SWP Mutual Fund

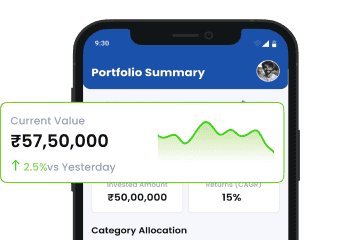

A Systematic Withdrawal Plan or SWP helps you to withdraw a fixed amount from your mutual fund regularly, offering a regular source of income by selling units earned from SIPs and crediting money to your bank on the set date.

What is Freedom SIP?

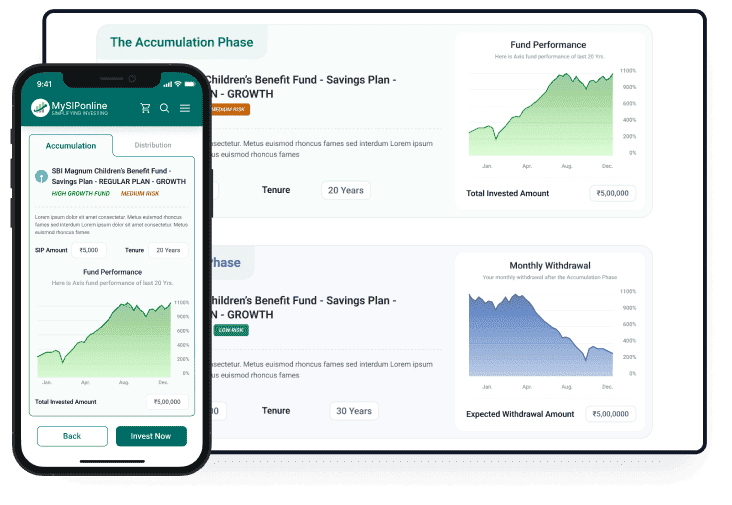

Freedom SIP is a plan that combines regular investments (SIP) and monthly withdrawals (SWP). You

invest a fixed amount in mutual funds, and once your investment grows, you can withdraw a fixed

amount every month for steady income.

To learn more about them, read our detailed guide on

What is

Freedom SIP?

SWP Calculator

A smart way to know your monthly withdrawal amount from your investments.

₹10,00,000 / Month

₹3,500

₹3,500

Find, compare and invest in 2025's best mutual funds.

Get Started Now!

Top SWP Funds In India For High Returns

Benefits of a Systematic Withdrawal Plan

Discover the various benefits of a SWP plan that helps you achieve a steady income.

Regular Income

Helps you get a steady flow of money at fixed intervals.

Tax Efficiency

You pay tax only on the profit, which can save money.

Wealth Growth

After withdrawal, rest of money stays invested & keeps growing.

Flexible Withdrawals

You can change or stop your withdrawals anytime.

Success Stories of Our Investors

See how 30 mins with an expert can be a game-changer.

Book a Free Session @

₹5,000

Every Month Effortlessly!

A Simple SIP to Build Your Passive Income

Enjoy Hassle-Free Passive Earnings

Start Small, Earn Big – The Future is Yours!

Types of SWP Options in Mutual Funds

There are three types of systematic withdrawal plans in Mutual Funds that you should know:

- Fixed Amount SWP: The first type of SWP allows you to withdraw a fixed amount from your investments in a fixed time frame, giving you a regular income source. However, your principal amount can decrease due to insufficient returns.

- Appreciation SWP: In this type of SWP, you withdraw only the profit earned which keeps your actual investment safe, a sustainable investment approach. Also, know that profits can increase or decrease depending on the market performance.

- Variable SWP: Here, you get full flexibility to increase or decrease your monthly withdrawal amount on the performance or if there is any change in your financial needs. However, it requires active management to make the right decision.

How Does SWP Work in Mutual Funds?

A Systematic Withdrawal Plan (SWP) is like setting up a regular payment from your mutual fund investment. Instead of selling your units every time you need cash, you can choose to automatically withdraw a fixed amount of money at regular intervals (like monthly or quarterly).

Here’s how it works:

-

Step 1: Pick Your Mutual Fund

First, you choose a mutual fund that matches your financial goals, risk tolerance, and time frame. You can do this online and you will get all the information you need, like past performance, risk level and how the fund is managed.

-

Step 2: Set Up SWP

After selecting the mutual fund, you set up your SWP. You decide how much money you want to withdraw (for example, Rs.10,000 per month) and how often you want it (monthly, quarterly, etc.). You can also choose between:

-

Step 3: Fixed Withdrawal

A fixed amount is withdrawn regularly from your investment and the mutual fund automatically sells units to give you that amount. Here, only the profit or gains from your investment are withdrawn, so your original investment stays intact.

-

Step 4: Get Your Money

Once the SWP is set up, you will start receiving regular payments in your bank account. The best part is that this happens automatically. You do not need to take action each time you need money.

Real-life Example:

Let’s say you invested Rs.5 lakh in a mutual fund. You set up an SWP to withdraw Rs.10,000 every month. After a few months, the value of your investment increases due to the fund’s growth.

Now, every month, you get Rs.10,000 from the fund. This withdrawal can be made from your original investment or the profit the fund has made, depending on the type of SWP you have chosen. This way, you do not have to worry about selling units or managing your money manually, it is all automated for you.

This could be useful for someone like Mr. Sharma, who invested in a mutual fund to fund his monthly expenses after retirement. With an SWP, he automatically receives his required income every month, without needing to actively manage his investment.

Pro Tip: Guessing is fun, but knowing is better, use SWP Calculator to start with ease.

How to Invest in SWP Mutual Fund?

Follow these simple steps to start your SWP (Systematic Withdrawal Plan):

- Sign Up or Log In: Visit MySIPonline, create an account or log in if you already have one.

