 21.34% | 16.53% | 23.07% | 10.77% | Invest | |

| 9605.67 | 19 years | 6% | 4.76% | -0.67% | -8.84% | 14.91% | 13.73% | 24.85% | 16.18% | 24.71% | 12.21% | Invest | |

| 25096.33 | 19 years | 5.93% | 6.23% | -0.35% | -6.1% | -4.12% | 13.33% | 16.9% | 7.29% | 19.82% | 11.46% | Invest | |

| 4046.69 | 19 years | 6.06% | 6.61% | -0.81% | -7.64% | 13.51% | 12.46% | 28.43% | 19.36% | 28.46% | 12.78% | Invest | |

| 5956.36 | 25 years | 4.59% | 5.16% | 0.63% | -3.83% | 12.9% | 11.81% | 21.45% | 15.55% | 22.72% | 11.64% | Invest | |

| 3959.48 | 19 years | 5.23% | 4.25% | -2.3% | -10.33% | 15.07% | 11.77% | 26.99% | 15.32% | 24.54% | 12.92% | Invest | |

| 1632.94 | 21 years | 1.81% | 3.12% | 2.8% | 1.44% | 2.1% | 11.27% | 12.21% | 9.48% | 12.3% | 8.17% | Invest | |

| 663.24 | 2 months | 0.51% | 2.64% | 4.38% | 5.02% | 4.41% | 11.01% | 8.77% | 7.76% | 6.31% | 7.56% | Invest | |

| 647.81 | 23 years | 0.51% | 2.64% | 4.38% | 5.02% | 4.41% | 11.01% | 8.77% | 7.76% | 6.31% | 7.56% | Invest | |

| 2921.21 | 1 years | 3.88% | 4.57% | 2.84% | 0.25% | 1.46% | 10.73% | - | - | - | - | Invest | |

| 315.98 | 26 years | 0.45% | 2.55% | 3.8% | 4.95% | 3.99% | 10.54% | 8.27% | 10.07% | 9.05% | 5.72% | Invest | |

| 4351.22 | 4 years | 7.04% | 6.29% | -8.4% | -13.7% | -13.66% | 10.41% | 24.23% | 14% | - | - | Invest | |

| 533.96 | 14 years | 0.49% | 2.46% | 3.73% | 4.63% | 3.82% | 10.23% | 8.31% | 9.73% | 9.19% | 6.91% | Invest | |

| 4778.69 | 6 years | 0.49% | 2.16% | 3.34% | 4.8% | 3.6% | 9.57% | 8.15% | 7.08% | 6.74% | - | Invest | |

| 39.35 | 10 years | 0.55% | 2% | 3.17% | 4.58% | 3.43% | 9.27% | 7.74% | 6.78% | 5.79% | 6.09% | Invest | |

| 3642.98 | 19 years | 5.88% | 6.31% | -0.13% | -8.19% | 11.86% | 9.18% | 19.4% | 10.77% | 21.17% | 11.32% | Invest | |

| 43451.23 | 9 years | 6.37% | 5.91% | 2.63% | -2.75% | 0.19% | 8.89% | 15.85% | 11.7% | 20.67% | - | Invest | |

| 12481.94 | 19 years | 5.81% | 6.1% | 1.7% | -4.84% | 13.18% | 8.88% | 17.76% | 10.41% | 20.19% | 10.91% | Invest | |

| 675.14 | 17 years | 4.94% | 8.44% | -1.21% | -10.37% | -4.55% | 8.85% | 20.91% | 12.89% | 18.33% | 10.2% | Invest |

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | Apr-2025 | Mar-2025 | Feb-2025 | Jan-2025 | Dec-2024 | Nov-2024 | Oct-2024 | Sep-2024 | Aug-2024 | Jul-2024 | Jun-2024 | May-2024 |

|---|

| Fund Name | 2025-Q2 | 2025-Q1 | 2024-Q4 | 2024-Q3 | 2024-Q2 | 2024-Q1 | 2023-Q4 | 2023-Q3 | 2023-Q2 | 2023-Q1 | 2022-Q4 | 2022-Q3 |

|---|

| Fund Name | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|

| Fund Name | AUM (Cr.) | Risk | 1W | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 5Y | 10Y |

|---|

| Fund Name | AUM (Cr.) | Initial NAV | Final NAV | NAV Change | Absolute Ret. | Annalized Ret. |

|---|

| Fund Name | AUM (Cr.) | Risk | 6M | 1Y | 2Y | 3Y | 5Y | 10Y | From Launch | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1150.43 | Very High |

