Getting Started

MySIPonline is the platform providing online solutions to make investments in the mutual fund programmes of the best-performing Asset Management Companies in India. Maintaining a stable position in the market with an efficient team of fund analysts and financial advisors available 24/7, the aim is to achieve the leading position in the wealth management services. Serving the investing needs of more than 10000 clients in a hassle-free manner since December 2015.

Login /Register

Create your investment account or Sign in to MySIPonline account

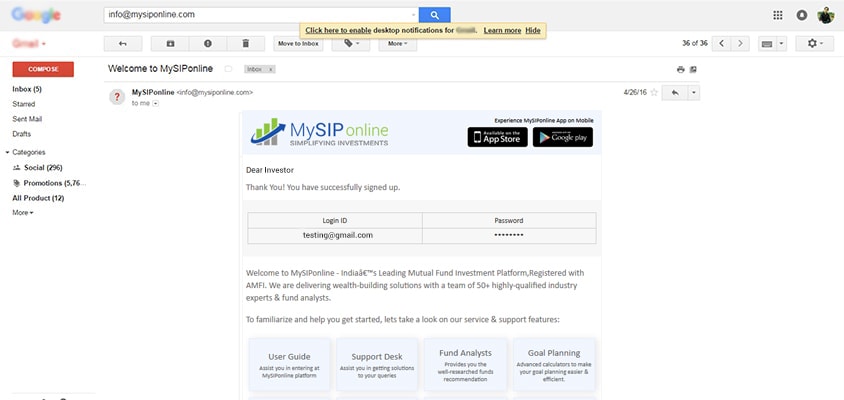

Welcome Mail

Once you get registered, a welcome mail is sent on your registered mail ID providing details about your account.

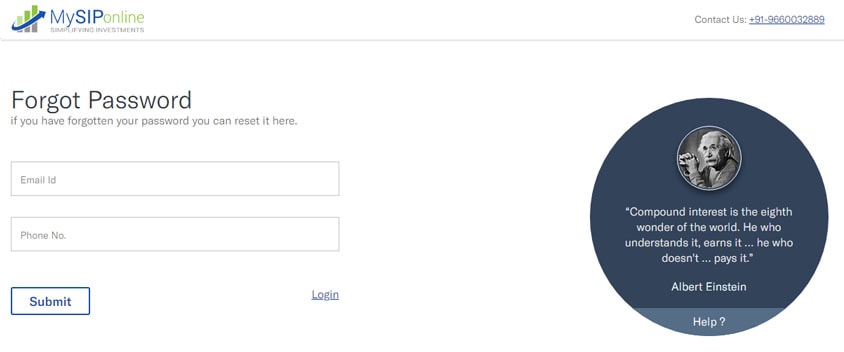

Password Change Process

Password once created while registering can be changed or reset by clicking the forgot password option available. An OTP(One Time Password) is sent to your registered mobile number which can be used to set a new password.

Profile Completion

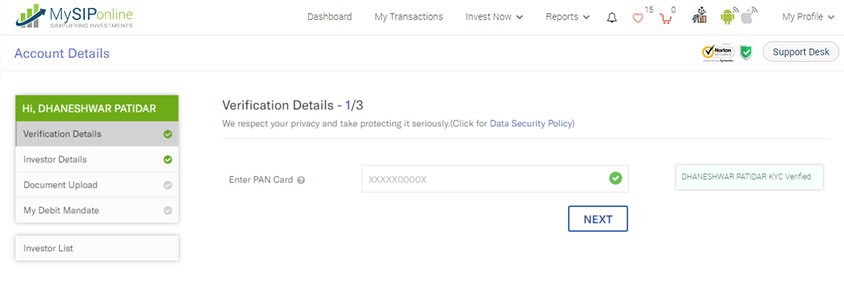

Verification Details

Once you login to your account, it is the time to verify your KYC compliance status. You are requested to be a KYC compliant to start your investments.

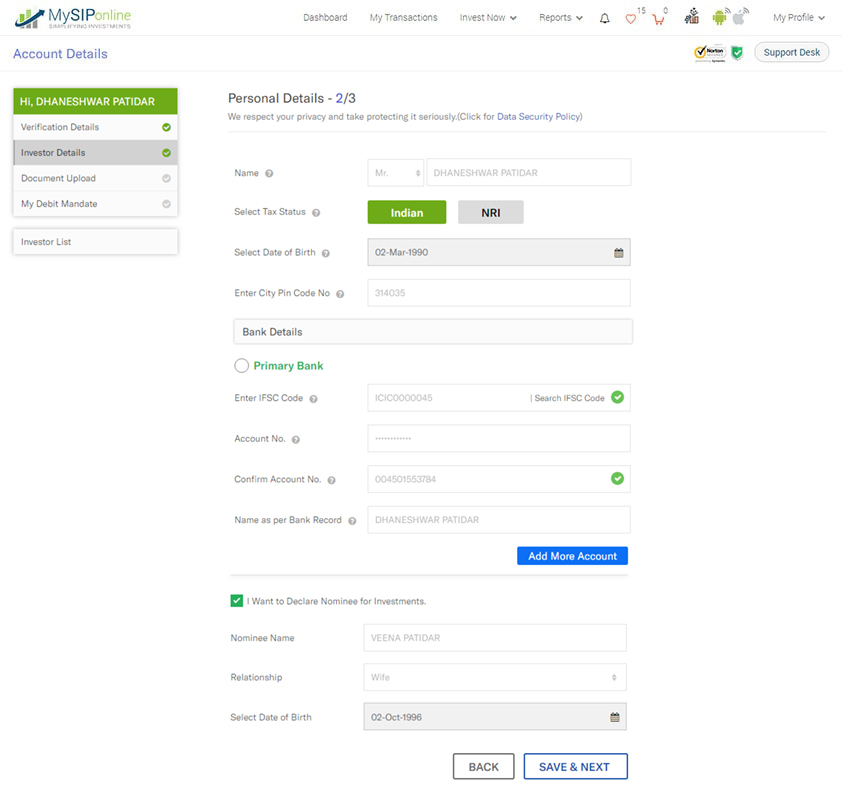

Personal Details

After completing the verification details and becoming a KYC compliant, you are further requested to complete profile by furnishing the personal details including name, Adhaar Card No., tax status, PAN details, contact information and other related particulars as mentioned therein.

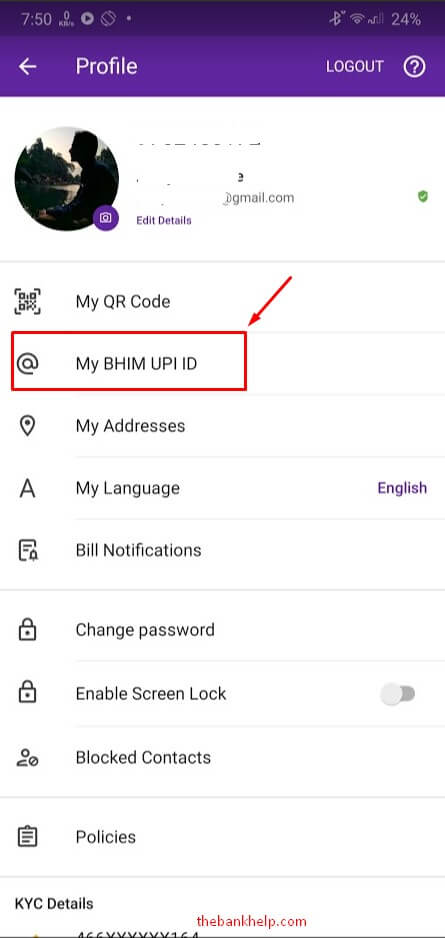

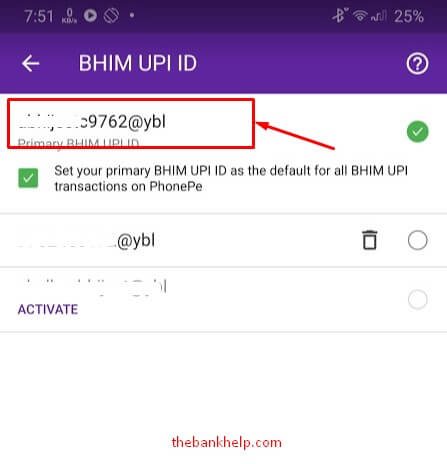

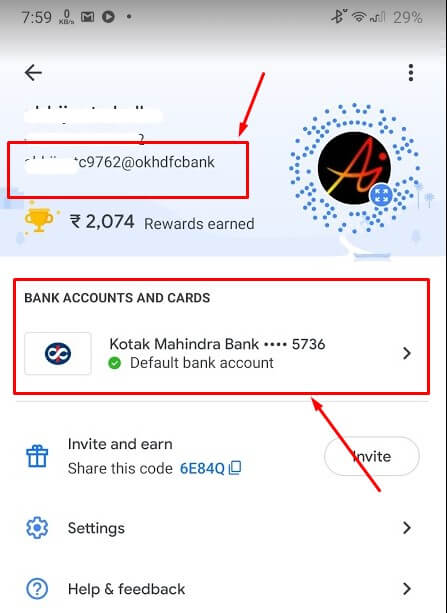

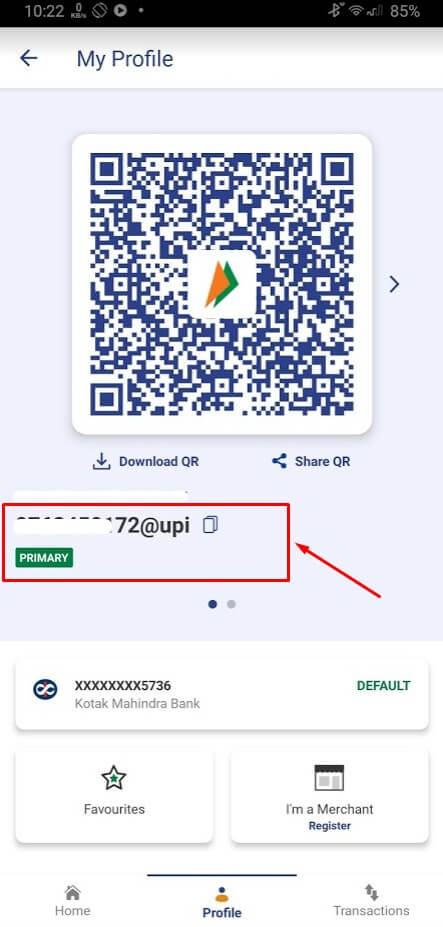

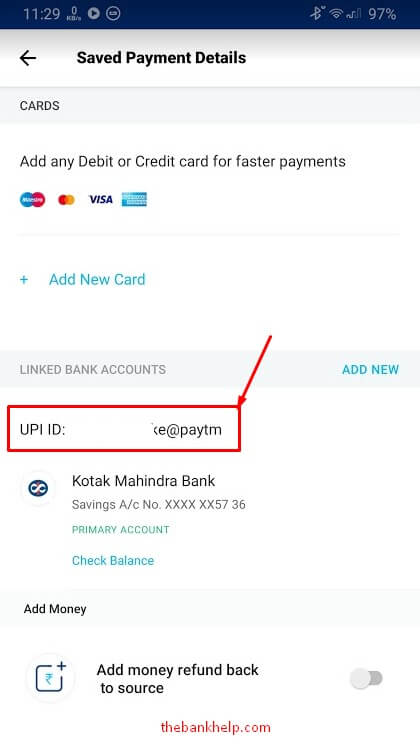

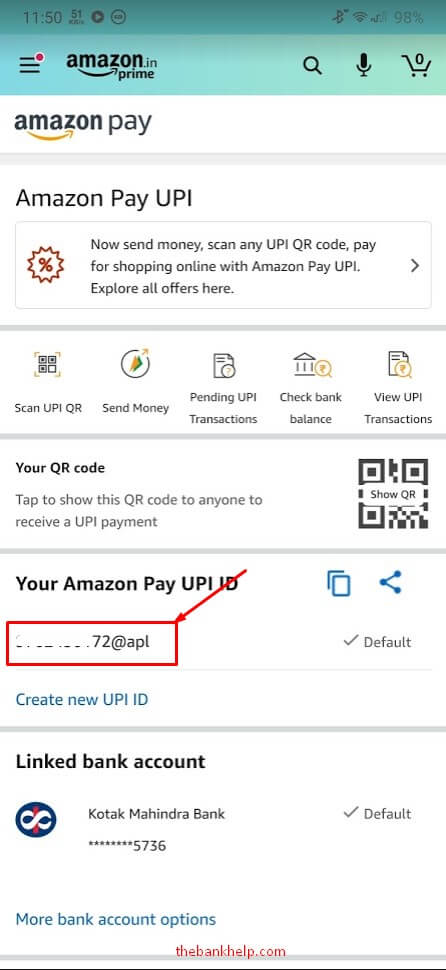

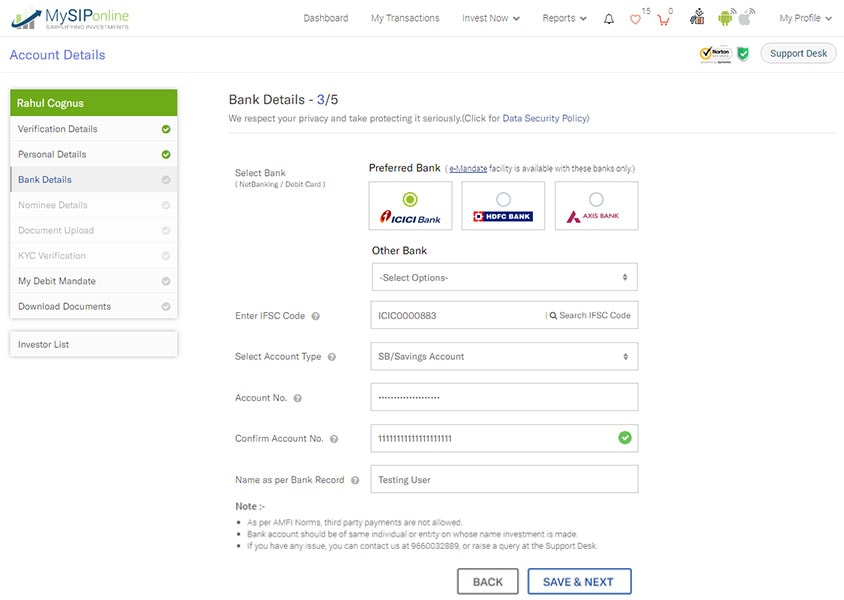

Banking Details

Further, you are required to furnish the details of the respective bank with which you are associating your mutual fund investment.