- Choose a Mutual Fund: Pick the Best Mutual Funds that match your goals and risk level.

- Invest First: You need an existing investment, either Start SIPor lumpsum.

- Set Up SWP: Select the fund, enter the withdrawal amountand frequency (monthly, quarterly etc.).

- Confirm & Submit: Review details and confirm to activate SWP.

- Get Regular Payouts: The chosen amount will be deposited into your bank as scheduled.

That’s it and your SWP is now set up for regular income with ease.

Tax Implications of Systematic Withdrawal Plan (SWP)

When you use a SWP to withdraw money from your mutual fund, there are a few things you need to know about taxes:

No Tax Deducted at Source: Unlike the Dividend option where the fund deducts tax before paying you, with an SWP, there is no tax taken out before you get the money. You will receive the full amount of the withdrawal in your account.

Capital Gains Tax: While there is no tax taken at source, you will still have to pay tax on the money you withdraw, depending on the type of mutual fund you invested in and how long you’ve held it. This is called capital gains tax.

| Type | Short Term Capital Gains Tax | Long Term Capital Gains Tax |

|---|---|---|

| Equity Mutual Funds | 15% | 10% without indexation |

| Balanced Mutual Funds | 15% | 10% without indexation |

| Debt Mutual Funds | As per tax slab | 20% after indexation |

Here’s how it works:

Equity Funds (stocks or share-based funds): If you sell your units within 1 year, you will pay a 15% tax on any profits (this is short-term capital gains tax or STCG).

If you sell your units after 1 year, you will pay a 10% tax on profits above Rs.1 lakh (long-term capital gains tax, or LTCG).

Debt Funds (bonds or loan-based funds): If you sell your units for a duration of 3 years, the tax depends on your income tax slab (short-term capital gains).

If you sell your units after 3 years, you pay 20% tax with some tax benefits (long-term capital gains).

Let us take the help of a real example:

Let’s say you invested in an equity mutual fund and set up an SWP. If you have held the investment for more than a year and withdraw Rs. 20,000, you would only pay tax on the profit you made, and if it is over Rs. 1 lakh in total for the year, you will pay 10% tax on those gains.

So, with SWPs, there is no immediate tax taken out, but remember you will have to pay capital gains tax based on how long you’ve held your investment and the type of fund you have invested in.

Effective Uses of Systematic Withdrawal Plan

A Systematic Withdrawal Plan (SWP) is a simple way to get regular income from your mutual fund investment. Here are some easy and practical ways to use a SWP:

-

Create Extra Income

With the rising cost of living, having an extra source of income can be very helpful. By investing in mutual funds and setting up an SWP, you can withdraw a fixed amount regularly. This extra income can help you cover monthly expenses.

-

Build Your Pension

Worried about your pension plan? You can still save for retirement. Start investing in mutual funds about 5 years before you plan to retire, based on how much risk you are comfortable with. Once you retire, you can set up a SWP to get regular income, just like a pension.

-

Protect Your Savings

If you prefer low risks with your money, you can invest in low-risk funds, like arbitrage mutual funds. These offer safe, stable returns. You can also choose to get dividends from these funds and reinvest them into safer debt funds. Later, you can set up a SWP to get a regular income without risking your savings.

In simple terms, SWPs are a great tool for creating regular income, saving for retirement or even protecting your capital while earning money.

Who Should Invest in SWP in Mutual Funds?

A systematic withdrawal plan is suitable for the following types of investors:

- For Regular Income: Perfect for retirees or anyone who wants a steady monthly income from their investments.

- For Safe Investing: Great for people who want to withdraw only the profits while keeping their original investment safe.

- For Retirement Planning: Ideal for those without a pension who want to create their own monthly income after retirement.

- For Tax Savings: Helpful for high-tax payers as SWP has lower taxes and no TDS on capital gains.

Frequently Asked Questions

SWP (Systematic Withdrawal Plan) is a way to withdraw a fixed amount of money from your mutual fund investment at regular intervals like monthly or quarterly, while the rest of your money stays invested.

The best SWP mutual fund depends on your needs. Debt funds are safer for steady income, while equity funds offer growth but come with risk. Popular choices include large cap mutual funds and balanced funds for stability.

To start SWP, you need to invest in a mutual fund first. Then, you can set up SWP through your fund house or online platform by selecting the withdrawal amount, frequency and start date.

Yes, you can stop an SWP anytime by informing your mutual fund provider. Some fund houses allow online cancellation, while others may require a written request.

SWP stands for Systematic Withdrawal Plan.

Yes, SWP is a good way to get regular income without withdrawing your entire investment. It is useful for retirees and those who want a steady cash flow.

There is no single best SWP fund. Debt mutual funds like ultra-short-term or dynamic bond funds are preferred for stable income, while balanced or hybrid funds are good for growth with moderate risk.

You can decide how much to withdraw, but it should be planned carefully so that your investment lasts longer. Withdrawals should not exceed the returns earned to avoid reducing your capital.

Withdrawals from SWP are taxed as capital gains. If the investment is in equity funds, short-term gains (less than 1 year) are taxed at 15%, and long-term gains (1 year or more) are taxed at 10% if the profit exceeds Rs.1 lakh. For debt funds, tax depends on your income slab.

The minimum amount varies by fund house but most allow SWP starting from Rs.500 to Rs.1,000 per month.

- 10+ Years In Business

- 1,50,000+ People Invested

- 5 Billion+ Assets Under Management

- 4.3 Star Users Rating

Amit Sharma

Amit Sharma

Rohit Mehta

Rohit Mehta

Sonia Kapoor

Sonia Kapoor

Pooja Verma

Pooja Verma