-2.09%

|

3.31%

|

22.09%

|

25.74%

|

19.89%

|

16.52%

|

15.35%

|

Invest | |

| 1127.8 | Very High |

8.9%

|

17.51%

|

18.35%

|

19.11%

|

18.43%

|

12.71%

|

12.88%

|

Invest | |

| 9605.67 | Very High |

-1.04%

|

-4.34%

|

14.03%

|

17.97%

|

18.53%

|

15.78%

|

14.26%

|

Invest | |

| 25096.33 | Very High |

-0.32%

|

-0.66%

|

9.35%

|

11.38%

|

11.4%

|

12.93%

|

13.58%

|

Invest | |

| 4046.69 | Very High |

-0.62%

|

-3.64%

|

15.35%

|

20.75%

|

21.85%

|

16.62%

|

11.88%

|

Invest | |

| 5956.36 | Very High |

0.6%

|

0.67%

|

12.92%

|

16.44%

|

17.43%

|

14.03%

|

12.28%

|

Invest | |

| 3959.48 | Very High |

-1.95%

|

-7.21%

|

13.59%

|

18.86%

|

18.82%

|

15.89%

|

14.04%

|

Invest | |

| 1632.94 | Moderately High |

2.49%

|

7.29%

|

10.44%

|

10.77%

|

10.31%

|

8.84%

|

9.18%

|

Invest | |

| 663.24 | Moderate |

3.91%

|

11.54%

|

10%

|

9.12%

|

7.2%

|

7.3%

|

7.94%

|

Invest | |

| 647.81 | Moderate |

3.91%

|

11.54%

|

10%

|

9.12%

|

7.2%

|

7.3%

|

7.95%

|

Invest | |

| 2921.21 | Very High |

2.46%

|

5.76%

|

-

|

-

|

-

|

-

|

9.93%

|

Invest | |

| 315.98 | Moderate |

3.57%

|

11.12%

|

9.4%

|

8.61%

|

8.95%

|

6.3%

|

6.98%

|

Invest | |

| 4351.22 | Very High |

-5.19%

|

-11.1%

|

8.21%

|

15.1%

|

-

|

-

|

16.25%

|

Invest | |

| 533.96 | Moderate |

3.46%

|

10.73%

|

9.35%

|

8.47%

|

9.05%

|

7.24%

|

7.53%

|

Invest | |

| 4778.69 | Low to Moderate |

3.21%

|

10.44%

|

9.01%

|

8.32%

|

6.93%

|

-

|

7.08%

|

Invest | |

| 39.35 | Moderate |

3.05%

|

10%

|

8.6%

|

7.95%

|

6.78%

|

5.73%

|

5.73%

|

Invest | |

| 3642.98 | Very High |

0.07%

|

-5.07%

|

8.87%

|

12.73%

|

14.04%

|

13.34%

|

12.09%

|

Invest | |

| 43451.23 | Very High |

2.05%

|

1.32%

|

9.3%

|

12.29%

|

13.75%

|

-

|

13.88%

|

Invest | |

| 12481.94 | Very High |

1.46%

|

-1%

|

9.51%

|

12.44%

|

13.47%

|

12.99%

|

12.47%

|

Invest | |

| 675.14 | Very High |

0.48%

|

-5.84%

|

10.25%

|

13.86%

|

14.5%

|

12.68%

|

12.16%

|

Invest |

| Fund Name | Risk | Standard Deviation | Alpha | Beta | Sharpe Ratio | |

|---|---|---|---|---|---|---|

| Very High |

16.371%

|

0.84%

|

0.958%

|

0.731%

|

Invest | |

| Very High |

14.251%

|

3.729%

|

0.915%

|

0.511%

|

Invest | |

| Very High |

12.09%

|

2.62%

|

0.93%

|

0.64%

|

Invest | |

| Very High |

14.334%

|

-

|

0.9%

|

0.03%

|

Invest | |

| Very High |

12.33%

|

3.15%

|

0.92%

|

0.81%

|

Invest | |

| Very High |

9.01%

|

4.53%

|

1.05%

|

0.76%

|

Invest | |

| Very High |