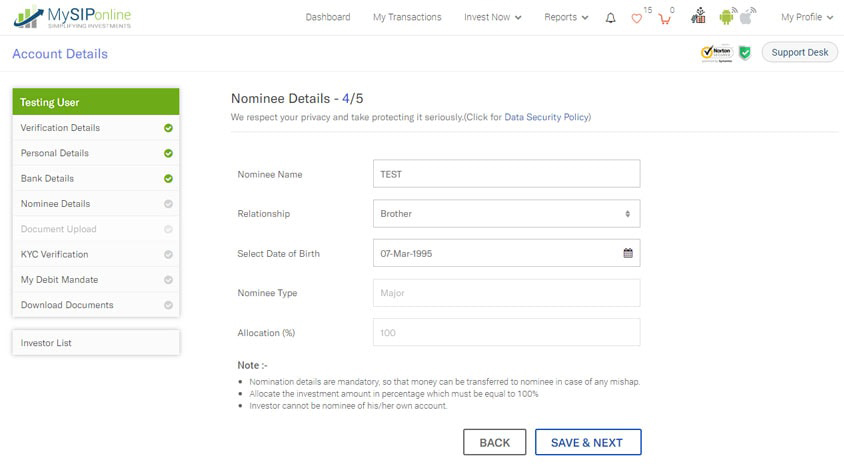

Nominee Details

A nominee has to be allotted who shall be having the legal rights to own the investments on behalf of the investor. There can be maximum two nominees and the proportionate allotment of the funds between them must be equal to 100 percent. Details of the allotted nominees are required to be presented.

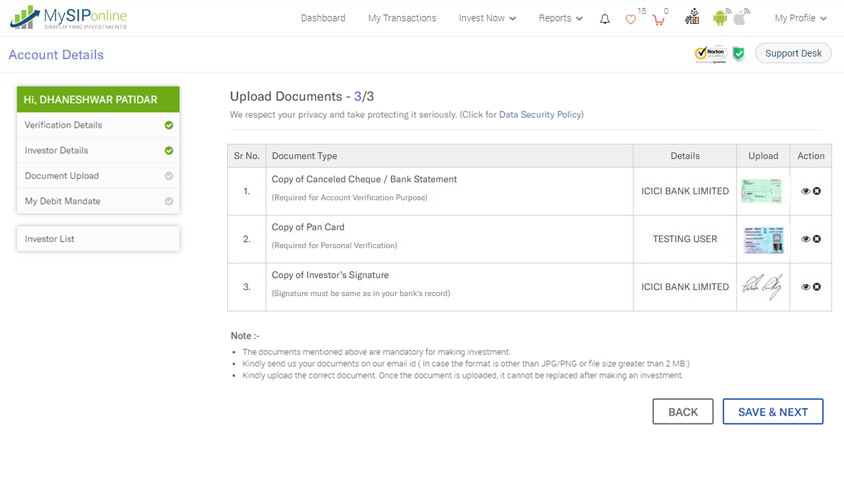

Upload Documents

The last requirement for completing profile is the documents which are to be furnished. Upload the scanned documents of PAN Card, Specimen Signature, and a Cancelled Cheque/Bank Statement.

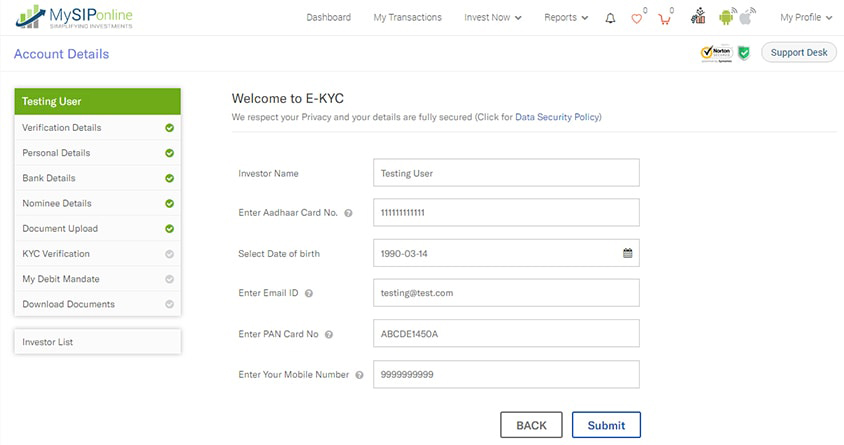

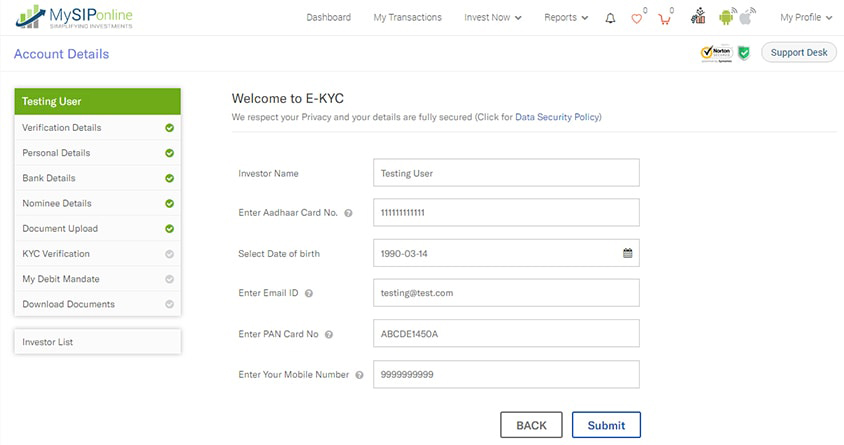

Kyc Process

KYC is an important ingredient for investment in mutual funds which can be done using any one of the two methods out of “E-KYC†and “Physical KYCâ€. To proceed for any one of the processes, click on the ‘Proceed’ button provided there under.

eKyc

The hassle-free online process to become a KYC compliant. You are requested to provide your Name and Adhaar Card No., for further processing of the KYC compliance.

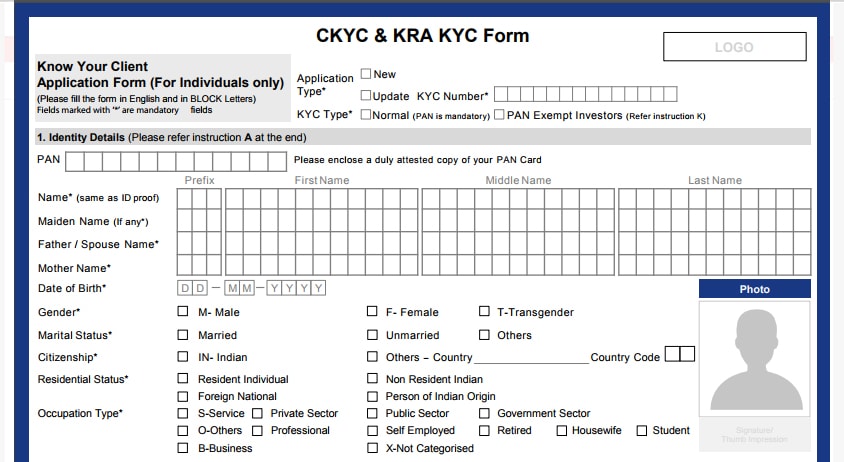

Physical KYC

For physical KYC, our team would assist you in processing and for that you need to provide your identity and address proof at first which must be duly signed and required to be sent at the address provided there under.

Selection Of Funds

- SIP- Whereby a small amount of money is to be invested at regular interval.

- Lumpsum- Where in the entire investment amount has to be submitted at once.

The transaction of your investment is completed in a hassle-free manner passing the secure payment gateway.

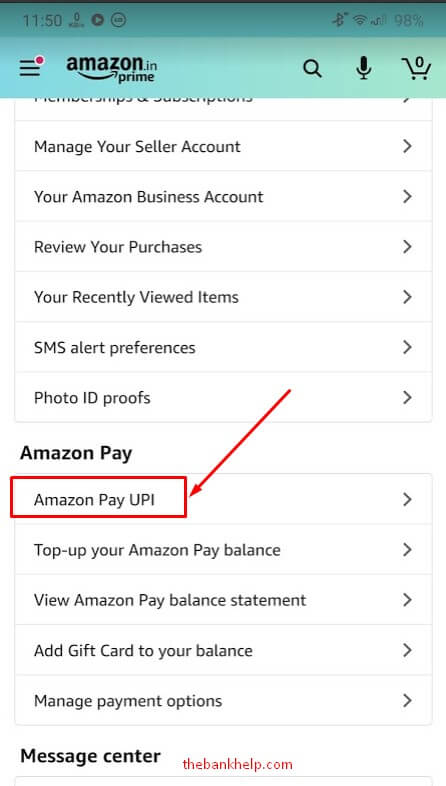

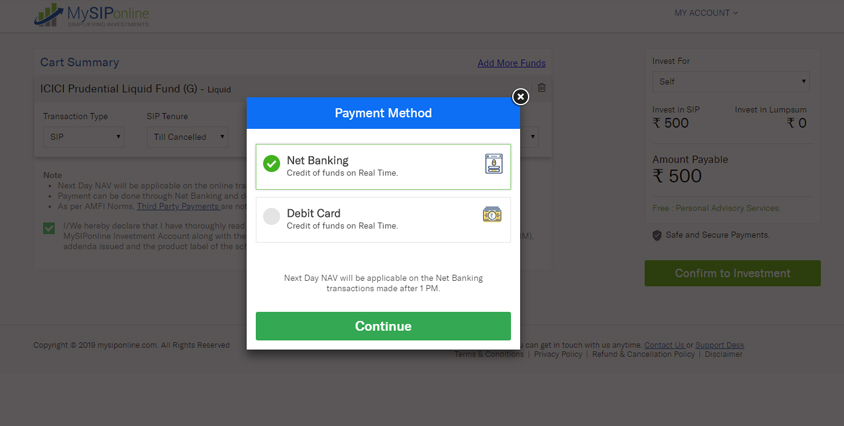

Payment Gateway

To make payment for the transaction you get the option to pay either via Debit Card or Net Banking. The payment gateway is highly secured as per the norms of the respective bank

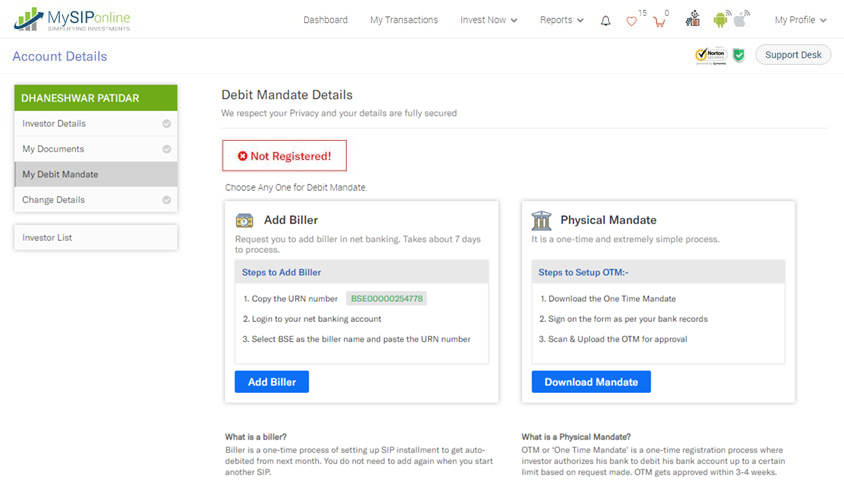

Debit Mandate

It is the one-time registration process wherein the investor authorizes his/her bank to debit a certain amount regularly from the bank account for investing in mutual funds. Once the profile is completed and investment is made in a mutual fund programme, the investor is required to download the debit mandate form and other documents(as per the tax status), fill the same following the sample as provided therein, duly sign all the requested documents, and send it at the address provided hereunder: 3rd Floor, 5 A, Saheli Marg, Opposite U.I.T. Office, Udaipur - 313001 INDIA. Phone No: +91-9660032889