13.05%

|

2.06%

|

0.95%

|

0.58%

|

Invest | |

| Moderately High |

4.158%

|

0.778%

|

1.159%

|

0.455%

|

Invest | |

| Moderate |

1.924%

|

-

|

0.637%

|

-

|

Invest | |

| Moderate |

1.924%

|

-

|

0.637%

|

-

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Moderate |

4.312%

|

2.074%

|

-

|

0.478%

|

Invest | |

| Very High |

15.798%

|

-

|

0.797%

|

0.643%

|

Invest | |

| Moderate |

4.308%

|

2.065%

|

-

|

0.478%

|

Invest | |

| Low to Moderate |

1.041%

|

-

|

0.838%

|

-

|

Invest | |

| Moderate |

1.436%

|

-

|

1.21%

|

-

|

Invest | |

| Very High |

12.37%

|

-

|

0.94%

|

0.28%

|

Invest | |

| Very High |

-

|

-

|

-

|

-

|

Invest | |

| Very High |

11.82%

|

-

|

0.9%

|

0.23%

|

Invest | |

| Very High |

15.355%

|

-

|

0.933%

|

0.317%

|

Invest |

| Fund Name | Min SIP | Min Lumpsum | Expense Ratio | Fund Manager | Launch Date | |

|---|---|---|---|---|---|---|

|

₹500

|

₹5000

|

2.22%

|

Kamal Gada

|

30-Jul 2005

|

Invest | |

|

₹500

|

₹5000

|

2.22%

|

Preethi R S

|

01-Aug 2005

|

Invest | |

|

₹500

|

₹5000

|

1.82%

|

Amit Kumar Premchandani

|

20-Jul 2005

|

Invest | |

|

₹500

|

₹5000

|

1.69%

|

Ajay Tyagi

|

01-Aug 2005

|

Invest | |

|

₹500

|

₹5000

|

1.9%

|

V Srivatsa

|

30-Jul 2005

|

Invest | |

|

₹500

|

₹1000

|

1.89%

|

V Srivatsa

|

25-Mar 2000

|

Invest | |

|

₹500

|

₹5000

|

1.99%

|

Amit Kumar Premchandani

|

15-May 2005

|

Invest | |

|

₹500

|

₹5000

|

1.81%

|

Amit Kumar Premchandani

|

16-Dec 2003

|

Invest | |

|

₹500

|

₹5000

|

0.93%

|

Sudhir Agrawal

|

14-Feb 2025

|

Invest | |

|

₹500

|

₹500

|

0.92%

|

Sudhir Agrawal

|

14-Jan 2002

|

Invest | |

|

₹500

|

₹5000

|

1.96%

|

Anurag Mittal

|

10-Aug 2023

|

Invest | |

|

₹500

|

₹500

|

1.61%

|

Sunil Madhukar Patil

|

18-Jul 1998

|

Invest | |

|

₹500

|

₹5000

|

1.9%

|

Ankit Agarwal

|

22-Dec 2020

|

Invest | |

|

₹500

|

₹500

|

1.53%

|

Sudhir Agrawal

|

24-Jun 2010

|

Invest | |

|

₹500

|

₹500

|

0.59%

|

Anurag Mittal

|

08-Aug 2018

|

Invest | |

|

₹500

|

₹500

|

1.49%

|

Ritesh Nambiar

|

31-Mar 2015

|

Invest | |

|

₹500

|

₹500

|

1.9%

|

Vishal Chopda

|

30-Jul 2005

|

Invest | |

|

₹500

|

₹5000

|

0.05%

|

Sharwan Kumar Goyal

|

01-Sep 2015

|

Invest | |

|

₹100

|

₹100

|

1.76%

|

Karthikraj Lakshmanan

|

30-Jul 2005

|

Invest | |

|

₹500

|

₹5000

|

2.44%

|

Vishal Chopda

|

30-Jul 2007

|

Invest |

| Fund Name | Current NAV | Previous NAV | 1D NAV Change | 52- Week High NAV | 52- Week Low NAV | |