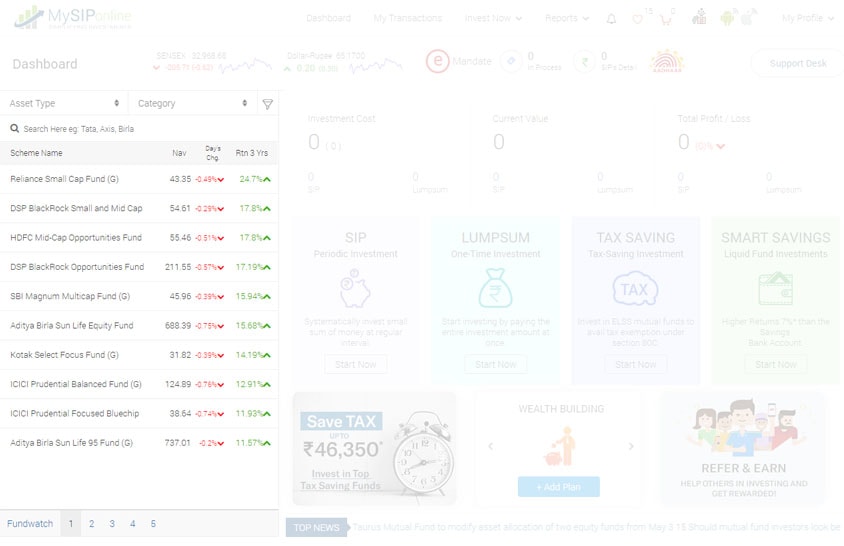

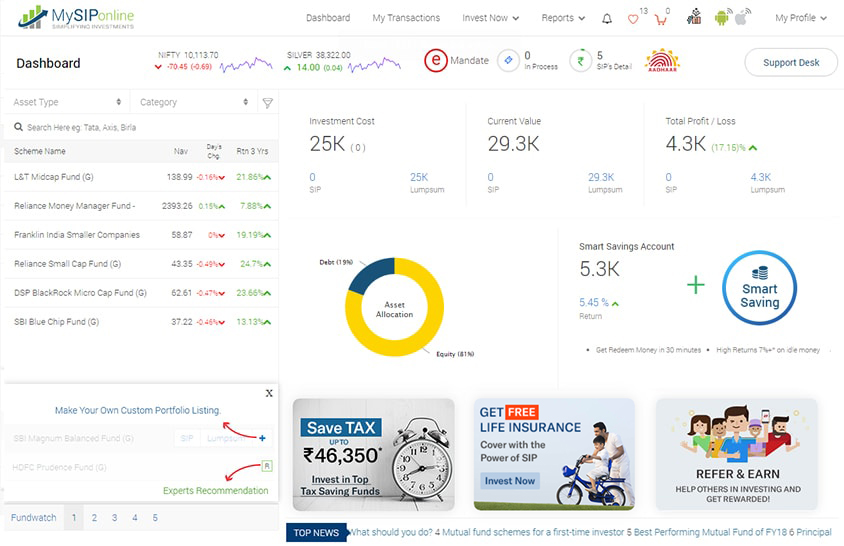

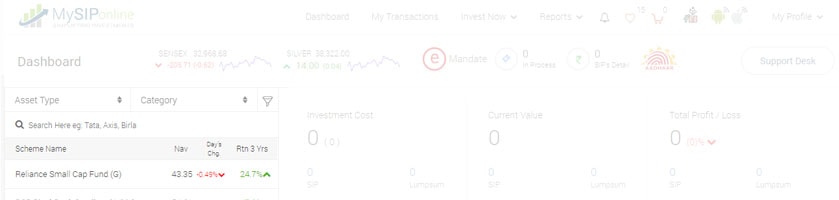

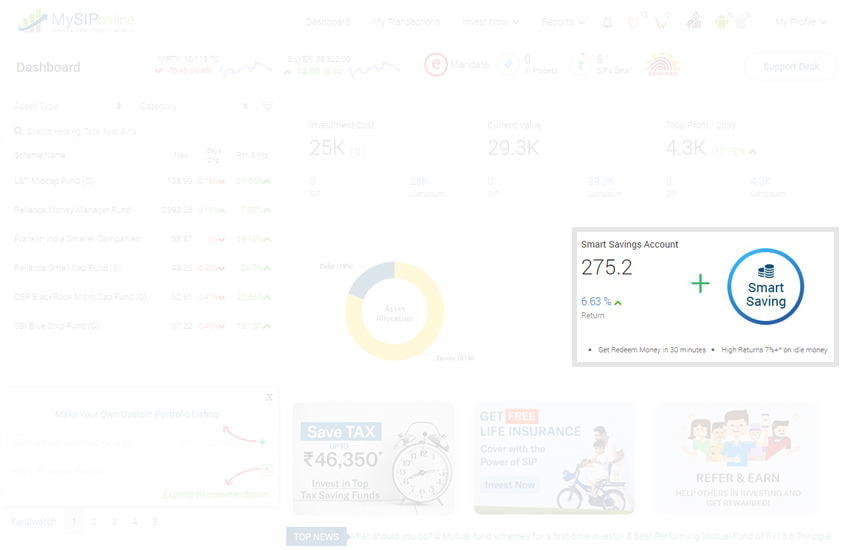

Dashboard Description

Summarised view of the account showing the current values of the invested capital with net profit or loss.

Market Summary

Review the market performance through NIFTY or SENSEX Index.

Quick Search

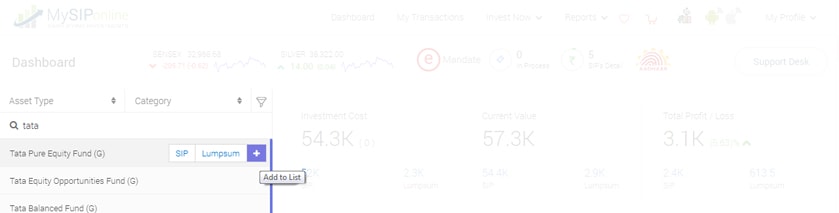

A smart search to find a preferable fund across the thousands of schemes of different fund houses. Select an asset type out of equity, debt or hybrid and to shortlist the schemes accordingly. The categorically search option makes finding schemes even more feasible.

While searching, you get the option to either buy SIP or a Lump sum then and there, or add the scheme to the list by clicking the + icon.

- The schemes added to the list can be bought via SIP or Lumpsum, be added to the cart from there only, be analysed with the per day NAV and monthly or yearly returns performances.

- X denotes the option to remove the scheme from the list.

Add Money

Enhance savings and earn better returns to fulfil instant cash requirements by adding money to the liquid funds.

Add New Goals

For the goal-based investment, enhance your investment portfolio by adding more goals to be accomplished by availing some of the recommendations.

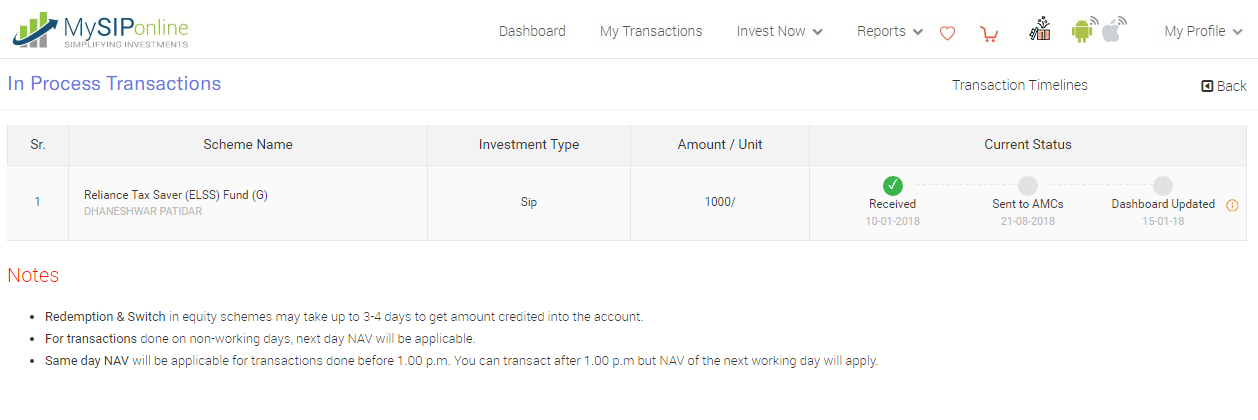

In-process Transactions

The transactions in process which have not been completed are visible here. Their pending status along with the reasons have been provided.

Transaction Overview

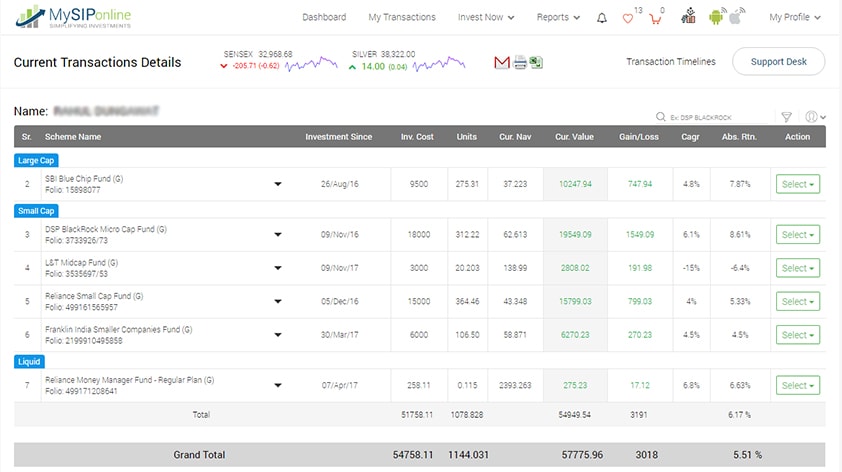

All Transaction

Insight of the total transactions processed by the account holder with the specific details related to returns, profit or loss.

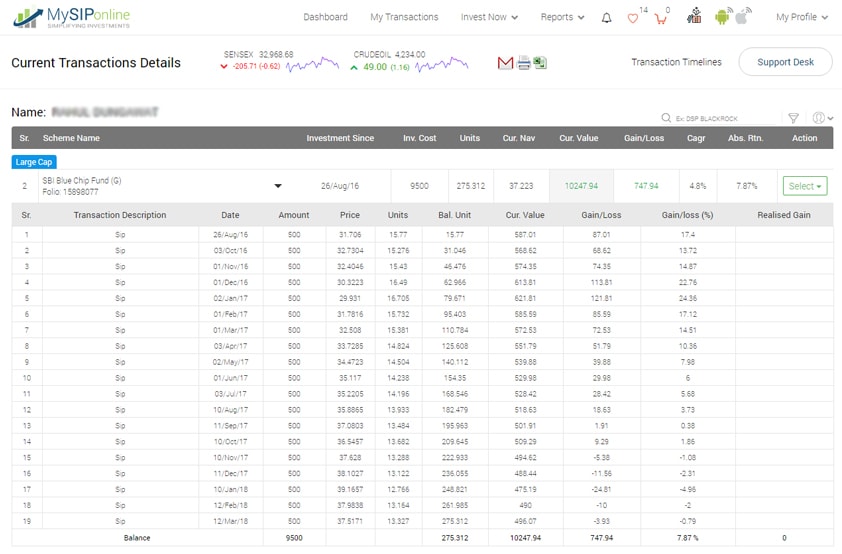

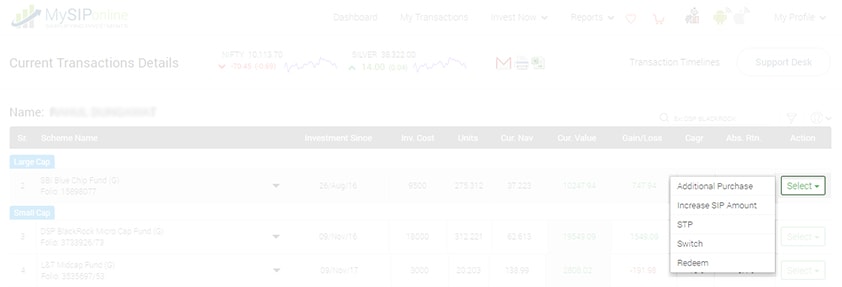

Single Transaction Analysis

Evaluate every single investment by analysing the overall cost, number of units, current NAV, current investment value, CAGR, absolute returns, total profit or loss.

Mail Transaction Report

To keep a record of the transaction data, investors can mail the report to their respective mail IDs.

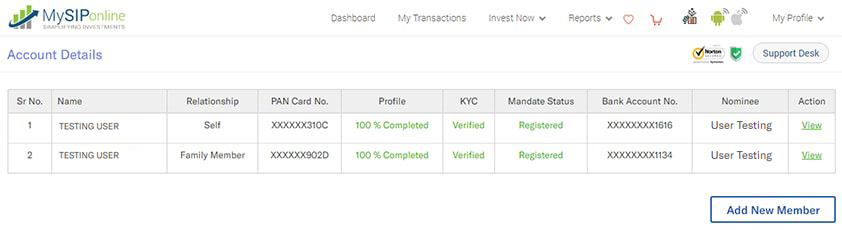

Family Member Overview

The transaction details of the family member can be analysed by opening their transaction details after selecting the name of the member from the drop-down menu present at the right-end corner.

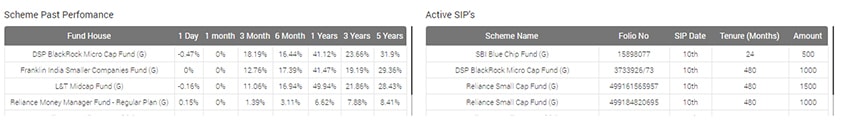

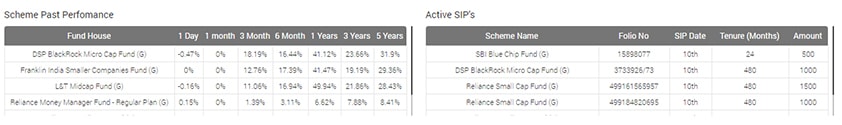

Past Performance

Take review of the past performance of all the mutual fund programmes you have invested in. Their monthly/yearly returns are mentioned therein.

SIP Due Date Column

To help you remind your due date of payment for SIP, it is regularly updated on the transaction page as shown below:

Transaction Action

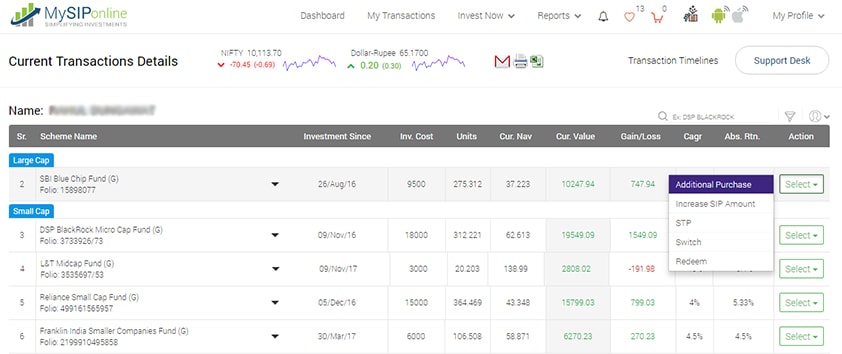

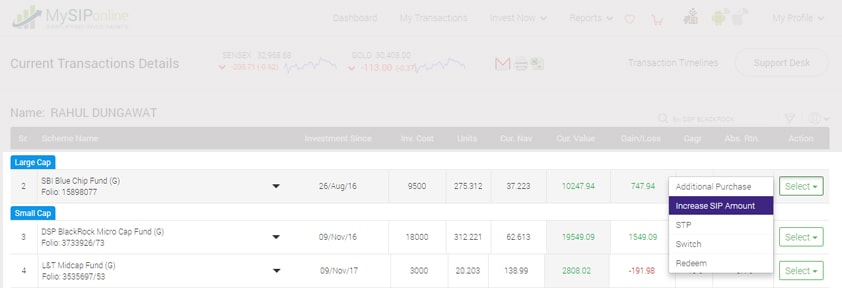

To perform specific action for making changes in the investments the 'Action' column is provided. You can select any one of the action out of the various to make the required changes.

Additional Purchase

To enhance the earning one can make an additional lumpsum purchase in the current investment by adding a certain amount of money.

Increase SIP

Investors are given the option to increase their monthly SIP investments with a certain amount.

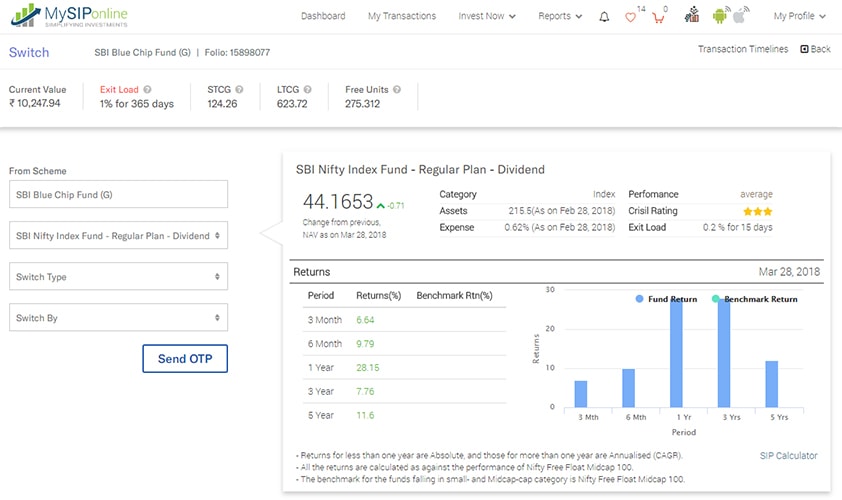

Switch

Finding the current investment non-performing, investors can switch to some other mutual fund programme with a single click.

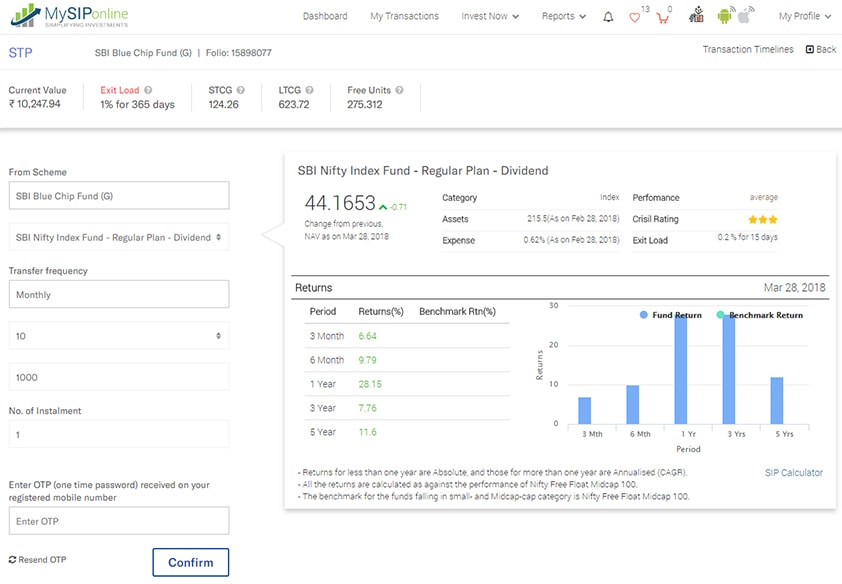

STP

Investors are given the opportunity to invest a lumpsum amount in a scheme and regularly transfer a fixed or variable amount into another scheme, it is called Systematic Transfer Plan.

Goal Planning

To accomplish the specific financial goals, the goal-based investment schemes are formulated for the investors.

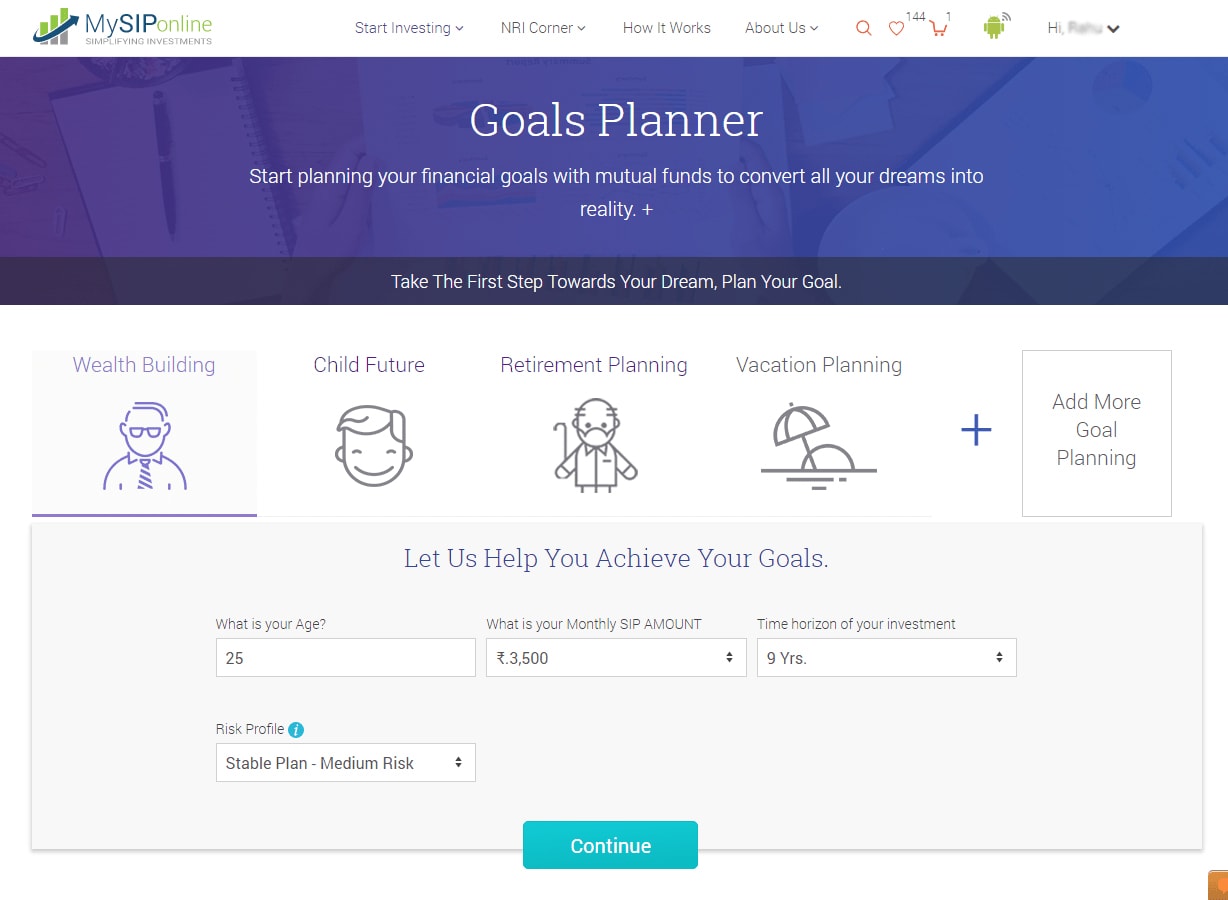

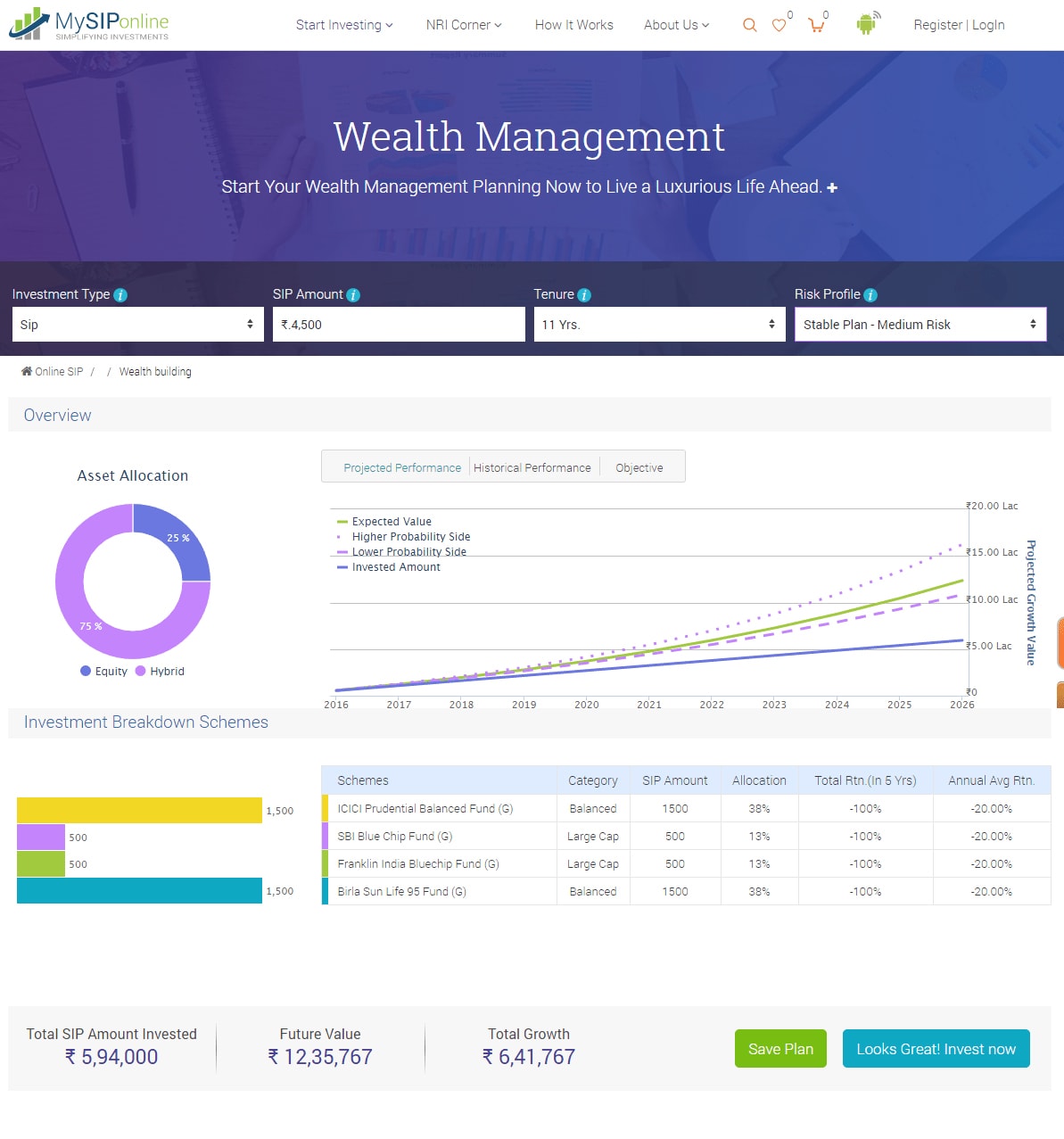

Wealth Building Plan

To enhance the worth of invested capital and create wealth for the future, the wealth building plan has been designed. One has the option to invest in the schemes providing wealth creation via SIP or lumpsum.