|---|---|---|---|---|---|---|

|

267.9458

(17-04-2025)

|

265.7823

(16-04-2025)

|

0.81%

|

295.297

|

219.587

|

Invest | |

|

183.4003

(17-04-2025)

|

179.5605

(16-04-2025)

|

2.14%

|

183.4

|

150.45

|

Invest | |

|

156.7636

(17-04-2025)

|

154.936

(16-04-2025)

|

1.18%

|

177.804

|

138.826

|

Invest | |

|

306.5047

(17-04-2025)

|

302.9133

(16-04-2025)

|

1.19%

|

338.73

|

270.333

|

Invest | |

|

166.9592

(17-04-2025)

|

165.3099

(16-04-2025)

|

1%

|

187.871

|

148.738

|

Invest | |

|

386.5108

(17-04-2025)

|

383.1708

(16-04-2025)

|

0.87%

|

414.675

|

346.383

|

Invest | |

|

164.9329

(17-04-2025)

|

163.4805

(16-04-2025)

|

0.89%

|

189.768

|

147.694

|

Invest | |

|

67.9389

(17-04-2025)

|

67.6439

(16-04-2025)

|

0.44%

|

67.9389

|

61.1699

|

Invest | |

|

46.8041

(17-04-2025)

|

46.7562

(16-04-2025)

|

0.1%

|

46.8041

|

42.1948

|

Invest | |

|

62.9482

(17-04-2025)

|

62.8839

(16-04-2025)

|

0.1%

|

62.9482

|

56.749

|

Invest | |

|

12.2209

(17-04-2025)

|

12.1091

(16-04-2025)

|

0.92%

|

12.4857

|

11.0771

|

Invest | |

|

73.1041

(17-04-2025)

|

73.0077

(16-04-2025)

|

0.13%

|

73.1041

|

66.1472

|

Invest | |

|

23.2921

(17-04-2025)

|

23.1724

(16-04-2025)

|

0.52%

|

27.661

|

20.8672

|

Invest | |

|

30.8

(17-04-2025)

|

30.7564

(16-04-2025)

|

0.14%

|

30.8

|

27.9661

|

Invest | |

|

16.2198

(17-04-2025)

|

16.1995

(16-04-2025)

|

0.13%

|

16.2198

|

14.8156

|

Invest | |

|

18.125

(17-04-2025)

|

18.0963

(16-04-2025)

|

0.16%

|

18.125

|

16.5878

|

Invest | |

|

194.5295

(17-04-2025)

|

192.3105

(16-04-2025)

|

1.15%

|

222.013

|

179.872

|

Invest | |

|

855.0225

(17-04-2025)

|

838.5996

(16-04-2025)

|

1.96%

|

931.622

|

779.505

|

Invest | |

|

261.0326

(17-04-2025)

|

257.3988

(16-04-2025)

|

1.41%

|

289.757

|

239.745

|

Invest | |

|

54.8601

(17-04-2025)

|

54.2719

(16-04-2025)

|

1.08%

|

65.3831

|

49.9616

|

Invest |

UTI Mutual Fund Return Calculator

Historical Returns

Future Value

Invested Amt.

+Net Profit

=Total Wealth

- Invested Amount

- Estimated Returns

- Invested Amount ₹43,855

- Interest Earned ₹6,145

Explore Other Popular Calculators

Comparison of Top UTI Mutual Fund

UTI Conservative Hybrid Fund - Regular Plan - Growth Option

3Y Returns 10.42%

VS

UTI Conservative Hybrid Fund - Regular Plan - Growth Option

3Y Returns 10.42%

VS

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns 12.24%

Sundaram Equity Savings Fund (Formerly Known as Principal Equity Savings Fund) - Direct Plan - Growth Option