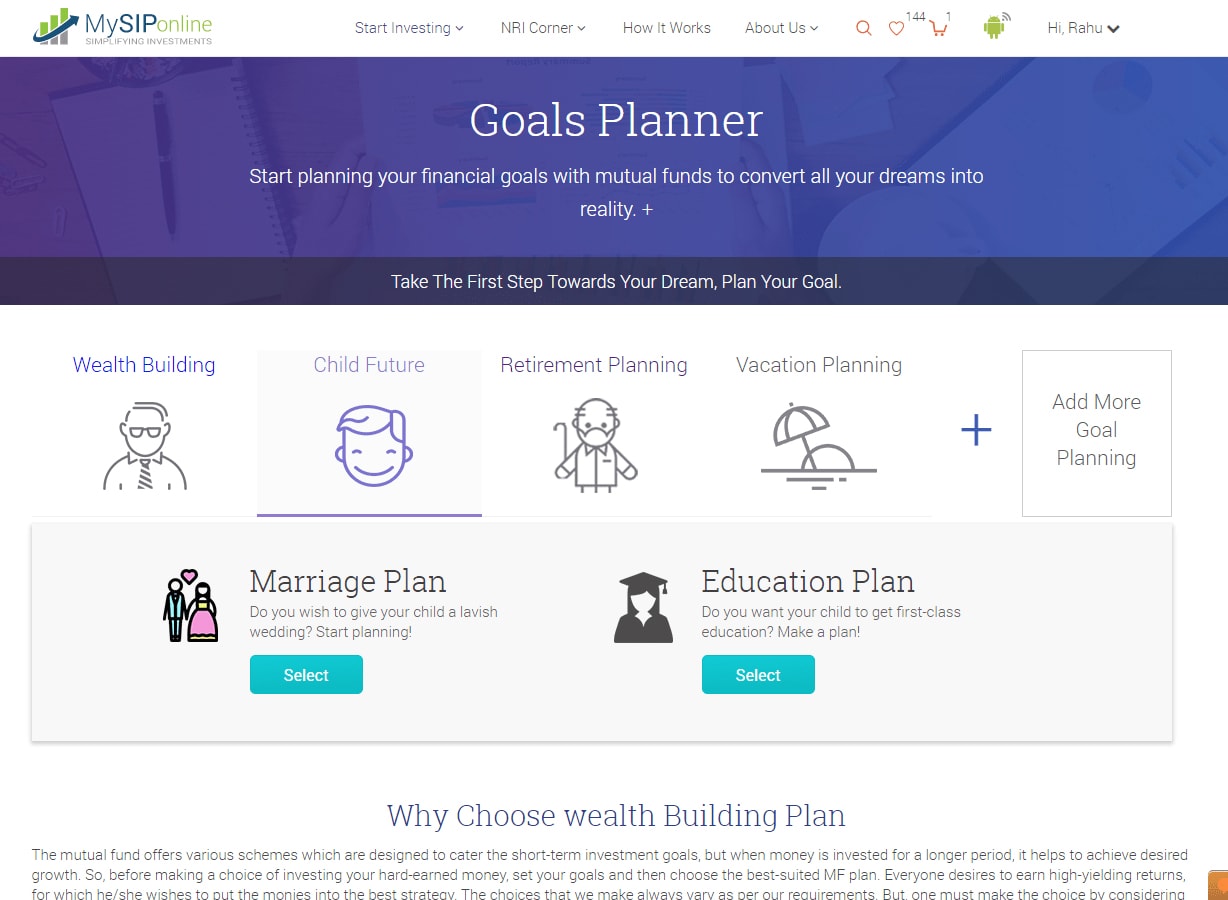

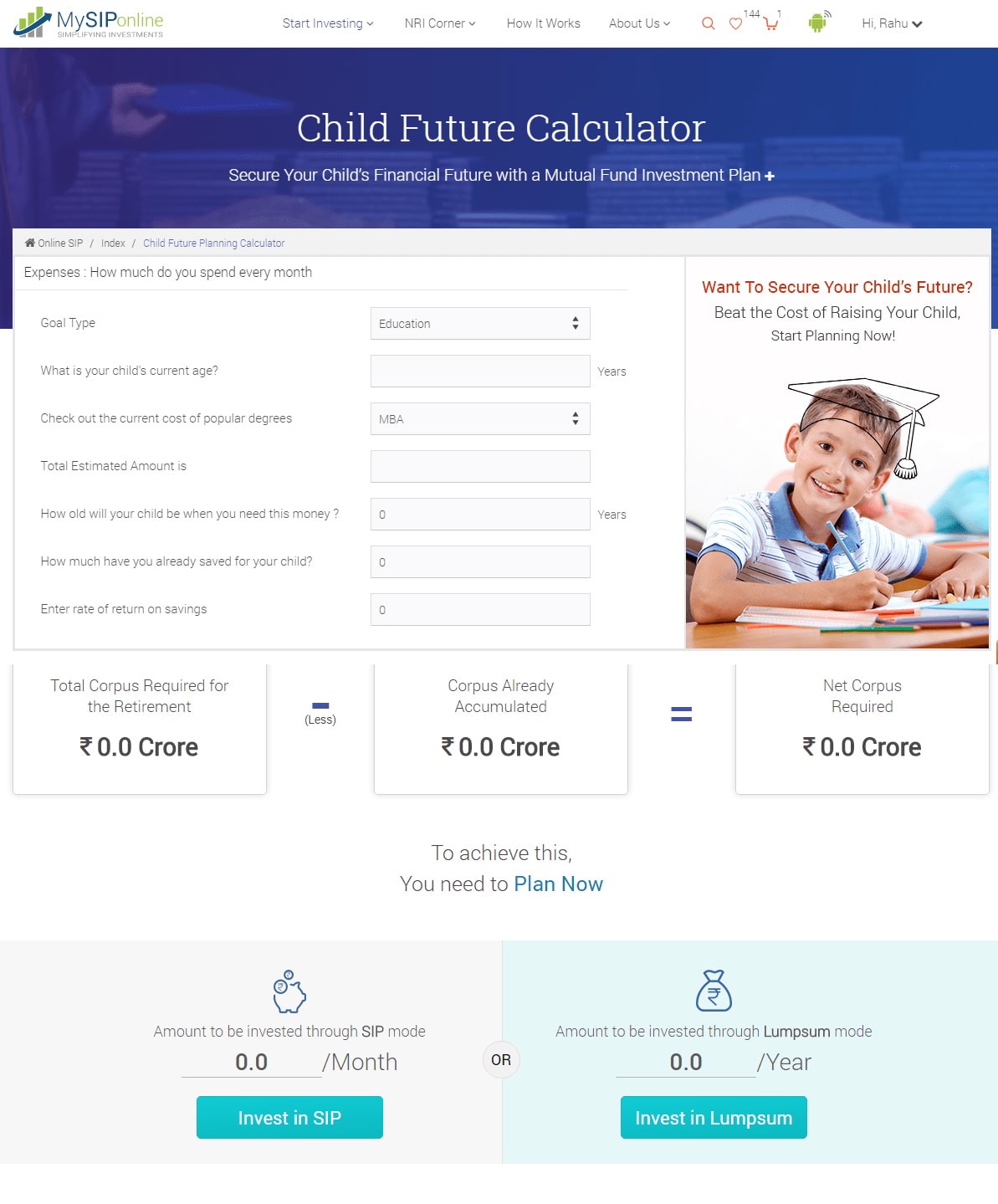

Child’s Future Plan

To brighten the future of your children the education and marriage plans are designed. Investors can invest via SIP or by making the lumpsum payment to either plan their child’s better education or for a lavish wedding.

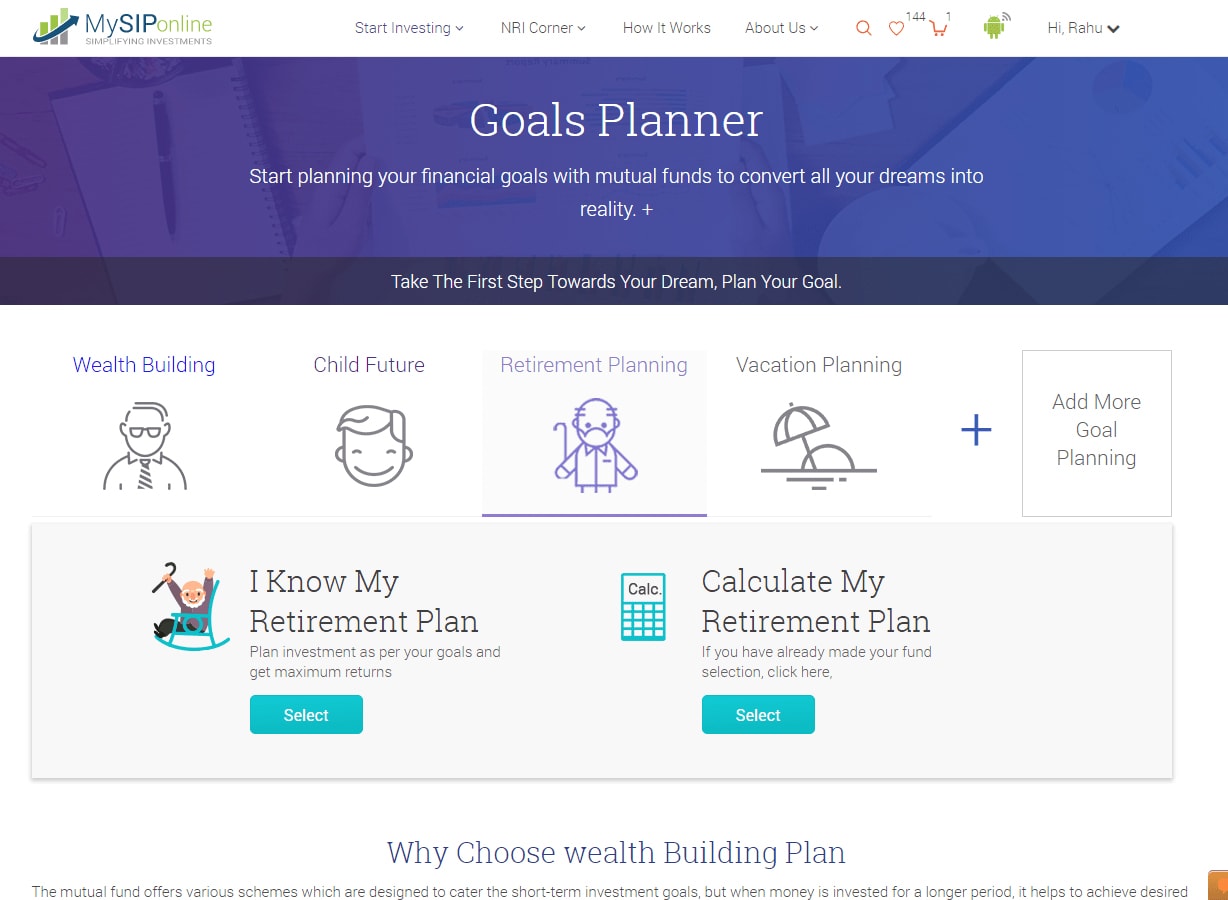

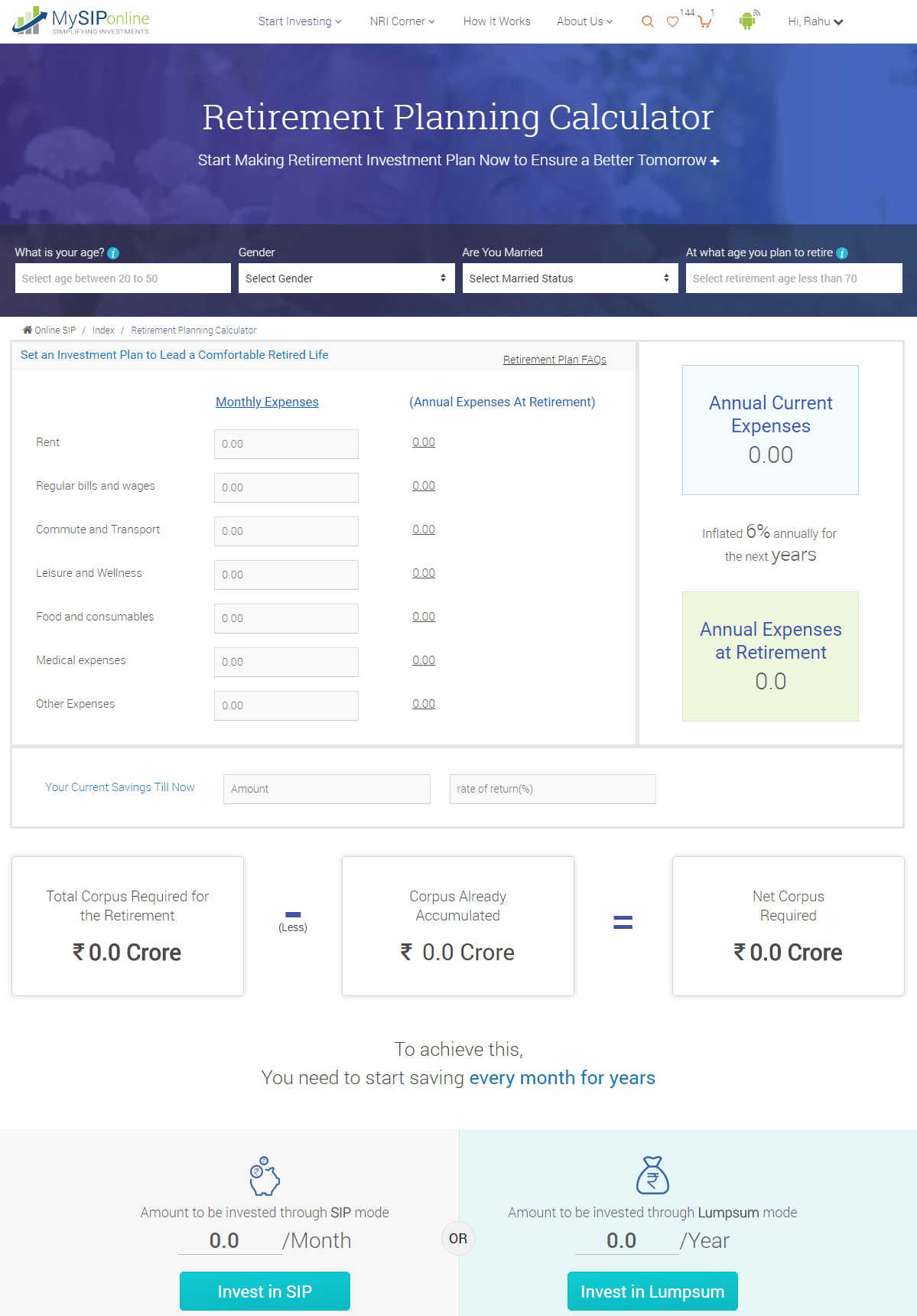

Retirement Planning

Planning retirement is made easy by providing a simplified process of selecting the best retirement investment plans. SIP or lumpsum investment alternatives are being provided to get started.

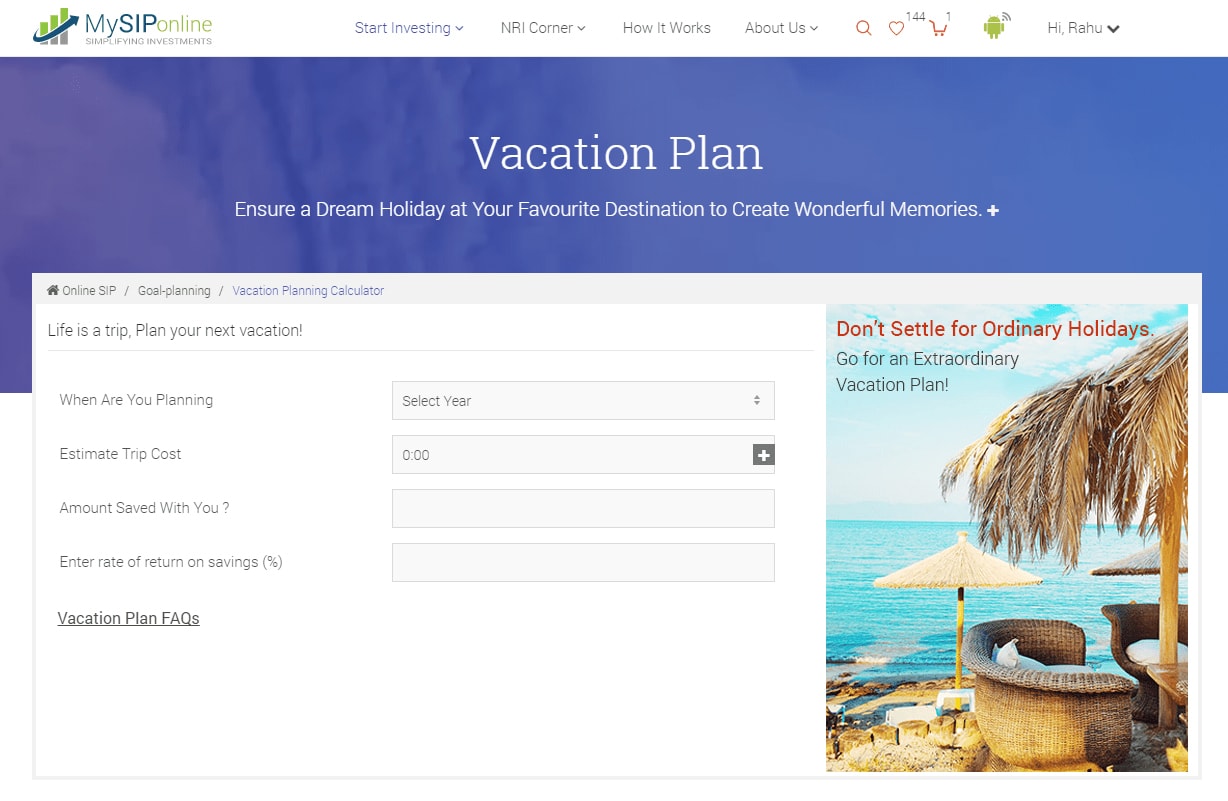

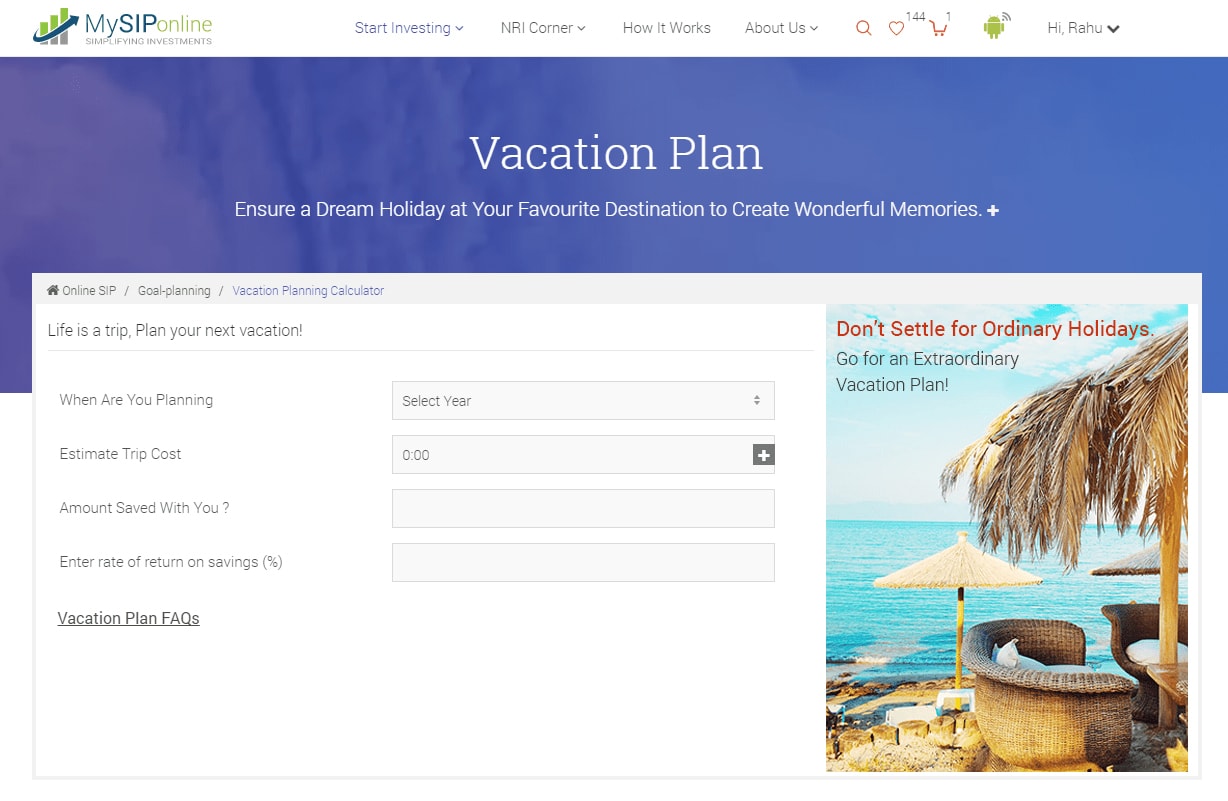

Vacation Planning

Invest the funds to go for a dream vacation by making an investment for a vacation plan. Invest via SIP or lumpsum as per the convenience.

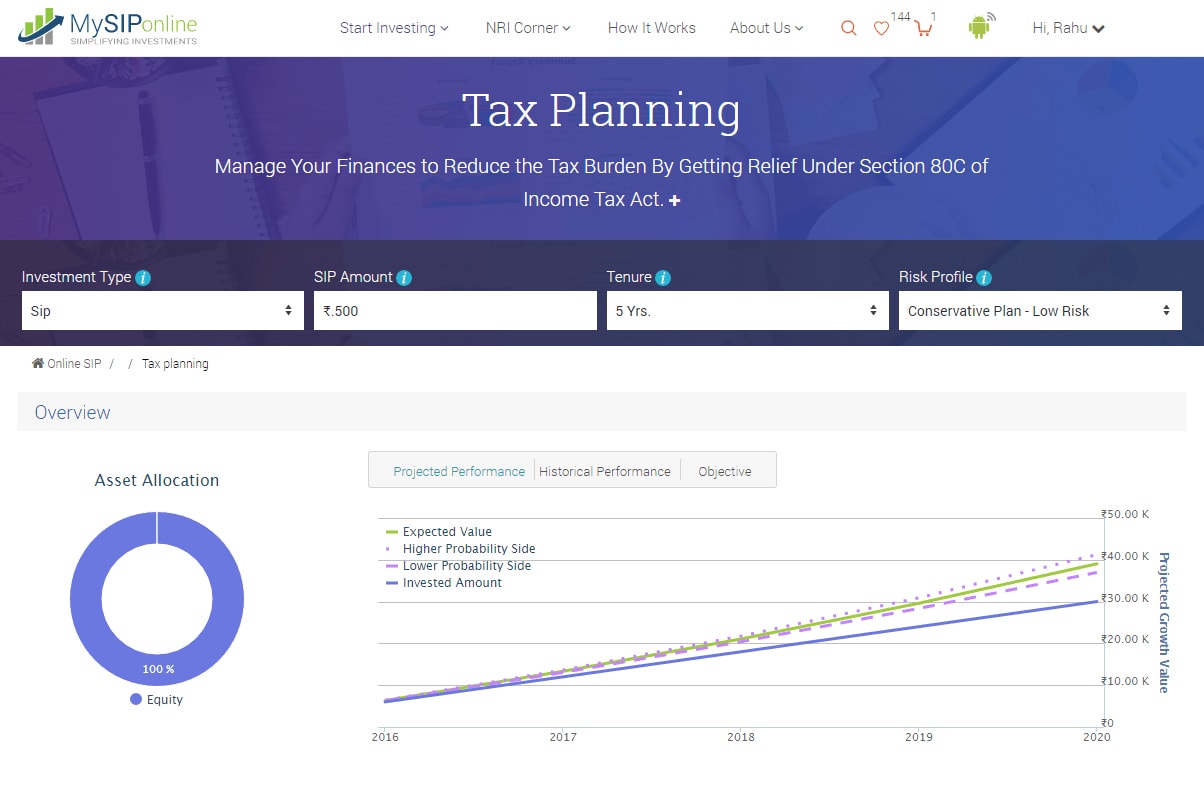

Tax Planning

Tax management is no longer a difficult task. Make a plan providing tax savings along with capital appreciation. Investing can be done via SIP or lumpsum payment.

Mutual Funds

Tax management is no longer a difficult task. Make a plan providing tax savings along with capital appreciation. Investing can be done via SIP or lumpsum payment.

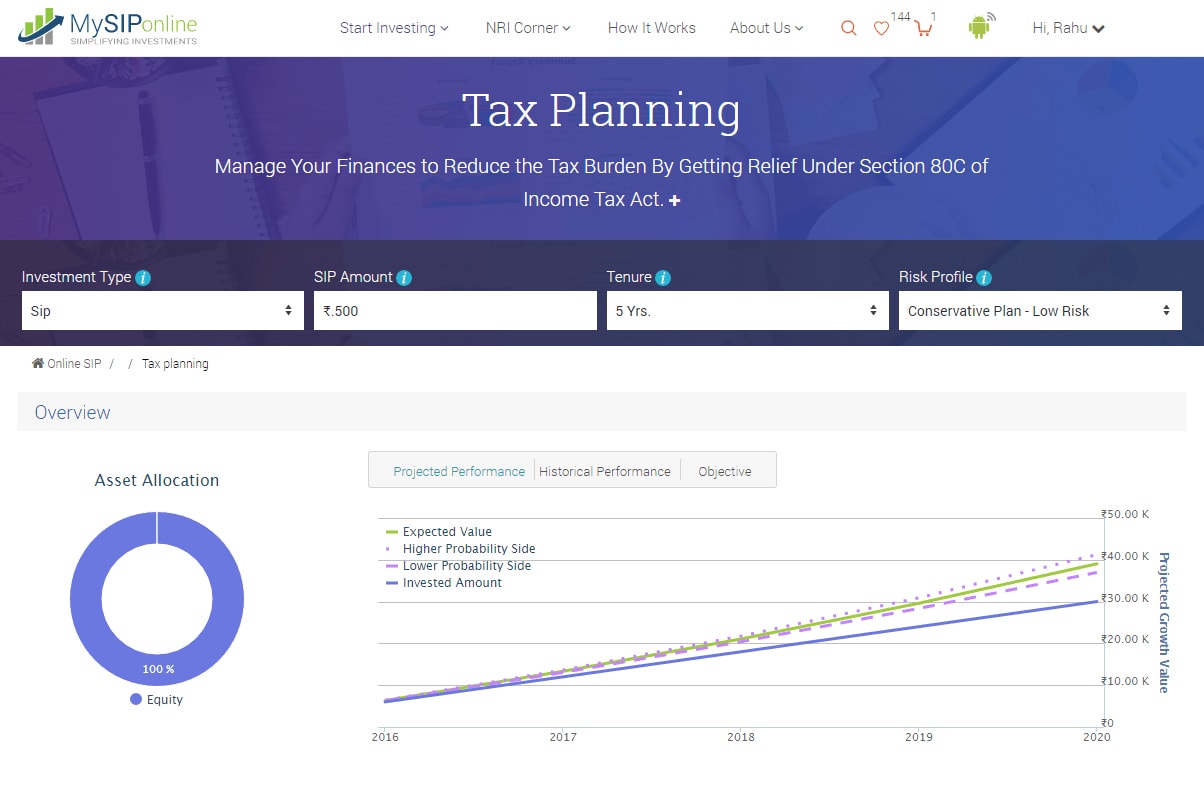

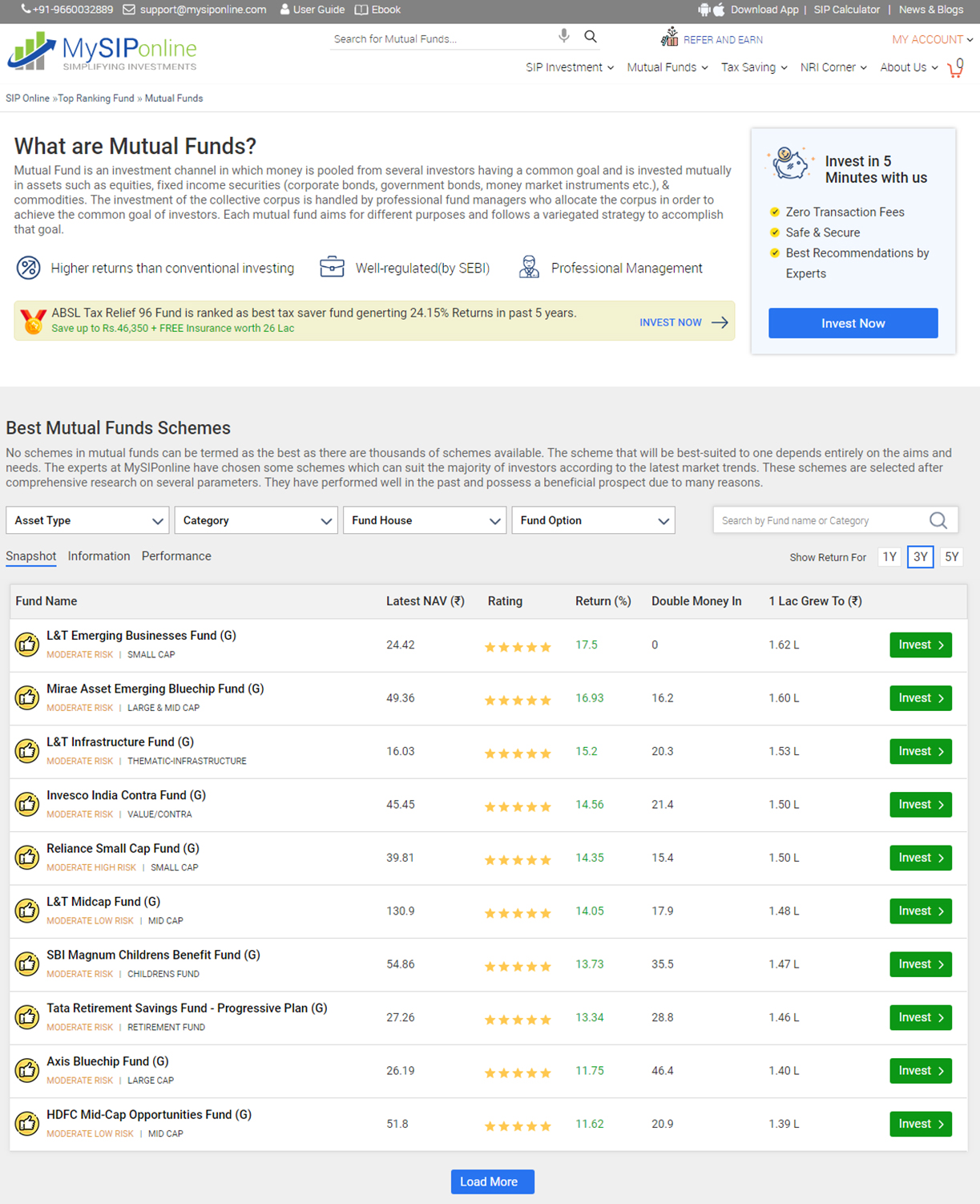

Recommended Funds

The investors are provided with the list of mutual fund programmes based on the past performance, current market scenario, and their ability to create wealth over time. The list includes scheme from various fund houses and assets and investors can invest in them either via SIP or Lumpsum.