3Y Returns 12.24%

UTI Value Fund- Regular Plan - Growth Option

3Y Returns 16.18%

VS

UTI Value Fund- Regular Plan - Growth Option

3Y Returns 16.18%

VS

HSBC Value Fund - Regular Growth

3Y Returns 19.82%

HSBC Value Fund - Regular Growth

3Y Returns 19.82%

UTI India Consumer Fund - Regular Plan - Growth Option

3Y Returns 12.89%

VS

UTI India Consumer Fund - Regular Plan - Growth Option

3Y Returns 12.89%

VS

Nippon India Consumption Fund-Growth Plan-Growth Option

3Y Returns 18.72%

Nippon India Consumption Fund-Growth Plan-Growth Option

3Y Returns 18.72%

UTI ANNUAL INTERVAL FUND II REGULAR PLAN GROWTH

3Y Returns 6.26%

VS

UTI ANNUAL INTERVAL FUND II REGULAR PLAN GROWTH

3Y Returns 6.26%

VS

AXIS Nifty Bank Index Fund - Regular (G)

3Y Returns 0%

AXIS Nifty Bank Index Fund - Regular (G)

3Y Returns 0%

Investing Strategy

It focuses on selecting high-quality firms that are likely to grow rapidly in the future and are cheaply priced. It analyzes each company separately, starting from the ground up. The goal is to invest in firms that are not just financially sound but also capable of self-sustaining and growing.

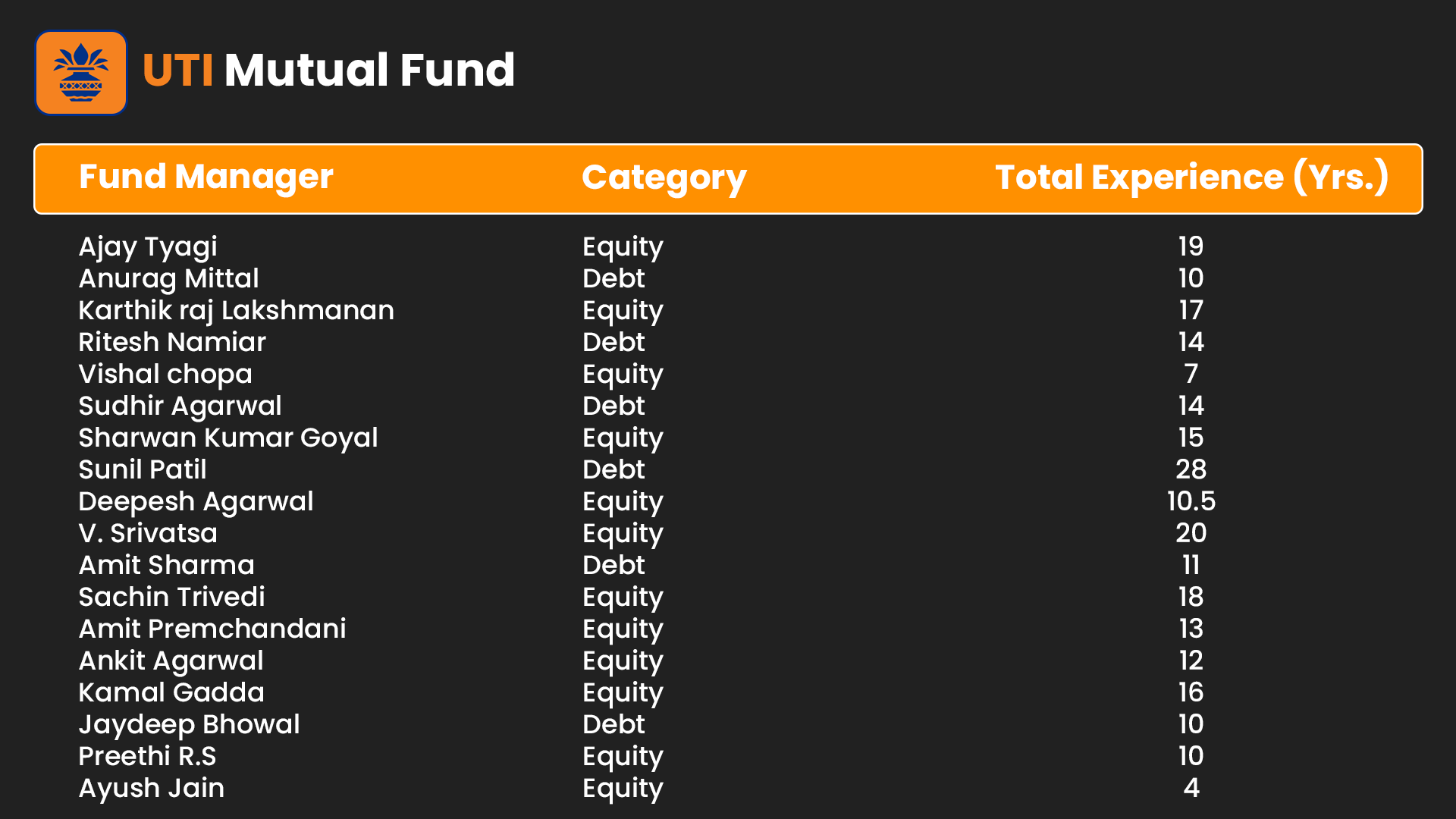

Fund Management Team

Mr. Vetri Subramaniam (CIO of equity)

Vetri Subramaniam currently serves as the Chief Investment Officer at UTI Asset Management Company Ltd. He initially joined UTI AMC as the Head of Equity in January 2017 and later took on the role of Chief Investment Officer in August 2021. With a career spanning over 30 years, Vetri brings extensive experience to his leadership position in the asset management industry.