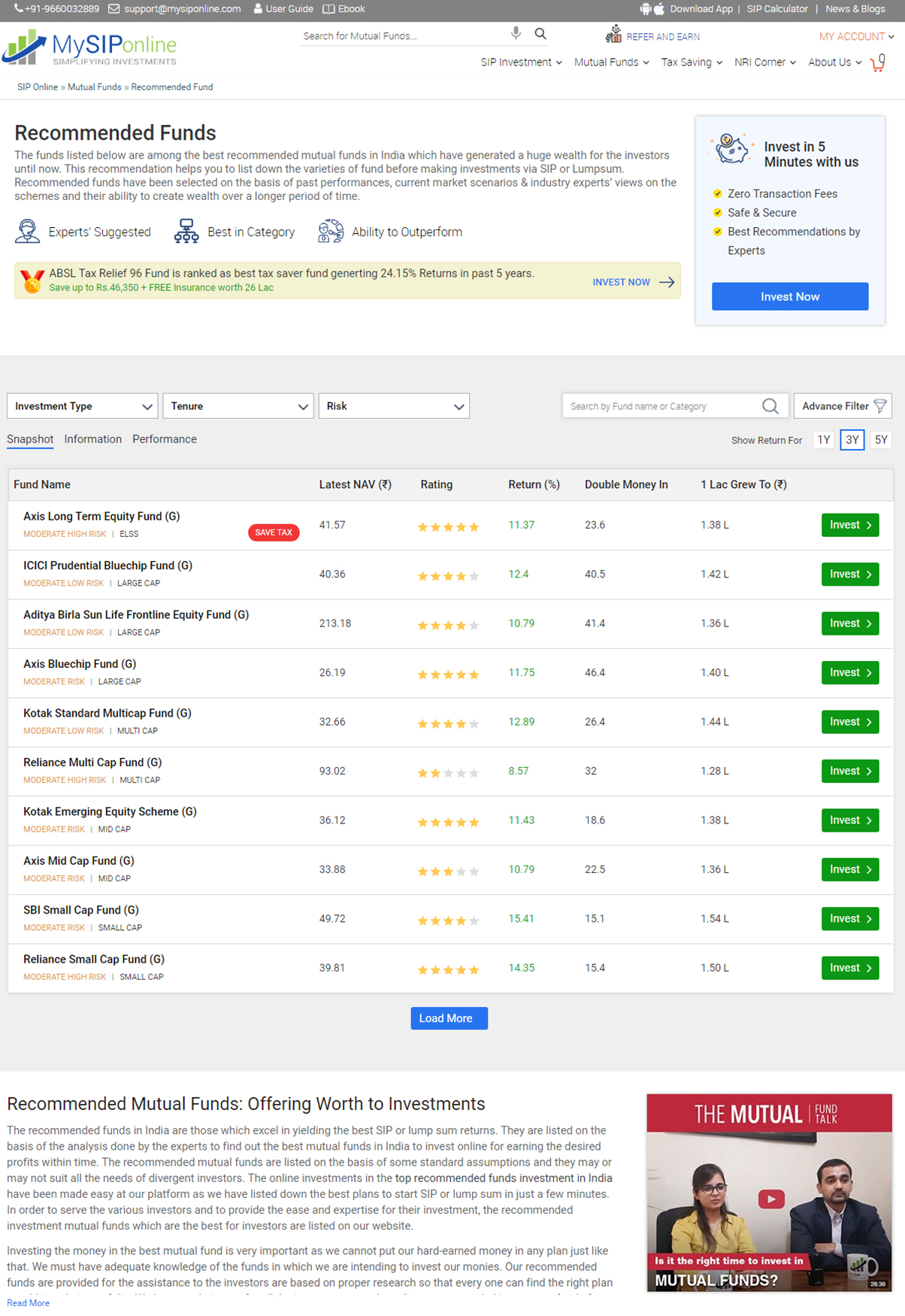

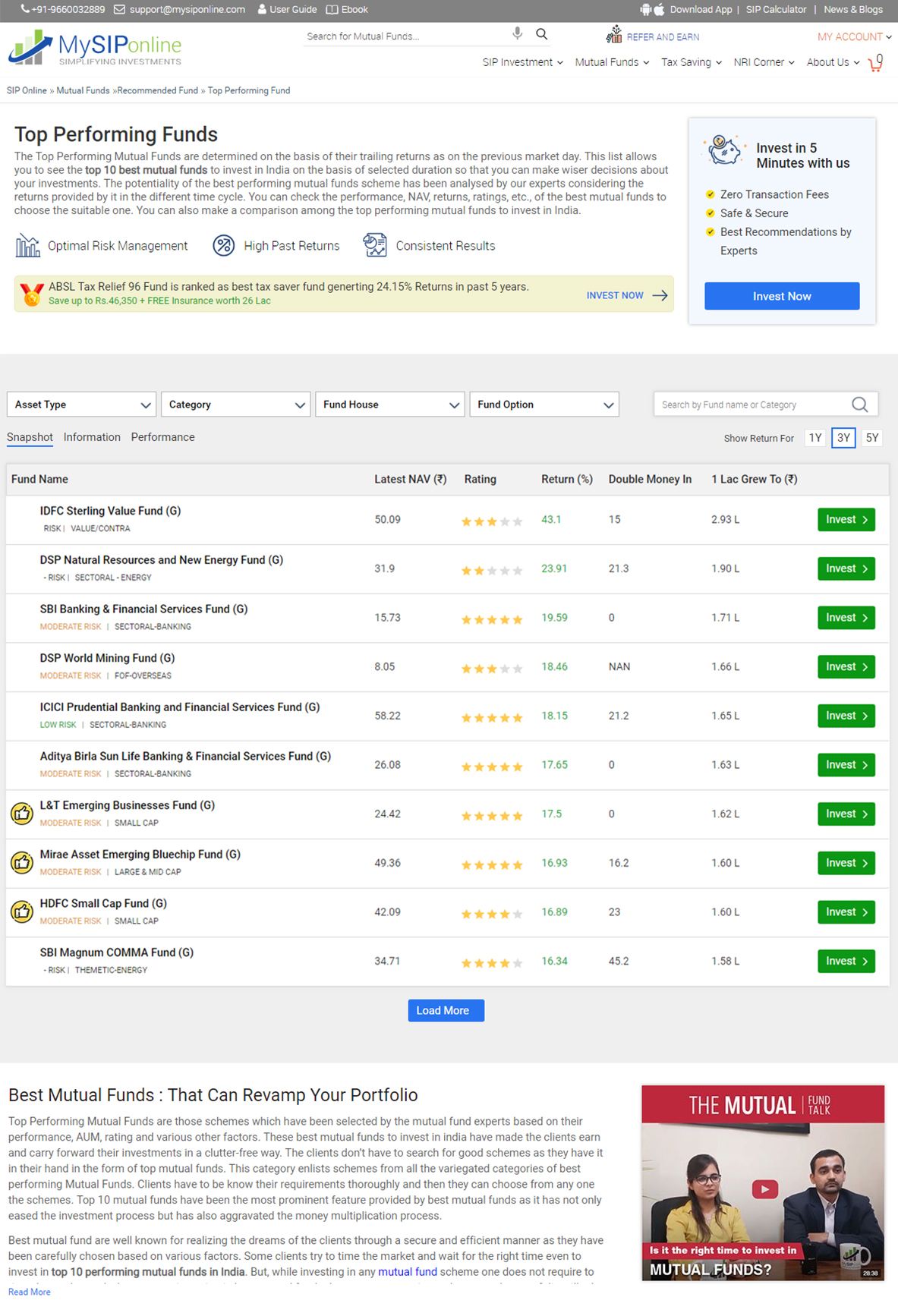

Top Performing Funds

The funds are listed by our experts on the basis of the returns for a selected duration or a particular tenure. The list is modified on a quarterly basis. Investors can invest in the listed schemes either via SIP or by making a lumpsum payment.

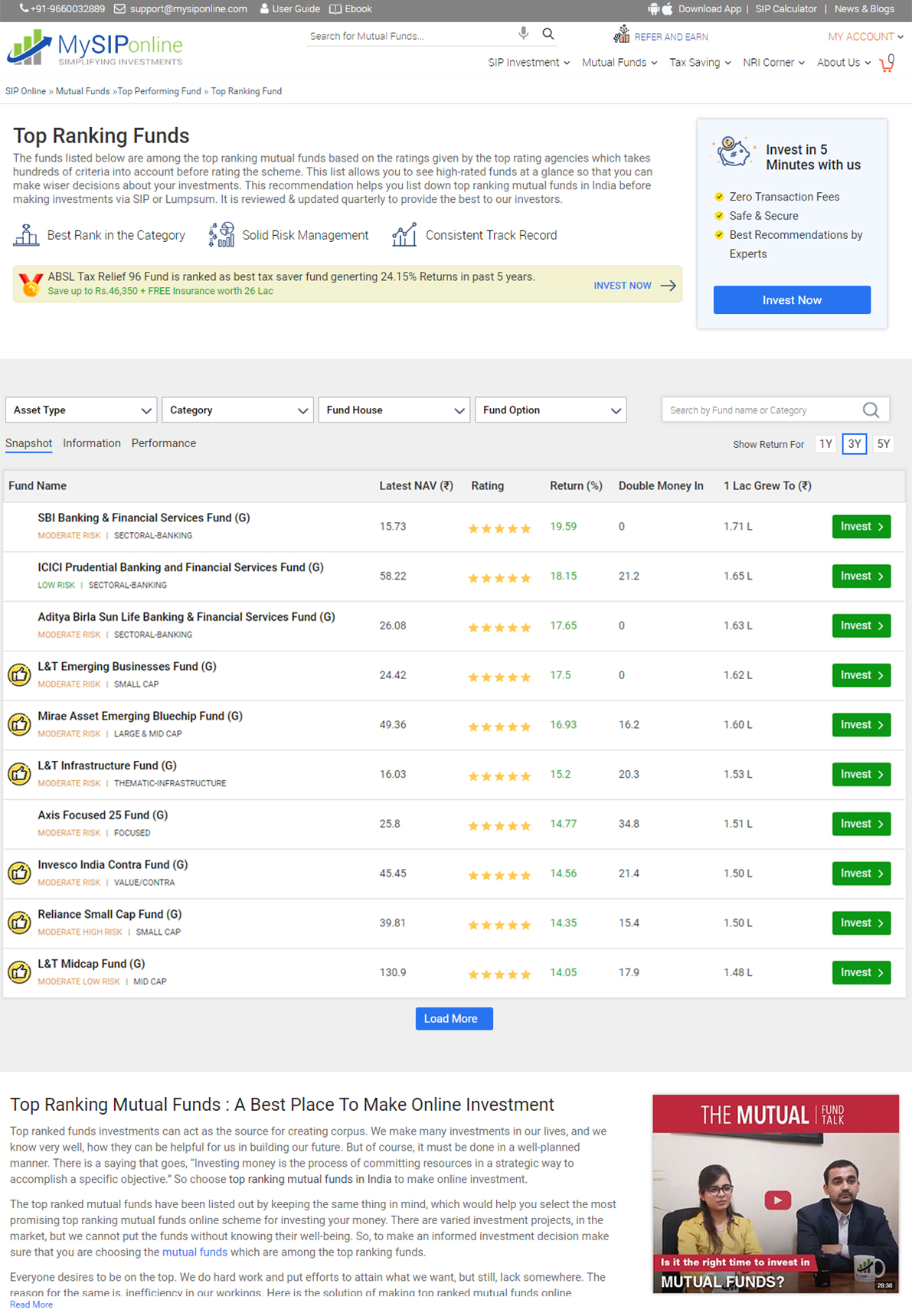

Top Ranking Funds

Funds are listed on the basis of CRISIL rating which is updated on a quarterly basis. Investors can buy an SIP or a lumpsum investment in the schemes so listed.