List of All Fund Managers

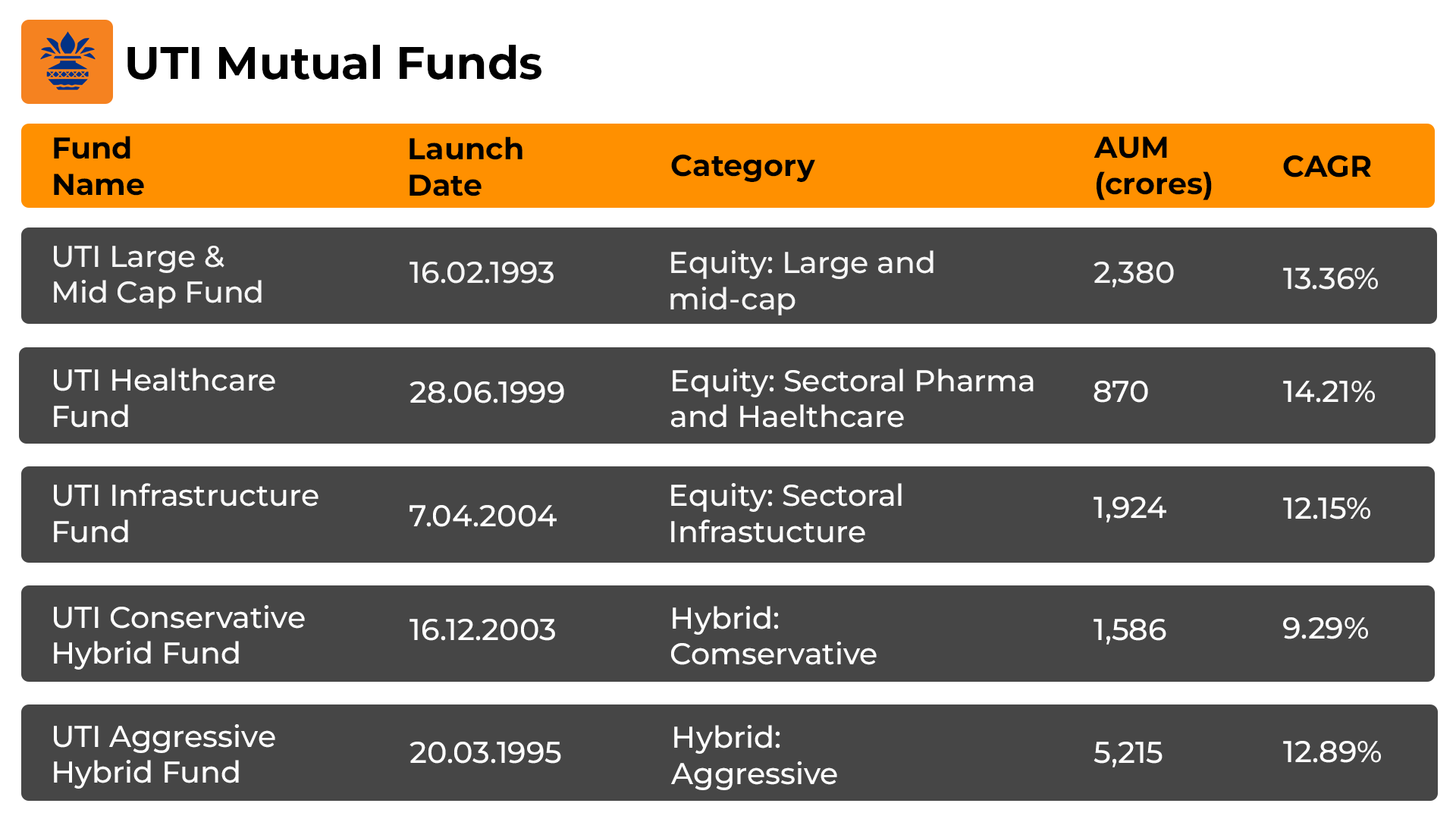

Top 5 UTI Mutual Funds

History of UTI Mutual Fund

On December 9, 2002, UTI fund house was chosen to be the company responsible for managing the investments of this Fund house. This decision was outlined in the Investment Management Agreement between UTI Trustee Co. Ltd. and this AMC. UTI Mutual Fund, a Trust under the Indian Trust Act, 1882 registered with SEBI on January 14, 2003. This fund house is a leader in the local market. In 1971, it made history by introducing the first Unit Linked Insurance Plan (ULIP), providing life and accident cover. Another significant achievement came in 1986 when this Mutual Fund house launched the 'India Fund,' It was India's first fund invested in foreign markets.

- UTI MF distinguishes with a unique investing style.

- The fund house has 146 branches nationwide.

- This AMC has a wide range of varieties of Funds

- UTI AMC's philosophy is Quality, Growth, and Valuation.

- This AMC is top-performing in their respective category

How to Select the Best UTI Mutual Fund?

Choose the best UTI mutual fund schemes while following these steps:

- Set realistic goals for your investments and plan accordingly.

- Assess your risk tolerance, establish limits for your investments.

- Diversify your portfolio across multiple industries to mitigate risk.

- Educate about the fund's investment philosophy track record.

- Monitor investments and make adjustments when necessary.

- Consult a financial professional to help you handle market risks.

In summary, set specific goals and plans, and utilize an SIP calculator for estimating future profits from your investment.

How to Invest in UTI Mutual Funds with mysiponline?

Investing in Top UTI Mutual Funds is made convenient through mysiponline, offering a hassle-free approach:

- Visit mysiponline.com, choose from the top UTI fund schemes

- Register a free account, profile details, and proceed to select fund.

- Quick, paperless KYC needs PAN, Aadhar, Signature, Bank proof.

- Add preferred funds to your cart based on your risk appetite.

- Finalize payment and await confirmation of your investment.

- Keep track of investments via your mysiponline.com account.

In summary, Online SIP provides hassle-free mutual fund investing with a user-friendly interface and simple administration choices.

Taxation of UTI Mutual fund?

The taxation of UTI Mutual Fund depends on which category they fall under equity or debt:

Equity-Oriented Mutual Funds

Short-term Capital Gains (STCG): Taxed at a flat rate of 15% if units are sold within one year of purchase.

Long-term Capital Gains (LTCG): Gains exceeding Rs. 1 lakh in a financial year are taxed at 10% without indexation if units are sold after one year.

Debt-Oriented Mutual Funds

Short-term Capital Gains (STCG): Taxed according to the investor's income tax slab rate if units are sold within three years of purchase.

Long-term Capital Gains (LTCG): Taxed at a rate of 20% with the benefit of indexation if units are sold after three years.

Frequently Asked Questions

Explore Other AMC’s

Top Blogs of UTI Mutual Fund

Blogs

You can select three funds for compare.

You can select three funds for compare.