All Mutual Funds

To deliver convenience to the investors in finding mutual fund schemes across several categories and fund houses, all mutual funds are listed at a single place. Investments can be made either via SIP or by lumpsum purchase.

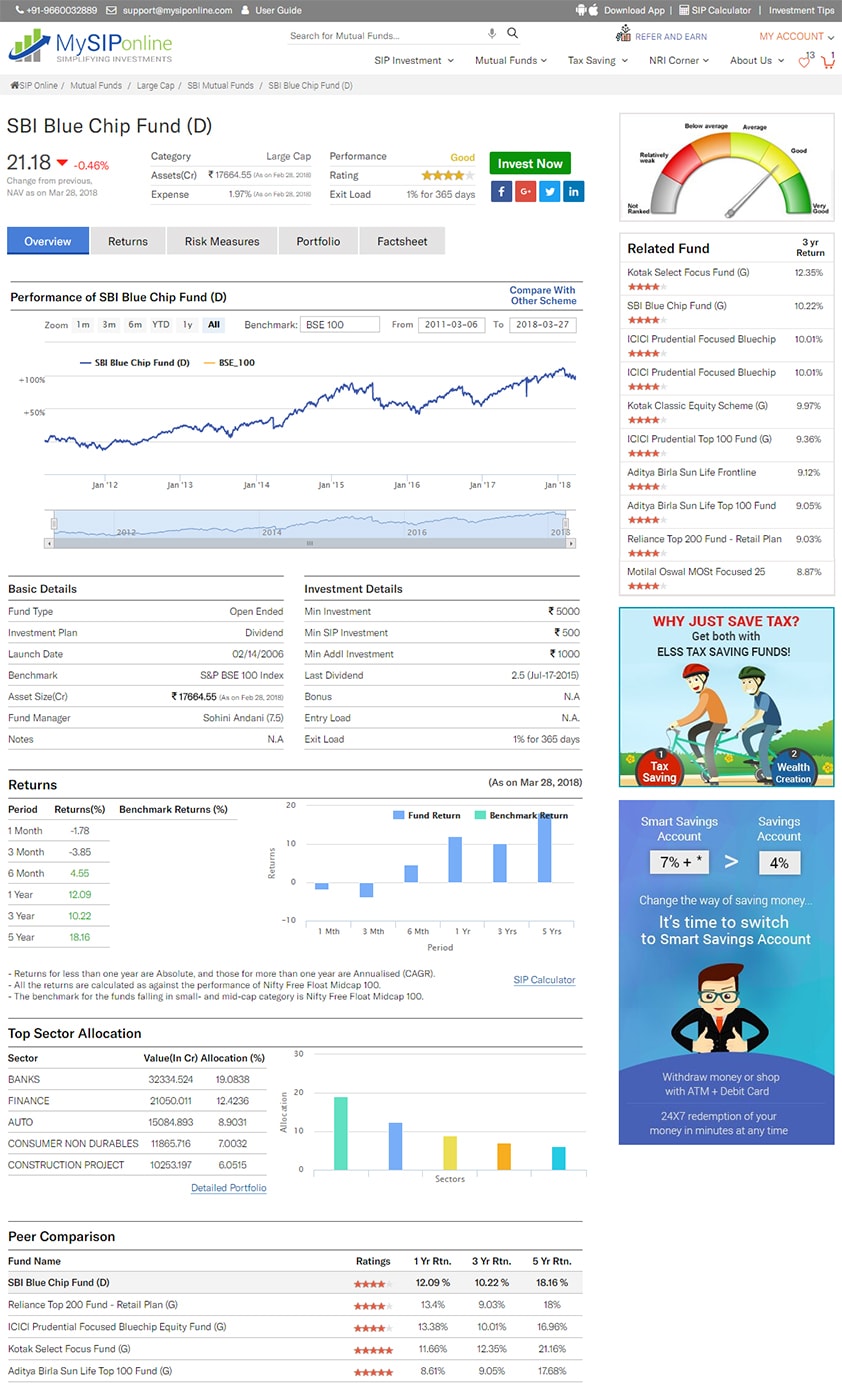

Scheme Overview

To get an insight of the performance, portfolio and other scheme-related detail, the page has been designed. The investors can fully analyse a particular plan from and take decision of investing in it via SIP or lumpsum.

Utilities

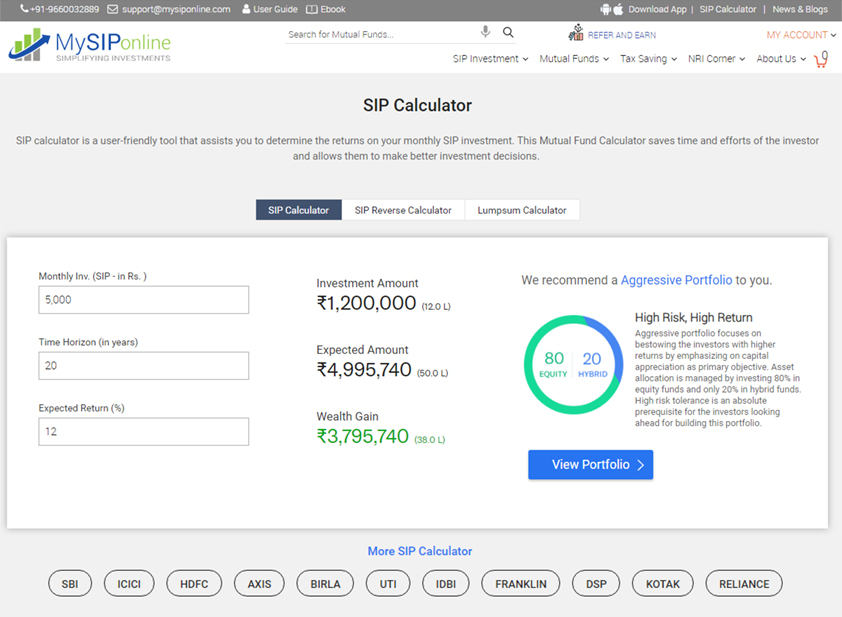

SIP Calculator

An online solution to compute the accurate value of the investment after a certain period.The graph depicts the growth of the invested amount in the specified investment horizon. The projected SIP returns for different period is presented in the table. On being satisfied with the returns, Click “Start SIP†to initiate investing.

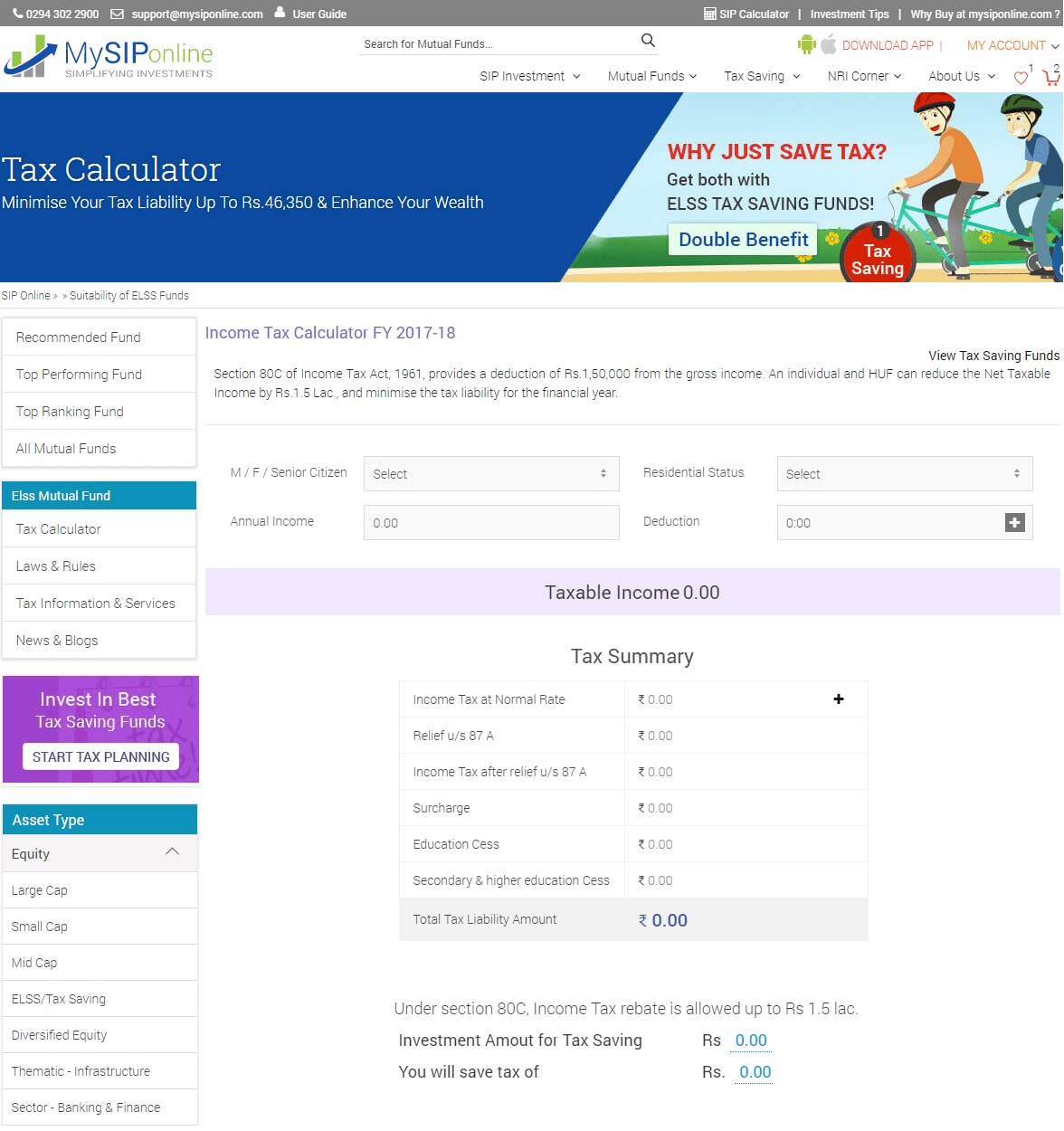

Tax Calculator

Calculation of the total tax liability made easier with this online tool. Open the calculator page the toolbar as shown below:One needs to specify the specification that include the residential status, assessment year, etc., and the net taxable amount to evaluate the Net Tax Payable along with the applicable cess and surcharge.

Retirement Calculator

Compute the total expenses to be borne post retirement on the basis of the current expenditures.Once the accurate post retirement expenses are computed, evaluate the amount to be invested now to maintain the desired living standard. Any one out of SIP or Lumpsum can be opted to start planning for retirement.

Child’s Future Planning Calculator

Calculate the amount you need to invest now for planning better education or a lavish wedding for your child.

Vacation Planning Calculator

Calculating the amount t be invested for planning a dream vacation is no more a difficult task. Just fill in the specifications and you get an exact solution.

Wealth Building Plan Calculator

Calculate the accurate amount of investment to build a huge wealth. The graph depicts the growth of the invested capital. You get the recommendations for investing in the Investment Breakdown Schemes.

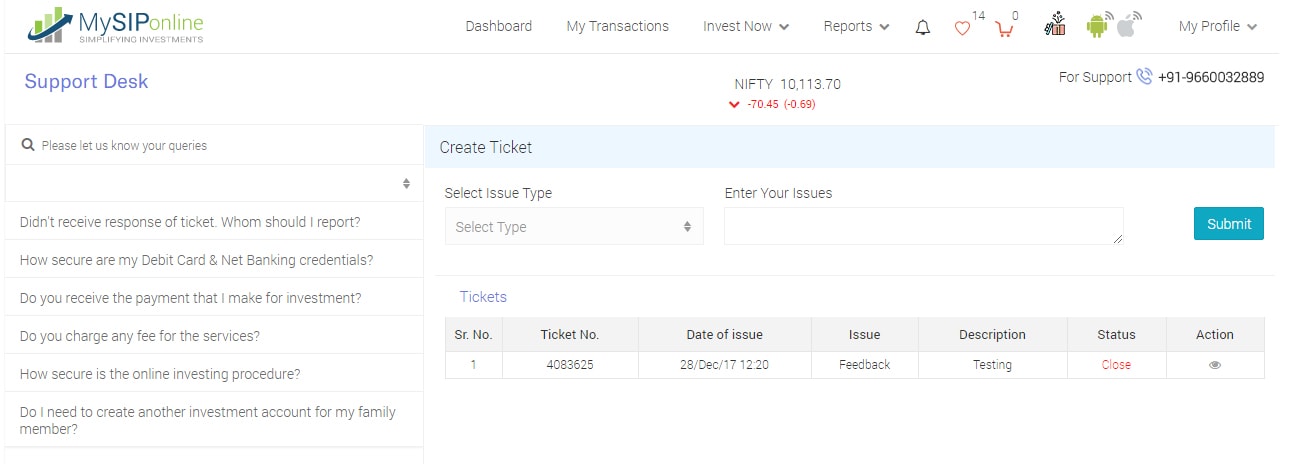

Support

To raise a query an get instant solution you can easily avail our assistance by clicking the ‘Support’ option available on the right-top corner of the dashboard.One can choose any of the category regarding which the query has to be raised for getting better solution then and there.

NRI

The NRI investors are given the opportunity to invest in the India mutual fund industry

Safety & Compliance

The NRI investors are given the opportunity to invest in the India mutual fund industry

256-Bit Encryption

The password security is ensured with the 256-bit encryption and SSL(Secure Socket Layers) standards, and its generation and storage is done in encrypted form. Client’s personal details and data cannot be retrieved by any third party.

Money Transfer Security

The financial data is secure and it is assured that clients’ money is never transferred without their consent.

Legal Obligation

We are obliged to maintain reasonable security of client’s data as per Information Technology Act, 2000

Bank Level Security

The safety of the financial data is same as provided by your banks.

Authorization of SEBI & AMFI

Being a registered entity under AMFI and approved by SEBI, we follow their regulations to safeguard the interest of investors.

Compliance Management

The grievances of our clients is handled by our “Compliance Officer Mr Alok Verma †at +91-9660032889.